Hydro Hotel Eastbourne Plc Final Results For The Year Ended 31 October 2022

February 22 2023 - 11:29AM

UK Regulatory

TIDMHYDP

22 February 2023

HYDRO HOTEL, EASTBOURNE, PLC

("Hydro Hotel" or the "Company")

FINAL RESULTS FOR THE YEAR ENDED 31 OCTOBER 2022

HIGHLIGHTS

The profit for the financial year after taxation was GBP336,700 (2021 profit of

GBP362,660). Turnover from the Hydro Hotel operation increased during the year

by 57.7% (2021 increased by 25.0%). Earnings per share were 56.12p compared to

60.44p for the previous year.

The Company's operating activities generated cash of GBP597,959 (2021 generated

cash of GBP829,213) and it invested GBP149,666 in new fixed assets (2021

GBP39,987). During the year the Company paid ordinary dividends of GBP204,000

(2021 GBP Nil). At the year end the Company had net current assets of

GBP1,459,345 (2021 GBP1,254,405).

CHAIRMAN'S STATEMENT

Results for year ended 31 October 2022

I report on the company's results for the year ended 31 October 2022.

It was another challenging trading year for the Company with the ongoing

Coronavirus pandemic, the cost of living crisis and the general effects of

Brexit on supply sources. However, I am pleased to announce that sales

recovered in the year totalling £4,402,288, an increase of 57.7% on the £

2,791,482 sales for the previous year (2021 25.0% increase). Operating profit

for the year was £429,300 (2021 £461,312). After interest receivable and the

corporation tax charge, the post-tax profits for the year were £336,700 (2021 £

362,660). Taking into account the level of post-tax profits for the year and

with the company having strong reserves and assets, the Board decided to pay a

dividend of 14p per share in October 2022 absorbing £84,000, reinstating the

second interim dividend based on the results for the year ended 31 October

2019, declared for payment in April 2020 and then cancelled due to the

Coronavirus pandemic. The Board also decided to declare a dividend of 23p per

share (2021 20p per share) absorbing £138,000 (2021 £120,000).

The trading environment for the company continues to be challenging. Despite

careful monitoring of food and drink costs the gross profit percentage was

slightly down on the previous year but increased sales meant that overall

profitability was up. Repair costs increased in the year reflecting the

implementation of window replacement and general maintenance and refurbishment

projects which were delayed during the Coronavirus pandemic.

Capital improvements at the hotel during the year included the refurbishment of

the Orangery, the Crystal Restaurant and Wedgewood patio, as well as general

refurbishment of some bedroom interiors.

There have been no periods of closure since last financial year but the Board

and management are mindful that future restrictions may be imposed by

Government to curb the spread of new variants of the Coronavirus and all

necessary action will be undertaken at the appropriate time to protect and

maintain the company's business.

Developments since 31 October 2022

New marketing techniques will continue to be developed during the year to

further encourage direct bookings at the hotel, which show an increase, year on

year.

Further updating of the décor and furniture of the Crystal Restaurant will be

undertaken in the coming year and it is planned to instal solar panels at the

hotel, in keeping with the company's green policy and to save energy costs.

Refurbishment of bedrooms and public areas will continue.

Our Staff

I would like to congratulate our General Manager, Jonathan Owen, on the results

achieved for the hotel this year, despite ongoing challenges for the hotel and

tourism industry.

I wish also to record our thanks to our management team and all our staff for

their dedication to the hotel during these challenging times. All staff

continued to deliver a high quality of service to the hotel's customers in

difficult circumstances.

Graeme C King, MA, CA

21 February 2023 Chairman of the Board

STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 OCTOBER 2022

2022 2021

GBP GBP

Turnover

Continuing operations 4,402,288 2,791,482

Cost of sales (3,694,357) (2,444,700)

Gross profit 707,931 346,782

Administrative expenses (285,729) (237,241)

Other operating income 7,098 351,771

Operating profit 429,300 461,312

Interest receivable and similar income 15,911 5,000

Interest payable and similar expenses - (9,286)

Profit before taxation 445,211 457,026

Taxation (108,511) (94,366)

Profit for the financial year GBP 336,700 GBP 362,660

Earnings per share - continuing operations 56.12p 60.44p

Earnings per share have been calculated using 600,000 shares, being the

weighted average number of shares for both years. The company has no potential

ordinary shares, therefore basic and diluted earnings per share is the same

figure.

STATEMENT OF FINANCIAL POSITION AS AT 31 OCTOBER 2022

2022 2021

GBP GBP

Fixed assets

Tangible Assets 2,456,700 2,500,211

Current assets

Stocks 36,645 36,657

Debtors 214,131 115,672

Investments 453,924 451,014

Cash at bank and in hand 1,585,647 1,328,353

2,290,347 1,931,696

Creditors: Amounts falling due within one year (831,002) (677,291)

Net current assets 1,459,345 1,254,405

Total assets less current liabilities 3,916,045 3,754,616

Provisions for liabilities (123,109) (94,380)

Net assets GBP 3,792,936 GBP 3,660,236

Capital and reserves

Ordinary Shares - Authorised and Issued:

600,000 Shares of GPB1.00 each fully paid 600,000 600,000

Revaluation reserve 398,372 402,651

Profit and loss reserves 2,794,564 2,657,585

Total equity GBP 3,792,936 GBP 3,660,236

STATUS OF FINANCIAL INFORMATION

The financial information set out above does not constitute statutory accounts

as defined in section 434 of the Companies Act 2006. This has, however, been

extracted from the statutory accounts for the year ended 31 October 2022. These

accounts have not to date been delivered to the Registrar of Companies. The

Company's auditor, UHY Hacker Young LLP, has issued an unqualified audit report

which does not contain a statement under section 498 of the Companies Act 2006

in respect of these accounts.

DIVIDEND ANNOUNCEMENT

An interim dividend of 23.0 pence per share (2021 20.0 pence paid) is to be

paid on 4 April 2023 to shareholders on the register on 17 March 2023. The

directors do not propose the payment of a final dividend.

The Directors of Hydro Hotel, Eastbourne, plc accept responsibility for this

announcement.

For further information please contact:

Hydro Hotel, Eastbourne, plc Sally Gausden

Telephone: (+44)(0) 1323 431200

Peterhouse Capital Limited Mark

Anwyl Telephone: (+44)(0) 2074 690930

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

END

(END) Dow Jones Newswires

February 22, 2023 12:29 ET (17:29 GMT)

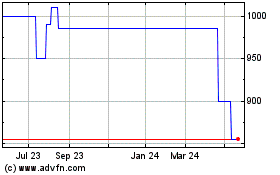

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Jan 2025 to Feb 2025

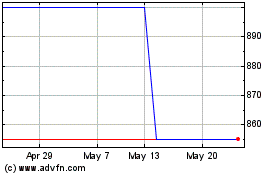

Hydro Hotel Eastbourne (AQSE:HYDP)

Historical Stock Chart

From Feb 2024 to Feb 2025