TIDMTHW

CHAIRMAN'S STATEMENT

The Company has had a good year and sales have increased in all areas. We have

come to the end of several long-term projects and completed a three-year period

of investment. As a result of this our businesses are in extremely good order,

and they are in a strong position to continue to grow their sales.

Our pubs and inns both posted strong performance and growth in the year, partly

as a result of a long period of hot summer weather and the Football World Cup.

However, the hotels and spas faced more of a challenge, experiencing

significant cost headwinds, as well as disruption from Brexit, a weakening in

corporate demand and room rate pressure in an increasingly competitive hotel

market. Overall, the growth in one area has balanced the challenges in the

other.

The challenges we face from increasing costs, particularly the national living

wage, auto enrolment and fixed charge levies on green energy have led us to

look at ways to increase productivity. We have taken various steps to deal with

these including restructuring the teams in our hotels in the first half of the

year. Our objective is to improve performance by focusing on increasing sales

and the quality of service delivery in our front of house teams. Whilst there

was inevitably some disruption as a result of this, we are pleased with the new

structure which is now bedded in and starting to deliver the benefits that we

were looking for.

Our strategy of investing in our core pub estate, inns and hotels, whilst

continuing to sell poorer quality properties to recycle capital into higher

returning and more sustainable assets is a successful one, which has

significantly improved the quality of our asset base over the past few years,

and allowed the business to grow.

Financial Results

Turnover for the year to 31 March 2019 grew by 5.0% to GBP96.9m (2018:

GBP92.2m). The primary driver of growth was in our inns, which are experiencing

strong like for like growth as well as the benefit of investment.

Underlying operating profit (before GMP equalisation) is level with last year

at GBP12.9m (2018: GBP12.9m). The performance of the hotels has suffered year

on year, offsetting gains elsewhere.

Profit before tax was GBP4.5m (2018: GBP9.8m) and suffered from an adverse mark

to market valuation on our swap contracts of GBP2.5m and one-off pension costs

of GBP1.2m associated with legislation to equalise historic pension benefits.

When these non-operating items are excluded, underlying profit before tax is

GBP8.2m (2018: GBP8.5m). Since the year end the swap costs have continued to

be volatile, reflecting the current political and economic uncertainty.

Cash generation has continued to be strong, with EBITDA increasing to GBP20.5m

(2018: GBP20.2m). With a capital investment programme of GBP22.5m (2018:

GBP30.8m), net debt increased in the year from GBP63.7m at 31 March 2018 to

GBP69.7m at 31 March 2019.

Acquisitions, Developments and Disposals

We have continued to invest in developing our properties and have completed

several large projects, including the GBP6.5m refurbishment of the Beverley

Arms and the completion of our new brewery and offices. In addition, we

substantially completed the accelerated programme of refurbishment in our

hotels as well as the usual number of schemes in the tenanted estate. Overall

the investments that we have made in the year continue to exceed our hurdle

rates and are performing well.

We acquired the Funny Girls business from the Administrators but did not

acquire any new properties in the year and will only do so where outstanding

opportunities present themselves. We continued to divest of pubs that no longer

suit our requirements with nine properties sold in the year.

Dividend

An interim dividend of 1.10p (2018: 1.10p) was paid in January 2019 and the

Board recommends a final dividend of 3.36p (2018: 3.36p). The Board will keep

the level of dividend under review, and assess the level of future dividends in

light of company performance.

Board

At the end of the financial year, Ann Yerburgh stepped down as Chairman. During

her 19 years in this role she has overseen many changes and helped to steer the

Company through some very challenging times, including the smoking ban and the

2009 financial crisis. She has encouraged and supported the move away from

wholesaling beer towards leisure and hospitality, including the building up of

our inns and hotels. I would like to thank her for the unwavering support that

she has given me in my role as Chief Executive and I am delighted that she will

remain on the board as a non-executive director where we will continue to

benefit from her experience and grounded perspective.

John Barnes retired as a non-executive at the end of December. John's

contribution over four years has been hugely valuable and we thank him for his

support.

Andrew Stothert joined the Board as a non-executive director in January. Andrew

is the founder of Brand Vista, an international brand consultancy based in

Manchester. His experience in helping to build genuinely differentiated brands,

that deliver through customer experience will be invaluable to us.

Following the appointment of Nick Mackenzie as Chief Executive Officer of

Greene King, he stood down as a non-executive director at the end of the

financial year.

I am delighted that Mark Fisher agreed to join us as a non-executive director

from 1 June 2019. Mark is currently Chief Development Officer of Merlin

Entertainments plc, where he has been a senior member of the management team

for over 18 years, throughout a period of impressive growth. Originally Group

Marketing Director, he has also held the Managing Director role in all of

Merlin's Operating Divisions. I look forward to working with Mark and I am

excited by the new perspective that he will bring.

People

There is no doubt that the steps that we have taken over the last few years to

provide development pathways within the business have helped us to attract and

retain great team members. This has been recognised once again by a number of

our businesses being recognised in the Sunday Times Best Companies to Work For.

We are a strong business with a long track record and excellent reputation as

an employer of choice in our local markets. However, the current nature of the

labour market means that we cannot afford to be complacent. Our family values

are an important part of our proposition, but offering an exciting career with

the prospect of development and progression is even more important and we are

well placed to do this.

I would like to thank all our staff, customers, suppliers and shareholders for

their support over the past year and look forward to the year ahead.

Outlook

There is much uncertainty in the country which stems from a lack of political

leadership, cohesion and direction and this has unsurprisingly seeped into both

business and consumer confidence. This lack of confidence means that for us,

now is a time to be cautious. After some years of significant capital

investment this next year is a time for consolidation and for us to focus on

fine tuning our core business. We have a reduced capital investment programme,

but are ever mindful to maintain the quality of our properties.

In the current environment the trading patterns of our business seem to have

become more seasonal, event and weather driven. The excellent weather over

Easter and in the early part of our new financial year means that we have got

off to a good start, which is encouraging.

The business is in good health with talented and motivated teams, and we are

well positioned to grow and make further progress in the year to come.

R A J Bailey

Chairman

11 June 2019

OPERATING REVIEW

Overview

The issues that have overshadowed the last few years persist, with the common

theme being increasing costs in most areas. This is most acute in labour and

utilities and we continue to make sure that where possible these are as

flexible as possible, although there is a fixed element to our cost base. The

compounding effect of increases to the National Living Wage and pension costs

are having a major structural change on hospitality businesses, and with

limited scope to increase prices we have to find new ways to enhance the

overall level of sales through increasing value, developing our customer

proposition and harnessing technology.

The first half of the year was encouraging, with an extended period of hot

sunny weather helping the pubs and the inns to get off to an excellent start.

The pattern of trade seems to have become more variable and unpredictable than

ever with consumers and corporate demand changing on what would appear to be

small variations in sentiment or weather. In particular, October and November

were extremely weak months with lower levels of activity than the year before.

Christmas was a strong period, but overall some of the gains made in the first

half of the year were eroded in the second half of the year.

Sales have increased by 5%, and on a like for like basis, excluding

acquisitions, they increased by 4%. Continued refurbishments have been an

important factor in supporting this growth. Despite pressure on food and labour

margins, EBITDA has increased by 1.5% to GBP20.5m (2018: GBP20.2m), whilst

group operating profit, before GMP equalisation (a one-off charge relating to

historic pension liabilities), has remained level at GBP12.9m (2018: GBP12.9m).

Early in the year we relaunched our websites, with the objective of bringing

them up to date and also encouraging people to book directly with us rather

than through online agents. This has been partially successful, and we have

seen the rate of increase in our online commissions slow year on year. This

year we will be looking at our loyalty programmes which have not been refreshed

for some time to address this same area from another angle.

In the summer we launched 'The House of Daniel Thwaites' as a way of

collectively marketing our hotels and inns. For the last few years we have been

working on the individuality and character of our properties and the House of

Daniel Thwaites builds on this. We do not want our properties to be another

corporate collection, more a collective, a family of different properties that

share common service levels, and represent different places where our guests

can feel comfortable and at home. We will continue to develop this theme over

the coming year.

In September, we took on the operation of Funny Girls in Blackpool under

licence from the administrator. The business includes a cabaret show venue, a

nightclub and two pubs. We have been involved with Funny Girls for over twenty

years as it was historically a free trade customer. When we sold our Beer Co to

Marston's in 2015, we retained this account and its associated loan. The

business entered administration in September and was marketed for sale. No

buyer was found, and so we assumed ownership of it in January in settlement of

our outstanding loan. The business has made a loss in the period, as we have

worked to resolve some of the issues that resulted in its financial

difficulties. We have made good progress in stabilising the operation and have

a plan in place to put the business on a firmer footing for the future. We

expect that it will be profitable in the financial year to 31 March 2020.

Our core strategy remains to focus on our pubs, inns and hotels and we have

plans to continue to invest in them to secure our future growth.

Pubs and Inns

Pubs

Our freehold estate of tenanted pubs numbers approximately 240 properties, and

we have continued to dispose of pubs that no longer suit our requirements. Our

pub estate encompasses community locals to destination food led pubs in both

rural and town centre locations, ranging geographically from Cumbria to the

Midlands, and from North Wales to Yorkshire.

We have a well-established approach to our tenanted pub business, focused on

investing alongside proven operators to expand and improve the premises with a

focus on establishing good quality food offerings and where there is demand,

the development and refurbishment of bedrooms. Our strategy has been focused on

creating an estate of high quality, sustainable, growth businesses with

multiple income streams.

Our tenanted pubs got off to a very strong start of the year aided by both good

weather and the Football World Cup, where England performed strongly and

reached the latter rounds of the competition - which boosted drinks sales. As a

result, by the half year we were well ahead of last year. Through the second

half of the year there were ups and downs in the trading performance,

particularly through October and November which were weaker, however Christmas

was strong and as a result we were able to hold on to the gains made in the

first half of the year. We disposed of nine pubs the year, despite which

operating profit increased by 6% year on year, and average EBITDA per pub

increased by 9%.

Once more we have participated in the annual tenanted pub company survey, which

provides an industry benchmark against our peers. This year the survey was

carried out by a new company, who have produced what is now known as The

Licensee Index. This new survey gives more detailed guidance on ways that we

can improve our service and delivery. We were pleased once again to receive a

high placing in this benchmarking exercise against our peers, improving our

ranking from third to second out of 14 participants.

The costs pressure that we are experiencing first hand in our own managed

business are also being felt by our tenanted pubs. As a result, during the year

we saw an increase in tenant churn which meant that at the year-end we had 19

pubs (8% of the estate) which were looking for new tenants compared to 14 pubs

last year.

During the year we completed 18 development projects at a cost of GBP2.3m, and

we continued to make returns ahead of our hurdle rate of 20%. Major projects in

the year have been completed at the Millstone in Darwen, the Queen Anne in

Bury, the Britannia in Oswaldtwistle and the Holcombe Tap in Ramsbottom.

We did not acquire any tenanted pubs in the year, however if the opportunity

arises we would be interested in adding new tenanted pubs to our estate.

Brewery

Our new craft brewery launched in July last year. After a very short settling

in period running the new equipment, we have been very happy with the quality

of the beers that it has produced and have received excellent feedback from our

customers.

We were delighted that our cask ales were singled out in the high-profile

International Brewing Awards, in Burton upon Trent where we received a gold

medal.

The costs that were associated with our old site in Blackburn have now largely

fallen away and the demolition of the old brewery is currently under way.

Inns

We own and manage a growing portfolio of inns and continue to seek high quality

properties in outstanding locations to develop this part of our business. Our

Inns have a busy bar at the hub, a home cooked food offering and high quality,

comfortable accommodation - they focus on providing outstanding hospitality and

offer an attractive and more personal alternative to the mid-market hotel

chains.

This segment of the market has seen increased competition with a number of new

operators expanding their presence over the past few years. However, the market

has proven to be strong, benefiting from the same factors that drove the

performance of our pubs. Sales in the current year increased to GBP19.3m (2018:

GBP16.1m) an increase of 20%, operating profits have increased by 35%.

The landmark event of the year for the inns was the launch of the Beverley

Arms, a project that has been underway since we acquired it in 2016. After a

complicated build programme, we launched the new Beverley Arms in July 2018. We

are delighted with the results, and the property has exceeded our expectations.

Customer feedback has been extremely positive and we were pleased that the

property has won a number of awards, including being highlighted in the Sunday

Times Cool Hotel Guide, winning the RICS 2019 Hospitality and Leisure Award and

winning the East Riding Chairman's Award for Heritage.

Elsewhere we undertook a major refurbishment of the bedrooms at the Fleece,

Cirencester and are pleased with the increases in room rate that we have been

able to achieve following their launch. The Millstone in Mellor underwent a

bedroom refurbishment after Christmas.

The performance of the inns is encouraging and we continue to look for new

acquisition opportunities where we believe we can add value.

Hotels & Spas

We own and operate ten hotels which are spread across England. Our hotels are

positioned towards the premium end of the market and most have leisure and spa

facilities. They are all different, and we wish to develop them to promote the

individual character of each hotel in its local area, supported by a great food

and drink offering with local nuances. Our vision, similar to our Inns, is to

create a collection of interesting, characterful contemporary hotels, that are

the best in their local area.

The provincial hotel market has faced challenges over the past year and our

hotels were no exception, and in two locations in particular, Bristol and

Fareham our properties faced particularly difficult markets. Overall, the total

provincial hotel market increased in value by 1.5%, with our hotels increasing

their sales by 1.4%. In conjunction with this the hotels have seen increases to

their costs, in particular wages and utilities, which grew by over 5%.

At the start of the year we restructured our hotel teams with the objective of

mitigating some of these cost increases and improving the focus on service and

sales, particularly to our front of house teams. It took us longer than we

would have hoped to fill some of the new roles that we created and this

inevitably led to some disruption. Now that things have settled down, we are

pleased with the new structure.

We continued the accelerated programme of refurbishment in the hotels, which

has largely now come to an end. The hotels are in materially better condition

than they were a few years ago, although these refurbishments have increased

the depreciation charges. In the current year we will see less disruption as we

have very few schemes planned. We are currently finalising our development

plans for Langdale Chase, which we acquired in 2017, and subject to planning

permission the work will start in early 2020.

In March we implemented a new Customer Relationship Management system, which

will allow us to talk directly with our customers in a more informed and

targeted manner. We hope that this will improve cross selling between our

different properties and encourage more customers to book direct.

The performance of the hotels has been disappointing with a combination of

increased costs and various factors contributing to disruption, this together

with increasing competition in Bristol and Southampton, meant that operating

profits dropped by 20%. In response to this and the other challenges we see in

the market place we are looking at every area of the business to find ways to

streamline costs and grow sales.

Summary and future developments

The pubs and the inns each had a strong year which was offset by the

performance of the hotels and spas. Despite the issues that we face, we are not

prepared to compromise the quality of offering that we provide our guests. The

government's wage agenda is forcing us to find different ways of operating, as

top line sales growth in the current economic and political environment is

difficult to pin down.

The changes and disruption that we have faced, particularly in the hotels this

year has been painful, and in the emerging political landscape may not be

behind us. Above inflation increases to our cost base means we will continue to

seek innovative ways to do business, through developing our operational

processes and harnessing technology. The work that we have undertaken with our

teams this last year and the training programmes that we have built over the

past few years mean that we are in a strong position to attract and retain high

quality team members.

We are very aware of the issues that face us and they have our full attention.

FINANCIAL REVIEW

Results

Turnover for the year ended 31 March 2019 increased by 5% to GBP96.9m (2018:

GBP92.2m). Operating profit, before the highlighted item (GMP adjustment of

GBP1.2m), is level with last year at GBP12.9m (2018: GBP12.9m).

The measurement of the interest rate swaps at fair value resulted in a charge

of GBP2.5m (2018: a profit of GBP1.3m).

Profit before taxation for the year was GBP4.5m (2018: GBP9.8m).

Business Review

The key issues facing the Group are covered in the Chairman's Statement and

Strategic Report. The KPIs used by the Group to monitor its overall financial

position can be summarised as follows:

2019 2018

Group GBP'm GBP'm

Turnover 96.9 92.2

EBITDA 20.5 20.2

Depreciation 7.6 7.3

Operating profit (before highlighted item) 12.9 12.9

Profit before tax 4.5 9.8

Net debt 69.7 63.7

Earnings per share (pence) 5.9 13.8

Pubs and Inns

GBP'm GBP'm

Turnover 52.7 48.6

EBITDA 17.9 16.5

Depreciation 3.6 3.8

Operating profit (before Group central charges) 14.3 12.7

Average number

Tenanted 238 255

Managed 13 11

Hotels & Spas

GBP'm GBP'm

Turnover 44.2 43.6

EBITDA 9.8 11.1

Depreciation 3.5 3.2

Operating profit (before Group central charges) 6.3 7.9

Average number

Hotels 8 8

Lodges 2 2

The principal non-financial indicators monitored by management are:

Pubs and Inns

Utility consumption, health and safety incidents, beer volumes and tenant

recruitment.

Hotels

Room occupancy rates, customer complaints, health and safety incidents, spa

memberships and wedding and event numbers.

GMP adjustment for past service

This highlighted item relates to the cost of adjustments to guaranteed minimum

pension (GMP) requirements following a 2018 court judgement in respect of a

Lloyds Bank pension scheme. The Daniel Thwaites 1959 Scheme was contracted out

of the State Earnings Related Pension Scheme (SERPS) and as a result granted

its members a GMP benefit in compensation. The Lloyds Bank case established

that schemes should equalise GMP such that people with the same salary and

length of service will receive the same benefit whether they are male or

female. Whilst the detailed calculations have not yet been performed, we have

put an estimated cost, provided by our actuary Barnett Waddingham, of GBP1.2m

into the accounts. This is treated as a cost in the current year as it is seen

as an enhancement to a past entitlement which has not been recognised

previously.

Interest rate swaps measured at fair value

The Group has interest rate swaps for GBP55m which are recognised as a

financial liability. During the year ended 31 March 2019 there was significant

volatility in future interest rate expectations due to the political and

economic uncertainty arising from Brexit, as a result the movement in the fair

value of the interest rate swaps was a charge to the profit and loss account of

GBP2.5m (2018: a credit of GBP1.3m).

Interest payable

Net interest payable was GBP3.9m (2018: GBP3.5m) as loan capital increased from

GBP66.5m at the start of the year to GBP73.5m at the end of the year.

Taxation

The tax charge on profit for the year was GBP1.0m, an effective rate of 22.2%.

Earnings per share

The earnings per share was 5.9p (2018: 13.8p).

Dividends

An interim dividend of 1.10p has been paid and the Board recommends a final

dividend of 3.36p, which will make a total of 4.46p for 2019 (2018: 4.46p).

Cash flow and financing

The Group's net borrowing increased by GBP6.0m, from GBP63.7m at 31 March 2018

to GBP69.7m at 31 March 2019 due to capital expenditure.

The Group made deficit contributions to the defined benefit pension schemes of

GBP1.8m (2018: GBP2.2m). Whilst these schemes were closed in August 2009, the

Group is committed to funding the deficit on the scheme which was GBP24.8m,

before tax, at 31 March 2019, a decrease of GBP10.1m from GBP34.9m at 31 March

2018.

The Group has GBP45m of long-term debt, GBP28.5m of bank loans and cash

balances of GBP3.8m at 31 March 2019. The Group has three-year bank facilities

of GBP30m which are due to be renewed at the end of 2019, which is less than 12

months from the date of the balance sheet. Consequently, our bank loans are

shown within current liabilities resulting in a net current liabilities

position on the balance sheet at 31 March 2019.

Property

During the year we sold nine pubs and four ancillary properties for a total of

GBP4.9m generating a profit against book value, after disposal costs, of

GBP0.1m.

In line with our accounting policy, 20% of our properties were subject to a

formal revaluation, and additionally an impairment review was carried out on

the rest of our property estate. This resulted in a reduction in the total

value of our property portfolio of GBP3.0m, which was deducted from the

revaluation reserve.

Treasury policy and financial risk management

Treasury policies are subject to Board approval. All borrowings are in sterling

and comprise a mixture of fixed interest loans and facilities carrying LIBOR

related floating rates. The Group has interest rate swaps for GBP55m where it

is committed to pay the difference between LIBOR and fixed interest rates. At

31 March 2019 a financial liability of GBP18.9m has been recognised in respect

of these interest rate swap contracts.

Kevin Wood

Finance Director

11 June 2019

EXTRACT FROM AUDITED FULL FINANCIAL STATEMENTS FOR THE YEARED

31 MARCH 2019

GROUP PROFIT AND LOSS ACCOUNT

2019 2018

GBP'm GBP'm

Total Total

Turnover 96.9 92.2

Cost of sales (72.8) (68.1)

Gross profit 24.1 24.1

Distribution costs (3.7) (3.7)

Administrative expenses (7.5) (7.5)

Operating profit before 12.9 12.9

highlighted item

Highlighted item - GMP (1.2) -

adjustment for past service

Operating profit 11.7 12.9

Property disposals 0.1 0.1

Operating profit before 11.8 13.0

interest

Net interest payable (3.9) (3.5)

(Loss) profit on interest rate (2.5) 1.3

swaps measured at fair value

Finance charge on pension (0.9) (1.0)

liability

Profit on ordinary activities 4.5 9.8

before taxation

Taxation on profit for the (1.0) (1.7)

year

Profit on ordinary activities 3.5 8.1

after taxation

Dividends : 2019 2018

Ordinary paid per share 1.10p (2018 - 1.10p) 0.6 0.6

Ordinary recommended per 25p share 3.36p (2018 - 2.0 2.0

3.36p)

Earnings per ordinary share 5.9p 13.8p

The final dividend of 3.36p per ordinary share in respect of the year ended 31

March 2019 will be paid on 23 July 2019 to shareholders on the register at 28

June 2019.

DANIEL THWAITES PLC

GROUP BALANCE SHEET

At 31 March 2019 2019 2018

GBP'm GBP'm

______________________________________________________________________ _______ _______

Fixed Assets

Tangible assets 298.0 289.5

Investments 0.8 3.1

______________________________________________________________________ _______ _______

298.8 292.6

Current assets

Stocks 0.7 0.6

Trade and other debtors 9.8 12.6

Cash at bank and in hand 3.8 2.8

______________________________________________________________________ _______ _______

Creditors due within one year 14.3 16.0

Trade and other creditors (15.2) (14.7)

Loan capital (28.5) -

______________________________________________________________________ _______ _______

(43.7) (14.7)

Net current (liabilities) assets (29.4) 1.3

______________________________________________________________________ _______ _______

Total assets less current liabilities 269.4 293.9

Creditors due after one year (63.9) (84.8)

______________________________________________________________________ ______ _______

Net assets excluding pension liability 205.5 209.1

______________________________________________________________________ _______ _______

Pension liability (24.8) (34.9)

______________________________________________________________________ _______ _______

Net assets 180.7 174.2

______________________________________________________________________ _______ _______

Capital and reserves

Called up share capital 14.7 14.7

Capital redemption reserve 1.1 1.1

Revaluation reserve 74.1 77.5

Profit and loss account 90.8 80.9

______________________________________________________________________ _______ _______

Equity shareholders' funds 180.7 174.2

______________________________________________________________________ ________ ________

DANIEL THWAITES PLC

GROUP CASH FLOW STATEMENT

For the year ended 31 March 2019

2019 2018

GBP'm GBP'm

__________________________________________________________________________ _______ _______

Cash flow from operating activities 19.2 19.5

Tax paid (2.1) (0.1)

Cash flow from financing activities 1.2 10.9

Cash flow from investing activities (14.7) (27.3)

Equity dividends paid (2.6) (2.6)

__________________________________________________________________________ _______ _______

Increase in cash and cash equivalents 1.0 0.4

Cash and cash equivalents at beginning of year 2.8 2.4

__________________________________________________________________________ _______ _______

Cash and cash equivalents at end of year 3.8 2.8

Loan capital (73.5) (66.5)

__________________________________________________________________________ _______ _______

Net debt (69.7) (63.7)

Reconciliation of net cash flow to movement in net debt

Increase in cash 1.0 0.4

Cash flow from increase in debt (7.0) (16.5)

___________________________________________________________________________ _______ _______

(6.0) (16.1)

Net debt at beginning of year (63.7) (47.6)

___________________________________________________________________________ _______ _______

Net debt at end of year (69.7) (63.7)

__________________________________________________________________ ________ ________

Notice of Meeting

Notice is hereby given that the Annual General Meeting of the Company will be

held at Daniel Thwaites, Myerscough Road, Mellor Brook, Blackburn, Lancashire,

BB2 7LB on Thursday 18 July 2019 at 12.00 noon for the transaction of the

following business:

Ordinary Business

To consider, and if thought fit, pass the following resolutions which will be

proposed as ordinary resolutions.

1. To receive and adopt the accounts for the year ended 31 March 2019 and

the reports of the directors and the auditor, and to approve and declare a

final dividend for the year ended 31 March 2019

2. To re-elect Kevin Wood as a director

3. To re-elect Andrew Stothert as a director

4. To re-elect Mark Fisher as a director

5. To approve and confirm the remuneration of the directors for the year

ended 31 March 2019

6. To reappoint BDO LLP as auditor and authorise the directors to determine

their remuneration

Special Business

To consider, and if thought fit, pass the following resolutions of which

resolutions 7 and 9 will be proposed as ordinary resolutions and resolution 8

as a special resolution.

7. THAT, for the purposes of section 551 of the Companies Act 2006 (the Act)

the directors of the Company be and are hereby generally and unconditionally

authorised to exercise all powers of the Company to allot equity securities

(within the meaning of section 560 of the Act) up to an amount equal to the

aggregate nominal amount of the authorised but unissued share capital of the

Company provided that this authority shall expire (unless previously renewed,

varied or revoked by the Company in general meeting) at the conclusion of the

next annual general meeting of the Company, save that the Company may before

such expiry make an offer or agreement which would or might require relevant

securities to be allotted after such expiry and the directors of the Company

may allot relevant securities in pursuance of such an offer or agreement as if

the authority conferred hereby had not expired.

This authority is in substitution for any and all authorities previously

conferred upon the directors for the purposes of section 551 of the Act,

without prejudice to any allotments made pursuant to the terms of such

authorities.

8. THAT, subject to the passing of resolution 7 above, the directors of the

Company be and are hereby empowered pursuant to section 570 of the Act to allot

equity securities (within the meaning of section 560 of the Act) pursuant to

the authority conferred by resolution 7 above as if section 561 of the Act did

not apply to any such allotment provided that the power conferred by this

resolution shall be limited to:

i. the allotment of equity securities for cash in connection with an

issue or offer of equity securities (including, without limitation, under a

rights issue, open offer or similar arrangement) to holders of equity

securities in proportion (as nearly as may be practicable) to their respective

holdings of equity securities subject only to such exclusions or other

arrangements as the directors of the Company may consider necessary or

expedient to deal with fractional entitlements or legal or practical problems

under the laws of any territory, or the requirements of any regulatory body or

stock exchange in any territory; and

ii. the allotment (otherwise than pursuant to resolution

8.1) of equity securities for cash up to an aggregate nominal amount of

GBP735,343.

The power conferred by this resolution 8 shall expire (unless previously

renewed, revoked or varied by the Company in general meeting), at such time as

the general authority conferred on the directors of the Company by resolution 7

above expires, except that the Company may at any time before such expiry make

any offer or agreement which would or might require equity securities to be

allotted after such expiry and the directors of the Company may allot equity

securities in pursuance of such an offer or agreement as if the authority

conferred hereby had not expired.

9. To authorise the Company generally and unconditionally to make market

purchases (within the meaning of section 693(4) of the Companies Act 2006) of

ordinary shares of 25 pence each in the capital of the Company provided that:

i. the maximum aggregate number of ordinary shares that may be

purchased is 5,882,750. Representing 10% of the issued share capital of the

Company;

ii. the minimum price (excluding expenses) which may be

paid for each ordinary share is 25 pence.

iii. the maximum price (excluding expenses) which may be

paid for each ordinary share is an amount equal to 105 per cent of the average

of the middle market quotations for an ordinary share of the Company (as

derived from the NEX Exchange website) for the five business days immediately

preceding the day on which the purchase is made; and

iv. unless previously renewed, varied or revoked, the

authority conferred by this resolution shall expire at the earlier of the

conclusion of the Company's next Annual General Meeting and the date which is

six months from the end of the Company's next financial year save that the

Company may, before the expiry of the authority granted by this resolution,

enter into a contract to purchase ordinary shares which will or may be executed

wholly or partly after the expiry of such authority.

NOTES

Resolution 7 - Authority to allot relevant securities

The Company requires the flexibility to allot shares from time to time. The

directors are limited as to the number of shares they can at any time allot

because allotment authority continues to be required under the Companies Act

2006 (the Act).

Accordingly, resolution 7 would grant this authority (until the next Annual

General Meeting or unless such authority is revoked or renewed prior to such

time) by authorising the directors (pursuant to section 551 of the Act) to

allot relevant securities up to an amount equal to the aggregate nominal amount

of the authorised but unissued share capital of the Company as at 31 March

2019. The directors believe it to be in the interests of the Company for the

Board to be granted this authority, to enable the Board to take advantage of

appropriate opportunities which may arise in the future.

Resolution 8 - Disapplication of statutory pre-emption rights

This resolution seeks to disapply the pre-emption rights provisions of section

561 of the Act in respect of the allotment of equity securities for cash

pursuant to rights issues and other pre-emptive issues, and in respect of other

issues of equity securities for cash up to an aggregate nominal value of

GBP735,343, being an amount equal to approximately 5 per cent of the current

issued share capital of the Company. If given, this power will expire at the

same time as the authority referred to in resolution 6. The directors consider

this power desirable due to the flexibility afforded by it.

Resolution 9 - Authority to make market purchases of shares

Resolution 9 seeks authority for the Company to make market purchases of its

own ordinary shares. If passed, the resolution gives authority for the Company

to purchase up to 5,882,750 of its ordinary shares, representing 10 per cent of

the Company's issued ordinary share capital.

Resolution 9 specifies the minimum and maximum prices which may be paid for any

ordinary shares purchased under this authority. The authority will expire at

the conclusion of the Company's next Annual General Meeting in 2020 or, if

earlier, the date which is six months from the end of the Company's financial

year which commenced on 1 April 2019.

Any shares purchased under this authority will be cancelled. As a member of the

Company entitled to attend and vote at the meeting convened by this notice you

are entitled to appoint another person as your proxy to exercise all or any of

your rights to attend and to speak and vote in your place at the meeting. Your

proxy need not be a member of the Company.

You may appoint more than one proxy in relation to the meeting convened by this

notice provided that each proxy is appointed to exercise the rights attached to

a different share or shares held by you. You may not appoint more than one

proxy to exercise rights attached to any one share.

By order of the Board Susan Woodward, A.C.I.S.

Secretary

11 June 2019

END

(END) Dow Jones Newswires

June 11, 2019 04:00 ET (08:00 GMT)

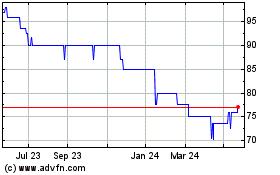

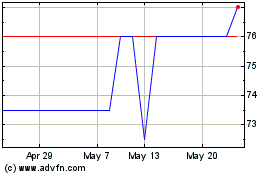

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024