OTAQ Plc (OTAQ)

Unaudited Interim Results

01-Aug-2023 / 07:00 GMT/BST

=----------------------------------------------------------------------------------------------------------------------

1 August 2023

OTAQ plc

("OTAQ", the "Company" or the "Group")

Unaudited Interim Results

OTAQ, the innovative technology company targeting the aquaculture, geotracking and offshore markets, is pleased to

announce unaudited interim results for the six months ended 30 June 2023.

Financial Highlights:

H1 2023 H2 2022 H1 2022

Group (restated)* (restated)*

GBP'000 GBP'000 GBP'000

Revenue 1,801 1,345 2,708

Gross profit 883 611 1,191

Adjusted EBITDA** (347) (473) 454

*Figures restated to reflect the change of year end from 31

March to 31 December

**Adjusted EBITDA means earnings before income, tax,

depreciation, exceptional costs, impairment, share option charges

and amortisation

Highlights:

-- Record rental income achieved by Offshore division's core

OceanSense product

-- Two new six figure orders received for shrimp sonar devices

from Minnowtech LLC for delivery in H2 FY23

-- Live Plankton Analysis beta live systems now deployed at

customer sites in Scotland and Ireland

-- Initial customer contracts signed for Water Quality

Monitoring product in Chile following contractssigned in Scotland

in 2022

-- Sealfence sales made to Scandinavian countries; regulatory

trials ongoing in other territories

Post-Period Highlights:

-- Current order profile to support in excess of GBP4m of

Revenue for FY23

-- Significant further orders for shrimp sonar devices which, if

achieved in this financial year, willsubstantially enhance revenue

expectations

-- Further Sealfence sales expected in H2

-- Offshore division continuing to benefit from further

strengthening market demand

Commenting on the results and prospects, Phil Newby, Chief

Executive at OTAQ, said:

"The Board is satisfied with these results which are in line

with our budget for the year. The Group is now delivering on the

strategic goals set for OTAQ to realise its full potential,

significantly increase shareholder value and return the Group to

profitability.

"I am confident of achieving at least GBP4m Revenue in the

current year and we have the potential to substantially exceed this

based around the order enquiries we are currently receiving.

Shareholders will be updated accordingly with developments."

Enquiries

OTAQ plc +44 (0)1524 748028

Adam Reynolds, Chairman

Phil Newby, Chief Executive Officer

Justine Dowds, Interim Chief Financial Officer

Dowgate Capital Limited - AQSE Corporate Advisor & Broker +44 (0)20 3903 7715

David Poutney / James Serjeant

Russell Cook / Nicholas Chambers

Walbrook PR +44 (0) 20 7933 8780

Tom Cooper / Nick Rome / Joe Walker OTAQ@walbrookpr.com

+44 (0) 797 122 1972

About OTAQ

OTAQ is a highly innovative technology company targeting the

aquaculture, geotracking and offshore markets. It already has a

number of established products in its portfolio and is focused on

further developing its presence, customer base and cross selling

opportunities within core markets both organically and via

acquisition.

OTAQ's aquaculture products, which include a sonar device

(developed for Minnowtech LLC) to scan shrimp in ponds and water

quality monitoring, are focused on maximising welfare and

production yields. Additionally, the Company is at the advanced

development stage of a potentially game changing live plankton

analysis system (LPAS). It also continues to target opportunities

in the acoustic deterrent devices market via its Sealfence product,

which is used by salmon farmers in multiple large global

territories.

The Company is also developing high accuracy location trackers

for specialist applications. Having already added clients within

safety and multiple participant sport/racing applications, the

Company is investigating wider market potential - including

opportunities in the seafood industry.

OTAQ's offshore product range includes OceanSense subsea leak

detection, Eagle IP camera systems, Lander seabed survey devices

and subsea electrical connectors and penetrators. It is targeting a

number of growth opportunities in new territories and has a strong

client base including Expro, Amphenol and National Oilwell Varco.

The Company is also focused on the development of new products

through this division, with the aim of increased cross-deployment

of skills and technologies into the aquaculture arena.

Summary

The Group presents its unaudited interim results for the

six-month period ended 30 June 2023.

Trading

As anticipated, revenue has improved from H2 2022 of GBP1.3m to

GBP1.8m (H1 2022: GBP2.7m) with the Offshore division achieving

GBP1.4m (H2 2022: GBP0.9m, H1 2022: GBP1.4m) and the Aquaculture

division achieving GBP0.3m (H2 2022: GBP0.4m, H1 2022: GBP1.0m).

The Company has reported an Adjusted EBITDA* loss of GBP347k (2022:

profit GBP454k)

Offshore

The Offshore division, as expected, has continued to build on

the strong performance reported in 2022. The opportunities

identified in new international markets through investment in sales

resource are now coming to fruition with the OceanSense subsea leak

detection system achieving record rental levels in H1 2023. The

launch of a deep water OceanSense 4 model has been particularly

well received as well as further sales of the Group's advanced IP

subsea camera systems. We are confident that the strong performance

of the Offshore division will continue into H2 2023.

Aquaculture

Having launched a number of exciting new products for the

aquaculture sector in the last 12 months, the challenge is to now

build on the early interest shown at launch across the industry.

From Minnowtech LLC, a company we continue to hold a 15% investment

in, we have received significant orders for the shrimp sonar

devices. Two six-figure orders are scheduled for delivery in H2

2023 with the prospect of further orders from Minnowtech in the

remainder of 2023.

As announced in April, the Group has secured its first trial

partners for the Live Plankton Analysis System (LPAS). The LPAS

product automatically identifies phytoplankton around marine

aquaculture sites that could potentially result in harmful algae

blooms adversely impacting on fish health and reducing yields.

Through the system's AI technology, the local analysis software

program generates on-site alerts for staff, alerting the presence

of specific algae species that are of concern in a particular area,

enabling farmers to respond to any threat far quicker than the

current manual process. The first beta systems have been deployed

in Ireland and in Scotland.

The Group's Water Quality Monitoring System, currently for

salmon farmers, provides continuous monitoring and recording of

crucial environmental parameters across the entire growing cycle,

supplying invaluable visibility and insight to support the

maintenance and safeguarding of fish welfare. Contracts or orders

have been fulfilled to supply the systems to salmon farms in Chile

and in Scotland.

As reported previously, revenue from the Group's historically

core product, Sealfence, has reduced significantly since 2022.

However, we are pleased to report that a modest level of Sealfence

sales to customers in Scandinavia was achieved in H1 2023, with

regulatory trials ongoing in other territories.

Geotracking

Trials with OTAQ's partners serving the rail sector, which

commenced in 2022, are continuing as planned with a number of

successful field trials now completed. This is a highly regulated

sector and, accordingly, progress can be slow. However, the Group

is hopeful that the first significant orders will be received in H2

2023.

Financial Highlights for the six months ended 30 June 2023

The results for H1 2022 and H2 2022, being the six months to

June 2022 and six months to December 2022 respectively, are

restated for comparative purposes following the Company's change of

accounting reference date from 31 March to 31 December.

H1 2023 H2 2022 H1 2022

Group (restated)* (restated)*

GBP'000 GBP'000 GBP'000

Revenue 1,801 1,345 2,708

Gross profit 883 611 1,191

Adjusted EBITDA** (347) (473) 454

*Figures restated to reflect the change of year end from 31

March to 31 December

**Adjusted EBITDA means earnings before income, tax,

depreciation, exceptional costs, impairment, share option charges

and amortisation

H1 2023 H1 2022

(restated)

GBP'000 GBP'000

Operating loss (709) (638)

Amortisation of intangible assets 134 424

Impairment of assets - 311

Depreciation of right-of-use assets 84 88

Depreciation on property, plant and equipment 144 269

Adjusted EBITDA (347) 454

Adjusted EBITDA was a loss of GBP0.35m from a profit of GBP0.45m

in 2022. This reduction followed the exit of the Sealfence industry

in Scotland and the investment in growing new product lines made in

2023.

Net debt as at 30 June was GBP0.51m (2022: GBP1.23m) with cash

balances of GBP0.91m.

Outlook

I am pleased that the Group is on track to achieve the Board's

growth target for 2023 with revenue of at least GBP4.0 million in

the current year and a return to EBITDA profitability in the

current year within reach if this revenue figure can be improved

upon, as anticipated.

The Offshore Division continues to benefit from strengthening

market demand and, whilst the timing of new client orders can be

difficult to predict, we anticipate significant further orders for

shrimp sonar devices, together with further sales of the Sealfence,

in the current financial year. We also expect to see further

progress and initial sales from railway customers in the

Geotracking Division.

Phil Newby

Chief Executive Officer

The Board confirms that to the best of its knowledge the

consolidated half year financial statements for the six months to

30 June 2023 have been prepared in accordance with IAS 34 Interim

Financial Reporting amended in accordance with changes in IAS 1

Presentation of Financial Statements, as adopted by the UK

Unaudited Condensed Consolidated Statement of Comprehensive

Income

Half-year ended

Notes 30 June 2023 30 June 2022

(restated)

GBP000 GBP000

Revenue 1 1,801 2,708

Cost of sales (918) (1,517)

Gross profit 1 883 1,191

Administrative expenses (1,592) (1,829)

Operating loss (709) (638)

Finance expense (64) (79)

Exceptional items 2 - (127)

Loss on ordinary activities before taxation (773) (844)

Taxation 14 250

Loss for the period (759) (594)

Other comprehensive loss - -

Total Comprehensive Loss (759) (594)

Attributable to:

The Group (759)) (594)

As per note 3, Losses Per Share were 0.6p (2022: 1.6p) and

Diluted Losses Per Share were 0.6p (2022: 1.6p).

The loss for the period arises from the Group's continuing

operations and is attributable to the equity holders of the

parent.

There were no other items of comprehensive income for the period

(2022: GBPnil) and therefore the loss for the period is also the

total comprehensive loss for the period.

The notes form an integral part of these condensed financial

statements. Unaudited Condensed Consolidated Balance Sheet

Notes 30 June 2023 30 June 2022 31 December 2022

GBP000 GBP000 GBP000

Assets

Non-current assets

Plant and equipment 710 829 582

Right-of-use assets 277 393 364

Unlisted investments 511 511 511

Intangible assets 3,118 3,153 3,008

4,616 4,886 4,465

Current assets

Inventories 1,023 1,126 937

Trade and other receivables 1,081 1,212 689

Income tax asset 111 166 275

Cash and cash equivalents 913 930 2,337

3,128 3,434 4,238

Total assets 7,744 8,320 8,703

Liabilities

Current liabilities

Trade and other payables 614 684 503

Deferred payment for acquisition - 236 -

Leases 169 173 172

Financial liabilities 5 465 441 447

1,248 1,534 1,122

Non-current liabilities

Deferred tax - 176 -

Leases 82 201 181

Financial liabilities 5 817 1,270 1,054

899 1,647 1,235

Total liabilities 2,147 3,181 2,357

Net assets 5,597 5,139 6,346

Capital and reserves

Share capital 6 1,280 5,662 1,278

Share premium 6 5,842 3,281 5,834

Deferred shares 6 5,286 - 5,286

Share option reserve 134 150 134

Merger relief reserve 9,154 9,154 9,154

Reverse acquisition reserve (6,777) (6,777) (6,777)

Other reserve 400 384 400

Revenue reserve (9,722) (6,715) (8,963)

Total equity 5,597 5,139 6,346

Unaudited Condensed Consolidated Statement of Changes in Equity

Issued Share Deferred Share Merger Reverse Other Revenue Total

Equity Premium shares option relief acquisition Reserve Reserve Equity

capital reserve reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 30 June 2022 5,662 3,281 - 150 9,154 (6,777) 384 (6,715) 5,139

Loss for the period - - - - - - - (2,248) (2,248)

Sub-division and (5,286) - 5,286 - - - - - -

conversion of shares

Issues of shares 902 2,553 - - - - - - 3,455

Transfer on expired (16) 16 - -

options

At 31 December 2022 1,278 5,834 5,286 134 9,154 (6,777) 400 (8,963) 6,346

At 1 January 2023 1,278 5,834 5,286 134 9,154 (6,777) 400 (8,963) 6,346

Loss for the period - - - - - - - (759) (759)

Issues of shares 2 8 - - - - - - 10

At 30 June 2023 1,280 5,842 5,286 134 9,154 (6,777) 400 (9,722) 5,597 Unaudited Condensed Consolidated Statement of Cash Flows

30 June 2023 30 June 2022

GBP'000 GBP'000

Cash flows from operating activities

Operating loss (709) (638)

Adjustments for non-cash/non-operating items:

Depreciation of property, plant and equipment 143 269

Impairment of property, plant and equipment - 311

Depreciation of right-of-use assets 84 88

Amortisation of intangible assets 134 119

Impairment of intangible assets - 295

Gain on remeasurement of deferred consideration payable - 40

Exceptional charges - (127)

Share option charge 10 30

(338) 387

Changes in working capital:

Increase / (decrease) in inventories (87) 168

Increase in trade and other receivables (391) (190)

Increase / (decrease) in trade and other payables 110 (894)

Cash from operations (706) (529)

Taxation 177 84

Net cash from operating activities (529) (445)

Cash flows from investing activities

Purchases of tangible fixed assets (267) (10)

Purchases of intangible assets (243) (285)

Interest received 10 -

Deferred payment of acquisition - (15)

Net cash used in investing activities (500) (310)

Cash flows from financing activities

Proceeds on issue of shares - 1408

Expenses of share issues - (70)

Repayment of loans (219) (189)

Principal element of lease payments (102) (60)

Interest paid (74) (79)

Net cash from financing activities (395) 1,010

Net (decrease) / increase in cash and cash equivalents (1,424) 255

Cash and cash equivalents at beginning of period 2,337 675

Cash and cash equivalents at end of period 913 930

????? ????? Notes to the condensed financial statements 1. Segmental information

The Group operated as three primary segments, being the rental

and sales of aquaculture products (Aquaculture), rentals of

underwater measurement and leak detection devices in the Offshore

market and the development and manufacture of products for

geo-tracking industries (Geotrackers). This is the level at which

operating results are reviewed by the chief operating decision

maker to make decisions about resources, and for which financial

information is available. All revenues have been generated from

continuing operations and are from external customers.

Half-year ended

30 June 2023 30 June 2022

GBP000 GBP000

Analysis of revenue

Aquaculture equipment rentals, sales and associated charges 319 993

Offshore equipment rentals, sales and associated charges 1,444 1,362

Geotracking 38 353

1,801 2,708

Half-year ended

30 June 2023 30 June 2022

GBP000 GBP000

Analysis of gross profit

Aquaculture equipment rentals, sales and associated charges 80 386

Offshore equipment rentals, sales and associated charges 818 681

Geotracking (15) 124

883 1,191 2. Exceptional items

Exceptional items in the prior period of GBP0.13m include legal

and professional costs associated with the January 2022 issue of

new shares and restructuring costs. 3. Losses per share

Basic earnings or losses per share are calculated by dividing

the loss or profit after tax attributable to the equity holders of

the Group by the weighted average number of shares in issue during

the year. Diluted earnings or losses per share are calculated by

adjusting the weighted average number of shares outstanding to

assume conversion of all potential dilutive shares, namely share

options.

The calculation of earnings or losses per share is based on the

following losses and number of shares:

Half-year ended

30 June 2023 30 June 2022

GBP000 GBP000

Loss for the period attributable to the owners of the Group (759) (557)

Weighted average number of shares:

-- Basic 127,900,627 37,129,411

-- Diluted 172,278,124 43,012,568

Basic earnings per share (pence) (0.6) (1.5)

Diluted earnings per share (pence) (0.6) (1.5) 4. Loan repayment

During the period, the Group repaid GBP0.22m of loans provided

under the Coronavirus Business Interruption Loan Scheme. 5. Share

capital and share premium

The called-up and fully paid share capital of the Company is as

follows:

30 June 2023

30 June 2022

GBP000 GBP000

Allotted, called-up and fully paid: 127,976,373 Ordinary shares of GBP0.01 each

1,280 5,662

(2022: 37,746,852 of GBP0.15 each) 6. Financial instruments - classification and measurement

Financial assets

Financial assets measured at fair value include the

following:

Half year ended

30 June 2023 30 June 2022

GBP'000 GBP'000

Unlisted equity securities 297 297

Investments made in unlisted equity securities 214 214

511 511

????? ?????

7. Basis of preparation of half-year report

This condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2023 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting. The interim report does not include all the notes of the

type normally included in an annual financial report. Accordingly,

this report is to be read in conjunction with the annual report for

the year ended 31 December 2022 and any public announcements made

by OTAQ PLC during the interim reporting period. This interim

financial information has not been reviewed nor audited by the

auditors. The accounting policies adopted are consistent with those

of the previous financial year and corresponding interim reporting

period, except for the adoption of new amended standards as set out

below.

New and amended standards adopted by the Group

A number of new or amended standards became applicable for the

current reporting period. The Group did not have to change its

accounting policies or make retrospective adjustments as a result

of adopting these standards.

Going concern

The Directors have considered going concern and whilst the

Company needs to continue to monitor cash flow carefully, the

Directors believe that the group has sufficient cash to meet its

obligations.

Significant estimates and judgements

The Group shall assess at each reporting date whether there is

any indication that non-current assets may be impaired. The

Directors believe that at the half-year reporting period ended 30

June 2023 no indicators of impairment existed. The Directors

continue to monitor regulatory and market developments and their

impact on the carrying value of the assets.

-----------------------------------------------------------------------------------------------------------------------

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

ISIN: GB00BK6JQ137

Category Code: IR

TIDM: OTAQ

LEI Code: 213800CZGMYB5XTUXJ52

Sequence No.: 261350

EQS News ID: 1692389

End of Announcement EQS News Service

=------------------------------------------------------------------------------------

Image link:

https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=show_t_gif&application_id=1692389&application_name=news

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

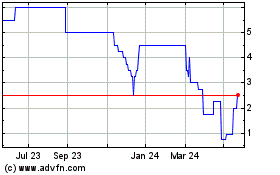

Otaq (AQSE:OTAQ)

Historical Stock Chart

From Feb 2025 to Mar 2025

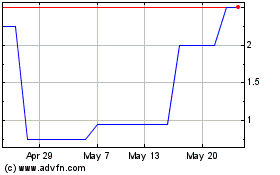

Otaq (AQSE:OTAQ)

Historical Stock Chart

From Mar 2024 to Mar 2025