TIDMTHW

Chairman's Statement

The Company has benefited in this past year from the major investment programme

that we embarked upon in 2016 and which has continued throughout the course of

this last year. This has allowed us to continue to grow whilst dealing with

some significant challenges to our cost base.

Turnover for the year was GBP92.2m (2017: GBP84.4), an increase of 9.2%.

Operating profit has increased by GBP0.8m or 6.6% on last year to GBP12.9m

(2017: GBP12.1m). Earnings per share increased by 79% to 13.8p (2017: 7.7p).

During the year we have continued our strategy of investing in our core pub

estate, inns and hotels, whilst continuing to sell poorer quality properties,

repositioning our estate into assets that are fit for the future. Last year we

reported that we were embarking on a major investment programme, and this has

been a key focus of the year, with many of those projects now nearing

completion. In addition we have acquired a new hotel in the Lake District. As a

result of that net debt increased in the year from GBP47.6m at 31 March 2017 to

GBP63.7m at 31 March 2018.

Strategy

The strategy of the Company is to own and operate freehold properties and offer

superb hospitality in outstanding properties in great locations. Our business

is diverse and operates in several different markets and we believe that this

diversity provides some resilience over the course of the business cycle.

Pubs & Inns

Pubs - We own and support an estate of high quality tenanted pubs, run by

dedicated and talented individuals, who are attracted by the support package

and investment that we offer to help them to realise their pub's potential.

Investment into our pubs is focused on creating sustainable, long term

businesses with multiple income streams and strong food offerings. Where there

is the potential and the demand we invest in letting bedrooms for our pubs to

create an additional income stream to their restaurant and drinks businesses.

Brewery - Great beer is an important part of our heritage and customer offer.

We are committed to continuing to brew fabulous beers and distribute them

exclusively in our own properties. Our new brewery in Mellor Brook is nearing

completion and we will start to brew interesting craft beers there as well as

giving our customers the traditional ales that Thwaites is famous for.

Inns - We have a small but growing number of high quality inns that each have

their own identity and support local suppliers. Our inns showcase our own

beers, offer fantastic local food and comfortable rooms. We will acquire and

develop these larger managed properties which ideally will have bedrooms as

well as an excellent and exciting food and drink offering.

Hotels

Hotels & Spas - Our collection of provincial hotels are individual in nature,

but united in their conviviality, which allows our customers to feel

comfortable and at home. We maintain our hotels in good order, provide high

levels of service to our guests and a warm welcome. We are looking to add to

the number of hotels that we own through acquisition and new build.

Awards

In the past few years we have placed much emphasis on the recruitment and

retention of great team members who can help our customers to feel welcome and

at home. As a result we have been working on developing and enhancing our

employee proposition. One element of this has been our move away, last year,

from being a national minimum wage employer. However developing new training

and development programmes, together with increased focus on employee

engagement, has also been important.

I am delighted that our People and Development Team was rewarded by being named

as HR Team of the Year in the HR Distinction Awards. This was followed up by us

being named in the Sunday Times Best Company to Work For in Yorkshire and

Gloucestershire

New Offices and Brewery

We have been on site for much of the year building our new offices, brewery and

stables in Mellor Brook and our plans to relocate from Blackburn are well

advanced. We expect that the site will be handed back to us in July and that we

will move in August.

Once we move to Mellor Brook, our old brewery site, much of which is derelict

and in an increasing state of decay, will be demolished. This will have the

benefit of removing the significant rates liability associated with it whilst

plans for its redevelopment or sale are finalised. Whilst this may take some

time and requires supplementary regeneration within Blackburn town centre we

are resolved to wait until such time as we can extract full value from our land

holdings in the town.

Acquisitions, developments and disposals

Last year's developments at The Crown at Pooley Bridge, the Royal at Heysham,

the Boot and Shoe, Lancaster and the Lister Barn, Malham have all provided a

full contribution in the current year. Inevitably there have been a few

teething problems as we have relaunched these businesses. Of particular

challenge, has been the recruitment and training of several new teams at the

same time, however the properties all show excellent promise for the future.

In March 2017 we acquired Middleton's Hotel in York, a 56 bedroom property

spread over six Grade II-listed buildings. We have undertaken some small works

to improve the property, with more to come in this current year. I am pleased

to say that the hotel has been fully integrated and is performing ahead of

expectations.

In April 2017 we acquired Langdale Chase Hotel, on the banks of Lake

Windermere, which has 29 bedrooms. We have plans to refurbish the main property

and are considering the addition of a spa and further bedrooms. Our initial

discussions with the planners have been positive and we believe that works will

start during the course of this year.

In August 2017 we completed the Lodge at Solent, a new 54 bedroom lodge

adjoining the Parsons Collar pub in Fareham, adjacent to the Solent Hotel &

Spa. The Lodge got off to a strong start, followed by a slightly slower winter,

however we are confident in its prospects and will benefit from a full year's

contribution in the current year.

The major redevelopment of the Beverley Arms in the East Riding of Yorkshire

has been ongoing all year. Work started in June 2017 and whilst we had hoped to

be open in April 2018 it is likely that the property will now open in July. We

have started the recruitment and training of the new team and once open the

property will be an exciting new addition to our Inns.

During the year we have sold 17 pubs from the bottom end of our estate.

Dividend

An interim dividend of 1.10p (2017: 1.10p) was paid in January 2018 and the

Board recommends a final dividend of 3.36p (2017: 3.36p). The Board will keep

the level of dividend under review, and assess the level of future dividends in

light of company performance.

Board

There have been no changes to the Board during the course of the year.

People

I have often said in my report that we are lucky to have within the Company

fantastic teams of people without whom we could not be the successful business

that we are. Our strong family values and progressive attitude, demonstrated

this year by some of the awards that we have won, continue to attract wonderful

people and exciting new talent to the company.

In the second half of the year we initiated a project to look at how we run our

hotels, questioning from the bottom up our team and management structures.

These have not changed for many years, and whilst the structure has served us

well in the past, the nature and mix of our hotel business has changed.

In March 2018 we undertook a full restructuring of our hotel operations,

putting in place a new, more focused and dynamic operational structure which we

believe will serve the business better for the future. Inevitably this led to

some uncertainty, however I am pleased that the changes are now largely

complete.

I would like to thank all our staff, customers, suppliers and shareholders for

their support over the past year and wish everyone well for the year ahead.

Outlook

The weather throughout the Spring and into April has been some of the worst

that I can remember, and this has had an inevitable impact across all areas of

the business, meaning that we have got off to a slightly slower start than we

would have liked.

The coming year presents some uncertainties, particularly in our negotiations

with the European Union over Brexit and the influence that outcome will have on

our exchange rate, interest rates and economic growth. However our business is

in good health, its assets are well invested, we are making good progress

against our strategic objectives and we are well placed to weather any

volatility that may present itself.

The significant investments that we have completed this year, together with the

full year effect of those completed last year give us cause for confidence, and

I am hopeful that we will once more make progress in the year to come.

Mrs Ann Yerburgh

Chairman

12 June 2018

Operating Review

Overview

The beginning of the year started with considerable concerns about food and

wage inflation, which threatened many areas of the cost base. At the same time

consumer spending has been fickle, with a number of the major industry

participants choosing to discount, particularly in the casual dining market and

at the value end of the pub market. As a result the ability to pass cost

increases on in full has been a challenge and in some areas of the business

operating margins have been under pressure.

Sales have increased by 9%, and on a like for like basis, excluding

acquisitions, they increased by 2.5%. Continued refurbishments, particularly in

the hotels have been an important factor in supporting this growth. Despite

pressure on food and labour margins EBITDA has increased to GBP20.2m (2017:

GBP18.9m) an increase of 7.0%, group operating profit has increased to GBP12.9m

(2017: GBP12.1m).

We have continued to place a significant emphasis on how we attract, recruit,

train, develop and retain the best teams possible to run and support our

various operations. We have put in place a new training and development at

local level across all of our properties and have continued to undertake annual

engagement surveys across the business. The shortage of available employees in

the hospitality industry is becoming more acute, as has been predicted over the

past few years, and it is our aim to be the employer of choice in all our local

markets. It was very pleasing therefore to be named in the Sunday Times

Regional Best Companies to Work For in Yorkshire and Gloucestershire and we are

working towards a national listing.

We took the decision at the half year to refresh our websites once more, an

operation that seems to be becoming an ongoing event every two to three years.

This project is currently underway and will be completed at the start of the

summer, with a relaunch in July. In part this has allowed us to consider how we

market our bedroom stock, with the objective of slowing the seemingly

inexorable rise in commissions payable to online booking agents. This cost

which has been rising at an alarming rate in recent years as the market moves

towards single platform providers at the expense of the owners and operators of

the underlying hotels.

Our strategy remains focused on our pubs, inns and hotels and we have plans to

continue to invest in them to secure our future growth.

Pubs

We own a freehold estate of approximately 240 tenanted pubs, having sold 17

pubs in the year. Our pub estate encompasses community locals to destination

food led pubs in both rural and town centre locations, ranging geographically

from Cumbria to the Midlands, and from North Wales to Yorkshire.

Our strategy has been consistent in recent years, focusing on the quality pubs

within the estate, investing in them alongside proven operators to expand and

improve the premises. We have focused on establishing good quality food

offerings and where possible the development and refurbishment of bedrooms. Our

strategy has been wholly focused on creating an estate of high quality,

sustainable, growth businesses with several income streams. Tenanted pub

businesses are by nature diversified, with resilient earnings and when well

invested, with dedicated operators operating profitable businesses, they should

suffer from low levels of disruption from tenant churn and profits achieved

should convert to high levels of cash generation.

Our trading started the first half of the year steadily, and by the half year

we were broadly level year on year. Despite disposing of 17 more poorly

performing pubs during the year this trend held up and has resulted in full

year operating profits being almost exactly the same as last year. The mix of

sales in our pubs continues to change with beer volumes declining in line with

the market at about 4-5%, in favour of wines, spirits and soft drinks. Average

EBITDA per pub increased during the year by 5%.

For the past ten years we have participated in the annual MCA Tenant Track

Survey - which is an independent survey benchmarking the performance of our

tenanted pub business against our peers. The survey places particular focus on

our reputation and ethics, what we are like to deal with, the quality of the

support that we offer, how we maintain and repair our properties and how we

recruit and train new tenants as they become partners with us. We were pleased

that this year we were once again ranked third in the top 13 UK tenanted pub

companies posting an improved score to the previous year. During the year we

did however see an increase in tenant churn which meant that at the year end

there were 14 pubs (5% of the estate) which were looking for new tenants

compared to four last year, a position which has since improved.

During the year we completed 25 development projects at a cost of GBP2.3m,

continuing to make returns ahead of our hurdle rate of 20%. Major projects in

the year have been completed at the Cock and Bottle in Tarleton, The Lindley

Tap in Lindley and the Red Lion Stockton Heath - all of which have been

successfully relaunched.

Last year we decided to trial some new managed pub concepts in pubs where the

level of investment required meant that it was difficult to attract a third

party operator. The first of these, the Grill and Grain at Hoghton, suffered a

total loss from fire in April 2017. We have recouped our investment from our

insurers following the year end and for the time being we have placed the

redevelopment of the pub on hold whilst we focus on other projects.

We did not find any suitable pubs to acquire in the year, however we continue

to look to add into our business good quality tenanted pubs with balanced

income streams that we can either absorb into our existing tenanted estate or

make significant investment to reposition as a managed operation.

Brewery

We continue to operate our small craft brewery in Blackburn and will move it in

the next few months to our new site at Mellor Brook. The new brewery will allow

us to continue to produce a range of seasonal and craft beers exclusively for

sale in our own pubs, inns and hotels. We believe that this gives us a point of

difference over other pub owning companies.

Inns

We own and manage a small portfolio of 'Inns of Character' and continue to seek

high quality properties in outstanding locations to develop this collection.

Our Inns have a busy bar at the hub, a home cooked food offering and high

quality, comfortable accommodation - they focus on providing outstanding

hospitality and offer an attractive and more personal alternative to the

mid-market branded chains.

Our Inns have continued to grow, with sales in the current year increasing to

GBP16.1m (2017: GBP13.3m) an increase of 21%, operating profits have increased

by a comparable amount.

In the current year the Inns have benefited from a full year contribution from

The Lister Barn and a part year contribution from The Crown at Pooley Bridge,

which opened in May 2017.

In February 2016 we acquired the Beverley Arms in East Yorkshire. This property

has been closed since acquisition and has been with our builders since June

2017. During the course of building works we have seen delays caused by

problems to the groundworks and issues with asbestos. This will be a large and

exciting addition to our inns, with 38 bedrooms, a bar and a restaurant, it is

now due to open in July 2018.

We continue to look for new opportunities to grow our Inns portfolio and will

make further acquisitions where we believe we can add value.

Hotels & Spas

We own and operate ten hotels which are geographically spread across the north

and south of England. Our hotels are positioned towards the premium end of the

market and most have leisure and spa facilities. They are all different, and we

wish to develop them to promote the individual character of each hotel

supported by a great food and drink offering with local nuances. Our vision,

similar to our Inns, is to create a collection of interesting, characterful

contemporary hotels that are the best in their local area.

The provincial hotel market continued to grow over the year and saw further

increases in bedroom stock being added to the market. During the year our

hotels grew their sales by 13%. Much of this increase reflects the acquisitions

of Middleton's in York in February 2017 and Langdale Chase on Lake Windermere

in April 2017 together with the opening of The Lodge at Solent in August 2017.

Trading at our other hotels has been the subject of some disruption as a result

of the accelerated refurbishment programme that we disclosed in last year's

report. During the year we have refurbished 67 bedrooms as well as the

restaurant areas at Aztec, North Lakes and The Solent and the Spa and Pool

Halls at Kettering and Cottons. As these project come to an end we will see the

benefit of both undisturbed trading together with the anticipated returns on

the investments that we have made. Despite this disruption occupancy increased

by 4% year on year and our room rates net of commissions were broadly flat. As

a result of this and other cost savings operating profit from our hotels

increased in the year by 10%.

Last year, in response to the costly impact of the National Living Wage, we

undertook a review of the whole of our hotel operations, seeking to redesign

our operational structure to become more efficient. This project was completed

at the year end and we hope that it will bring benefits in the current year.

Summary and outlook

Once again the last year has been an extremely busy one, with continuing

investment in a good number of large and high quality investment schemes. We

are working hard to settle in our new investments and are pleased with the

early results from them. The successful launch of the Beverley Arms will be a

significant part of our growth this coming year and the recruitment and

training of the new team there has our full attention.

Our priority this year will be to cement the performance of the investment

projects delivered last year, of which there are a good number, and to make a

success of the new operational and management structure in our hotels. The

delivery of our new website will give us a better opportunity to market our

hotels directly to our guests, rather than through third parties. We also look

forward to finalising our plans for the development of Langdale Chase. The

business has good momentum and in the absence of any shocks we expect to make

continued progress.

We will be highly selective in making any further acquisitions, but should the

opportunities present themselves we will seek to acquire additional outstanding

properties in great locations to grow the business for the future.

Financial Review

Results

Turnover for the year ended 31 March 2018 increased by 9% to GBP92.2m (2017:

GBP84.4m). Operating profit increased by 7% to GBP12.9m (2017: GBP12.1m).

The measurement of the interest rate swaps at fair value resulted in a profit

of GBP1.3m (2017: a loss of GBP2.6m).

Profit before taxation for the year increased by 72% to GBP9.8m (2017:

GBP5.7m).

Business Review

The key issues facing the Group are covered in the Chairman's Statement and

Strategic Report. The KPI's used by the Group to monitor its overall financial

position can be summarised as follows:

2018 2017

Group GBP'm GBP'm

Turnover 92.2 84.4

EBITDA 20.2 18.9

Depreciation 7.3 6.8

Operating profit 12.9 12.1

Profit before tax 9.8 5.7

Net debt 63.7 47.6

Earnings per share (pence) 13.8 7.7

Pubs and Inns

GBP'm GBP'm

Turnover 48.6 45.7

EBITDA 16.5 15.9

Depreciation 3.8 3.6

Operating profit (before Group central charges) 12.7 12.3

Average number

Tenanted 255 265

Managed 11 10

Hotels & Spas

GBP'm GBP'm

Turnover 43.6 38.7

EBITDA 11.1 10.0

Depreciation 3.2 2.8

Operating profit (before Group central charges) 7.9 7.2

Average number

Hotels 8 6

Lodges 2 1

The principal non-financial indicators monitored by management are:

Pubs and Inns

Utility indices, beer quality, room occupancy rates, customer complaints,

health and safety incidents, beer volumes and tenant recruitment.

Hotels

Room occupancy rates, customer complaints, health and safety incidents, spa

memberships and wedding and event numbers.

Interest rate swaps measured at fair value

The Group has interest rate swaps for GBP55m which are recognised as a

financial liability. During the year ended 31 March 2018 the movement in the

fair value of the interest rate swaps resulted in a credit to the profit and

loss account of GBP1.3m (2017: a charge of GBP2.6m)

Interest payable

Net interest payable was GBP3.5m (2017: GBP3.0m) as loan capital increased from

GBP50m at the start of the year to GBP66.5m at the end of the year.

Taxation

The tax charge on profit for the year was GBP1.7m, an effective rate of 17.3%.

Earnings per share

The earnings per share was 13.8p (2017: 7.7p).

Dividends

An interim dividend of 1.10p has been paid and the Board recommends a final

dividend of 3.36p, which will make a total of 4.46p for 2018 (2017: 4.46p).

Cash flow and financing

The Group's net borrowing increased by GBP16.1m, from GBP47.6m at 31 March 2017

to GBP63.7m at 31 March 2018 due to capital expenditure.

The Group made deficit contributions to the defined benefit pension schemes of

GBP2.2m (2017: GBP2.2m). Whilst these schemes were closed in August 2009, the

Group is committed to funding the deficit on the scheme which was GBP34.9m,

before tax, at 31 March 2018, an increase of GBP4.2m from GBP39.1m at 31 March

2017.

The Group has GBP45m of long term debt, GBP21.5m of bank loans and cash

balances of GBP2.8m at 31 March 2018. The Group has three year bank facilities

of GBP30m. of which GBP8.5m is undrawn at 31 March 2018, these facilities are

sufficient to meet the requirements of the Group's capital investment plans.

Property

During the year we sold 17 pubs and four ancillary properties for a total of

GBP3.2m generating a profit against book value, after disposal costs, of

GBP0.1m.

In line with our accounting policy, 20% of our properties were subject to a

formal revaluation, and additionally an impairment review was carried out on

the rest of our property estate. This resulted in no overall change to the

total value of our property portfolio.

Treasury policy and financial risk management

Treasury policies are subject to Board approval. All borrowings are in sterling

and comprise a mixture of fixed interest loans and facilities carrying LIBOR

related floating rates. The Group has interest rate swaps for GBP55m where it

is committed to pay the difference between LIBOR and fixed interest rates. At

31 March 2018 a financial liability of GBP18.3m has been recognised in respect

of these interest rate swap contracts.

Kevin Wood

Finance Director

12 June 2018

EXTRACT FROM AUDITED FULL FINANCIAL STATEMENTS FOR THE YEARED

31 MARCH 2018

GROUP PROFIT AND LOSS ACCOUNT

2018 2017

GBP'm GBP'm

Total Total

Turnover 92.2 84.4

Cost of sales (68.1) (62.1)

Gross profit 24.1 22.3

Distribution costs (3.7) (3.2)

Administrative expenses (7.5) (7.0)

Operating profit 12.9 12.1

Property disposals 0.1 0.3

Profit before interest 13.0 12.4

Net interest payable (3.5) (3.0)

Profit (loss) on interest rate 1.3 (2.6)

swaps measured at fair value

Finance charge on pension (1.0) (1.1)

liability

Profit on ordinary activities 9.8 5.7

before taxation

Taxation on profit for the (1.7) (1.2)

year

Profit on ordinary activities 8.1 4.5

after taxation

Dividends : 2018 2017

Ordinary paid per share 1.10p (2017 - 1.10p) 0.6 0.6

Ordinary recommended per 25p share 3.36p (2017 - 2.0 2.0

3.36p)

Earnings per ordinary share 13.8p 7.7p

The final dividend of 3.36p per ordinary share in respect of the year ended 31

March 2018 will be paid on 17 July 2018 to shareholders on the register at 22

June 2018.

DANIEL THWAITES PLC

GROUP BALANCE SHEET

At 31 March 2018 2018 2017

GBP'm GBP'm

___________________________________________ ________ ________

Fixed Assets

Tangible assets 289.5 270.9

Investments 3.1 3.2

__________________________________________ ________ ________

292.6 274.1

Current assets

Stocks 0.6 0.6

Trade and other debtors 12.6 12.1

Cash at bank and in hand 2.8 2.4

__________________________________________ ________ ________

16.0 15.1

Creditors due within one year

Trade and other creditors (14.7) (12.1)

Net current assets 1.3 3.0

_______________________________________ ________ ________

Total assets less current liabilities 293.9 277.1

Creditors due after one year (84.8) (71.8)

_______________________________________ ________ ________

Net assets excluding pension liability 209.1 205.3

________________________________________ ________ ________

Pension liability (34.9) (39.1)

_____________________________________________ ________ ________

Net assets 174.2 166.2

_______________________________________ ________ ________

Capital and reserves

Called up share capital 14.7 14.7

Capital redemption reserve 1.1 1.1

Revaluation reserve 77.5 78.5

Profit and loss account 80.9 71.9

_______________________________________________ ________ ________

Equity shareholders' funds 174.2 166.2

_________________________________________ ________ ________

DANIEL THWAITES PLC

GROUP CASH FLOW STATEMENT

For the year ended 31 March 2018

2018 2017

GBP'm GBP'm

______________________________________________ ________ _________

Cash flow from operating activities 19.5 15.0

Tax paid / refunded (0.1) 0.1

Cash flow from financing activities 10.9 -

Cash flow from investing activities (27.3) (21.0)

Equity dividends paid (2.6) (2.6)

___________________________________________ ________ ________

Increase (decrease) in cash and cash equivalents 0.4 (8.5)

Cash and cash equivalents at beginning of year 2.4 10.9

________________________________________________ ________ _________

Cash and cash equivalents at end of year 2.8 2.4

Loan capital (66.5) (50.0)

__________________________________________________ ________ _________

Net debt (63.7) (47.6)

Reconciliation of net cash flow to movement in net debt

Increase (decrease) in cash 0.4 (8.5)

Cash flow from increase in debt (16.5) (5.0)

__________________________________________________ ________ ________

(16.1) (13.5)

Net debt at beginning of year (47.6) (34.1)

_____________________________________________ ________ ________

Net debt at end of year (63.7) (47.6)

__________________________________________ ________ ________

Notice of Meeting

Notice is hereby given that the Annual General Meeting of the Company will be

held at The North Lakes Hotel and Spa, Ullswater Road, Penrith, Cumbria, CA11

8QT on Thursday 12 July 2018 at 12.00 noon for the transaction of the following

business:

Ordinary Business

To consider, and if thought fit, pass the following resolutions which will be

proposed as ordinary resolutions.

1. To receive and adopt the accounts for the year ended 31 March 2018 and

the reports of the directors and the auditor, to confirm the interim dividend

and to approve and declare a final dividend for the year ended 31 March 2018

2. To re-elect Mr RAJ Bailey as a director

3. To re-elect Mrs AJM Yerburgh as a director

4. To approve and confirm the remuneration of the directors for the year

ended 31 March 2018

5. To reappoint KPMG LLP as auditor and authorise the directors to determine

their remuneration

Special Business

To consider, and if thought fit, pass the following resolutions of which

resolutions 6 and 8 will be proposed as ordinary resolutions and resolution 7

as a special resolution.

6. THAT, for the purposes of section 551 of the Companies Act 2006 (the Act)

the directors of the Company be and are hereby generally and unconditionally

authorised to exercise all powers of the Company to allot equity securities

(within the meaning of section 560 of the Act) up to an amount equal to the

aggregate nominal amount of the authorised but unissued share capital of the

Company provided that this authority shall expire (unless previously renewed,

varied or revoked by the Company in general meeting) at the conclusion of the

next annual general meeting of the Company, save that the Company may before

such expiry make an offer or agreement which would or might require relevant

securities to be allotted after such expiry and the directors of the Company

may allot relevant securities in pursuance of such an offer or agreement as if

the authority conferred hereby had not expired.

This authority is in substitution for any and all authorities previously

conferred upon the directors for the purposes of section 551 of the Act,

without prejudice to any allotments made pursuant to the terms of such

authorities.

7. THAT, subject to the passing of resolution 6 above, the directors of the

Company be and are hereby empowered pursuant to section 570 of the Act to allot

equity securities (within the meaning of section 560 of the Act) pursuant to

the authority conferred by resolution 6 above as if section 561 of the Act did

not apply to any such allotment provided that the power conferred by this

resolution shall be limited to:

i. the allotment of equity securities for cash in connection with an issue or

offer of equity securities (including, without limitation, under a rights

issue, open offer or similar arrangement) to holders of equity securities in

proportion (as nearly as may be practicable) to their respective holdings of

equity securities subject only to such exclusions or other arrangements as the

directors of the Company may consider necessary or expedient to deal with

fractional entitlements or legal or practical problems under the laws of any

territory, or the requirements of any regulatory body or stock exchange in any

territory; and

ii. the allotment (otherwise than pursuant to resolution 7.1) of

equity securities for cash up to an aggregate nominal amount of GBP735,343.

The power conferred by this resolution 7 shall expire (unless previously

renewed, revoked or varied by the Company in general meeting), at such time as

the general authority conferred on the directors of the Company by resolution 6

above expires, except that the Company may at any time before such expiry make

any offer or agreement which would or might require equity securities to be

allotted after such expiry and the directors of the Company may allot equity

securities in pursuance of such an offer or agreement as if the authority

conferred hereby had not expired.

8. To authorise the Company generally and unconditionally to make market

purchases (within the meaning of section 693(4) of the Companies Act 2006) of

ordinary shares of 25 pence each in the capital of the Company provided that:

i. the maximum aggregate number of ordinary shares that may be purchased is

5,882,750. Representing 10% of the issued share capital of the Company;

ii. the minimum price (excluding expenses) which may be paid for

each ordinary share is 25 pence.

iii. the maximum price (excluding expenses) which may be paid for

each ordinary share is an amount equal to 105 per cent of the average of the

middle market quotations for an ordinary share of the Company (as derived from

the ICAP Securities & Derivatives (ISDX) website) for the five business days

immediately preceding the day on which the purchase is made; and

iv. unless previously renewed, varied or revoked, the authority

conferred by this resolution shall expire at the earlier of the conclusion of

the Company's next Annual General Meeting and the date which is six months from

the end of the Company's next financial year save that the Company may, before

the expiry of the authority granted by this resolution, enter into a contract

to purchase ordinary shares which will or may be executed wholly or partly

after the expiry of such authority.

NOTES

Resolution 6 - Authority to allot relevant securities

The Company requires the flexibility to allot shares from time to time. The

directors are limited as to the number of shares they can at any time allot

because allotment authority continues to be required under the Companies Act

2006 (the Act).

Accordingly, resolution 6 would grant this authority (until the next Annual

General Meeting or unless such authority is revoked or renewed prior to such

time) by authorising the directors (pursuant to section 551 of the Act) to

allot relevant securities up to an amount equal to the aggregate nominal amount

of the authorised but unissued share capital of the Company as at 31 March

2018. The directors believe it to be in the interests of the Company for the

Board to be granted this authority, to enable the Board to take advantage of

appropriate opportunities which may arise in the future.

Resolution 7 - Disapplication of statutory pre-emption rights

This resolution seeks to disapply the pre-emption rights provisions of section

561 of the Act in respect of the allotment of equity securities for cash

pursuant to rights issues and other pre-emptive issues, and in respect of other

issues of equity securities for cash up to an aggregate nominal value of

GBP735,343, being an amount equal to approximately 5 per cent of the current

issued share capital of the Company. If given, this power will expire at the

same time as the authority referred to in resolution 5. The directors consider

this power desirable due to the flexibility afforded by it.

Resolution 8 - Authority to make market purchases of shares

Resolution 8 seeks authority for the Company to make market purchases of its

own ordinary shares. If passed, the resolution gives authority for the Company

to purchase up to 5,882,750 of its ordinary shares, representing 10 per cent of

the Company's issued ordinary share capital.

Resolution 8 specifies the minimum and maximum prices which may be paid for any

ordinary shares purchased under this authority. The authority will expire at

the conclusion of the Company's next Annual General Meeting in 2019 or, if

earlier, the date which is six months from the end of the Company's financial

year which commenced on 1 April 2018.

Any shares purchased under this authority will be cancelled. As a member of the

Company entitled to attend and vote at the meeting convened by this notice you

are entitled to appoint another person as your proxy to exercise all or any of

your rights to attend and to speak and vote in your place at the meeting. Your

proxy need not be a member of the Company.

You may appoint more than one proxy in relation to the meeting convened by this

notice provided that each proxy is appointed to exercise the rights attached to

a different share or shares held by you. You may not appoint more than one

proxy to exercise rights attached to any one share.

By order of the Board Mrs S. I. Woodward, A.C.I.S.

Secretary

12 June 2018

END

(END) Dow Jones Newswires

June 12, 2018 04:00 ET (08:00 GMT)

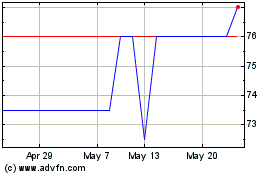

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

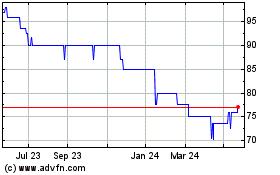

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024