TIDMNFC TIDMSAA

RNS Number : 6388D

Next Fifteen Communications Grp PLC

21 October 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, IN OR INTO ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A

VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH

JURISDICTION.

FOR IMMEDIATE RELEASE

21 October 2022

FINAL [i] CASH AND SHARE ACQUISITION

OF

M&C SAATCHI PLC ("M&C Saatchi")

BY

NEXT FIFTEEN COMMUNICATIONS GROUP PLC (the "Company" or "Next

15")

Next 15 notes the announcement today by M&C Saatchi that it

has posted a notice to reconvene the M&C Saatchi Meetings for

31 October 2022 in order for M&C Saatchi Shareholders to vote

on the proposed acquisition of M&C Saatchi by Next 15.

In summary:

-- The Scheme is currently not expected to be approved by

M&C Saatchi Shareholders, given the previous statement made by

ADV and Vin Murria

-- Pricing discipline remains a key focus of Next 15's M&A strategy

-- The Next 15 Board remains highly confident in delivering future growth

On 15 August 2022, ADV announced that, based on the implied

value of the Next 15 Offer at that date, ADV and Vin Murria

intended to vote their respective shareholdings in M&C Saatchi

against the Next 15 Scheme. ADV and Vin Murria, who together hold

approximately 22.3% of M&C Saatchi's issued share capital, will

be required by virtue of their previous statement to vote against

the Next 15 Scheme unless the implied value of the Next 15 Offer

increases above 197.3p per M&C Saatchi Share, being the implied

value at the time the ADV statement was made.

In light of this position, Next 15 does not currently expect the

Next 15 Scheme to be approved by M&C Saatchi Shareholders at

the M&C Saatchi Meetings.

While this would be a disappointing outcome and the Board of

Next 15 (the "Board") continues to believe in the benefits which a

combination of Next 15 and M&C Saatchi could deliver, the Board

will always maintain pricing discipline when pursuing its M&A

strategy which may result in certain transactions not

proceeding.

The Board remains highly confident in the Next 15 Group's future

prospects. As noted in the Next 15 Group's Interim Results on 26

September 2022, strong trading in H1 has continued into the third

quarter of our financial year, with results for the full financial

year expected to be at least in line with management expectations.

The scale and strength of our US business, combined with recently

announced new client wins, give us confidence for further growth in

the next financial year.

The Board believes that Next 15 is well positioned to continue

to generate shareholder value through its strategy of organic

growth complemented by M&A and the Next 15 Group's strong

balance sheet provides scope for further investments both in its

existing businesses and in M&A to accelerate our longer-term

growth.

Capitalised terms used but not defined in this announcement

shall have the meanings given to them in the Scheme Document, a

copy of which is available on Next 15's website at

www.next15.com/investors/ .

Enquiries:

Next 15

Tim Dyson (Chief Executive Officer) +1 415 350 2801

Peter Harris (Chief Financial Officer) +44 20 7908 6444

Smith Square Partners (Financial adviser

to Next 15) +44 20 3696 7260

John Craven

Jonathan Coddington

Douglas Gilmour

Numis (Broker and NOMAD to Next 15) +44 20 7260 1000

Mark Lander

Hugo Rubinstein

Berenberg (Broker to Next 15) +44 20 3207 7800

Ben Wright

Mark Whitmore

Richard Andrews

MHP (PR adviser to Next 15) +44 7710 032 657

Katie Hunt next15@mhpc.com

Eleni Menikou

Pete Lambie

Robert Collett-Creedy

Important Information

Smith Square Partners LLP, which is authorised and regulated by

the FCA in the United Kingdom, is acting exclusively for Next 15

and no one else in connection with the Acquisition and other

matters set out in this announcement and will not be responsible to

anyone other than Next 15 for providing the protections afforded to

clients of Smith Square Partners, or for providing advice in

connection with the Acquisition or any matter referred to herein.

Neither Smith Square Partners nor any of its affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Smith Square

Partners in connection with this announcement, any statement

contained herein or otherwise.

Numis Securities, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively for Next 15 as nominated adviser and broker, and

exclusively for M&C Saatchi as joint financial advisor and

joint broker, and no one else in connection with the Acquisition

and will not be responsible to anyone other than Next 15 and

M&C Saatchi for providing the protections afforded to clients

of Numis nor for providing advice in relation to the Acquisition or

any other matters referred to in this announcement. Neither Numis

nor any of its affiliates owes or accepts any duty, liability or

responsibility whatsoever (whether direct or indirect, whether in

contract, in tort, under statute or otherwise) to any person who is

not a client of Numis in connection with this announcement, any

statement contained herein or otherwise.

Joh. Berenberg, Gossler & Co. KG, London Branch

("Berenberg"), which is authorised and regulated by the German

Federal Financial Supervisory Authority (BaFin) and is deemed

authorised and regulated by the FCA in the United Kingdom, is

acting exclusively for Next 15 and no one else in connection with

the Acquisition and other matters set out in this Announcement and

will not be responsible to anyone other than Next 15 for providing

the protections afforded to clients of Berenberg, or for providing

advice in connection with the Acquisition or any matter referred to

herein. Neither Berenberg nor any of its affiliates owes or accepts

any duty, liability or responsibility whatsoever (whether direct or

indirect, whether in contract, in tort, under statute or otherwise)

to any person who is not a client of Berenberg in connection with

this Announcement, any statement contained herein or otherwise.

Further information

This announcement is for information purposes only and is not

intended to and does not constitute or form part of an offer,

invitation or the solicitation of an offer or invitation to

purchase, or otherwise acquire, subscribe for, sell or otherwise

dispose of any securities or the solicitation of any vote or

approval in any jurisdiction pursuant to the Acquisition or

otherwise nor shall there be any sale, issuance or transfer of

securities of Next 15 or M&C Saatchi pursuant to the

Acquisition in any jurisdiction in contravention of applicable

laws. The Acquisition will be implemented solely pursuant to the

terms of the Scheme Document (or, in the event that the Acquisition

is to be implemented by means of an Offer, the offer Document),

which contains the full terms and conditions of the Acquisition,

including details of how to vote in respect of the Acquisition. Any

decision in respect of, or other response to, the Acquisition

should be made on the basis of the information contained in the

Scheme Document.

This announcement does not constitute a prospectus or prospectus

equivalent document.

Overseas jurisdictions

The release, publication or distribution of this announcement in

or into jurisdictions other than the United Kingdom may be

restricted by law and therefore any persons who are subject to the

laws of any jurisdiction other than the United Kingdom should

inform themselves about, and observe any applicable legal or

regulatory requirements. In particular, the ability of persons who

are not resident in the United Kingdom to vote their M&C

Saatchi Shares with respect to the Scheme at the M&C Saatchi

Court Meeting, or to execute and deliver forms of proxy appointing

another to vote at the M&C Saatchi Court Meeting on their

behalf, may be affected by the laws of the relevant jurisdictions

in which they are located. Any failure to comply with the

applicable restrictions may constitute a violation of the

securities laws of any such jurisdiction. To the fullest extent

permitted by applicable law the companies and persons involved in

the Acquisition disclaim any responsibility or liability for the

violation of such restrictions by any person. This announcement has

been prepared for the purpose of complying with English law and the

Takeover Code and the information disclosed may not be the same as

that which would have been disclosed if this announcement had been

prepared in accordance with the laws of jurisdictions outside the

United Kingdom.

Unless otherwise determined by Next 15 or required by the

Takeover Code, and permitted by applicable law and regulation, the

availability of New Next 15 Shares to be issued pursuant to the

Acquisition to M&C Saatchi Shareholders will not be made

available, directly or indirectly, in, into or from a Restricted

Jurisdiction where to do so would violate the laws in that

jurisdiction and no person may vote in favour of the Acquisition by

any such use, means, instrumentality or form within a Restricted

Jurisdiction or any other jurisdiction if to do so would constitute

a violation of the laws of that jurisdiction. Accordingly, copies

of this announcement and any formal documentation relating to the

Acquisition are not being, and must not be, directly or indirectly,

mailed or otherwise forwarded, distributed or sent in or into or

from any Restricted Jurisdiction or any other jurisdiction where to

do so would constitute a violation of the laws of that

jurisdiction, and persons receiving such documents (including

custodians, nominees and trustees) must not mail or otherwise

forward, distribute or send such documents in or into or from any

Restricted Jurisdiction. Doing so may render invalid any related

purported vote in respect of the

Acquisition. If the Acquisition is implemented by way of a

Takeover Offer (unless otherwise permitted by applicable law and

regulation), the Takeover Offer may not be made directly or

indirectly, in or into, or by the use of mails or any means or

instrumentality (including, but not limited to, facsimile, e-mail

or other electronic transmission or telephone) of interstate or

foreign commerce of, or of any facility of a national, state or

other securities exchange of any Restricted Jurisdiction and the

Takeover Offer may not be capable of acceptance by any such use,

means, instrumentality or facilities or from within any Restricted

Jurisdiction.

The availability of New Next 15 Shares pursuant to the

Acquisition to M&C Saatchi Shareholders who are not resident in

the United Kingdom or the ability of those persons to hold such

shares may be affected by the laws or regulatory requirements of

the relevant jurisdictions in which they are resident. Persons who

are not resident in the United Kingdom should inform themselves of,

and observe, any applicable legal or regulatory requirements.

M&C Saatchi Shareholders who are in doubt about such matters

should consult an appropriate independent professional adviser in

the relevant jurisdiction without delay.

Further details in relation to M&C Saatchi Shareholders in

overseas jurisdictions are contained in the Scheme Document.

The Acquisition is subject to the applicable requirements of the

Takeover Code, the Panel, the London Stock Exchange and the

FCA.

Additional information for US Investors

The Acquisition relates to the shares of a company incorporated

in England and Wales and is proposed to be effected by means of a

scheme of arrangement under Part 26 of the Companies Act 2006 that

will be governed by the laws of England and Wales. A transaction

effected by means of a scheme of arrangement is not subject to the

tender offer rules or the proxy solicitation rules under the US

Exchange Act. Accordingly, the Acquisition is subject to the

disclosure requirements and practices applicable in the United

Kingdom to schemes of arrangement which differ from the disclosure

requirements of United States tender offer and proxy solicitation

rules. If, in the future, Next 15 exercises the right to implement

the Acquisition by way of a Takeover Offer and determines to extend

the Takeover Offer into the United States, the Acquisition will be

made in compliance with applicable United States laws and

regulations.

Financial information included in this announcement, the Next 15

Circular and/or the Scheme Documentation has been or will have been

prepared in accordance with accounting standards applicable in the

United Kingdom that may not be comparable to financial information

of US companies or companies whose financial statements are

prepared in accordance with generally accepted accounting

principles in the United States.

It may be difficult for US holders of M&C Saatchi Shares to

enforce their rights and any claim arising out of the US federal

laws, since M&C Saatchi and Next 15 are located in a non-US

jurisdiction, and some or all of their officers and directors may

be residents of a non-US jurisdiction. US holders of M&C

Saatchi Shares may not be able to sue a non-US company or its

officers or directors in a non-US court for violations of the US

securities laws. Further, it may be difficult to compel a non-US

company and its affiliates to subject themselves to a US court's

judgement.

The New Next 15 Shares to be issued pursuant to the Scheme have

not been and will not be registered under the US Securities Act or

the securities laws of any state or other jurisdiction of the

United States and may not be offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements of the US Securities Act and such other

laws. The Acquisition is intended to be carried out under a scheme

of arrangement under Part 26 of the Companies Act 2006 (which

requires the approval of the Scheme Shareholders). If so, it is

expected that any New Next 15 Shares to be issued pursuant to the

Scheme to M&C Saatchi Shareholders will be issued in reliance

upon the exemption from the registration requirements of the US

Securities Act, provided by Section 3(a)(10) thereof. The New Next

15 Shares issued pursuant to the Scheme will not be registered

under any US state securities laws and may only be issued to

persons resident in a state pursuant to an exemption from the

registration requirements of the securities laws of such state.

Publication on website and availability of hard copies

A copy of this announcement will be available, subject to

certain restrictions relating to persons resident in Restricted

Jurisdictions, for inspection on Next 15's website

www.next15.com/investors/ by no later than 12 noon (London time) on

the Business Day following this announcement. For the avoidance of

doubt, the contents of the websites referred to in this

announcement are not incorporated into and do not form part of this

announcement.

Next 15 Shareholders may request a hard copy of this

announcement by contacting Next 15's registrars, Link Group, 0371

664 0300. Calls are charged at the standard geographic rate and

will vary by provider. From overseas please call +44 (0)371 664

0300. Calls from outside the United Kingdom will be charged at the

applicable international rate. Lines are open between 9.00 a.m. and

5.30 p.m. Monday to Friday excluding public holidays in England and

Wales.

Dealing and Opening Position Disclosure requirements

Under Rule 8.3(a) of the Takeover Code, any person who is

interested in one per cent. or more of any class of relevant

securities of an offeree company or of any securities exchange

offeror (being any offeror other than an offeror in respect of

which it has been announced that its offer is, or is likely to be,

solely in cash) must make an Opening Position Disclosure following

the commencement of the Offer Period and, if later, following the

announcement in which any securities exchange offeror is first

identified.

An Opening Position Disclosure must contain details of the

person's interests and short positions in, and rights to subscribe

for, any relevant securities of each of (i) the offeree company and

(ii) any securities exchange offeror(s). An Opening Position

Disclosure by a person to whom Rule 8.3(a) applies must be made by

no later than 3.30 pm (London time) on the 10th Business Day

following the commencement of the Offer Period and, if appropriate,

by no later than 3.30 pm (London time) on the 10th Business Day

following the announcement in which any securities exchange offeror

is first identified. Relevant persons who deal in the relevant

securities of the offeree company or of a securities exchange

offeror prior to the deadline for making an Opening Position

Disclosure must instead make a Dealing Disclosure.

Under Rule 8.3(b) of the Takeover Code, any person who is, or

becomes, interested in one per cent. or more of any class of

relevant securities of the offeree company or of any securities

exchange offeror must make a Dealing Disclosure if the person deals

in any relevant securities of the offeree company or of any

securities exchange offeror. A Dealing Disclosure must contain

details of the dealing concerned and of the person's interests and

short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s), save to the extent that these

details have previously been disclosed under Rule 8. A Dealing

Disclosure by a person to whom Rule 8.3(b) applies must be made by

no later than 3.30 pm (London time) on the Business Day following

the date of the relevant dealing. If two or more persons act

together pursuant to an agreement or understanding, whether formal

or informal, to acquire or control an interest in relevant

securities of an offeree company or a securities exchange offeror,

they will be deemed to be a single person for the purpose of Rule

8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and 8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Panel's website at www.thetakeoverpanel.org.uk, including

details of the number of relevant securities in issue, when the

Offer Period commenced and when any offeror was first identified.

You should contact the Panel's Market Surveillance Unit on +44 20

7638 0129 if you are in any doubt as to whether you are required to

make an Opening Position Disclosure or a Dealing Disclosure.

[i] Next 15 reserves the right to increase the offer price if

there is an announcement on or after the date of this announcement

of an offer or a possible offer for M&C Saatchi by a third

party offeror or potential offeror, other than ADV.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OUPMMBMTMTATTPT

(END) Dow Jones Newswires

October 21, 2022 02:15 ET (06:15 GMT)

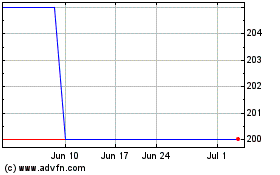

M&C Saatchi (AQSE:SAA.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

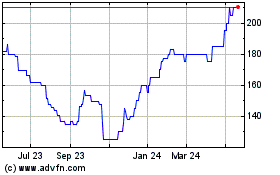

M&C Saatchi (AQSE:SAA.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024