TIDMSRES

RNS Number : 5216M

Sunrise Resources Plc

15 September 2023

15 September 2023

SUNRISE RESOURCES PLC

("Sunrise" or the "Company")

Market Study and Pozzolan Project Update

Sunrise Resources plc is pleased to provide the following

project update and to release the findings of a market study

commissioned by the Company to evaluate market opportunities and

market growth predictions for cement and the use of supplementary

cementitious materials ("SCMs"), including natural pozzolan, in the

USA, and California and Nevada in particular.

Key Points

The Market Study:

-- was commissioned by the Company with Cement Distribution

Consultants, Amsterdam to examine the cement markets in California

and Nevada which are being targeted by the Company with its CS and

Hazen natural pozzolan projects in Nevada.

-- provides the Company with a detailed breakdown of cement

markets, county by county in California and for the two main

population centres in Nevada (Reno-northern Nevada and Las

Vegas-Henderson).

-- details the production profiles of all cement producers and

ready-mix companies in California and Nevada and details movements

of cement within and between different US states.

Forecasts, considering the US as a whole:

-- The consumption of cementitious materials (including ordinary

Portland cement) is forecast to increase at 10% annualised rate

from just over 129 million tonnes in 2021 to over 154 million

tonnes by 2030.

-- The production of ordinary Portland cement will be largely

static as no new cement plants will be built or existing plants

expanded.

-- The increased consumption of cement will come entirely from increased use of the main SCMs.

-- US consumption and production of natural pozzolan will

increase from a very low base in 2021 to nearly 6 million tonnes

per annum by 2030.

Forecasts for California and Nevada:

-- Production of natural pozzolan is forecast to increase

substantially in both states based on known resources of volcanic

natural pozzolan which include both the Company's Hazen and CS

Projects in Nevada.

-- The Company's natural pozzolan projects are well placed to

benefit from these structural changes in the cement and concrete

industries.

-- California and Nevada together are expected to produce 62% of all SCMs consumed in the US.

_________________________________________________________________________

Commenting today, Executive Chairman Patrick Cheetham said:

"The study that we have commissioned provides a detailed

breakdown by volume and location for all cement production and use

of cement and SCMs in the USA, and is already proving to be a

useful tool in our endeavours to find a development partner for our

natural pozzolan projects in Nevada."

"The Company is currently waiting for a bulk sample from its

Hazen natural pozzolan project to be test ground in a commercial

grinding mill by an existing producer of natural pozzolan. It is

also discussing joint development of its CS Natural pozzolan

Project with three companies. One, a large cement and ready-mix

group, has successfully completed an extensive programme of

testwork. The second is a materials company that is currently

undertaking its own testwork programme on CS natural pozzolan. The

third is a cement company that is just starting its evaluation of

the project."

_________________________________________________________________________

Further information:

Sunrise Resources plc Tel: +44 (0)1625 838 884

Patrick Cheetham, Executive

Chairman

Tel: +44 (0)207 628 3396

Beaumont Cornish Limited

Nominated Adviser

James Biddle/Roland Cornish

Tel: +44 (0)207 469 0930

Peterhouse Capital Limited

Broker

Lucy Williams/Duncan Vasey

Shares in the Company trade on AIM. EPIC: "SRES".

Website: www.sunriseresourcesplc.com

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 which forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Detailed Information

The following information has been extracted from a market study

commissioned by the Company with Cement Distribution Consultants of

Amsterdam ("CDC") to examine the cement markets in California and

Nevada which are being targeted by the Company with its CS and

Hazen natural pozzolan projects in Nevada.

The market study provides the Company with a detailed breakdown

of cement markets, county by county in California and for the two

main population centres in Nevada (Reno-northern Nevada and Las

Vegas-Henderson). It also details the production profiles of all

cement producers and ready-mix companies in these two states and

details movements of cement within and between different US

states.

Much of the information is commercially sensitive but summary

information of possible interest to shareholders has been included

in this news release.

Moreover, the report is helping the Company to identify a wider

range of potential partners for the development of its natural

pozzolan projects in Nevada.

Cement Markets

California cement production of around 10.7 million tons per

annum ("mtpa") is located almost entirely in southern California.

CalPortland Cement ("CPC", a subsidiary of Japan's Taiheiyo Cement

Corporation in Japan) is the largest cement producer in California

with an installed capacity of 4.5 mtpa. Cemex is second with 3.1

mtpa and Mitsubishi is the third largest with a capacity of 1.4

mtpa. The California plants are currently working at a

high-capacity utilisation.

Only CalPortland's Redding plant with a capacity of about 0.6

mtpa supplies northern California directly following the closure of

Heidelberg Cement's Permanente plant at Cupertino near San José in

northern California.

The cement market in Nevada is much smaller than in California.

Nevada's cement consumption in 2022 was 1.7 mt. Of this volume

about 0.7 mt is produced in Nevada's only cement plant at Fernley

by Nevada Cement (Eagle Materials) and the rest is supplied from

California, Arizona and Utah. Nevada Cement has a rail terminal in

Sacramento, supplied from its Fernley cement plant and it has

recently purchased a ship import terminal in Sacramento.

The California cement market is strongly influenced by the

overall cement market in the wider Southwest US as the combined

states of Nevada, Arizona, Utah, New Mexico and Colorado have a

structural cement deficit which is compensated from the cement

plants in southern California.

When cement consumption is low in the region, the region is

largely self-sufficient with only small inflows from the large

cement plants in southern California. These plants then supply a

significant part of their production by rail to the northern

California market. In these periods (e.g. during and after the 2008

- 2011 financial crisis) there are no cement imports into

California.

When cement consumption in the southwest US grows then an

overall deficit builds and this is then filled by the cement plants

in southern California which direct their output more to the region

and reduce the supply (by rail) to northern California. The

corresponding shortage in northern California is then resolved by

imports from Asia via the ship terminals. The ship terminals are

mainly owned by the cement producers. When cement demand in the

southwest US grows further the cement plants in southern California

direct more cement to the region and when they cannot fully supply

the southern California market anymore the local cement terminals

in the port of Los Angeles, Long Beach open up. Here, also, the

import terminals are owned by the cement producers.

Ready-Mix Companies

Most cement and SCM's are destined, with sand and gravel

aggregates, for the production of concrete in pre-cast concrete

structures or for use by the ready-mix industry.

In California and Nevada, the production and sale of concrete is

dominated by the major cement producers who are vertically

integrated. Nevertheless, there are a significant number of large

independent ready-mix companies owned by non-cement producing

materials (aggregate) companies, some of which are showing interest

in adding natural pozzolan to their mix of products.

Natural Pozzolan

All of the cement producers in southern California have shown

interest in natural pozzolan as an SCM and CPC is currently

permitting a deposit of natural pozzolan near to their Mohave

cement plant in southern California. In northern Nevada, Nevada

Cement is producing natural pozzolan from a third-party quarry near

Reno.

Independent production of natural pozzolan is currently taking

place at dedicated grinding plants in Utah (Geofortis) and Arizona

(Kirkland Mining & Drake Cement) where the market is either

internal or with the ready-mix companies and with fly ash suppliers

producing blended fly ash/natural pozzolan products.

Market Forecasts

In the Company's announcement of 23 May 2023,which followed the

2023 Symposium of the Natural Pozzolan Association, the Company

presented its views on the direction of travel of the cement

industry which is looking to reduce the Portland cement clinker

component in cement manufacture through the introduction of 1L, 1P

and 1T cements where limestone (1L) and natural pozzolan (1P) are

introduced as clinker extenders and substitutes or used together in

Ternary blends (1T).

CDC has provided the Company with forecasts to 2030 of

consumption and production of cement and the three main

volumetrically important SCMs - fly ash, ground granulated blast

furnace slag ("GGBS") and natural pozzolan. This data has been

provided independently from the market study commission by the

Company. The forecasts are detailed and cover every state in the

USA. CDC has also provided 2021 figures for comparison which is

taken as a baseline year when natural pozzolan was in its

infancy.

The forecast and comparison are shown the attached Tables 1-3

which show the 2030 forecasts and 2021 comparisons for the US as a

whole, and for California and Nevada separately.

Considering the US as a whole, Table 1 shows that:

-- the consumption of cementitious materials (including ordinary

Portland cement) is forecast to increase at 10% annualised rate

from just over 129 million tonnes to over 154 million tonnes by

2030.

-- the production of ordinary Portland cement will reduce,

albeit marginally, as no new cement plants will be built nor

existing plants expanded so cement clinker production will be

relatively steady.

-- the increased consumption of cement will come entirely from

increased use of the main SCMs through the production of blended

cements or by blending SCMs and cement at the ready-mix or casting

plants or at various cement terminals.

-- fly ash production will reduce from over 24.3 mtpa in 2021 to

15.7 mtpa in 2023 but consumption will increase and be met from

overseas imports and/or reclamation of historically ponded fly

ash.

-- US consumption and production of GGBS will increase

marginally, constrained by domestic and international availability,

and changing iron and steel making technologies.

-- US consumption and production of natural pozzolan will

increase from a very low base to nearly 6 mtpa by 2030.

Whilst looking at the US is instructive, when those same

statistics are considered on state-by-state basis there are

substantial regional differences. These differences arise due to

the availability of different SCMs in different states, transport

costs and state-to-state infrastructure etc., as well as varying

state legislation on mandating SCM use and decarbonisation of the

cement industry.

Of primary interest to Sunrise are the target markets in

California and Nevada.

Tables 2 and 3 show comparable statistics for California and

Nevada respectively for 2021 and 2030. The tables show that:

-- production of cement will increase in both states through

increased use of SCMs in line with predicted national trends.

-- consumption of fly ash will increase only marginally and the

production of fly ash in Nevada will cease. This reflects the lack

of fly ash production and ponded fly ash in California and

Nevada.

-- production of natural pozzolan will increase substantially in

both states based on known resources of volcanic natural pozzolan

which include both the Company's Hazen and CS Projects in

Nevada.

-- California and Nevada together are expected to produce 62% of all SCMs consumed in the US.

Project Updates - Hazen and CS Natural Pozzolan Projects

The Company's natural pozzolan projects are well placed to

benefit from these structural changes in the cement and concrete

industries and the forecast increase in the market for natural

pozzolan.

The Company is currently waiting for a bulk sample from its

Hazen pozzolan project to be test ground in a commercial grinding

mill by an existing producer of natural pozzolan. It is also

discussing joint development of its CS Project with three

companies. One, a large cement and ready-mix group, has

successfully completed an extensive programme of testwork. The

second is a materials company that is currently undertaking its own

testwork and the third is a cement company that is just starting

its evaluation of the CS Project.

Note: The news release contains certain statements and

expressions of belief, expectation or opinion which are forward

looking statements, and which relate, inter alia, to the Company's

market forecasts, proposed strategy, plans and objectives or to the

expectations or intentions of the Company's directors. Such

forward-looking statements involve known and unknown risks,

uncertainties, and other important factors beyond the control of

the Company that could cause the actual performance or achievements

of the Company to be materially different from such forward-looking

statements. Accordingly, you should not rely on any forward-looking

statements and save as required by the AIM Rules for Companies or

by law, the Company does not accept any obligation to disseminate

any updates or revisions to such forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGPUUWBUPWGMC

(END) Dow Jones Newswires

September 15, 2023 02:00 ET (06:00 GMT)

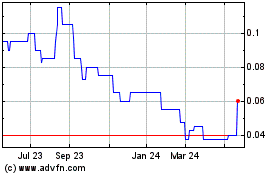

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

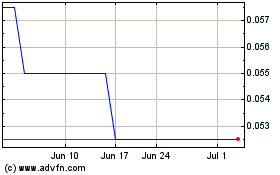

Sunrise Resources (AQSE:SRES.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024