TIDMSHEP

RNS Number : 9168A

Shepherd Neame Limited

28 September 2022

Shepherd Neame

Preliminary results for the 52 weeks to 25 June 2022

Shepherd Neame, Britain's Oldest Brewer and owner and operator

of over 300 high quality pubs in Kent and the Southeast, today

announces results for the 52 weeks ended 25 June 2022.

The period under review has been dominated by the impact of

COVID-19 in the first half and by the effects of the war in Ukraine

in the second half. In this context, we are pleased to have

achieved the strong rebound in sales and profits.

Significant growth in revenue, a return to profits and final

dividend recommended

-- Statutory profit before tax was GBP7.4m (2021: loss of GBP(16.4)m)

-- Basic earnings per share was 42.5p (2021: loss per share of (120.5)p)

-- Underlying basic earnings per share[1] was 39.4p (2021: loss per share of (55.5)p)

-- EBITDA[2] rose significantly to GBP23.4m (2021: GBP7.7m)

-- Final dividend of 15.00p recommended which together with the

interim dividend of 3.50p, makes a total of 18.50p for 2022 (2021:

nil; 2019: 30.08p)

-- Net assets per share[3] increased from GBP11.40 as at 26 June

2021 to GBP11.94 as at 25 June 2022

-- Tight cash management has resulted in net debt, excluding

lease liabilities[4], being reduced to pre-pandemic levels,

allowing for the resumption of investment in the existing estate

and new pubs. Net debt, excluding lease liabilities 4 , as at 25

June 2022 was GBP75.3m (2021: GBP90.8m)

Strong operational performanc e

-- Retail Pubs and Hotels (63 pubs):

-- Total retail like-for-like sales[5] were -8% vs 2019[6] and

+130% vs 2021 for the 52 weeks to 25 June 2022 with footfall

outside London near normal and strong in our coastal estate

-- Retail like-for-like sales 5 inside the M25 (25 pubs and hotels) were

-30% vs 2019 6 and +263% vs 2021. Outside of the M25 (38 pubs

and hotels), retail like-for-like sales 5 were +1% vs 2019 6 and

+104% vs 2021

-- Total like-for-like drink sales were -16% vs 2019 6 and +168%

vs 2021 and like-for-like food sales were -1% vs 2019 6 and +94% vs

2021

-- Total like-for-like accommodation sales were +25% vs 2019 6 and +111% vs 2021

-- Four high quality pubs acquired post year-end for GBP6.7m

-- Tenanted Pubs (231 pubs): Following our strong support during

the pandemic, like-for-like tenanted pub income[7] was +1% vs 2019

6 and +119% vs 2021

-- Brewing and Brands:

-- Good sales momentum with total beer volumes[8] +7% vs 2019 6 and +27% vs 2021

-- Own beer volumes[9] were -8% vs 2019 6 and +16% vs 2021

-- The business is largely protected from the worst of the

energy inflation through fixed price contracts at below market

rate: the brewery through to 2024 and retail pubs through to March

2023

Encouraging trading over the summer

-- For the 13 weeks to 24 September 2022, retail like-for-like

sales 5 were level with 2020[10] and +9.4% vs the 2022[11]

financial year

-- For the 13 weeks to 24 September 2022, retail like-for-like

sales 5 inside the M25 (25 pubs and hotels) were -11.0% vs 2020 10

and +50.6% vs 2022 11 . Outside of the M25 (38 pubs and hotels),

retail like-for-like sales 5 were +4.7% vs 2020 10 and -0.4% vs

2022 11

-- For the 9 weeks to 27 August 2022, like-for-like tenanted pub

income 7 was +2.9% vs 2020 10 and +12.8% vs 2022 11

-- For the 13 weeks to 24 September 2022, total beer volumes 8

were +5.6% vs 2020 10 and +1.2% vs 2022 11 . Own beer volumes 9

were +4.4% vs 2020 10 and +14.4% vs 2022 11

Outlook

-- Fundamentals of the business remain strong. Demand is

encouraging and the business is in good shape. Short term may be

challenging with many political and economic uncertainties

ahead

-- Government assistance on energy costs for consumers and for

business is warmly welcomed but further material inflation still

anticipated in the coming year

-- Business is well placed for the long term as our geographic

heartland is undergoing significant infrastructure development and

we continue to seek good opportunities to enhance our portfolio of

high-quality pubs

Jonathan Neame, CEO of Shepherd Neame, said:

"Shepherd Neame has rebounded well from the challenges of the

last two years - a testament to the strength of the business model

and depth of talent across the business.

The Company has strengthened its balance sheet through tight

cash management and net debt reduction and continues to evolve

operationally to meet changes in the market.

Our business is in good shape and has traded well through the

summer. Whilst we are cautious about the winter ahead and the

inflationary environment, we retain an optimistic view for the

business and continue to seek investment and acquisition

opportunities for the long term."

27 September 2022

ENQUIRIES

Shepherd Neame Tel: 01795 532206

Jonathan Neame, Chief Executive

Mark Rider, Chief Financial

Officer

Instinctif Partners Tel: 020 7457 2020

Matthew Smallwood

NOTES FOR EDITORS

Shepherd Neame is Britain's oldest brewer. Established in 1698

and based in Faversham, Kent it employs around 1,600 people.

At the reporting date, the Company operated 300 pubs, of which

231 were tenanted or leased, 63 managed and six were held as

investment properties under commercial free of tie leases. 85% of

the estate is freehold. The pub estate ranges from inns and hotels

to destination dining, great traditional and local community

pubs.

The Company brews, markets and distributes its own beers to

national and export customers under a range of highly successful

brand names including traditional classics such as Spitfire and

Bishops Finger as well as newer brands, such as Whitstable Bay and

Bear Island.

The Company also has partnerships with Boon Rawd Brewery Company

for Singha beer, Thailand's original premium beer and with Boston

Beer Company for Samuel Adams Boston Lager and Angry Orchard Hard

Cider.

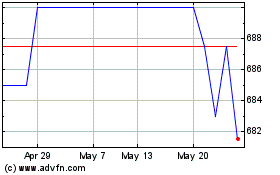

Shepherd Neame's shares are traded on the AQUIS Stock Exchange

Growth Market. See http://www.aquisexchange.com/ for further

information and the current share price.

For further information on the Company, see

www.shepherdneame.co.uk .

Chairman's statement

Overview

I am pleased to report a significant growth in revenue on last

year and a return to profit for the Company.

Whilst this year's result does not represent a full recovery to

the levels of profitability seen in 2019 - the last year

pre-pandemic - it does represent a substantial recovery of the

majority of our cashflow and operating profit.

Performance was dominated by the impact of COVID-19 and its

aftermath, and by consequences of the war in Ukraine: specifically

by the ongoing restrictions on hospitality in July 2021 and

December 2021, as well as unexpected and material cost impacts from

importing certain essential products, and temporary industrial

action from our logistics provider.

We now face more general and widespread cost inflation and much

higher energy costs. Inflation provides a new dimension of

complexity to management decisions, a dimension which has been

absent for many years.

Forecasting at all times is hazardous. The Nobel Prize-winning

economist Kenneth Arrow, employed by the US Air Force during the

Second World War as a meteorologist, quickly realised that his

medium-term weather forecasts were no better than randomly right

and asked to be relieved of this responsibility. The response came

back: "the commanding general is well aware that your forecasts are

no good. However, they are essential for planning purposes."

Inflation complicates forecasting because it is unstable and hard

to predict, and especially when some of the present inflationary

pressures result from supply shortages arising from lockdown and

from the conflict in Ukraine. These may be ephemeral.

Our best estimate is that we will not see full recovery of

profitability in the Company's business to pre-pandemic levels

before 2024/25 as a consequence of the ongoing energy crisis. We

have no doubt that there will be surprises along the way, perhaps

some good surprises. In any event, management will need to be both

as flexible and as steadfast as it has been in the last few years

in order to extract the best result amidst many uncertainties.

The difficulties of the immediate past for a business largely

dependent on congregation, the current inflationary background, and

the dire forecasts for consumer spending have combined to create a

good deal of gloom in the pub and brewing sector. We observe the

surveys of consumer sentiment anxiously but we do not share this

pessimism. People like pubs. The underpinnings of the business

remain strong.

In the short term, the evidence so far in the new financial year

is that many consumers remain willing to spend and enjoy the

conviviality and sense of community which our pubs offer.

Throughout the pandemic, management has shown great agility and

adaptability to ever-changing circumstances. I hope that

shareholders will feel proud of the way we have supported our

licensees, our teams and our communities and impressed by the

various actions and initiatives we have taken to maintain the

essence and spirit of the Company. The Company is ready to face

whatever economic or external challenges are thrown at us in the

coming year.

I would like to thank all in the Shepherd Neame team for their

relentless hard work and the senior team for their leadership,

often under extreme pressure. I also thank our lenders and

shareholders for their patience and understanding as we navigated

each step of the way. I am pleased we can report a return to more

normal debt levels and the restoration of a meaningful

dividend.

Our efforts were recognised with the award of AQSE Company of

the year at the Small Cap Awards 2022.

strategy

The focus in the last year has been to restore our balance sheet

and profitability sufficiently to be in a position to resume

dividends and take advantage of whatever opportunities arise.

We remain convinced that our business - local, authentic,

community-focused, customer-orientated, with a long-term family

outlook - is essentially strong, with attributes increasingly

valued by consumers. We value personal relationships highly and

have a reputation for looking after our people well.

Our teams are very closely connected to local markets; pubs are

at the heart of their communities. This local knowledge gives us a

privileged insight into the needs of our customers as well as

helping us make informed investment decisions.

Our strategy is to build on the brand reputation of Shepherd

Neame, by developing a portfolio of unique and individual pubs and

distinctive and characterful beers.

We aim to delight our customers with great experiences, and so

create passionate advocates for our beers and pubs.

We remain firmly committed to the three different parts of our

business to help us deliver our goals: retail pubs and hotels,

tenanted pubs and brewing and brands. Retail pubs and hotels give

us the direct relationship with consumers and are our principal

engine for long-term growth; tenanted pubs are strongly linked with

their communities and provides part of the asset and cashflow

backbone of our business; brewing and brands is key to recruiting

new customers and building our brand equity.

Financial Results

Our accounts are prepared on an IFRS (International Financial

Reporting Standards) basis. Revenue for the 52 weeks to 25 June

2022 was GBP151.5m (2021: GBP86.9m), an increase of +74% on the

prior year which was significantly impacted by the COVID-19

pandemic.

Statutory operating profit was GBP10.4m (2021: statutory

operating loss of GBP(10.5)m). Underlying operating profit was

GBP12.9m (2021: underlying operating loss of GBP(4.2)m).

Statutory profit before tax was GBP7.4m (2021: statutory loss

before tax of GBP(16.4)m). Underlying profit before tax was GBP7.3m

(2021: underlying loss before tax of GBP(10.1)m).

Basic earnings per share was 42.5p (2021: basic loss per share

of (120.5)p).Underlying basic earnings per share was 39.4p (2021:

underlying basic loss per share of (55.5)p).

Net assets per share increased from GBP11.40 in June 2021 to

GBP11.94.

Dividend

The Board feels that the Company's recovery is sufficiently well

established to resume dividend payments.

At the half year, we paid an interim dividend of 3.50p (2021:

nil). This compares with the interim dividend of 6.00p that was

declared and subsequently cancelled in March 2020.

We are now proposing the first final dividend to be paid since

October 2019, of 15.00p. This compares with the final dividend of

2019 of 24.21p, and represents dividend cover for the full year of

2.1 times on underlying earnings per share of 39.4p.

Board changes

Jonathon Swaine joined us on 27 June 2022 as Managing Director,

Pubs. He joins us from Rank Group Plc, having spent the majority of

his career in the pub industry, initially at Bass plc from 1997 to

2005, and then 14 years at Fuller, Smith and Turner plc. He is an

experienced and proven operator.

At the same time, Nigel Bunting took on a new role as Commercial

Director, overseeing the brewing, sales, procurement and supply

chain operations.

Summary

In its long history, Shepherd Neame has experienced many

economic crises and downturns. It survives them because the

business model is fundamentally robust, because we provide a

product and service that people want even in the hard times, and

because we constantly adapt to the wider industry trends and change

to meet the needs of our local market. More broadly, Shepherd Neame

is a business that is trusted, with a management that is

trusted.

While there will be challenges ahead over the next 12 months and

beyond, nothing is likely to compare with the challenge of being

closed for the best part of a year in 2020.

As a long-term business, we see opportunity as well as challenge

in times of turbulence - as evidenced by the acquisitions made post

year end. We are positioned to take advantage of similar

opportunities that may arise.

The business has recovered its momentum. The team is full of

ambition, energy and new initiatives and I have no doubt this

momentum will continue in the coming year.

Richard Oldfield

Chairman

Chief Executive's Review

Overview

I am extremely proud of the way the business has rebounded after

the challenges of the last two years. To have grown our revenues

and recovered the majority of our operating profit - compared with

2019 - is testament to the strength of the business, and the

resilience and agility of our team members in adapting to ever

changing circumstances.

At almost every step of the way since pubs were allowed to

re-open their gardens in April 2021, there have been fresh hurdles

to cross, and new and unexpected challenges, which have either

impacted trading or resulted in higher costs for the business.

We have controlled cash tightly, reduced our net debt and

strengthened the balance sheet so that we are able to resume

dividend payments and investment in the business.

Consumer demand so far has remained robust, in spite of having

to pay higher prices for most goods and services. It is anticipated

that consumer demand over the coming winter may soften, as the high

energy and fuel bills squeeze disposable income. Having coped with

the greater challenge of the long periods of closure during the

COVID-19 pandemic, over which we had no control, we feel able to

deal with these issues as they arise.

The business is now back on a firm footing. Whilst the road to

full recovery may take slightly longer than originally anticipated

as a result of inflationary pressures, the next few years may also

present some great long-term opportunities for the business and so

we look forward to the future with confidence.

Meeting the COVID challenge

Initially, we anticipated "freedom day" would come in June 2021,

but this was delayed by six weeks to end July 2021, with ongoing

restrictions still in place. As demand recovered, many goods and

services were in short supply, particularly food products and

materials for the building trade. Finding new team members was

difficult and it has proved challenging to fill certain roles, such

as chefs and kitchen staff, ever since.

As these challenges started to settle, we were faced with

disruption in our logistics and supply chain, with short-term

industrial action from our service provider and exceptionally high

costs of international freight for our beer imports.

Throughout the autumn, we experienced materially higher costs

and delays for international shipments of beer and wine. The back

to work momentum started to build, workers returned to offices in

London, and the prospects rose for a busy Christmas trade, until

the Omicron variant struck, which resulted in substantial

cancellations and more waste.

As the fears about Omicron started to subside, trade through

February and early March was most encouraging, before the Ukraine

war brought fresh concerns.

We enjoyed excellent trade in the week leading up to Easter, and

over the May bank holiday. The Platinum Jubilee celebrations gave

us a small boost, but the train strike impacted the final month of

the year.

Meeting the Inflation Challenge

Throughout this period, there have been three major economic

phases, each of which has had a cost impact on our business:

-- the first was the inflationary surge in the summer of 2021,

driven largely by suppressed demand during the pandemic;

-- the second was the removal of the reduced rate of VAT at the

end of March, and the move to the higher national insurance rate

and higher national minimum wage; and

-- the third was the second inflationary wave driven by energy

and cereal shortages, as a consequence of the war in Ukraine.

All three of these phases have increased our cost base, and we

have had no option but to pass on these costs with higher prices.

Consumers have so far shown remarkable resilience to this

inflation, as our strong recent trade demonstrates. The demand for

socialising, particularly after the restrictions of the last two

years, is encouraging, and previous experience suggests that people

are more likely to prioritise spending on going out, over other

discretionary or delayable expenditure.

During the last year, the Company received GBP2.4m in furlough,

grants and business rates relief (2021: GBP15.0m), to compensate

for periods of ongoing restrictions.

Across the business we have experienced material inflation

across our cost base above the prevailing rate of RPI: in retail

pubs and hotels, this is driven mainly by the higher national

minimum wage, national insurance and electricity costs; in the

brewery, mainly by higher CO(2) and packaging costs.

So far, we have been largely protected from an even higher

inflationary impact by long-term fixed price purchasing contracts.

In the brewery, we are fully fixed on gas and electricity prices

through to September 2024; while in the retail pubs we are fully

fixed through to March 2023, and fixed on two-thirds of our

anticipated requirement through to September 2024. In both cases,

our current fixed prices are substantially below the prevailing

market price, albeit, in the retail pubs, we will nonetheless incur

incremental costs in the coming year of GBP1.2m for utility

procurement.

We have secured all our malt and hops requirement through to the

end of calendar 2023.

In the coming year, we expect further inflation. Our known

principal exposure is in energy-related products, specifically

glass and CO(2) , and potential further increases in national

minimum wage levels above those previously announced.

Our tenanted licensees will be exposed to these same

inflationary forces to varying degrees, although will be protected

through the winter by the Energy Bills Relief Scheme.

Following a full market tender, we are in discussions to extend

our logistics contract. This is likely to result in a materially

higher price than presently, as our existing contract rebases to

normal market levels, and as all logistics providers tackle the

impact of driver shortages and the high cost of fuel.

Aside from the inflationary forces we remain concerned about the

impacts that any industrial action may have on our business.

The Market

Total market beer volumes have recovered to pre-pandemic levels,

despite the extraordinary disruption of the last two years. Certain

trends, such as on- versus off-trade beer consumption are just

starting to normalise; other trends such as city centre footfall

and in-bound tourism will take slightly longer.

Certain consumer trends that were evident pre-pandemic continue

to evolve, for example the trend towards premiumisation, on the one

hand, and moderation - in the form of lower alcohol and less

calories - and economising on the other. We continue to develop our

business to adapt to these trends.

Tourism started to recover in summer 2022, with more visitors

than expected from the US, but overall in-bound international

tourism remains significantly below pre-pandemic levels and this is

not expected to recover in full until 2024.

The inflationary challenge will drive higher prices for beer and

food, and tighter margins for most retailers. Higher energy costs

and higher interest rates are likely to squeeze consumers'

disposable income.

Operational Overview

Tenanted and Retail Pub Operations

As at 25 June 2022, we owned 300 pubs (2021: 310) of which 231

(2021: 235) are tenanted or leased and 63 (2021: 65) are retail

pubs. Six (2021: 10) are operated as free of tie investment

properties. 85% of our pubs are freehold.

During the period we have transferred two tenanted pubs to

retail pubs, one retail pub to tenanted and three tenanted pubs to

investment property. We have sold two freehold pubs, surrendered

one leasehold pub and sold investment property and land (2021: two

freehold pubs and investment property and land) for total proceeds

of GBP9.1m. This includes two hotels, the Royal Wells, Tunbridge

Wells and the Conningbrook, Ashford for GBP5.75m. These disposals

in total have realised a profit of GBP1.7m. We anticipate further

transfers from tenanted to retail in the coming year.

We did not invest in any major capital projects during the first

half of the year and focused instead on our external signage and

decoration programme. We have maintained our pubs at a high level.

In the second half we resumed our capital programme with notable

projects to refresh the Old Mill, Ashford and upgrade the White

Horse, Boughton-under-Blean, as well as other smaller projects in

gardens and outside areas.

In the coming year, we intend to resume the major development

programme that was stalled during the pandemic, and have identified

the Crown at Rochester, the Crown at Chislehurst and the Tom Cribb

in Haymarket as priority projects. Subject to relevant permissions

being granted, we hope to commence the build of our new pub site at

Ebbsfleet by the end of the current financial year, but this venue

is not due to open until end 2024.

We have invested in our digital infrastructure with an upgrade

of the wi-fi network in our pubs. This will improve the customer

experience and allow us to create stronger customer engagement. We

have also enhanced our pub websites. We have an ongoing digital

transformation strategy to build better awareness through data and

drive stronger marketing connections with our customers and so

build loyalty.

We are constantly reviewing our food and drink offer to provide

our customers with a premium experience, whilst addressing the

needs of increasingly more calorie and price conscious consumers.

We expect to be able to mitigate cost inflation in food and drink

through careful buying, price increases and menu management.

Retail Pubs and Hotels

Our retail pubs and hotels are the principal engine for growth.

We are targeting 100 outlets in this division in the medium term.

We have identified a number of sites within our existing estate

that are suitable for management in due course. Many of these sites

would benefit from major redevelopment.

We are investing to enhance our offer and the people experience,

to build our digital infrastructure and to develop our customer

engagement.

For the 52 weeks to 25 June 2022, the retail pubs achieved

like-for-like sales of -8% vs the 2019 6 financial year, but were

+130% vs 2021. We have returned to profit.

Within this performance, retail like-for-like sales were -19% vs

20196 in July 2021, due to the delay in lifting restrictions, and

-25% vs 20196 in December 2021, as Omicron impacted footfall. In

most other periods, we were running close to or above 2019

levels.

Like-for-like drinks sales were -16% vs 2019 6 and +168% vs

2021; like-for-like food sales were -1% vs 2019 6 and +94% vs

2021.

Like-for-like accommodation sales were +25% vs 20196 and +111%

vs 2021. Occupancy was 76% (20196: 76%; 2021: 31%) and RevPAR was

GBP80 (2019 6 : GBP67; 2021: GBP32).

Footfall outside of London has been near normal - except during

periods of restrictions - particularly at those coastal pubs and

hotels which benefit from their unique locations and great outside

space. We have 25 retail pubs inside the M25. Footfall here

increased steadily throughout the autumn - until Omicron -, but

resumed quickly in February, and has continued to build month on

month. We expect the back to office momentum to continue through

Autumn 2022, though we recognise that pre-pandemic office patterns

are unlikely to recover in full.

For the 52 weeks to 25 June 2022, our retail estate inside the

M25 achieved like-for-like sales of -30% vs 20196, but were +263%

vs 2021. Outside of the M25, retail like-for-like sales were +1% vs

2019 6 and +104% vs 2021.

Tenanted Pubs

Trade in our tenanted pubs has followed roughly the same pattern

as in retail, with a weak July and December, when restrictions were

in place, followed by good trade in the autumn, and early spring

and summer. Volumes were impacted by the supply chain difficulties

in September, and remain lower than pre-pandemic levels.

For the 52 weeks to 25 June 2022, like-for-like tenanted pub

income was +1% vs 20196 and +119% vs 2021. In the restriction-free

periods, income levels were generally above the equivalent month in

2019. For those periods where restrictions were in place, we

provided a 10% discount on rent to our licensees, helped them

secure grants and provided other advice.

Despite the economic and inflationary challenges facing the

sector, the turnover of licensees has remained low thanks in part

to the excellent support we have given our licensees during the

pandemic. Although there is a shortage of applicants, as with other

areas of the economy, we remain able to attract good-quality

candidates.

We have again registered good scores in the industry Tenant

Tracker benchmark survey and are one of the most respected tenanted

pub operators in the sector.

Capital and Investment

We have maximised our cashflow by restricting core capital

expenditure to GBP5.4m (2021: GBP3.9m), from more normal levels of

GBP10m-GBP14m and by realising GBP9.1m in disposal of non-core

assets. We plan to increase core capital expenditure in the coming

year to be in line with historic levels.

Since the year end we have acquired three popular pubs in Essex

- all freehold - from the East Anglia Pub Company and one leasehold

site in Bournemouth. The aggregate investment in these acquisitions

is GBP6.7m. All four pubs will be operated in the retail

division.

The three in Essex are near Southend-on-Sea. They are all

characterful pubs, including the very popular 16th century dining

venue, the Bellhouse in Leigh-on-Sea. These acquisitions build on

our presence in south Essex. Urban Reef in Bournemouth has been one

of our many free-trade customers in the area and enjoys a

spectacular location on the beach at Boscombe.

Brewing and Brands

The underlying trends in this division are encouraging. Volume

has been good, but cost inflation has been significant.

For the 52 weeks to 25 June 2022, total beer sales were +7% vs

20196 and +27% vs 2021. Own beer volume was -8% vs 20196 and +16%

vs 2021.

In 2019, we took the decision to strengthen our on-trade local

Heartland team, and as business has resumed this has paid good

dividends, as we are winning some excellent new business, and high

profile accounts in an ever wider geography. We have built great

new brand platforms with Bromley FC, Remarkable Pubs and the Pig

Hotel Group in particular.

As anticipated, trade through the grocers has been lower this

year, as the on-trade has re-opened. The off-trade is now c. 60% of

the overall beer market.

Our more mature brands such as Spitfire and Bishops Finger still

deliver substantial volumes, but our marketing increasingly

supports our Whitstable Bay and Bear Island portfolios, both of

which have proved very popular with customers.

That portfolio is now strengthened with the brewing of Singha

beer at Faversham, as from March 2022, in partnership with the Boon

Rawd Brewery. This will not only reduce import costs materially,

but also gives us an exciting and super-premium world lager, to

enhance our enviable and unique brand portfolio.

This portfolio will be strengthened further in the coming year

as we commission our small batch brewery. This will enable us to

develop taste and flavour profiles that are hard to achieve in a

larger plant, and so will provide an exciting and dynamic new beer

range for our customers.

We have again this year showcased our brands at various high

profile events. In March we were the official beer of the Oxford

and Cambridge University Boat Race on the Thames; in July, we were

once again chosen as the supplier to the 150th Open Golf in St

Andrews. In addition we have supported many local events such as

the Black Deer Festival and the Pig Hotel Smoked and Uncut

Festival.

Investment Property

As at 25 June 2022, the Company owns investment property valued

at GBP6.7m (2021: GBP6.1m). We have sold seven investment

properties during this period as part of our plan to reduce debt

incurred during the pandemic.

We continue to work on promoting a number of sites in and around

Faversham which we believe are suitable for residential development

as part of the overall local plan. Faversham has seen substantial

housing development in the last few years and more is anticipated

as demand in the area increases.

Financing, Cashflow and Net Debt

The principal focus of the Board over the last two years has

been to manage cashflow as tightly as possible, to restrict cash

outflow during times of closure and to maximise cash inflow during

periods of trading.

In 2020 we took an additional CLBILS loan to give us additional

headroom and were granted relaxation of banking covenants by our

lenders. These could have remained in place until September 2022,

but through good trading and active property management, we reduced

our debt position sufficiently quickly to be able to terminate

these arrangements at the end of March 2022. We have returned to

our previous covenant tests on other debt.

During the year we generated underlying EBITDA (earnings before

interest, tax, depreciation and amortisation) of GBP23.4m (2021:

GBP7.7m).

Statutory net debt, including lease liabilities, was GBP131.2m

(2021: GBP149.1m), made up of GBP75.3m of bank and private

placement debt, and GBP55.9m of lease liabilities.

Net debt, excluding lease liabilities, fell sharply from

GBP90.8m in the prior year to GBP75.3m. At the end of the 2021

financial year, GBP2.4m of VAT was deferred in agreement with HMRC

and was settled in full by the year end 2022.

This rapid debt reduction has given us the confidence to resume

investment again. We have substantial headroom. At the year end our

covenant leverage was 3.7:1. Our medium-term covenant leverage

target remains at 3:1.

Post Year End

Since the year end, we have extended our long-term financing. We

have taken an additional GBP20m private placement from BAE Systems

Pension Fund, for a term of ten years, at a fixed rate of 5.47%.

This sits alongside the 20-year private placement for GBP35m, that

we issued with the same lender in 2018, at a rate of 3.99%.

This extends our total long-term committed facilities, at a time

of economic uncertainty, and reduces our overall cost of debt. We

are in the process of renewing our revolving credit facilities.

These steps provide with us a sound funding platform to take

advantage of any opportunities that arise in the future.

Environment and our Community

We have carried out extensive research in this area in the last

year, established an ESG steering committee and clarified our goals

as:

-- to become carbon neutral (scopes 1 and 2) by 2030;

-- to become carbon neutral in our supply chain (scope 3) by 2040; and

-- no waste to landfill by 2025.

We have made good progress in a number of areas. We are founder

members of the Zero Carbon Forum and have led the pilot of the

Green Mark programme in a group of pubs. We have entered into a new

waste contract to support our goal of zero waste to landfill.

We have consolidated the purchase of energy across the business

and now buy 100% electricity from renewable sources. We are

planning a major solar installation on one of the brewery

buildings. We continue to roll out electric vehicle rapid charging

points in our pubs.

We have launched a variety of initiatives to raise funds to

support the great work of Kent Wildlife Trust and we supported the

Platinum Jubilee Green Canopy project by planting a series of small

fruit tree orchards at our pubs.

Building a Great Team of Dedicated People

To meet the challenges of recruiting staff, we have chosen to

strengthen our People Team. We have recruited several new roles in

this area under our People Director, Kate Ware, including

appointing People Partners for each part of the business and an

Apprenticeship Lead.

We have also installed new software to help us manage the

recruitment process more effectively, and carried out an in-depth

survey to identify areas where we can improve the people experience

and build clearer career paths.

We are fortunate that our people are so passionate about the

Company, their roles and the teams they work with. I would like to

thank them for their commitment and extraordinary hard work, in

such difficult circumstances, in the last year.

Current Trading

Trading over the summer has been encouraging.

July and August have been boosted by exceptionally dry, warm and

sunny weather. This has driven drinks sales in particular.

Occupancy has remained high, but overall accommodation sales are

slightly lower than last year as people returned to overseas

holiday destinations after the staycation boom of 2021. Food is in

line with recent trends, slightly lower than 2019, but strong

nonetheless.

Many towns have reinstated local events and festivals, such as

the Faversham Hop Festival and Broadstairs Folk Week, which provide

a welcome boost to those communities. Our new acquisitions have

performed well and in line with expectations. Urban Reef in

particular has produced some exceptional trading weeks.

For the 13 weeks to 24 September 2022, retail like-for-like

sales were level with 202010 and +9.4% vs 2022 11 .

For the 13 weeks to 24 September 2022, our retail estate inside

the M25 achieved like-for-like sales of -11.0% vs 202010 and +50.6%

vs 2022 11 . Outside of the M25, retail pubs achieved like-for-like

sales of +4.7% vs 202010 and were in line with 2022 11 .

Like-for-like tenanted pub income for the nine weeks to 27

August 2022 was +2.9% vs 202010 and +12.8% vs 2022 11 .

Beer volumes have remained strong throughout the summer, driven

primarily by Heartland sales, and offset by declines in the

off-trade and the rebalancing between on- and off-trade sales

post-pandemic. Total beer volume for the 13 weeks to 24 September

2022 was +5.6% vs 202010 and +1.2% vs 2022 11 . Own beer volume was

+4.4% vs 202010 and +14.4% vs 2022 11 .

We continue to incur high costs in all areas of the business,

which we expect to persist throughout the year.

Summary and Outlook

There are many economic and political uncertainties ahead, and a

recession is forecast.

In this context we warmly welcome the recent government

announcement to support consumers and businesses manage their way

through the utility crisis. This will provide considerable relief

for those tenanted pubs who are not on fixed contracts. In other

parts of the business we have fixed price contracts that are below

the market rate.

In line with many in the industry, the current energy crisis

will hold back full recovery. However, previous experience would

suggest that the beer and hospitality sector is more resilient than

most to such an environment, and that consumers will prioritise

this over spend in other areas. The pandemic has shown that

socialising in a pub remains core to our way of life. As such,

whilst the short-term market conditions may be challenging, this

may also prove to be a time of great long-term opportunity.

Furthermore, the ongoing house building and infrastructure

projects continue to turn our heartland into a larger and more

affluent community. Of note this year is the opening of the

Elizabeth Line, with its terminus in North Kent, and the

development of a new Thanet Parkway station. Both these projects

will bring shorter journey times to London and so support the

hybrid lifestyle that people desire. We are well positioned to

capitalise on these economic and lifestyle trends in the

future.

After the hard work to rebuild momentum post-pandemic, we now

have the confidence to move forward, to resume investment and seek

good-value opportunities when they arise.

Jonathan Neame

Chief Executive

GROUP INCOME STATEMENT

For the 52 weeks ended 25 June 2022

52 weeks ended 25 June 52 weeks ended 26 June

2022 2021

------------------ ---- ============================================= =============================================

Items excluded Items excluded

Underlying from underlying Underlying from underlying

results results Total statutory results results Total statutory

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

1,

Revenue 2 151,538 - 151,538 86,884 - 86,884

Other income 1 383 - 383 2,839 - 2,839

Operating charges 3 (139,028) (2,470) (141,498) (93,963) (6,307) (100,270)

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

Operating

profit/(loss) 3 12,893 (2,470) 10,423 (4,240) (6,307) (10,547)

Net finance costs 3 (5,599) (83) (5,682) (5,817) (471) (6,288)

Fair value

movements on

financial

instruments

charged to profit

and

loss 3 - 397 397 - 115 115

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

Total net finance

costs (5,599) 314 (5,285) (5,817) (356) (6,173)

Profit on disposal

of

property 3 - 1,709 1,709 - 221 221

Investment

property fair

value movements 3 - 520 520 - 87 87

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

Profit/(loss)

before taxation 7,294 73 7,367 (10,057) (6,355) (16,412)

Taxation 4 (1,462) 375 (1,087) 1,868 (3,247) (1,379)

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

Profit/(loss)

after taxation 5,832 448 6,280 (8,189) (9,602) (17,791)

------------------ ---- ---------- ---------------- --------------- ---------- ---------------- ---------------

Earnings/(loss)

per 50p

ordinary share 6

Basic 42.5p (120.5)p

Diluted 42.3p (120.5)p

All results are derived from continuing activities.

GROUP STATEMENT OF COMPREHENSIVE INCOME

For the 52 weeks ended 25 June 2022

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

Note GBP'000 GBP'000

------------------------------------------------------ ---- -------- --------

Profit/(loss) after taxation 6,280 (17,791)

Items that may be reclassified subsequently to profit

or loss:

Gains arising on cash flow hedges during the period 2,596 1,605

Income tax relating to these items 4 (561) (166)

Items that will not be reclassified subsequently to

profit or loss:

Unrealised gain on revaluation of property - 31

------------------------------------------------------ ---- -------- --------

Other comprehensive gains 2,035 1,470

------------------------------------------------------ ---- -------- --------

Total comprehensive income/(loss) 8,315 (16,321)

------------------------------------------------------ ---- -------- --------

GROUP STATEMENT OF FINANCIAL POSITION

As at 25 June 2022

Group Group

25 June 26 June

2022 2021

GBP'000 GBP'000

-------------------------------------- --------- ---------

Non-current assets

Goodwill and intangible assets 375 328

Property, plant and equipment 274,651 285,063

Investment properties 6,716 6,068

Other non-current assets - 5

Right-of-use assets 44,235 47,311

--------------------------------------- --------- ---------

325,977 338,775

-------------------------------------- --------- ---------

Current assets

Inventories 8,067 7,320

Trade and other receivables 17,685 15,360

Cash and cash equivalents 5,579 5,560

Assets held for sale 1,099 2,419

--------------------------------------- --------- ---------

32,430 30,659

-------------------------------------- --------- ---------

Current liabilities

Trade and other payables (27,222) (26,383)

Borrowings (1,600) (1,600)

Lease liabilities (2,780) (5,100)

--------------------------------------- --------- ---------

(31,602) (33,083)

-------------------------------------- --------- ---------

Net current assets/(liabilities) 828 (2,424)

--------------------------------------- --------- ---------

Total assets less current liabilities 326,805 336,351

--------------------------------------- --------- ---------

Non-current liabilities

-------------------------------------- --------- ---------

Lease liabilities (53,106) (53,226)

Borrowings (79,270) (94,765)

Derivative financial instruments (2,353) (5,414)

Provisions - (498)

Deferred tax liabilities (14,749) (13,101)

--------------------------------------- --------- ---------

(149,478) (167,004)

-------------------------------------- --------- ---------

Net assets 177,327 169,347

--------------------------------------- --------- ---------

Capital and reserves

Share capital 7,429 7,429

Share premium account 1,099 1,099

Revaluation reserve 31 31

Own shares (660) (1,010)

Hedging reserve (1,489) (3,524)

Retained earnings 170,917 165,322

--------------------------------------- --------- ---------

Total equity 177,327 169,347

--------------------------------------- --------- ---------

CONSOLIDATED statement of changes in equity

For the 52 weeks ended 25 June 2022

Share

Share premium Revaluation Own Hedging Retained

capital account reserve shares reserve earnings Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 27 June

2020 7,429 1,099 17 (1,328) (4,963) 182,982 185,236

Loss for the financial

year - - - - - (17,791) (17,791)

Gains arising on cash

flow hedges during the

year - - - - 1,605 - 1,605

Gains on revaluation

of property, plant and

equipment - - 31 - - - 31

Tax relating to components

of other comprehensive

income 4 - - - - (166) - (166)

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Total comprehensive

income/(loss) - - 31 - 1,439 (17,791) (16,321)

Revaluation reserve

realised on disposal

of properties - - (17) - - 17 -

Accrued share-based

payments - - - - - 428 428

Distribution of own

shares - - - 125 - (121) 4

Unconditionally vested

share awards - - - 193 - (193) -

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 26 June

2021 7,429 1,099 31 (1,010) (3,524) 165,322 169,347

Profit for the financial

year - - - - - 6,280 6,280

Gains arising on cash

flow hedges during the

year - - - - 2,596 - 2,596

Tax relating to components

of other comprehensive

income 4 - - - - (561) - (561)

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Total comprehensive

income - - - - 2,035 6,280 8,315

Ordinary dividends paid - - - - - (520) (520)

Accrued share-based

payments - - - - - 183 183

Distribution of own

shares - - - 101 - (99) 2

Unconditionally vested

share awards - - - 249 - (249) -

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 25 June

2022 7,429 1,099 31 (660) (1,489) 170,917 177,327

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

GrouP statement of cash flows

For the 52 weeks ended 25 June 2022

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

Note GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ---- -------- -------- ------- ---------

Cash flows from operating activities

Cash generated from operations 7 21,141 1,631

Income taxes received - 195

-------- -------

Net cash generated by operating activities 21,141 1,826

Cash flows from investing activities

Proceeds from disposal of property,

plant and equipment 5,792 383

Proceeds from disposal of investment

property 1 658

Proceeds from disposal of assets held

for sale 3,292 3,485

Purchases of property, equipment and

lease premiums (5,304) (3,878)

Purchase of intangible assets (129) -

-------- -------

Net cash generated by investing activities 3,652 648

Cash flows from financing activities

Dividends paid 5 (520) -

Interest paid (4,436) (4,796)

Payments of principal portion of lease

liabilities (4,220) (3,930)

Repayment of borrowings 7 (15,600) -

Proceeds from borrowings 7 - 2,000

Share option proceeds 2 5

-------- -------

Net cash used in financing activities (24,774) (6,721)

------------------------------------------- ---- -------- -------- ------- ---------

Net movement in cash and cash equivalents 19 (4,247)

Cash and cash equivalents at beginning

of the period 5,560 9,807

------------------------------------------- ---- -------- -------- ------- ---------

Cash and cash equivalents at end of

the period 5,579 5,560

------------------------------------------- ---- -------- -------- ------- ---------

Notes to the financial statements

25 June 2022

1 Segmental reporting

The accounting policy for identifying segments is based on

internal management reporting information that is regularly

reviewed by the Chief Operating Decision-Maker (CODM).

The Group has three operating segments, which are largely

organised and managed separately according to the nature of the

products and services provided and the profile of their

customers:

Brewing and Brands which comprises the brewing, marketing and

sales of beer and other products;

-- Retail Pubs and Hotels; and

-- Tenanted Pubs which comprises pubs operated by third parties

under tenancy or tied lease agreements.

-- Transfer prices between operating segments are set on an arm's-length basis.

As segment assets and liabilities are not regularly provided to

the CODM, the Group has elected, as provided under IFRS 8 Operating

Segments (amended), not to disclose a measure of segment assets and

liabilities.

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated(1) Total

52 weeks ended 25 June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- ----------- -------- -------------- --------

Revenue 56,615 61,240 32,773 910 151,538

Other income - 383 - - 383

--------------------------------------- -------- ----------- -------- -------------- --------

Underlying operating (loss)/profit (252) 8,288 13,359 (8,502) 12,893

Items excluded from underlying

results - (1,899) (940) 369 (2,470)

--------------------------------------- -------- ----------- -------- -------------- --------

Segmental operating (loss)/profit (252) 6,389 12,419 (8,133) 10,423

Net underlying finance costs (5,599)

Finance costs excluded from underlying

results (83)

Fair value movements on ineffective

element of cash flow hedges 397

Profit on disposal of property 1,709

Investment property fair value

movements 520

--------------------------------------- -------- ----------- -------- -------------- --------

Profit before taxation 7,367

--------------------------------------- -------- ----------- -------- -------------- --------

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated Total

52 weeks ended 25 June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- ----------- -------- ----------- --------

Other segment information

Capital expenditure - tangible

and intangible assets 1,400 1,736 1,677 639 5,452

Depreciation and amortisation pre

IFRS 16 1,592 2,840 2,601 397 7,430

Depreciation and amortisation 1,695 4,614 3,601 570 10,480

Impairment of property, plant and

equipment, goodwill and assets

held for sale - 1,010 603 24 1,637

Impairment of right-of-use assets - 889 337 - 1,226

Underlying segmental EBITDA pre

IFRS 16 1,394 10,920 15,812 (8,143) 19,983

Underlying segmental EBITDA 1,508 12,882 16,967 (7,929) 23,428

Number of pubs - 63 231 6 300

---------------------------------- -------- ----------- -------- ----------- --------

1. GBP910,000 of unallocated income (2021: GBP1,050,000)

includes rent receivable from investment properties and other

non-core trading income. Unallocated expenses primarily represent

Head Office support costs.

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated Total

52 weeks ended 26 June 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- ----------- -------- ----------- --------

Revenue 42,018 27,068 16,748 1,050 86,884

Other Income - 2,839 - - 2,839

--------------------------------------- -------- ----------- -------- ----------- --------

Underlying operating (loss)/profit (1,287) 983 2,343 (6,279) (4,240)

Items excluded from underlying

results - (4,816) (562) (929) (6,307)

--------------------------------------- -------- ----------- -------- ----------- --------

Segmental operating (loss)/profit (1,287) (3,833) 1,781 (7,208) (10,547)

Net underlying finance costs (5,817)

Finance costs excluded from underlying

results (471)

Fair value movements on ineffective

element of cash flow hedges 115

Profit on disposal of property 221

Investment property fair value

movements 87

--------------------------------------- -------- ----------- -------- ----------- --------

Loss before taxation (16,412)

--------------------------------------- -------- ----------- -------- ----------- --------

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated Total

52 weeks ended 26 June 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- -------- ----------- -------- ----------- --------

Other segment information

Capital expenditure - tangible

and intangible assets 779 1,494 847 123 3,243

Depreciation and amortisation pre

IFRS 16 1,662 3,280 2,698 386 8,026

Depreciation and amortisation 1,752 4,629 4,248 481 11,110

Impairment of property, plant and

equipment, goodwill and assets

held for sale - 3,407 352 331 4,090

Impairment of right-of-use assets - 1,409 210 - 1,619

Underlying segmental EBITDA pre

IFRS 16 449 2,855 5,150 (5,732) 2,722

Underlying segmental EBITDA 546 6,184 6,616 (5,636) 7,710

Number of pubs - 65 235 10 310

---------------------------------- -------- ----------- -------- ----------- --------

Geographical information

An analysis of the Group's revenue by geographical market is set

out below:

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

------------------ -------- --------

Revenue

UK 149,011 84,606

Rest of the World 2,527 2,278

------------------ -------- --------

151,538 86,884

------------------ -------- --------

2 Revenue

An analysis of the Group's revenue by category is as

follows:

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

---------------------------- -------- --------

Sale of goods and services1 142,296 83,707

Rental income 9,242 3,177

---------------------------- -------- --------

Revenue 151,538 86,884

---------------------------- -------- --------

1. Revenue in the prior year includes GBP609,000 received from

the Government under the Eat Out to Help Out scheme.

3 Non-GAAP reporting measures

Certain items recognised in reported profit or loss before tax

can vary significantly from year to year and therefore create

volatility in reported earnings which does not reflect the

underlying performance of the Group. The Directors believe that

"underlying operating profit", "underlying profit before tax",

"underlying basic earnings per share", "underlying earnings before

interest, tax, depreciation, and amortisation" as presented provide

a clear and consistent presentation of the underlying performance

of the ongoing business for shareholders. Underlying profit is not

defined by IFRS and therefore may not be directly comparable with

the "adjusted" profit measures of other companies. The adjusted

items are:

-- profit or loss on disposal of properties;

-- investment property fair value movements;

-- separately disclosed operating and finance charges which are

either material or infrequent in nature and do not relate to the

underlying performance;

-- fair value movements on financial instruments charged to profit and loss; and

-- taxation impacts of the above (see note 4).

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

---------------------------------------------------------- -------- --------

Underlying EBITDA 23,428 7,710

Depreciation and amortisation (10,480) (11,110)

Free trade loan discounts (2) -

Loss on sale of assets (excluding property) (53) (840)

---------------------------------------------------------- -------- --------

Underlying operating profit/(loss) 12,893 (4,240)

---------------------------------------------------------- -------- --------

Net underlying finance costs pre IFRS 16 (4,355) (4,532)

---------------------------------------------------------- -------- --------

Net underlying finance costs (5,599) (5,817)

---------------------------------------------------------- -------- --------

Underlying profit/(loss) before taxation 7,294 (10,057)

Profit on disposal of properties 1,709 221

Investment property fair value movements 520 87

Separately disclosed operating charges:

Impairment of intangible assets, properties, right-of-use

assets and assets held for sale (2,863) (5,709)

Restructuring costs - (709)

Other operating charges excluded from underlying results 393 111

Separately disclosed finance costs:

Costs related to putting in place CLBILS loan - (201)

Costs relating to the agreement of covenant waivers with

our lenders (50) (270)

Costs relating to the transition from LIBOR to SONIA

for sterling debt instruments (33) -

Fair value movements on financial instruments charged

to profit and loss 397 115

---------------------------------------------------------- -------- --------

Profit/(loss) before taxation 7,367 (16,412)

---------------------------------------------------------- -------- --------

Separately disclosed operating charges

a) An impairment charge of GBP2,863,000 (2021: GBP5,709,000) in

relation to seven freehold properties and eight right-of-use

assets.

b) A recovery of GBP159,000 (2021: GBP111,000) in relation to

previously disclosed fraud carried out by an employee.

c) A provision of GBP498,000 was made in the year to 27 June

2020 in respect of potential charges relating to an inquiry opened

by HMRC regarding the provision of uniforms and training to

employees. The inquiry was closed by HMRC in March 2022 and the

excess provision of GBP443,000 has been released in the period.

d) Professional fees of GBP47,000 relating to two company

acquisitions which completed after the year end (see note 8).

e) Professional fees of GBP162,000 relating to the transition of

the pension scheme administration to an independent master

trust.

During the 52 weeks ended 26 June 2021, there was a one-off net

charge of GBP709,000 in respect of restructuring costs.

Separately disclosed finance costs

During the 52 weeks ended 25 June 2022, the Group incurred

GBP83,000 of legal and professional fees associated with agreeing

covenant waivers with our lenders, as well as fees associated with

the transition of existing debt instruments from LIBOR to SONIA.

These charges were offset by GBP397,000 credited in respect of the

ineffective portion of the movement in fair value interest rate

swaps.

The non-underlying finance charges for the 52 weeks ended 26

June 2021 comprise GBP471,000 of legal and professional fees

associated with agreeing revised covenants and agreeing covenant

waivers with our lenders, as well as fees associated with the

CLBILS loan. These charges were offset by GBP115,000 credited in

respect of the ineffective portion of the movement in fair value

interest rate swaps.

4 Taxation

a Tax on profit/(loss)

52 weeks ended 25 June 52 weeks ended 26 June

2022 2021

---------------------------------- ======================================== ========================================

Excluded Excluded

Underlying from underlying Total Underlying from underlying Total

Tax charged/(credited) to the results results statutory results results statutory

income statement GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Current income tax

Current tax on profit/(loss) for

the year - - - (37) - (37)

Adjustments for current tax on

prior periods - - - (110) 47 (63)

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Total current income tax credit - - - (147) 47 (100)

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Deferred income tax

Origination and reversal of timing

differences 1,462 (84) 1,378 (1,724) (784) (2,508)

Change in corporation tax rate - (33) (33) - 4,032 4,032

Adjustments for current tax on

prior periods - (258) (258) 3 (48) (45)

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Total deferred tax charge/(credit) 1,462 (375) 1,087 (1,721) 3,200 1,479

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Total tax charged/(credited)

to the income statement 1,462 (375) 1,087 (1,868) 3,247 1,379

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Tax charged to other comprehensive

income

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Deferred tax

Gains arising on cash flow hedges

in the period 493 305

Effect of increase in future rate

of corporation tax 68 (139)

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

Total tax charged to other

comprehensive

income 561 166

---------------------------------- ---------- ---------------- ---------- ---------- ---------------- ----------

b Reconciliation of the total tax charge

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

-------------------------------------------------------------- -------- --------

Profit/(loss) before income tax 7,367 (16,412)

-------------------------------------------------------------- -------- --------

Tax on Group profit/(loss) at UK standard rate of corporation

tax of 19.0% (2021: 19.0%) 1,400 (3,118)

Expenses not deductible/(taxable) for tax purposes 151 (9)

Profit on sale of property less chargeable gains (173) 582

Effect of a change in tax rate (33) 4,032

Current and deferred tax over-provided in previous years (258) (108)

-------------------------------------------------------------- -------- --------

Total tax charged to the income statement 1,087 1,379

-------------------------------------------------------------- -------- --------

c Factors that may affect future tax charges

An increase in the future main corporation tax rate to 25% from

1 April 2023, from the previously enacted 19%, was announced in the

Budget on 3 March 2021, and substantively enacted on 24 May 2021.

Therefore deferred tax assets and liabilities that are expected to

reverse on or after 1 April 2023 have been calculated at the rate

of 25% as at the reporting date. A 1% reduction in the rate of

corporation tax from this level will decrease deferred tax balances

held by GBP600,000.

There is no expiry date on timing differences.

5 Dividends

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

---------------------------------------------------------- -------- --------

Declared and paid during the year

Interim dividend for 2022: 3.50p (2021: nil) per ordinary

share 520 -

---------------------------------------------------------- -------- --------

Dividends paid 520 -

---------------------------------------------------------- -------- --------

The Directors propose a final dividend of 15.00p (2021: nil) per

50p ordinary share totalling GBP2,222,000 (2021: nil) for the 52

weeks ended 25 June 2022. The dividend is subject to approval by

shareholders at the Annual General Meeting, to be held on 28

October 2022, and has not been included as a liability in these

financial statements as it has not yet been approved or paid.

Shares held by the Company (and not allocated to employees under

the Share Incentive Plan) are treated as cancelled when calculating

dividends and earnings per share.

6 Earnings per share

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

GBP'000 GBP'000

------------------------------------------------------------- -------- --------

Profit/(loss) attributable to equity shareholders 6,280 (17,791)

Items excluded from underlying results (448) 9,602

------------------------------------------------------------- -------- --------

Underlying profit/(loss) attributable to equity shareholders 5,832 (8,189)

------------------------------------------------------------- -------- --------

Number Number

------------------------------------------------------------- -------- --------

Weighted average number of shares in issue 14,784 14,760

Dilutive outstanding options 62 -

------------------------------------------------------------- -------- --------

Diluted weighted average share capital 14,846 14,760

------------------------------------------------------------- -------- --------

Earnings/(loss) per 50p ordinary share

------------------------------------------------------------- -------- --------

Basic 42.5p (120.5)p

Diluted 42.3p (120.5)p

Underlying basic 39.4p (55.5)p

------------------------------------------------------------- -------- --------

The basic earnings per share figure is calculated by dividing

the profit attributable to equity shareholders of the Parent

Company for the period by the weighted average number of ordinary

shares in issue during the period.

Diluted earnings per share have been calculated on a similar

basis taking into account 62 (2021: nil) dilutive potential shares,

which excludes shares held by trusts in respect of employee

incentive plans and options. There were no dilutions in the

previous year due to the loss per share.

Underlying basic earnings per share are presented to eliminate

the effect of the underlying items and the tax attributable to

those items on basic and diluted earnings per share.

7 Notes to the STATEMENT OF Cash Flows

a Reconciliation of operating profit/(loss) to cash generated by

operations

52 weeks ended 25 June 52 weeks ended 26 June

2022 2021

------------------------------------ ====================================== ======================================

Excluded Excluded

Underlying from underlying Underlying from underlying

results results Total results results Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ ---------- ---------------- -------- ---------- ---------------- --------

Operating profit/(loss) 12,893 (2,470) 10,423 (4,240) (6,307) (10,547)

Adjustment for:

Depreciation and amortisation 10,480 - 10,480 11,110 - 11,110

Impairment of property, plant

and equipment - 1,561 1,561 - 3,628 3,628

Impairment of intangible assets - 52 52 - 328 328

Impairment of right-of-use assets - 1,226 1,226 - 1,619 1,619

Impairment of assets held for

sale - 24 24 - 134 134

Share-based payments expense 183 - 183 428 - 428

(Increase)/decrease in inventories (747) - (747) 910 - 910

Increase in debtors and prepayments (2,242) - (2,242) (5,279) - (5,279)

Increase/(decrease) in creditors

and accruals 712 (374) 338 (870) (678) (1,548)

Loss on sale of assets (excluding

property) 53 - 53 840 - 840

Interest received - - - 3 - 3

Income tax received - - - 195 - 195

Fair value movements on financial

assets (210) - (210) 5 - 5

------------------------------------ ---------- ---------------- -------- ---------- ---------------- --------

Net cash inflow/(outflow) from

operating activities 21,122 19 21,141 3,102 (1,276) 1,826

------------------------------------ ---------- ---------------- -------- ---------- ---------------- --------

b Reconciliation of movement in cash to movement in net debt

52 weeks 52 weeks

ended ended

25 June 26 June

2022 2021

Group and Company GBP'000 GBP'000

----------------------------------------------- --------- ---------

Opening cash and overdraft 5,560 9,807

Closing cash and overdraft 5,579 5,560

----------------------------------------------- --------- ---------

Movement in cash in the period 19 (4,247)

Cash from increase in bank loans - (2,000)

Cash used to repay bank loans 15,600 -

Movement in loan issue costs (105) (103)

----------------------------------------------- --------- ---------

Movement in net debt resulting from cash flows 15,514 (6,350)

Net debt at beginning of the period (90,805) (84,455)

----------------------------------------------- --------- ---------

Net debt (75,291) (90,805)

----------------------------------------------- --------- ---------

Current lease liability (2,780) (5,100)

Non-current lease liability (53,106) (53,226)

----------------------------------------------- --------- ---------

Statutory net debt (131,177) (149,131)

----------------------------------------------- --------- ---------

c Analysis of net debt

Reclassification

of long-term Repayment

June 2021 Cash flow loans of loans Non-cash June 2022

Group and Company 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ---------------- --------- -------- ---------

Cash and cash equivalents 5,560 19 - - - 5,579

Debt due in less than one

year (1,600) - (1,600) 1,600 - (1,600)

Debt due after more than

one year (94,765) - 1,600 14,000 (105) (79,270)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Net debt (90,805) 19 - 15,600 (105) (75,291)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Lease liabilities (58,326) 4,220 - - (1,780) (55,886)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Statutory net debt (149,131) 4,239 - 15,600 (1,885) (131,177)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Reclassification

of long-term

June 2020 Cash flow loans New loans Non-cash June 2021

Group and Company 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- --------- --------- ---------------- --------- -------- ---------

Cash and cash equivalents 9,807 (4,247) - - - 5,560

Debt due in less than one

year (94,262) - 92,662 - - (1,600)

Debt due after more than

one year - - (92,662) (2,000) (103) (94,765)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Net debt (84,455) (4,247) - (2,000) (103) (90,805)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Lease liabilities (55,860) 3,930 - - (6,396) (58,326)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Statutory net debt (140,315) (317) - (2,000) (6,499) (149,131)

-------------------------- --------- --------- ---------------- --------- -------- ---------

Non-cash movements in lease liabilities comprises lease

additions and modifications of GBP699,000 (2021: GBP5,844,000) and

interest of GBP1,245,000 (2021: GBP1,285,000), less waivers of

GBP164,000 (2021: GBP733,000).

8 Events after the reporting period

After the reporting period, the Company acquired two freehold

pubs in Essex from East Anglia Pub Co Limited. These pubs have been

transferred to the Retail estate.

The Company has also acquired East Anglia Pub Corporation

Limited which operated one pub in Essex, and Urban Reef Restaurant

Limited which operated one pub in Bournemouth. Both of these pubs

have been transferred to the Retail estate.

The total investment in these acquisitions was GBP6.7m.

After the reporting period, the Company has also taken an

additional private placement of loan notes for GBP20,000,000 with

BAE Systems Pension Funds Investment Management Ltd (BAE Pension

Fund). BAE Pension Fund will receive loan notes at a fixed interest

rate of 5.47% for 10 years. This is in addition to the 20-year

private placement of GBP35,000,000 arranged with BAE Pension Fund

in October 2018 at a fixed rate of interest of 3.99%.

9 ACCOUNTS

The financial information for the period ended 25 June 2022 and

the period ended 26 June 2021 does not constitute the Company's

statutory accounts for those years.

Statutory accounts for the period ended 26 June 2021 have been

delivered to the Registrar of Companies. The statutory accounts for

the period ended 25 June 2022 will be delivered to the Registrar of

Companies following the Company's Annual General Meeting.

The auditor's report on the statutory accounts for 25 June 2022

is unqualified, did not draw attention to any matters by way of

emphasis, and did not contain a statement under s498(2) or s498(3)

of the Companies Act 2006. The auditor's report on the statutory

accounts for 26 June 2021 was unqualified, and did not contain a

statement under s498(2) ors498(3) of the Companies Act 2006.

[1] Underlying profit/(loss) less attributable taxation divided

by the weighted average number of ordinary shares in issue during

the period. The numbers of shares in issue excludes those held by

the Company and not allocated to employees under the Share

Incentive Plan which are treated as cancelled

[2] Underlying profit/(loss) before tax pre net finance costs,

depreciation, amortisation, profit or loss on sale of fixed assets

excluding property and free trade loan discounts

[3] Net assets at the reporting date divided by the number of

shares in issue being 14,857,500 50p shares

[4] Net debt excluding lease liabilities comprises cash, bank

overdrafts, bank and other loans less unamortised loan fees

[5] Retail like-for-like sales includes revenue from the sale of

drink, food and accommodation but excludes machine income.

Like-for-like sales performance is calculated against a comparable