TIDMSHEP

RNS Number : 7720T

Shepherd Neame Limited

22 March 2023

Shepherd Neame

Interim results for the 26 weeks to 24 December 2022

Shepherd Neame, Britain's Oldest Brewer and owner and operator

of 301 high quality pubs in Kent and the Southeast, today announces

results for the 26 weeks ended 24 December 2022.

The period under review has seen continuing strong consumer

demand, but is dominated by significant inflationary pressures

which have impacted margins, with Brewing and Brands remaining

challenging. Our investment programme has now resumed , with many

projects that are essential for the future development of the

Company underway.

This time last year, the Board restored the dividend for the

first time post-pandemic and have increased it again.

Record revenue in H1, in spite of economic headwinds

-- Revenue was GBP85.3m (H1 2022: GBP78.7m; H1 20201 restated:

GBP79.0m), an increase of +8.4% vs H1 2022

-- Statutory profit before tax was GBP5.5m (H1 2022: GBP5.4m; H1

2020 (1) restated: GBP5.3m), an increase of +1.8% vs H1 2022

-- Underlying profit before tax2 was GBP3.5m (H1 2022: GBP3.0m;

H1 2020 (1) restated: GBP6.0m), an increase of +15.5% vs H1

2022

-- Cashflow has remained robust. Net debt, excluding lease

liabilities3, is level at GBP82.8m (H1 2022: GBP82.4m; H1 2020 (1)

restated: GBP85.4m)

-- Basic earnings per share was 28.9p (H1 2022: 28.9p; H1 2020 (1) restated: 27.9p)

-- Underlying basic earnings per share4 was 18.7p (H1 2022:

15.9p; H1 2020 (1) restated: 32.4p)

-- Net assets per share5 were GBP12.12 (H1 2022: GBP11.76; H1 2020 (1) restated: GBP14.06)

-- Interim dividend of 4.00p per share declared (H1 2022: 3.50p;

H1 2020 (1) restated: nil), an increase of +14.3% vs H1 2022

Operational performance

Performance Performance

H1 2023 vs H1 H1 2023 vs H1

2022 2020 (1)

Retail like-for-like

sales 6 +11.9% +1.2%

--------------- ---------------

Like-for-like tenanted

income7 +7.1% +1.5%

--------------- ---------------

Total beer volume8 -0.9% +4.7%

--------------- ---------------

Own beer volume9 +12.7% +8.2%

--------------- ---------------

-- Retail Pubs and Hotels (67 pubs) revenue grew by +18.0%

-- Total retail sales up +18.0% to GBP36.9m (H1 2022: GBP31.3m)

-- Retail like-for-like sales (6) were +11.9% vs H1 2022 and +1.2% vs H1 2020 (1)

-- Retail like-for-like sales (6) inside the M25 were up +39.1%,

outside the M25 +3.4% vs H1 2022, reflecting increased footfall in

London as people return to their offices

-- Retail sales growth mainly driven by drink sales with

like-for-like sales up +27.4% vs H1 2022

-- Food like-for-like sales reduced by -3.3% vs H1 2022

-- Accommodation like-for-like sales down -8.6% vs H1 2022.

RevPAR was up +2.6% vs H1 2022 at GBP90

-- Divisional operating profit was up +2.4% at GBP4.7m (H1 2022: GBP4.6m)

-- Tenanted Pubs (229 pubs) remained resilient during the period

-- Like-for-like tenanted pub income(7) was +7.1% vs H1 2022 and +1.5% vs H1 2020 (1)

-- Divisional revenue was GBP17.4m (H1 2022: GBP16.4m) and

operating profit was GBP6.9m (H1 2022: GBP5.6m)

-- Brewing and Brands: sales maintained, but margins impacted by

exceptional inflationary pressures

-- Total beer volumes(8) were down -0.9% vs H1 2022 and up +4.7% vs H1 2020 (1)

-- Own beer volumes(9) were up +12.7% vs H1 2022 and +8.2% vs H1 2020 (1)

-- Divisional revenue maintained at GBP30.3m (H1 2022:

GBP30.6m), with an operating loss of GBP0.4m (H1 2022: GBP0.0m)

New long term financing put in place

-- At the end of February 2023, we had total committed

facilities of GBP114.3m and headroom of GBP32.8m. 69% of our

committed facilities are at a fixed rate, with all debt medium and

long term

Current trading and outlook

-- For the 12 weeks to 18 March, retail like-for-like sales was

+12.8% vs 202210 and +13.0% vs 202011

-- Like-for-like tenanted pub income for the nine weeks to 25

February was +4.9% vs 2022(10) and +1.7% vs 2020(11)

-- Total beer volume for the 12 weeks to 18 March was -5.5% vs

2022(10) and -6.5% vs 2020(11) . Own beer volume was -3.0% vs

2022(10) and -1.8% vs 2020(11)

-- Fundamentals of the business remain strong and the business

is in good shape. Demand is encouraging but we expect further cost

inflation in the second half and into next financial year.

-- Measures announced in the budget to reduce alcohol duty on beer in pubs, are most welcome.

Jonathan Neame, CEO of Shepherd Neame, said:

"We have an excellent pub estate with considerable potential,

well established brands, a loyal customer base, and a high profile

within the individual communities we serve. All these factors will

stand us in good stead as the cost of living crisis eases and the

economy returns to growth."

22 March 2023

ENQUIRIES

Shepherd Neame Tel: 01795 532206

Jonathan Neame, Chief Executive

Mark Rider, Chief Financial

Officer

Instinctif Partners Tel: 020 7457 2020

Matthew Smallwood

NOTES FOR EDITORS

Shepherd Neame is Britain's oldest brewer. Established in 1698

and based in Faversham, Kent it employs around 1,600 people.

At the reporting date, the Company operated 301 pubs, of which

229 were tenanted or leased, 67 managed and five were held as

investment properties under commercial free of tie leases. 85% of

the estate is freehold. The pub estate ranges from inns and hotels

to destination dining, great traditional and local community

pubs.

The Company brews, markets and distributes its own beers to

national and export customers under a range of highly successful

brand names including Spitfire, Bishops Finger, Whitstable Bay and

Bear Island.

The Company also has a partnership with Boon Rawd Brewery

Company for Singha beer, Thailand's original premium beer.

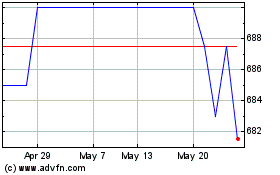

Shepherd Neame's shares are traded on the AQUIS Stock Exchange

Growth Market. See http://www.aquisexchange.com/ for further

information and the current share price.

For further information on the Company, see

www.shepherdneame.co.uk

INTERIM STATEMENT

Overview

The Company has made further good progress in this period, in

spite of significant economic headwinds.

Our revenue is now at record level for the first half of the

year. Net debt, excluding lease liabilities, is level year on year,

even after investment in four new pubs, and the interim dividend is

increased, albeit not yet returned to pre-pandemic levels.

This is our first half-year period since 2019 without any

COVID-19 related restrictions. Consumer spending overall has

remained strong. A long hot summer and a mild autumn helped our

coastal sites and there has been a progressive return to offices

within the City of London. Christmas trading was generally good,

although we did not see quite as many large parties as we would

have expected pre-pandemic, and the train strikes had a significant

impact on what would have been the busiest week.

Profit levels are not yet back to pre-pandemic levels. Overall,

our tenanted pubs have been strong, retail sales most encouraging,

but with margins impacted by high costs, and brewing and brands

remains challenging.

The inflationary surge in the wider economy has impacted our

cost base in many areas, with huge increases in food, energy,

glass, brewing raw materials, packaging waste and logistics. The

root cause of these increases is the higher cost of energy and

energy-intensive products. Inflation in the sector has generally

been significantly higher than the headline rate of inflation.

In the brewery, we are fully fixed on gas and electricity prices

through to September 2024; while in the retail pubs we are fully

fixed through to March 2023, and fixed on two-thirds of our

anticipated requirement through to September 2024.

The supply chain itself has become slightly more resilient and

we have been able to source raw materials at all times. We have

contracts in place in the brewery and retail pubs that protect us

from further inflation from direct utility purchases, during the

forthcoming year.

This period compares with the prior year during which we

benefited from lower rates of VAT, set at 12.5% until March 2022.

We value that benefit at GBP1.7m in the first half of last year. We

also received business and furlough grants of GBP421k during that

period. All Government support has now ceased except for the Energy

Bills Relief Scheme and ongoing support for business rates, for

some of our tenanted pubs.

We are optimistic that we are past peak inflation, and so we

expect to see many, but not all, of our raw material and input

costs start to stabilise in the second half. We will, however, see

a further step-up in wage costs, as the National Minimum Wage

increases by 9.7% in April. We pay ahead of the National Minimum

Wage, but this increase will have a consequential impact across all

employee grades.

Price increases have been necessary, and the impact of these

will come through in the second half. We are mindful that our

customers face similar cost pressures in their own businesses and

consumers can only afford so much at a time when mortgages and

energy costs are rising.

During the pandemic, we restrained investment and projects, but

these have now resumed. We are re-commencing many projects that are

essential for the future development of the Company.

We have invested GBP0.5m year to date in these projects and will

carry out further projects in the second half. We have built up our

People Team to support learning and development to develop our own

talent, improve retention levels and focus on customer service. We

have refocused our food team to support the introduction of a menu

refresh across the business in the second half; we have re-designed

our pub websites; we have strengthened our property and health and

safety teams and restored our IT team to full complement.

Financial Results

Revenue was GBP85.3m (H1 2022: GBP78.7m; H1 2020(1): GBP79.0m),

an increase of +8.4% on the prior year.

Underlying operating profit was GBP6.3m (H1 2022: GBP5.9m; H1

2020(1): GBP8.5m), an increase of +5.6%.

Statutory profit before tax was GBP5.5m (H1 2022: GBP5.4m; H1

2020(1): GBP5.3m), an increase of +1.8%.

Underlying profit before tax was GBP3.5m (H1 2022: GBP3.0m; H1

2020(1): GBP6.0m), an increase of +15.5%.

Basic earnings per share was 28.9p (H1 2022: 28.9p; H1 2020(1):

27.9p).

Underlying basic earnings per share was 18.7p (H1 2022: 15.9p;

H1 2020(1): 32.4p).

Net assets per share were GBP12.12 (H1 2022: GBP11.76; H1

2020(1): GBP14.06).

Dividend

This time last year the Board restored the dividend for the

first time post-pandemic. We feel sufficiently confident to

increase it again in spite of the economic headwinds.

The Board is declaring an interim dividend of 4.00p per share

(H1 2022: 3.50p; H1 2020(1): nil), an increase of +14.3%.

The dividend will be paid on 17 April 2023 to those shareholders

on the register as at 31 March 2023.

Capital Expenditure, Net Debt and Cash Flow

Cashflow has remained robust. During the period, we have

achieved underlying EBITDA (earnings before interest, tax,

depreciation and amortisation) of GBP11.4m (H1 2022: GBP11.3m; H1

2020(1): GBP14.4m), an increase of +0.5%.

Statutory net debt fell to GBP138.9m from GBP139.8m in the prior

year. Net debt, excluding lease liabilities, was level at GBP82.8m

(H1 2022: GBP82.4m; H1 2020(1): GBP85.4m).

The robust cash and net debt position have supported an increase

in capital expenditure, as we restore more normalised levels of

investment. In the first half, we invested GBP10.7m (H1 2022:

GBP2.7m; H1 2020(1): GBP8.1m). The larger part of this investment

was the acquisition of four retail pubs in July 2022, as previously

announced, for GBP6.7m.

Financing

The Company has put in place a new long-term financing facility.

This provides certainty of funds to the Company, a reduction in

exposure to interest rate rises and an improved debt maturity

profile.

Specifically, we now have a four-year revolving credit facility

of GBP40m that matures in 2026, and a second private placement

tranche of GBP20m with BAE Systems Pension Funds Investment

Management Ltd at a fixed interest rate of 5.47% for 10 years. This

is in addition to the 20 year private placement arranged with the

same party in October 2018 at a fixed interest rate of 3.99%. The

new facilities sit alongside the existing term loan which remains

in place until December 2026, with the repayment of GBP1.6m payable

on 31 December each year.

At the end of February, we had total committed facilities of

GBP114.3m. 69% of our committed facilities are at a fixed rate,

with all debt medium and long term. This provides a financing

platform from which to take advantage of any opportunities that may

arise in the next few years.

Tenanted and Retail Pub Operations

As at 24 December 2022, we owned 301 pubs (June 2022: 300), of

which 229 (June 2022: 231) are tenanted or leased, 67 (June 2022:

63) are retail pubs and five (June 2022: six) operated on a

free-of-tie basis as investment properties. 85% of our pubs are

owned freehold.

During the period we have transferred one tenanted pub to

retail, and one retail pub to investment property. We have sold

three pubs and have acquired four. These disposals have realised

GBP0.9m of net proceeds (H1 2022: GBP8.0m).

Since the half year, we have recommenced major capital projects.

The Crown at Chislehurst is underway and will complete by Easter,

and the Tom Cribb near Haymarket will commence at the year end. We

plan to undertake a transformational development at the Duke of

Cumberland in Whitstable in the summer. We have carried out minor

schemes at the Jamaica Winehouse, London, the Minnis Bay,

Birchington and the garden at the Botany Bay, Kingsgate.

We are building a pipeline of substantial projects to carry out

over the next three years as we transfer some pubs from tenancy and

look to exploit the full potential of our estate, in line with our

medium term goal to have 100 retail sites. In the second half we

will transfer five pubs from tenanted to retail. We expect to incur

transitional costs of GBP0.5m as these sites await transformational

development.

RETAIL PUBS AND HOTELS

For the 26 weeks to 24 December 2022, our retail pubs achieved

encouraging like-for-like sales growth on the prior year and on

pre-pandemic levels, at +11.9% vs H1 2022 and +1.2% vs H1 2020(1).

All individual months were in growth on the prior year, with the

strongest growth in July and December, since these periods were

affected by COVID-19 restrictions in the prior year. However,

December was below expectations as we lost an estimate of GBP250k

of sales due to the rail strikes.

Within the M25, like-for-like sales are +39.1% vs H1 2022 and

-5.6% vs H1 2020(1). Outside the M25, like-for-like sales are +3.4%

vs H1 2022 and +4.4% vs H1 2020(1).

This growth has been mainly driven by drinks sales, with

like-for-like sales +27.4% vs H1 2022, driven by the recovery of

our London pubs as people return to their offices. Like-for-like

food sales were -3.3% vs H1 2022 and like-for-like accommodation

sales -8.6% vs H1 2022. Food and accommodation benefited from VAT

reduction in the prior year to 12.5%, which has now normalised to

20%.

Whilst revenue on food and drink is up on a like-for-like basis

on pre-pandemic levels, the volume of meals and pints sold remains

below. Rooms sold are +6.7% up.

At 24 December 2022, we operated 232 rooms in our retail estate,

14 rooms more than at the year-end. Occupancy has been strong in

this half at 82% (H1 2022: 77%) and RevPAR excellent at GBP90 (H1

2022: GBP84). The current economic conditions indicate that 2023

will be another staycation year.

Divisional revenue in Retail Pubs was up +18.0% at GBP36.9m (H1

2022: GBP31.3m), divisional operating profit was up +2.4% at

GBP4.7m (H1 2022: 4.6m).

Tenanted Pubs

Trade in our tenanted pubs has remained resilient during this

period. As in our retail pubs, most have benefited from the warm

summer weather, and have seen demand remain robust during the

autumn. Some pubs however have experienced material increases in

their energy bills, depending on the specific terms of their

utilities contract. The Government Energy Bills Relief Scheme has

been most welcome but is currently due to expire at the end of

March. Unless the lower market rate for energy starts to feed

through to customers, this may cause a substantial challenge for

individual licensees. Measures announced in the budget to reduce

alcohol duty on beer in pubs are most welcome.

Like-for-like net pub income was +7.1% vs H1 2022 and +1.5% vs

H1 2020(1).

Divisional revenue in Tenanted Pubs was GBP17.4m (H1 2022:

GBP16.4m) and divisional operating profit was GBP6.9m (H1 2022:

GBP5.6m).

Brewing and Brands

Total beer volume was -0.9% vs H1 2022 and +4.7% vs H1 2020(1).

Own beer volume was +12.7% vs H1 2022 and +8.2% vs H1 2020(1).

We have all seen higher inflation in the last year, but the

degree of inflation experienced in this area is quite exceptional.

Inflation has been particularly acute in glass, CO , packaging

waste and logistics. Our customers have been generally supportive

but the price increases we have been able to pass on so far are

short of these particular cost increases. As such we will need to

pass on further price increases in the coming months, whilst

exploring every avenue to contain cost inflation.

Divisional revenue in Brewing and Brands was GBP30.3m (H1 2022:

GBP30.6m) and divisional operating loss was (GBP0.4m) (H1 2022:

GBP0.0m).

Investment Property

As at December 2022, the Company owned investment property

valued at GBP6.9m (2022: GBP6.2m). We have sold two properties

during the period (2022: five). We continue to promote sites in the

local area for potential development. We remain confident one or

two of these schemes will be approved in the near term, but recent

changes in Government policy make others less likely.

Outlook and Current Trading

Consumer spending has remained good throughout this period - and

better than many had expected - albeit the underlying volumes of

food and drink are still down on pre-pandemic levels. Costs are up

in all channels, some significantly above the prevailing rate of

RPI, with further costs to be absorbed.

The extraordinary rises in costs in the brewing business, in

particular, are likely to impact margins in the short term. The

second half will present further challenges to our cost base, but

it seems likely that the specific energy and Ukraine-war related

factors that have driven this inflation will start to abate in the

next financial year. The consumer cost of living squeeze may also

start to ease as wage increases close the gap.

For the 12 weeks to 18 March, retail like-for-like sales was

+12.8% vs 2022 and +13.0% vs 2020(2). Like-for-like tenanted pub

income for the nine weeks to 25 February was + 4.9% vs 2022 and

+1.7% vs 2020(2). Total beer volume for the 12 weeks to 18 March

was -5.5% vs 2022 and -6.5% vs 2020(2). Own beer volume was -3.05%

vs 2022 and -1.8% vs 2020(2).

This has been a tough time for anyone in the hospitality sector,

with one crisis rolling in to the next. The events of the last few

years demonstrate how unpredictable such things can be, and we

remain flexible and agile to respond to further events.

The fundamentals, though, for the business remain good. With a

strong balance sheet, and a cash generative business, we are now

focused on maximising growth potential through delivering our

investment and project plans.

We have an excellent pub estate with considerable potential,

well established brands, a loyal customer base, and a high profile

within the individual communities we serve.

All these factors will stand us in good stead as the cost of

living crisis eases and the economy returns to growth.

Jonathan Neame

Chief Executive

1. H1 2020 is the first half of the financial period of the 52

weeks to the 27 June 2020. The first half equated to the 26 weeks

ended 28 December 2019.

2. The periods referred to are the comparative periods during

the financial years 52 weeks to 27 June 2020.

Group income statement

For the 26 weeks ended 24 December 2022

Audited

52 weeks

Unaudited Unaudited ended

26 weeks ended 24 26 weeks ended 25 25 June

December 2022 December 2021 2022

------------------------------------- ------------------------------------------ ---------

Items Items

excluded excluded

from from

Underlying underlying Total Underlying underlying Total Total

results results statutory results results statutory statutory

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ---- ---------- ------------ ----------- -------------- ------------- ----------- ---------

Revenue 3 85,330 - 85,330 78,729 - 78,729 151,538

Other income 3 - - - 121 - 121 383

Operating charges (79,048) (798) (79,846) (72,903) 451 (72,452) (141,498)

---------------------- ---- ---------- ------- ------------ ------------- --------- ----------- ------------------

2,

Operating profit 3 6,282 (798) 5,484 5,947 451 6,398 10,423

2,

Net finance costs 4 (2,779) (214) (2,993) (2,915) - (2,915) (5,682)

Fair value movements

on financial

instruments

charged to profit and 2,

loss 4 - 195 195 - 95 95 397

---------------------- ---- ---------- ------- ------------ ------------- --------- ----------- ------------------

Total net finance

costs (2,779) (19) (2,798) (2,915) 95 (2,820) (5,285)

Profit on disposal of

property 2 - 2,639 2,639 - 1,487 1,487 1,709

Investment property

fair

value movements 2 - 136 136 - 300 300 520

---------------------- ---- ---------- ------- ------------ ------------- --------- ----------- ------------------

Profit before taxation 3,503 1,958 5,461 3,032 2,333 5,365 7,367

Taxation 5 (746) (455) (1,201) (687) (406) (1,093) (1,087)

---------------------- ---- ---------- ------- ------------ ------------- --------- ----------- ------------------

Profit after taxation 2,757 1,503 4,260 2,345 1,927 4,272 6,280

---------------------- ---- ---------- ------- ------------ ------------- --------- ----------- ------------------

Earnings per 50p

ordinary

share 7

Basic 28.9p 28.9p 42.5p

Diluted 28.7p 28.5p 42.3p

---------------------- ---- ---------- ------- ------------ ------- ------------- --------- ------------------

All results are derived from continuing activities.

Group statement of comprehensive income

For the 26 weeks ended 24 December 2022

Unaudited Unaudited Audited

26 weeks 26 weeks 52 weeks

ended ended ended

24 December 25 December 25 June

2022 2021 2022

Note GBP'000 GBP'000 GBP'000

Profit after taxation 4,260 4,272 6,280

Items that may be reclassified subsequently

to profit or loss:

Gains arising on cash flow hedges

during the period 1,389 1,036 2,596

Income tax relating to these items 5 (318) (197) (561)

-------------------------------------------- -------- ----------- ------------ ---------

Other comprehensive gains 1,071 839 2,035

-------------------------------------------- -------- ----------- ------------ ---------

Total comprehensive income 5,331 5,111 8,315

-------------------------------------------- -------- ----------- ------------ ---------

Group statement of financial position

As at 24 December 2022

Unaudited Unaudited Audited

24 December 25 December 25 June

2022 2021 2022

Note GBP'000 GBP'000 GBP'000

-------------------------------------- ---- ------------ ------------ ---------

Non-current assets

Goodwill and intangible assets 2,320 319 375

Property, plant and equipment 8 277,590 277,694 274,651

Investment properties 6,887 6,243 6,716

Other non-current assets - 2 -

Right-of-use assets 10 45,850 46,570 44,235

Finance lease receivables 2,450 - -

-------------------------------------- ---- ------------ ------------ ---------

335,097 330,828 325,977

-------------------------------------- ---- ------------ ------------ ---------

Current assets

Inventories 8,042 9,068 8,067

Trade and other receivables 18,358 17,795 17,685

Cash and cash equivalents 691 4,041 5,579

Assets held for sale 1,341 1,359 1,099

Finance lease receivables 65 - -

-------------------------------------- ---- ------------ ------------ ---------

28,497 32,263 32,430

-------------------------------------- ---- ------------ ------------ ---------

Current liabilities

Trade and other payables (27,132) (25,846) (27,222)

Borrowings 11 (1,600) (1,600) (1,600)

Lease liabilities 10 (1,976) (4,379) (2,780)

-------------------------------------- ---- ------------ ------------ ---------

(30,708) (31,825) (31,602)

-------------------------------------- ---- ------------ ------------ ---------

Net current (liabilities)/assets (2,211) 438 828

-------------------------------------- ---- ------------ ------------ ---------

Total assets less current liabilities 332,886 331,266 326,805

-------------------------------------- ---- ------------ ------------ ---------

Non-current liabilities

Lease liabilities 10 (54,155) (53,021) (53,106)

Borrowings 11 (81,871) (84,818) (79,270)

Derivative financial instruments (656) (4,280) (2,353)

Provisions - (55) -

Deferred tax liabilities (16,173) (14,390) (14,749)

-------------------------------------- ---- ------------ ------------ ---------

(152,855) (156,564) (149,478)

-------------------------------------- ---- ------------ ------------ ---------

Net assets 180,031 174,702 177,327

-------------------------------------- ---- ------------ ------------ ---------

Capital and reserves

Share capital 7,429 7,429 7,429

Share premium account 1,099 1,099 1,099

Revaluation reserve 31 31 31

Own shares (1,045) (745) (660)

Hedging reserve (418) (2,685) (1,489)

Retained earnings 172,935 169,573 170,917

-------------------------------------- ---- ------------ ------------ ---------

Total equity 180,031 174,702 177,327

-------------------------------------- ---- ------------ ------------ ---------

Group statement of changes in equity

For the 26 weeks ended 24 December 2022

Share

Share premium Revaluation Own Hedging Retained

capital account reserve shares reserve earnings Total

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 25 June

2022 7,429 1,099 31 (660) (1,489) 170,917 177,327

Profit for the period - - - - - 4,260 4,260

Gains arising on cash

flow hedges during the

period - - - - 1,389 - 1,389

Tax relating to components

of other comprehensive

income 5 - - - - (318) - (318)

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Total comprehensive

income - - - - 1,071 4,260 5,331

Ordinary dividends paid - - - - - (2,227) (2,227)

Accrued share-based

payments - - - - - 206 206

Purchase of own shares - - - (610) - - (610)

Distribution of own

shares - - - 41 - (37) 4

Unconditionally vested

share awards - - - 184 - (184) -

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 24 December

2022 7,429 1,099 31 (1,045) (418) 172,935 180,031

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 26 June

2021 7,429 1,099 31 (1,010) (3,524) 165,322 169,347

Profit for the period - - - - - 4,272 4,272

Gains arising on cash

flow hedges during the

period - - - - 1,036 - 1,036

Tax relating to components

of other comprehensive

income 5 - - - - (197) - (197)

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Total comprehensive

income - - - - 839 4,272 5,111

Accrued share-based

payments - - - - - 243 243

Distribution of own

shares - - - 16 - (15) 1

Unconditionally vested

share awards - - - 249 - (249) -

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Balance at 25 December

2021 7,429 1,099 31 (745) (2,685) 169,573 174,702

--------------------------- ---- -------- -------- ----------- -------- -------- --------- --------

Group statement of cash flows

For the 26 weeks ended 24 December 2022

Audited

Unaudited Unaudited 52 weeks

26 weeks ended 26 weeks ended ended

24 December 25 December 25 June

2022 2021 2022

------------------------------------- ---- ----------------- ------------------ ------------------

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash flows from operating activities 12a

Cash generated from operations 8,822 7,034 21,141

Income taxes paid (114) - -

-------- -------- --------

Net cash flow generated by

operating activities 8,708 7,034 21,141

Cash flows from investing activities

Proceeds from disposal of property,

plant and equipment 20 5,746 5,792

Proceeds from disposal of investment

property - 1 1

Proceeds from disposal of assets

held for sale 869 2,284 3,292

Purchases of property, plant,

equipment and lease premiums (5,446) (2,670) (5,304)

Purchase of intangible assets - - (129)

Customer loan repayments 1 2 -

Acquisition of subsidiaries 9 (5,221) - -

Cash acquired on acquisition 9 766 - -

-------- -------- --------

Net cash flow (absorbed)/generated

by investing activities (9,011) 5,363 3,652

Cash flows from financing activities

Dividends paid 6 (2,227) - (520)

Interest paid (2,073) (2,285) (4,436)

Payments of principal portion

of lease liabilities 10 (2,081) (1,632) (4,220)

Proceeds from borrowings 12c 3,000 - -

Repayment of borrowings 12c - (10,000) (15,600)

Issue costs of new long term

loans 12c (598) - -

Purchase of own shares (610) - -

Share option proceeds 4 1 2

Net cash flow used in financing

activities (4,585) (13,916) (24,774)

------------------------------------- ---- -------- ------- -------- -------- -------- --------

Net (decrease)/increase in

cash and cash equivalents (4,888) (1,519) 19

Cash and cash equivalents at

beginning of the period 5,579 5,560 5,560

------------------------------------- ---- -------- ------- -------- -------- -------- --------

Cash and cash equivalents at

end of the period 691 4,041 5,579

------------------------------------- ---- -------- ------- -------- -------- -------- --------

Notes to the financial statements

24 December 2022

1 Accounts

General information and basis of preparation

The consolidated interim financial statements, which are

unaudited, do not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. Statutory accounts for the

52 weeks ended 25 June 2022, upon which the auditors issued an

unqualified opinion and did not make any statement under section

498 of the Companies Act 2006, have been filed with the Registrar

of Companies. The financial information comprises the results of

Shepherd Neame Limited (the Company) and its subsidiaries (the

Group).

The consolidated interim financial statements have been prepared

in accordance with international accounting standards, in

conformity with the requirements of the Companies Act 2006

(UK-adopted International Accounting Standards). These standards

are applied from 26 June 2022, with no changes to the accounting

policies set out in the statutory accounts of Shepherd Neame

Limited for the period ended 25 June 2022, except for those noted

below. The financial statements have not been prepared (and are not

required to be prepared) in accordance with IAS 34: 'Interim

Financial Reporting', with the exception of note 5, taxation, where

the tax charge for the half year to 24 December 2022 has been

calculated using an estimate of the full year effective tax rate,

in line with the principles of IAS 34. The accounting policies have

been applied consistently throughout the Group for the purposes of

preparation of this financial information.

The interim financial statements are presented in pounds

sterling and all values are shown in thousands of pounds (GBP'000)

rounded to the nearest thousand (GBP'000), unless otherwise

stated.

The financial information for the 52 weeks ended 25 June 2022 is

extracted from the statutory accounts of the Group for that

year.

New accounting standards and accounting policies

The accounting policies adopted in the preparation of the

interim financial statements are consistent with those followed in

the preparation of the Group's annual consolidated financial

statements for the 52 weeks ended 25 June 2022. The Group has not

early adopted any standard, interpretation or amendment that has

been issued but is not yet effective.

Amendments to accounting standards applied from 26 June 2022

were as follows:

Amendments to IAS 16 - Property, Plant and Equipment: Proceeds

before Intended Use;

Amendments to IAS 37 - Onerous Contracts - Costs of Fulfilling a

Contract;

Annual Improvements to IFRS Standards 2018-2020 (Amendments to

IFRS 1, IFRS 9, IFRS 16 and IAS 41).

The adoption of these amendments has not had a material impact

on the interim financial statements of the Group.

Going concern

The Board has adopted the going concern basis in preparing these

accounts. When assessing the ability of the Group to continue as a

going concern, the Board has considered the Group's financing

arrangements as well as other principal risks and uncertainties as

disclosed in the Group's latest Annual Report, namely the current

economic downturn and its impact on consumers, and the inflationary

cost pressures that the hospitality industry is currently

facing.

At 24 December 2022, the Group had a strong balance sheet with

85% of the estate being freehold properties. The Group had cash in

hand of GBP0.7m and has forecast cash inflows for the financial

years to June 2023 and June 2024. At 24 December 2022, the Group

had existing facilities of GBP115.9m. Net debt, excluding lease

liabilities, was GBP82.8m (H1 2022: GBP82.4m).

The Company put in place a new long term financing facility

during the period. This provides certainty of funds to the Company,

a reduction in exposure to interest rate rises and an improved debt

maturity profile (see note 11).

After due consideration of the matters set out above, the

Directors are satisfied that there is a reasonable expectation that

the Group has

adequate resources to enable its interim financial statements to

be presented on the basis of the Group being a going concern.

2 Non-GAAP reporting measures

Certain items recognised in reported profit or loss before tax

can vary significantly from year to year and therefore create

volatility in reported earnings which does not reflect the

underlying performance of the Group. The Directors believe that

'underlying operating profit', 'underlying profit before tax',

'underlying basic earnings per share', 'underlying earnings before

interest, tax, depreciation, and amortisation' as presented provide

a clear and consistent presentation of the underlying performance

of the ongoing business for shareholders. Underlying profit is not

defined by IFRS and therefore may not be directly comparable with

the 'adjusted' profit measures of other companies. The adjusted

items are:

-- profit or loss on disposal of properties;

-- investment property fair value movements;

-- operating and finance charges/credits which are either

material or infrequent in nature and do not relate to the

underlying performance;

-- fair value movements on financial instruments charged to

profit and loss; and

-- taxation impacts of the above (see note 5).

26 weeks 26 weeks 52 weeks

ended ended ended

24 December 25 December 25 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ------------ ------------ --------

Underlying EBITDA 11,394 11,337 23,428

Depreciation and amortisation (5,077) (5,393) (10,480)

Free trade loan discounts - (1) (2)

(Loss)/profit on sale of assets (excluding

property) (35) 4 (53)

-------------------------------------------------- ------------ ------------ --------

Underlying operating profit 6,282 5,947 12,893

Net underlying finance costs pre IFRS 16 (2,179) (2,295) (4,355)

-------------------------------------------------- ------------ ------------ --------

Net underlying finance costs (2,779) (2,915) (5,599)

-------------------------------------------------- ------------ ------------ --------

Underlying profit before taxation 3,503 3,032 7,294

Profit on disposal of properties 2,639 1,487 1,709

Investment property fair value movements 136 300 520

Separately disclosed operating charges:

Impairment of intangible assets, properties,

right-of-use assets and assets held for sale - (148) (2,863)

Other operating (charges)/credits excluded

from underlying results (798) 599 393

Separately disclosed finance costs:

Settlement of ineffective portion of interest

rate swap (73) - -

Write-off of unamortised loan fees on refinancing (141) - -

Fair value movements on financial instruments

credited to profit and loss 195 95 397

Costs relating to the agreement of covenant

waivers with our lenders - - (50)

Costs relating to the transition from LIBOR

to SONIA for sterling debt instruments - - (33)

-------------------------------------------------- ------------ ------------ --------

Profit before taxation 5,461 5,365 7,367

-------------------------------------------------- ------------ ------------ --------

Separately disclosed operating charges:

During the 26 weeks ended 24 December 2022, separately disclosed

operating charges comprise:

a) Professional fees of GBP491,000 relating to the extension of

our distribution agreement with our logistics partner.

b) Professional fees of GBP269,000 relating to two company

acquisitions (see note 9).

c) Professional fees of GBP38,000 relating to the transition of

the pension scheme administration to an independent master

trust.

During the 26 weeks ended 25 December 2021, separately disclosed

operating charges comprised:

a) An impairment charge of GBP148,000 in relation to three

freehold properties.

b) A recovery of GBP156,000 in relation to a previously

disclosed fraud carried out by an employee.

c) The release of a provision to the value of GBP443,000 in

respect of an inquiry opened by HMRC relating to the provision of

uniforms and training to employees, which was closed in March

2022.

During the 52 weeks ended 25 June 2022, separately disclosed

operating charges comprised:

a) An impairment charge of GBP2,863,000 in relation to seven

freehold properties and eight right-of-use assets.

b) A recovery of GBP159,000 in relation to previously disclosed

fraud carried out by an employee.

c) The release of a provision to the value of GBP443,000 in

respect of an inquiry opened by HMRC relating to the provision of

uniforms and training to

employees, which was closed in March 2022.

d) Professional fees of GBP47,000 relating to two company

acquisitions which completed after the year end (see note 9).

e) Professional fees of GBP162,000 relating to the transition of

the pension scheme administration to an independent master

trust.

Separately disclosed finance costs:

During the 26 weeks ended 24 December 2022, the Group settled

the ineffective portion of the interest rate swap for cash

consideration of GBP73,000, wrote off GBP141,000 of unamortised

finance costs relating to the previous facility, and recognised a

credit of GBP195,000 in respect of the ineffective portion of the

movement in fair value interest rate swaps.

During the 26 weeks ended 25 December 2021, the Group recognised

a credit of GBP95,000 in respect of the ineffective portion of the

movement in fair value interest rate swaps.

During the 52 weeks ended 25 June 2022, the Group incurred

GBP83,000 of legal and professional fees associated with agreeing

covenant waivers with our lenders, as well as fees associated with

the transition of existing debt instruments from LIBOR to SONIA.

These charges were offset by GBP397,000 credited in respect of the

ineffective portion of the movement in fair value interest rate

swaps.

3 Segmental reporting

The accounting policy for identifying segments is based on

internal management reporting information that is regularly

reviewed by the Chief Operating Decision Maker (CODM). The CODM is

the Chief Executive Officer.

The Group has three operating segments, which are largely

organised and managed separately according to the nature of the

products and services provided and the profile of their

customers:

Brewing and Brands, which comprises the brewing, marketing and

sales of beer and other products;

Retail Pubs and Hotels; and Tenanted Pubs, which comprises pubs

operated by third parties under tenancy or tied lease

agreements.

Transfer prices between operating segments are set on an

arm's-length basis.

As segment assets and liabilities are not regularly provided to

the CODM, the Group has elected, as provided under IFRS 8 Operating

Segments (amended), not to disclose a measure of segment assets and

liabilities.

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated(1) Total

26 weeks ended 24 December 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- ----------- -------- -------------- --------

Revenue 30,320 36,896 17,445 669 85,330

--------------------------------------- -------- ----------- -------- -------------- --------

Underlying operating (loss)/profit (449) 4,680 6,884 (4,833) 6,282

Items excluded from underlying

results - (3) - (795) (798)

--------------------------------------- -------- ----------- -------- -------------- --------

Divisional operating (loss)/profit (449) 4,677 6,884 (5,628) 5,484

Net underlying finance costs (2,779)

Finance costs excluded from underlying

results (214)

Fair value movements on ineffective

element of cash flow hedges 195

Profit on disposal of property 2,639

Investment property fair value

movements 136

--------------------------------------- -------- ----------- -------- -------------- --------

Profit before taxation 5,461

--------------------------------------- -------- ----------- -------- -------------- --------

Other divisional information

Capital expenditure - tangible

and intangible assets 978 6,465 1,408 629 9,480

Depreciation and amortisation

pre IFRS 16 785 1,410 1,235 225 3,655

Depreciation and amortisation 840 2,274 1,650 313 5,077

Underlying divisional EBITDA pre

IFRS 16 346 5,662 7,901 (4,561) 9,348

Underlying divisional EBITDA 405 6,967 8,542 (4,520) 11,394

Number of pubs - 67 229 5 301

--------------------------------------- -------- ----------- -------- -------------- --------

1. GBP669,000 of unallocated income (2021: GBP535,000) includes

rent receivable from investment properties and other non-core

trading income. Unallocated expenses primarily represent Head

Office support costs.

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated(2) Total

26 weeks ended 25 December 2021 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ -------- ----------- -------- -------------- --------

Revenue 30,555 31,261 16,378 535 78,729

Other income(1) - 121 - - 121

------------------------------------ -------- ----------- -------- -------------- --------

Underlying operating profit/(loss) 39 4,572 5,676 (4,340) 5,947

Items excluded from underlying

results - - (124) 575 451

------------------------------------ -------- ----------- -------- -------------- --------

Divisional operating profit/(loss) 39 4,572 5,552 (3,765) 6,398

------------------------------------ -------- ----------- -------- -------------- --------

Net underlying finance costs (2,915)

Fair value movements on ineffective

element of cash flow hedges 95

Profit on disposal of property 1,487

Investment property fair value

movements 300

------------------------------------ -------- ----------- -------- -------------- --------

Profit before taxation 5,365

------------------------------------ -------- ----------- -------- -------------- --------

Other divisional information

Capital expenditure - tangible

and intangible assets 604 774 891 264 2,533

Depreciation and amortisation

pre IFRS 16 806 1,462 1,315 191 3,774

Depreciation and amortisation 856 2,472 1,805 260 5,393

Impairment of property, plant

and equipment, goodwill and assets

held for sale - - 124 24 148

Underlying divisional EBITDA pre

IFRS 16 840 6,107 7,124 (4,168) 9,903

Underlying divisional EBITDA 906 7,028 7,480 (4,077) 11,337

Number of pubs - 64 232 6 302

------------------------------------ ---- ------ ------ ------- ------

1. Other income includes Omicron Hospitality and Leisure Grants

administered by local councils in response to the outbreak of the

Omicron variant of COVID-19 in December 2021.

2. GBP535,000 of unallocated income includes rent receivable

from investment properties and other non-core trading income.

Unallocated expenses primarily represent Head Office support

costs.

Brewing Retail

and Pubs Tenanted

Brands and Hotels Pubs Unallocated(2) Total

52 weeks ended 25 June 2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------------- -------- ----------- -------- -------------- --------

Revenue 56,615 61,240 32,773 910 151,538

Other income(1) - 383 - - 383

--------------------------------------- -------- ----------- -------- -------------- --------

Underlying operating (loss)/profit (252) 8,288 13,359 (8,502) 12,893

Items excluded from underlying

results - (1,899) (940) 369 (2,470)

--------------------------------------- -------- ----------- -------- -------------- --------

Divisional operating (loss)/profit (252) 6,389 12,419 (8,133) 10,423

Net underlying finance costs (5,599)

Finance costs excluded from underlying

results (83)

Fair value movements on ineffective

element of cash flow hedges 397

Profit on disposal of property 1,709

Investment property fair value

movements 520

--------------------------------------- -------- ----------- -------- -------------- --------

Profit before taxation 7,367

--------------------------------------- -------- ----------- -------- -------------- --------

Other divisional information

Capital expenditure - tangible

and intangible assets 1,400 1,736 1,677 639 5,452

Depreciation and amortisation

pre IFRS 16 1,592 2,840 2,601 397 7,430

Depreciation and amortisation 1,695 4,614 3,601 570 10,480

Impairment of property, plant

and equipment, goodwill and assets

held for sale - 1,010 603 24 1,637

Impairment of right-of-use assets - 889 337 - 1,226

Underlying divisional EBITDA pre

IFRS 16 1,394 10,920 15,812 (8,143) 19,983

Underlying divisional EBITDA 1,508 12,882 16,967 (7,929) 23,428

Number of pubs - 63 231 6 300

------------------------------------ ------ ------- ------- ------- -------

1. Other income includes Omicron Hospitality and Leisure Grants

administered by local councils in response to the outbreak of the

Omicron variant of COVID-19 in December 2021.

2. GBP910,000 of unallocated income includes rent receivable

from investment properties and other non-core trading income.

Unallocated expenses primarily represent Head Office support

costs.

4 Net finance costs

26 weeks 26 weeks

ended ended 52 weeks

24 December 25 December ended

2022 2021 25 June 2022

Total statutory Total statutory Total statutory

GBP'000 GBP'000 GBP'000

-------------------------------------------------- ---------------- ---------------- ----------------

Finance costs

Interest expense arising on:

Financial liabilities at amortised cost

- bank loans 2,181 2,300 4,363

Financial liabilities at amortised cost

- lease liabilities 600 620 1,244

Unwinding of discounts on provisions (2) (5) (8)

-------------------------------------------------- ---------------- ---------------- ----------------

Underlying net finance costs 2,779 2,915 5,599

-------------------------------------------------- ---------------- ---------------- ----------------

Finance costs excluded from underlying

results

Settlement of ineffective portion of interest

rate swap 73 - -

Write-off of unamortised loan fees on refinancing 141 - -

Costs relating to the agreement of covenant

waivers with our lenders - - 50

Costs relating to the transition from LIBOR

to SONIA for sterling debt instruments - - 33

Ongoing fair value movements on financial

instruments credited to profit and loss (195) (95) (397)

-------------------------------------------------- ---------------- ---------------- ----------------

Total finance costs excluded from underlying

results 19 (95) (314)

-------------------------------------------------- ---------------- ---------------- ----------------

Net finance costs 2,798 2,820 5,285

-------------------------------------------------- ---------------- ---------------- ----------------

5 Taxation

52 weeks

ended

26 weeks ended 24 26 weeks ended 25 25 June

December 2022 December 2021 2022

======================================== ======================================== ==========

Excluded Excluded

Tax charged to the Underlying from underlying Total Underlying from underlying Total Total

income results results statutory results results statutory statutory

statement GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ---------- ---------------- ---------- ---------- ---------------- ---------- ----------

Current income tax

charge/(credit) 424 (114) 310 - - - -

Deferred income tax

charge 322 569 891 687 406 1,093 1,087

---------------------- ---------- ---------------- ---------- ---------- ---------------- ---------- ----------

Total tax charged to

the

income statement 746 455 1,201 687 406 1,093 1,087

---------------------- ---------- ---------------- ---------- ---------- ---------------- ---------- ----------

Tax charged to other comprehensive income

----------------------------------------------------------------------------------------------------------------------

Deferred tax charge 318 197 561

---------------------- ---------- ---------------- ---------- ---------- ---------------- ---------- ----------

Total tax charged to

other

comprehensive income 318 197 561

---------------------- ---------- ---------------- ---------- ---------- ---------------- ---------- ----------

Taxation on the underlying result for the 26 weeks ended 24

December 2022 has been provided at 21.3% (2021: 22.7%) based on the

current best estimate of the effective tax rate for the 52 weeks to

24 June 2023. The average statutory rate of corporation tax for the

52 weeks to 24 June 2023 is expected to be 20.5% (52 weeks to 25

June 2022: 19.0%).

6 Dividends

26 weeks 26 weeks 52 weeks

ended ended ended

24 December 25 December 25 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

---------------------------------------------- ------------ ------------ --------

Declared and paid during the year

Final dividend for 2022: 15.00p (2021:

nil) per ordinary share 2,227 - -

Interim dividend for 2022: 3.50p per ordinary

share - - 520

---------------------------------------------- ------------ ------------ --------

Dividends paid 2,227 - 520

---------------------------------------------- ------------ ------------ --------

The interim dividend, in respect of the period ended 24 December

2022, at a cost of GBP590,000 (for the period ended 25 December

2021: GBP520,000), is to be paid on 17 April 2023 to shareholders

on the register at the close of business on 31 March 2023.

7 Earnings per share

26 weeks 26 weeks 52 weeks

ended ended ended

24 December 25 December 25 June

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------------------------------- ------------ ------------ --------

Profit attributable to equity shareholders 4,260 4,272 6,280

Items excluded from underlying results (1,503) (1,927) (448)

------------------------------------------- ------------ ------------ --------

Underlying profit attributable to equity

shareholders 2,757 2,345 5,832

------------------------------------------- ------------ ------------ --------

Number Number Number

Weighted average number of shares in issue 14,752 14,775 14,784

Dilutive outstanding options 90 190 62

------------------------------------------- ------------ ------------ --------

Diluted weighted average share capital 14,842 14,965 14,846

------------------------------------------- ------------ ------------ --------

Earnings per 50p ordinary share

------------------------------------------- ------------ ------------ --------

Basic 28.9p 28.9p 42.5p

Diluted 28.7p 28.5p 42.3p

Underlying basic 18.7p 15.9p 39.4p

------------------------------------------- ------------ ------------ --------

The basic earnings per share figure is calculated by dividing

the profit attributable to equity shareholders of the parent

company for the period by the weighted average number of ordinary

shares in issue during the period.

Diluted earnings per share have been calculated on a similar

basis taking into account 90 (2021: 190) dilutive potential shares,

which excludes shares held by trusts in respect of employee

incentive plans and options.

Underlying basic earnings per share are presented to eliminate

the effect of the non-underlying items and the tax attributable to

those items on basic and diluted earnings per share.

8 Property, plant and equipment

Plant,

Leasehold machinery,

properties vehicles Fixtures Assets

Freehold under and and under

properties 50 years containers fittings construction Total

Group and Company GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

Valuation or cost

At 26 June 2021 254,563 2,088 37,106 95,319 230 389,306

Additions 45 119 454 4,098 513 5,229

Disposals (6,051) (39) (45) (5,021) (12) (11,168)

Transfers within property, plant and

equipment - - 20 34 (54) -

Transfers to investment property (326) - - (198) - (524)

Transfers from investment property 20 - - - - 20

Transfers to assets held for sale (1,272) - - (375) - (1,647)

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

At 25 June 2022 246,979 2,168 37,535 93,857 677 381,216

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

Additions 3,195 1 423 2,732 1,077 7,428

Disposals - (39) - (729) - (768)

Transfers within property, plant and

equipment 1 - - 69 (70) -

Transfers to assets held for sale (828) - - (292) - (1,120)

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

At 24 December 2022 249,347 2,130 37,958 95,637 1,684 386,756

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

Accumulated depreciation and impairment

At 26 June 2021 13,269 978 31,035 58,914 47 104,243

Charge for year 564 128 1,011 5,587 - 7,290

Impairment 1,141 13 - 407 - 1,561

Disposals (1,695) (39) (44) (3,998) (1) (5,777)

Transfers to investment property (74) - - (130) - (204)

Transfers to assets held for sale (263) - - (285) - (548)

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

At 25 June 2022 12,942 1,080 32,002 60,495 46 106,565

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

Charge for period 289 40 494 2,689 - 3,512

Disposals - (39) - (674) - (713)

Transfers to assets held for sale (19) - - (179) - (198)

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

At 24 December 2022 13,212 1,081 32,496 62,331 46 109,166

------------------------------------- ----------- ----------- ----------- --------- ------------- --------

Net book values

At 24 December 2022 236,135 1,049 5,462 33,306 1,638 277,590

At 25 June 2022 234,037 1,088 5,533 33,362 631 274,651

At 26 June 2021 241,294 1,110 6,071 36,405 183 285,063

Impairment considerations

The Group has performed an assessment of whether any indicators

of impairment exist. This assessment included a review of internal

and external indicators and the Group has concluded that no

impairment indicators existed at 24 December 2022.

There will be an impairment if the recoverable amount is lower

than carrying value. The recoverable amount is taken as the higher

of the fair value less costs to sell and its value in use. The same

assumptions to calculate value in use are used for right-of-use

assets as for property, plant and equipment. During the 26 weeks

ended 24 December 2022, the Group recognised a charge of nil (2021:

GBP148,000) in respect of the write-down of freehold properties

(2021: three freehold properties) to their recoverable value.

During the 52 weeks ended 25 June 2022, the Group recognised a

charge of GBP2,863,000 in relation to seven freehold properties and

eight right-of-use assets.

9 ACQUISITION OF SUBSIDIARY UNDERTAKINGS

On 28 July 2022, the Company acquired 100% of the issued share

capital of East Anglia Pub Corporation Limited, a company which

owns and operates one pub in Leigh-on-Sea, Essex, for cash

consideration of GBP3,653,000. The fair value of the assets

acquired at that date was GBP1,952,000, which was less than the

fair value of the consideration by GBP1,701,000, which has been

treated as goodwill.

The acquisition has been accounted for under the purchase

method. The following table sets out the book values of the

identifiable assets and liabilities acquired, and their fair value

to the Group:

Provisional

fair value

Book value Revaluation to Group

GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ----------- -----------

Non-current assets

Property, plant and equipment 862 1,138 2,000

Current assets

Inventories 12 - 12

Trade and other receivables - - -

Cash and cash equivalents 576 - 576

-------------------------------- ---------- ----------- -----------

Total assets 1,450 1,138 2,588

Trade and other payables (422) - (422)

Deferred tax liabilities (30) (184) (214)

-------------------------------- ---------- ----------- -----------

Total liabilities (452) (184) (636)

-------------------------------- ---------- ----------- -----------

Net assets 998 954 1,952

Goodwill arising on acquisition 1,701

-------------------------------- ---------- ----------- -----------

3,653

-------------------------------- ---------- ----------- -----------

Satisfied by:

Cash 3,653

-------------------------------- ---------- ----------- -----------

The business of East Anglia Pub Corporation Limited was hived up

to Shepherd Neame Limited at the date of acquisition, and results

since this date have been recognised in this company.

On 19 July 2022, the Company acquired 100% of the issued share

capital of Urban Reef Restaurant Limited, a company which owns and

operates one pub in Boscombe, Bournemouth, for cash consideration

of GBP1,618,000. The fair value of the assets acquired at that date

was GBP1,352,000, which was less than the fair value of the

consideration by GBP266,000, which

has been treated as goodwill.

Provisional

fair value

Book value Revaluation to Group

GBP'000 GBP'000 GBP'000

-------------------------------- ---------- ----------- -----------

Non-current assets

Property, plant and equipment 390 1,110 1,500

Current assets

Inventories 10 - 10

Trade and other receivables 107 - 107

Cash and cash equivalents 190 - 190

-------------------------------- ---------- ----------- -----------

Total assets 697 1,110 1,807

Trade and other payables (455) - (455)

Deferred tax liabilities (27) 27 -

-------------------------------- ---------- ----------- -----------

Total liabilities (482) 27 (455)

-------------------------------- ---------- ----------- -----------

Net assets 215 1,137 1,352

Goodwill arising on acquisition 266

-------------------------------- ---------- ----------- -----------

1,618

-------------------------------- ---------- ----------- -----------

Satisfied by:

Cash 1,568

Contingent consideration 50

-------------------------------- ---------- ----------- -----------

1,618

-------------------------------- ---------- ----------- -----------

The GBP50,000 contingent consideration has not yet been

settled.

The business of Urban Reef Restaurant Limited was hived up to

Shepherd Neame Limited at the date of acquisition, and results

since this date have been recognised in this company.

10 Lease liabilities and right-of-use assets

Set out below are the carrying amounts of the Group's

right-of-use assets and lease liabilities, and the movements during

the period:

Right-of-use

assets Lease liabilities

Group and Company GBP'000 GBP'000

------------------------------------------ ------------ -----------------

Net carrying value as at 26 June 2021 47,311 58,326

Additions 339 322

Disposals (15) (672)

Lease amendments - rent concessions (48) (164)

Lease amendments - other(1) 1,034 1,049

Depreciation (3,160) -

Impairment (1,226) -

Accretion of interest - 1,245

Payments - (4,220)

------------------------------------------ ------------ -----------------

Net carrying value as at 25 June 2022 44,235 55,886

Additions 3,168 1,718

Lease amendments - other(1) (10) (12)

Depreciation (1,543) -

Accretion of interest - 620

Payments - (2,081)

------------------------------------------ ------------ -----------------

Net carrying value as at 24 December 2022 45,850 56,131

------------------------------------------ ------------ -----------------

Right-of-use assets predominantly relate to leasehold

properties, along with motor vehicles and other equipment.

1. Lease amendments include lease terminations, modifications,

reassessments and extensions to existing lease arrangements.

11 Borrowings

24 December 25 December 25 June

2022 2021 2022

Group and Company GBP'000 GBP'000 GBP'000

------------------------------------------ ----------- ----------- --------

Bank loans 29,400 52,000 46,400

Other loans 55,000 35,000 35,000

Less: capitalised loan arrangement fees (929) (582) (530)

------------------------------------------ ----------- ----------- --------

Total borrowings 83,471 86,418 80,870

Analysed as:

Borrowings within current liabilities 1,600 1,600 1,600

Borrowings within non-current liabilities 81,871 84,818 79,270

------------------------------------------ ----------- ----------- --------

83,471 86,418 80,870

------------------------------------------ ----------- ----------- --------

Borrowings at the end of the reporting period comprise a 20-year

term loan of GBP35,000,000 arranged in October 2018, a 10-year term

loan of GBP20,000,000 arranged in October 2022, a 20-year term loan

of GBP20,900,000 arranged in April 2007 and drawings of

GBP8,500,000 on the revolving credit facility.

The GBP35,000,000 and GBP20,000,000 loans represent a private

placement of loan notes with BAE Systems Pension Funds Investment

Management Ltd and are repayable on 30 October 2038 and 26 October

2032 respectively. The interest rates are fixed at 3.99% and 5.47%

respectively, and both are payable six-monthly. Due to a technical

breach of covenants, the interest rate on the GBP35,000,000 loan

was temporarily increased to 4.49% until the Company's leverage

ratio returned to an accepted level for four consecutive quarters.

The interest rate reverted to 3.99% on 1 January 2023.

The GBP20,900,000 term loan was provided by Lloyds Bank plc and

is repayable in four instalments of GBP1,600,000 payable in

December every year, with the outstanding balance being repayable

on 31 December 2026. The interest rate payable is three-month SONIA

plus a margin dependent on the ratio of net debt to underlying

EBITDA. The variable interest payments have been swapped for fixed

interest payments payable quarterly.

The four-year revolving credit facility with Lloyds Bank plc and

HSBC Bank plc matures on 31 December 2026. This is a committed

facility which permits drawings of different amounts and for

different periods. These drawings carry interest at a margin above

SONIA with a commitment payment on the undrawn portions. Interest

is payable at each loan renewal date.

The Group has a GBP5,000,000 overdraft facility within the

revolving credit facility with interest linked to the Bank of

England base rate.

At the end of the reporting period, GBP26,500,000 (2021:

GBP30,500,000) of the total GBP35,000,000 (2021: GBP60,000,000)

committed revolving credit bank facility was available and undrawn,

with nil (2021: nil) drawn on the GBP5,000,000 overdraft

facility.

The Company's loans and overdraft are secured by a first

floating charge over the Company's assets.

12 Notes to the Cash Flow Statement

a Reconciliation of operating profit to cash generated by

operations

26 weeks 52 weeks

ended ended

26 weeks ended 24 25 December 25 June

December 2022 2021 2022

Excluded

Underlying from underlying

results results Total Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating profit 6,282 (798) 5,484 6,398 10,423

Adjustment for:

Depreciation and amortisation 5,077 - 5,077 5,393 10,480

Impairment of property, plant and

equipment - - - 74 1,561

Impairment of intangible assets - - - - 52

Impairment of right-of-use assets - - - - 1,226

Impairment of assets held for sale - - - 74 24

Share-based payments expense 206 - 206 243 183

Decrease/(increase) in inventories 46 - 46 (1,748) (747)

Increase in debtors and prepayments (459) - (459) (2,485) (2,242)

(Decrease)/increase in creditors

and accruals (1,327) (55) (1,382) (883) 338

Free trade loan discounts 1 - 1 1 -

Loss/(profit) on sale of assets

(excluding property) 35 - 35 (4) 53

Interest received - - - 3 -

Income tax paid (114) - (114) - -

Fair value movements on financial

assets (186) - (186) (32) (210)

------------------------------------ ---------- ---------------- -------- ------------ --------

Net cash inflow from operating

activities 9,561 (853) 8,708 7,034 21,141

------------------------------------ ---------- ---------------- -------- ------------ --------

b Reconciliation of movement in cash to movement in net debt

26 weeks 26 weeks 52 weeks

ended ended ended

24 December 25 December 25 June

2022 2021 2022

Group and Company GBP'000 GBP'000 GBP'000

----------------------------------------- ------------ ------------ ---------

Opening cash and overdraft 5,579 5,560 5,560

Closing cash and overdraft 691 4,041 5,579

----------------------------------------- ------------ ------------ ---------

Movement in cash in the period (4,888) (1,519) 19

Cash from increase in bank loans (3,000) - -

Cash used to repay bank loans - 10,000 15,600

Movement in loan issue costs 399 (53) (105)

----------------------------------------- ------------ ------------ ---------

Movement in net debt resulting from cash

flows (7,489) 8,428 15,514

Net debt at beginning of the period (75,291) (90,805) (90,805)

----------------------------------------- ------------ ------------ ---------

Net debt (82,780) (82,377) (75,291)

----------------------------------------- ------------ ------------ ---------

Current lease liability (1,976) (4,379) (2,780)

Non-current lease liability (54,155) (53,021) (53,106)

----------------------------------------- ------------ ------------ ---------

Statutory net debt (138,911) (139,777) (131,177)

----------------------------------------- ------------ ------------ ---------

c Analysis of net debt

Issue

costs

of new December

June 2022 Cash flow New loans loans Non-cash 2022

Group and Company GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cash and cash equivalents 5,579 (4,888) - - - 691

Debt due in less than one year (1,600) - - - - (1,600)

Debt due after more than one

year (79,270) - (3,000) 598 (199) (81,871)

------------------------------- --------- --------- --------- -------- -------- ---------

Net debt (75,291) (4,888) (3,000) 598 (199) (82,780)

------------------------------- --------- --------- --------- -------- -------- ---------

Lease liabilities (55,886) 2,081 - - (2,326) (56,131)

------------------------------- --------- --------- --------- -------- -------- ---------

Statutory net debt (131,177) (2,807) (3,000) 598 (2,525) (138,911)

------------------------------- --------- --------- --------- -------- -------- ---------

Non-cash movements in lease liabilities comprises lease

additions and modifications of GBP1,706,000 (2021: GBP231,000),

interest of GBP620,000 (2021: GBP620,000), less waivers of nil

(2021: GBP145,000).

13 Capital commitments

Contracts for capital expenditure not provided for in the

accounts amounted to GBP1,448,000 (2021: GBP102,000).

14 Related party transactions

George Barnes is an Executive Director of Shepherd Neame

Limited. Mr A J A Barnes, a close member of George Barnes' family,

is a partner at Barnes Solicitors LLP. During the 26 weeks ended 24

December 2022, Barnes Solicitors LLP provided legal services at a

cost of GBP10,000, including VAT and disbursements to third parties

(2021: GBP1,500). No balance was owed to Barnes Solicitors LLP by

Shepherd Neame Limited at the end of the reporting period (2021:

nil).

Nigel Bunting, an Executive Director of Shepherd Neame Limited,

is also a Director of Davy and Company Limited. During the 26 weeks

ended 24 December 2022, the Group did not purchase any goods (2021:

nil) but made sales to the value of GBP195,000 (2021: GBP49,000) to

Davy and Company Limited and its associated companies. At the end

of the reporting period, no balance was owed by Shepherd Neame

Limited to the Davy Group of companies (2021: nil) and GBP52,000

was owed to the Group by the Davy Group of companies (2021:

GBP7,000).

Hilary Riva, a Non-Executive Director of Shepherd Neame Limited,

is also a Director of the Alexander Centre CIC. During the 26 weeks

ended 24 December 2022, the Group did not purchase any goods (2021:

GBP1,000) but made sales to the value of GBP4,000 (2021: GBP3,000)

to the Alexander Centre CIC. At the end of the reporting period, no

balance was owed by Shepherd Neame Limited to the Alexander Centre

CIC (2021: nil) and no balance was owed to the Group by the

Alexander Centre CIC (2021: nil).

All the transactions referred to above were made in the ordinary

course of business on an arm's-length basis and outstanding

balances were not overdue. There is no overall controlling party of

Shepherd Neame Limited.

1 H1 2020 is the first half of the financial period of the 52

weeks to the 27 June 2020. This first half equated to the 26 weeks

ended 28 December 2019, restated on an IFRS basis

2 Profit/(loss) before any profit or loss on the disposal of

properties, investment property fair value movements and operating

charges which are either material or infrequent in nature and do

not relate to the underlying performance

3 Net debt excluding lease liabilities comprises cash, bank

overdrafts, bank and other loans less unamortised loan fees

4 Underlying profit/(loss) less attributable taxation divided by

the weighted average number of ordinary shares in issue during the

period. The numbers of shares in issue excludes those held by the

Company and not allocated to employees under the Share Incentive

Plan which are treated as cancelled

5 Net assets at the reporting date divided by the number of

shares in issue being 14,857,500 50p shares

6 Retail like-for-like sales includes revenue from the sale of

drink, food and accommodation but excludes machine income.

Like-for-like sales performance is calculated against a comparable

26 week period in the prior year for pubs that were in the estate

in the same period within both years

7 Tenanted income calculated to exclude from both periods those

pubs which have not been in the estate throughout the two periods.

The principal exclusions are pubs purchased or sold, pubs which

have closed, and pubs transferred to or from our retail business.

Income is calculated against a comparable 26 week period in the