Redcentric PLC Share issue in connection with the FY23 Dividend (2192A)

January 19 2024 - 1:00AM

UK Regulatory

TIDMRCN

RNS Number : 2192A

Redcentric PLC

19 January 2024

Redcentric plc

("Redcentric" or the "Company")

Share issue in connection with the FY23 Dividend

Redcentric (AIM: RCN) a leading UK IT managed services provider,

announces that, in respect of the final dividend of 2.4 pence per

ordinary share of 0.1 penny each ("Ordinary Shares") for the year

ended 31 March 2023 (the "Dividend") due to be paid today, 19

January 2024, the Company has agreed with certain shareholders

representing 63.4% of the Company's total voting rights, that its

obligation to make payment to them of the Dividend (amounting to,

in aggregate, GBP2,383,145.11) shall be satisfied by the issue of,

in aggregate, 1,892,937 new Ordinary Shares (the "Dividend

Shares").

Having regard to the strategy of the Company, the Board has

decided to take this course of action to strengthen cash balances

that enable the Company to make strategic decisions in respect of

its long-term leases that the Board believe will improve the future

profitability of the Company.

The Company continues to trade in line with expectations as per

the interim announcement on 22 November 2023.

The Dividend Shares will be issued at 125.8961 pence per

Ordinary Share, being the five-day volume weighted average price of

an Ordinary Share] at the close of business on 18 January 2024 (the

last business day prior to the dividend payment date). The Dividend

Shares will represent in aggregate 1.19% of the enlarged issued

share capital of the Company ("ISC").

Related Party Transactions

Oliver Scott, a Non-Executive Director of the Company, is a

partner of, and holds a beneficial interest in, Kestrel Partners

LLP ("Kestrel"). Mr. Scott is also a shareholder in Kestrel

Opportunities and is therefore deemed to have a beneficial interest

in Kestrel Opportunities' entire legal holding in Redcentric.

Kestrel and Lombard Odier Asset Management ("Lombard Odier"),

both substantial shareholders in the Company, are participating in

the Subscription as follows:

Name Dividend Shares

Kestrel Partners LLP 596,599

Lombard Odier Asset Management 497,160

As such, the Subscriptions by Kestrel and Lombard Odier

constitute related party transactions pursuant to Rule 13 of the

AIM Rules for Companies.

The Company's independent directors (being Peter Brotherton,

David Senior, Nick Bate and Alan Aubrey) consider, having consulted

with the Company's nominated adviser, Cavendish Capital Markets

Limited, that the terms of Kestrel's subscription are fair and

reasonable insofar as the Company's shareholders are concerned.

The Company's directors (being Peter Brotherton, David Senior,

Nick Bate, Oliver Scott and Alan Aubrey) consider, having consulted

with the Company's nominated adviser, Cavendish Capital Markets

Limited, that the terms of Lombard Odier's subscription are fair

and reasonable insofar as the Company's shareholders are

concerned.

Total voting rights

Application has been made for the Dividend Shares to be admitted

to trading on AIM and it is expected that their admission to AIM

will take place on or around 24 January 2024 ("Admission").

Following Admission, the Company's ISC will consist of

158,884,919 Ordinary Shares, 655,278 of which remain held in

Treasury. For reporting under the FCA's Disclosure Guidance and

Transparency Rules, shareholders should exclude any Ordinary Shares

held in Treasury and should use the figure of 158,229,641 Ordinary

Shares (the issued voting share capital) when determining if they

are required to notify their interest, or a change of their

interest in the Company.

Enquiries:

Redcentric plc

Peter Brotherton, Chief Executive Officer +44 (0)800 983

David Senior, Chief Financial Officer 2522

Cavendish Capital Markets Limited - Nomad

and Broker

Marc Milmo / Simon Hicks / Charlie Beeson

(Corporate Finance) +44 (0)20 7220

Andrew Burdis / Sunila de Silva (ECM) 0500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEQKFBKDBKBADD

(END) Dow Jones Newswires

January 19, 2024 02:00 ET (07:00 GMT)

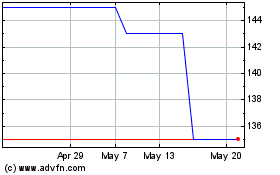

Redcentric (AQSE:RCN.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

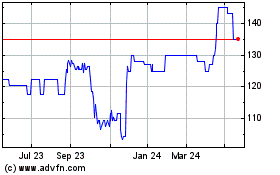

Redcentric (AQSE:RCN.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025