Thwaites (Daniel) Plc Half-year Report

November 13 2018 - 3:00AM

UK Regulatory

TIDMTHW

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2018

CHAIRMAN'S STATEMENT

Results

The company has benefitted from some excellent summer weather and a good

football world cup run in the first half of the year. However, headwinds in the

form of increasing costs and weakening corporate and consumer confidence linked

to the political landscape have presented challenges as the year has

progressed.

Turnover for the period of GBP49.9m (2017: GBP48.0m) represents a 4% increase.

Operating profit of GBP8.0m (2017: GBP7.7m) also represents an increase of 4%.

The expectation that the bank base rate may increase in the short to medium

term has again had a positive impact on the fair value of our interest rate

swaps, leading to a reduction in the provision of GBP0.6m at the half year

(2017: GBP1.4m) and this positive movement is shown in our profit and loss

account.

Net debt at 30 September 2018 was GBP70.2m (2017: GBP60.9m); increased as a

result of the investments that we have made at the Beverley Arms and our new

brewery, offices and stables.

The construction of our new brewery, offices and stables is now finished and we

were very pleased to move there in September. We have awarded the demolition

contract for our old brewery site, which will take just over a year to

complete.

Pubs and Inns

Our tenanted pubs have had an excellent first half to the year - they are

benefitting from sustained investment over a number of years and so were well

positioned to take advantage of the heatwave experienced over the summer and

the football world cup.

Once again our average earnings per pub has risen, by 14%, with like for like

turnover up by 5% and operating profit up by 7%. We have completed 12

investment schemes in the first half of the year, investing GBP1.7m and

continue to make good returns on our investments.

Major refurbishment schemes have been carried out at The Red Lion, Wybunbury,

The Millstone, Darwen, The Holcombe Tap, Ramsbottom and The Queen Anne in Bury.

Our Inns have also had a good summer, with turnover up by 27% and operating

profit up by 25%. They too are benefitting from investment and their premium

positioning and are in fairly robust health. The major investments made last

year at The Royal, Heysham; The Crown, Pooley Bridge; The Lister Barn, Malham;

The Fleece, Cirencester and The Royal Oak, Keswick have all contributed to this

strong performance.

We opened The Beverley Arms in July, later than we would have hoped, but just

in time to capture the latter part of the summer trading period. The property

has 38 bedrooms, a bar and restaurant area, as well as a large outside trading

space.

I am pleased to report strong trading since opening, ahead of expectations and

to positive local reviews.

We have sold five poor quality pubs for GBP1.6m, generating a profit of

GBP0.2m.

Hotels & Spas

In the hotels & spas sales for the first half of the year have grown by 1%,

although on a like for like basis they have declined by 2% due to a softening

in corporate demand.

We have had to absorb some significant increases in government imposed costs;

continued increases to the living wage, auto enrolment pension costs, business

rates and renewable energy levies - these are outside our control and we have

been unable to grow sales at a sufficient rate to absorb them. Inflation caused

by the decline in the value of sterling has led to food and utility increases.

Consequently, operating profits have decreased by 12% year on year.

We have completed the reorganisation of our hotel management structure in the

period to make efficiency gains and re-focus our operations teams. This will

significantly shorten the span of control in our hotel teams which we believe

will enhance our sales function and more importantly enrich the customer

experience.

We have continued our ongoing refurbishment programme and have spent GBP2.8m in

the half year. The current refurbishment programme in our hotels is now

largely complete.

Brand Review

During the period we undertook a review of the marketing of our inns and

hotels, particularly to review how we encourage people to re-visit us across a

number of different property types.

As a result we have relaunched our properties under a new collective, which we

have called The House of Daniel Thwaites. The purpose of this was not to build

another hotel collection in a crowded market but to celebrate our family of

highly individual, characterful properties, in a way that preserves their

identity.

Our ethos is to offer guests in our managed properties rich experiences and

build on our reputation for high quality places to eat, drink and relax where

people can feel genuinely at home.

An important part of this transition was to build new websites for each of our

managed properties, which were completed and launched in July. We are pleased

with the results and believe that it will allow us to market our properties in

a new and different manner, helping us to appeal to a niche but discerning

audience.

Funny Girls

When we sold our Free Trade business to Marston's in 2015 we retained our

investment in one large free trade account in Blackpool. Over a number of

years, we had advanced loans to the business, secured over its freehold assets.

Funny Girls comprises a popular cabaret venue, a nightclub and several bars

based in the historic art deco Odeon cinema in the heart of the town; it is an

iconic part of Blackpool's nightlife.

In September administrators were appointed to the business, which is now being

marketed for sale. Since administration we have been operating the business

under license, which may or may not become a longer term arrangement depending

on the outcome of the sale process.

Whilst it is our preference that a new owner be found to take the business

forward, equally we are ready do so under our own stewardship should that be

required. We expect that the position will be clearer by the end of the

financial year.

Change of Auditor

The Board has conducted a review of the Group's audit arrangements and,

following a tendering process, has decided to appoint BDO LLP to replace KPMG

LLP for the financial year ending 31 March 2019.

Earnings per Share

The basic earnings per share for the period was 8.5p per share (2017: 9.0p).

This movement is largely due to the year on year movement in the fair value of

our interest rate swaps, which whilst again positive this year, is less so than

last.

Dividend

The Board recommends an interim dividend of 1.10p (2017: 1.10p) to be paid on 3

January 2019 to shareholders on the register on 7 December 2018.

Board Changes

John Barnes has decided to step down as a non-executive director on 31 December

2018. I would like to thank John for his valuable contribution over the past 4

years. His experience in many different hospitality and restaurant businesses

has been invaluable to us as we have grown our managed operations.

I am delighted to confirm that he will be replaced by Andrew Stothert who will

join us from 1 January 2019. Andrew is the Chief Executive of Brand Vista, and

one of its founding partners.

Andrew has been an integral part in building Brand Vista into a highly regarded

consumer brand consultancy and is passionate about helping his clients build

genuinely differentiated brands that deliver a customer experience that becomes

"irresistible". I am sure that his disciplined approach to what matters to the

customer will help us remain focused and encourage us to evolve in a fast

moving market.

After 18 years as Chairman, I also intend to step down from that role at the

end of the current financial year. I will be replaced by Rick Bailey, our Chief

Executive, who, with the support of the rest of the board and our family

shareholders, will become Executive Chairman.

Summary

The Company is in good shape following a prolonged period of investment and our

financial results have moved forward in a challenging market. Our pubs, inns

and hotels are now in a strong position to weather any further changes in the

market.

We have opened an exciting new property in Beverley, together with our new

small and artisan brewery. We have a differentiated approach to the beer and

pub market that is shaped around our ability to offer our own award winning

beers for sale exclusively in our own properties.

We have delivered on our goal to move from Blackburn town centre after over 200

years to our new home at Mellor Brook. This is a momentous change that should

not be understated in our ambition to evolve our business for the future

leaving behind our industrial past, whilst not failing to acknowledge its'

place in our heritage.

These past six months have cemented the delivery of a longer term plan and

there is much to celebrate. However, there is no doubt that the second half of

this year will be a challenge, particularly in our hotels business, which is

having to absorb cost increases that we are struggling to recoup through sales

growth.

Whilst I firmly believe that our business is in a strong position to move

forward into the future, we face challenges to our trade, which are almost

exclusively politically induced. For the time being our focus must move to

making the most of our assets and tightening our operational performance. We

expect continued volatility and uncertainty in the negotiations around Brexit,

so we maintain a cautious outlook and will be watchful.

Mrs A J M Yerburgh

Chairman

13 November 2018

Profit and Loss Account for the six months ended 30 September 2018

Unaudited Unaudited Audited

6 months 6 months 12 months ended

ended ended 31 March

30 September 2018 30 September 2018

GBP'm 2017 GBP'm

GBP'm

Turnover 49.9 48.0 92.2

Operating profit 8.0 7.7 12.9

Property disposals 0.2 - 0.1

______ ______ ______

Profit before interest 8.2 7.7 13.0

Net interest payable (1.9) (1.8) (3.5)

Gain on interest rate swaps measured at fair

value 0.6 1.4 1.3

Finance charge on pension liability (0.5) (0.5) (1.0)

______ ______ ______

Profit on ordinary activities 6.4 6.8 9.8

before taxation

Taxation (Note 2) (1.4) (1.5) (1.7)

______ ______ ______

Profit on ordinary activities after taxation 5.0 5.3 8.1

______ ______ ______

Earnings per share 8.5p 9.0p 13.8p

Balance Sheet as at 30 September 2018

Unaudited Unaudited Audited

30 September 30 September 31 March

2018 2017 2018

GBP'm GBP'm GBP'm

Fixed assets

Tangible assets 297.2 287.7 289.5

Investments 3.2 3.0 3.1

______ ______ ______

300.4 290.7 292.6

Current assets

Stocks 0.6 0.6 0.6

Trade and other debtors 12.8 12.6 12.6

Cash at bank and in hand 2.3 2.6 2.8

______ ______ ______

15.7 15.8 16.0

Creditors due within one year

Trade and other creditors (15.5) (15.6) (14.7)

______ ______ ______

Net current assets 0.2 0.2 1.3

______ ______ ______

Total assets less current liabilities 300.6 290.9 293.9

Creditors due after one year (89.2) (82.8) (84.8)

______ ______ ______

Net assets excluding pension liability 211.4 208.1 209.1

Pension liability (34.2) (38.5) (34.9)

______ ______ ______

Net assets including pension liability 177.2 169.6 174.2

______ ______ ______

Capital and reserves

Called up share capital 14.7 14.7 14.7

Capital redemption reserve 1.1 1.1 1.1

Revaluation reserve 77.3 78.3 77.5

Profit and loss account 84.1 75.5 80.9

______ ______ ______

Equity shareholders' funds 177.2 169.6 174.2

______ ______ ______

NOTES:-

1. Basis of preparation

The interim accounts, which have not been audited, have been prepared on the

basis of the accounting policies set out in the Annual Report and Accounts for

the year ended 31 March 2018.

2. Taxation

The taxation charge is based on the estimated tax rate for the year.

END

(END) Dow Jones Newswires

November 13, 2018 04:00 ET (09:00 GMT)

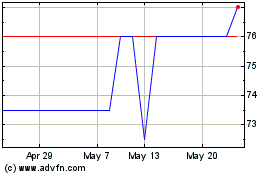

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

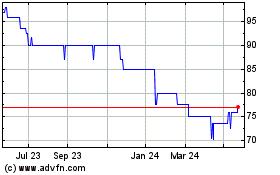

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024