TIDMTHW

CHAIRMAN'S STATEMENT

The darkest days of the past year are now behind us and whilst the whole

COVID-19 episode has been most unwelcome the Company is emerging from closure,

lockdowns and restrictions intact, with its pubs, inns and hotels ready to make

the most of the situation as a wave of pent-up demand is released once our

personal liberty is restored.

Thwaites entered the COVID-19 pandemic in excellent shape, with well invested

assets, a strong balance sheet and businesses orientated to attractive parts of

the market. The company faced a year of accumulating losses, worrying

uncertainty and immense challenge. However, the decisive actions that we took

to control our cost base and safeguard the financial strength of the business

ensured that we reopened on the front foot and were able to welcome back our

customers, new and old, help them to feel at ease and enjoy themselves once

more.

Whilst it would be too much to say that we are coming out of the past year

stronger, we have minimised the financial scarring from being shut and have

plenty of liquidity to get us back on our feet and consider how we re-establish

the growth path that we had been on.

We guard our family values preciously; they provide a strong framework to guide

us and have shone through during the past year. Our teams have been nothing

short of outstanding and I am tremendously proud of the way that they have

navigated the highs and lows, from the frantic days of Eat Out to Help Out and

the strong trading of last summer, to closure and safeguarding our properties.

We have asked much of them in the past year and the way that they have gone the

extra mile to put us in good shape for the future is humbling.

The benefit of our freehold only philosophy has shown its' strength and with no

leaseholds we have avoided the fixed costs of rental payments in lockdown and

the need to negotiate with landlords.

Last spring we had no expectation that this pandemic would cast such a long

shadow for over a year; nor at our interim results did we contemplate that the

winter lockdowns would be as persistent or as challenging as they have been.

However, the storm has been weathered and the continuing long-term success of

the Company is now at the forefront of our thoughts.

Results

The business was not able to trade without some form of restrictions for a

single day during the year to 31 March 2021. It was shut, other than to key

workers, for 208 days, traded in the debilitating tier system for 55 days and

was open inside with social distancing restrictions for only 102 days.

As a result the financial performance has been severely and adversely impacted,

with turnover down 67% on the previous year at £32.2m (2020: 98.1m) and an

operating loss of £9.4m compared to an operating profit of £12.6m to 31 March

2020, which also included a negative COVID-19 impact of £2.5m. In total, the

pandemic has lost the Company approximately £24m. The loss per share was 17.8p

(2020: earnings per share 5.6p).

These results would have been significantly worse were it not for the financial

support the government and the treasury have provided during the recent crisis.

Net debt at 31 March 2021 was £78.8m (2020: £65.4m), an increase of £12.2m

since the interim results at 30 September 2020. Whilst this is clearly

undesirable, the measures taken by the Company to mitigate controllable spend

across the board means that this is as satisfactory a result as we could have

hoped for.

Towards the end of the financial year the financial markets began to consider

the unprecedented amounts of fiscal stimulus funded through central government

debt and the likely impact that this would have on future interest rates. As a

result, expectations that interest rates would increase sooner than had been

thought saw an increase in the discount rate used to value the Company's

pension scheme and swap liabilities. This led to a decrease in these two

liabilities of £11.9m at the 31 March 2021 - by chance this means that despite

the trading losses incurred the profit and loss reserve ended the year

unchanged at £85.9m. Net asset value per share at the year end was £3.00

(2020: £3.02).

The Tenanted Pub Model

The tenanted pub model has attracted much criticism over recent years from

detractors who would say that the relationship is unfairly balanced in the

favour of the owner of the freehold property. Our consistent response to this

has been that a model where interests are aligned in the success of a pub

between the property owner and the publican promotes the long term success of

the pub and allows good operators to succeed with confidence, partnered with a

company that can invest in the pub and provide business support that a sole

operator might not access on their own.

The past year has been a litmus test for the model and one which Daniel

Thwaites and the rest of the industry has passed with flying colours. As a

result of the scale and financial strength of our business we, like others in

the industry, have supported our tenanted pubs as far as we have been able with

both financial and business support. We provided more than £3.2m of direct

financial support to our tenanted pubs at a time when the commercial property

market is tying itself in knots over how to resolve unpaid rents.

The alignment of interests between us and our tenanted pub operators has made

the decision to forgo rent an easy one. We are motivated to make sure that

these small independent and previously successful businesses were ready to open

and be profitable, without huge historic debts, when the time came. Likewise,

that alignment has led the industry to ask government to support pubs,

generating a voice that could otherwise have been drowned out. Government

support has been an additional critical contribution in preventing mass pub

failure and unemployment.

To those who have sought to destroy the tenanted pub model in the recent past,

the experience of the last year is a salutary lesson in the strength of the

model.

Acquisitions, Developments and Disposals

In March 2020 we put in place a freeze on returning capital investment and

acquisitions, although we have continued to maintain our properties throughout

the year at a normal rate. As a result, no acquisitions have been made during

the past year. The Company has sold three bottom end pubs and two ancillary

properties with proceeds of £0.8m.

Dividend

The Board does not recommend the payment of any dividend, be it interim or

final, and will not do so while the business is loss making and in receipt of

the government's financial assistance. The Board understands that the dividend

plays an important role for shareholders and will look to reinstate a dividend

as the business recovers and a dividend distribution is prudent and

sustainable.

People

Our teams are the beating heart of our business and their commitment to the

business underpins our success. The way that they have responded, both those

that have worked through lockdowns and those who have supported the business,

ready to return at the end of furlough has been outstanding. I would like to

thank everyone for the way that they have approached the past year and their

faith in the company.

The recruitment market has been impacted by the loss of overseas workers

following Brexit and furlough. We have used our time over the past months to

review our benefits package to make sure that we continue to offer a compelling

proposition to new employees and maintain our position as an employer of choice

in our local markets.

There have been no changes to the Board during the year

Once more I would like to thank our shareholders for their unwavering support

as we come through this difficult period and rebuild the business.

Outlook

The first rays of light are breaking through the clouds and the early signs of

trading as we have reopened have been most encouraging. The decision to delay

removing social distancing from 21 June is a critical one to the hospitality

industry. We must now wait for the government's next move.

One of the consequences of the past year has been to raise the profile of the

pub with government and also with the general public, who have discovered that

life without the pub is not as fun as it is when it is there.

In the medium term this bodes well, as the role that the pub plays in

socialising and as the glue holding together local communities has been

highlighted. At all levels of government there has been an awakening to the

fact that community pubs are the biggest social outreach programme in the land,

delivered by landlords and landladies free of charge. These precious assets

need to be protected and nurtured and I have increasing confidence that the

government will support that.

We have put considerable focus as we reopen on maintaining quality within our

properties. This puts them in an excellent position to be the place of choice

as our customers choose to trade up and treat themselves. We do not have many

properties in city centre locations and our larger hotels are located on the

motorway network away from public transport. We have good representation in

rural locations and national parks, places that people will seek out. The

corporate meeting and travel market for the moment is a little more opaque, but

I am confident that it will recover in the coming months.

I have no doubt that there may be bumps along the road, but the strength of the

business built up over many years has proven its worth over the past year. As

we reopen we will closely observe what our customers now want from us, it may

be that things have changed. If they have, we will respond with enthusiasm and

agility.

R A J Bailey

Chairman

30 June 2021

OPERATING REVIEW

Overview

This has been a year of great unknowns, in which uncertainty and the shifting

sands of COVID-19 response have at times obscured our way out from the crisis.

It has certainly been one of the most testing in our history, however the

absolute resolution to prevail, the knowledge that we would come through and

get ourselves going again and the willingness of our teams to go the extra mile

has been demonstrated across every area of the Company.

The financial results of the Company, ravaged by COVID-19, are stark and there

is no shying away from the reality that it has been an expensive year on many

levels. However, much of the impact of COVID-19 has been contained within this

last financial year and we have acted quickly and decisively to ensure that the

core of the business and its teams have been protected. When we have been able

to open we have fought hard for every available pound of revenue, despite the

difficulties brought by capacity constraints as a result of social distancing

and the effect of work from home orders on the corporate hotel market.

Wherever possible we have used the government furlough scheme to protect

sustainable jobs, but we have been forced to address the overhead cost base of

the business. Inevitably, and sadly, some roles have been lost to redundancy,

but I have no doubt that many new roles will be created once we reopen fully.

What is encouraging is that when we were able to trade, we performed well,

particularly in our pubs and inns, and this bodes extremely well for the coming

months as restrictions are eased.

Financial Results

Turnover for the year was £32.2m, (2020: £98.1m), the business was shut for 57%

of the year and traded under severe restrictions for a further 15% of the time.

When trading under tier 3 it quickly became apparent that this was lockdown in

all but name. The operating loss for the year was £9.4m, (2020: operating

profit £12.6m). The loss after tax, which benefited from a tax credit of £1.9m,

was £10.5m (2020: profit £3.3m). Net debt increased to £78.8m, (2020: £65.4m)

an increase of £13.4m, the unwinding of the working capital position accounted

for approximately £3.1m so the underlying net debt position at the year-end was

£75.7m. At the year end the company had £11.2m of headroom on its banking

facilities, and in closure cash burn was running at approximately £1.5m per

month.

Responding to closure

The Company closed all its pubs, inns and hotels on 20 March 2020 following the

directive from the UK Government that all hospitality businesses should shut.

As a result, as we started our new financial year on 1 April 2020 the Company

was essentially closed and was responding to the uncertainty of the initial

lockdown, at this stage we were told that the UK would turn the tide of

coronavirus in three weeks.

The Company quickly took all possible steps to secure the business, protect

cash flow and take advantage of the support measures put in place by the

Government.

The overriding concern throughout the crisis has been to ensure that our

employees were protected both physically from a health and safety perspective

as well as considering the mental and emotional strain that the last year has

brought. Our support teams have largely worked from home and we have been

forced to adopt Microsoft Teams and Zoom, although we will start to use them

less as we reopen. In addition we have put in place new online and video

communication channels which allowed us to be in touch with people at home.

Various steps were taken to mitigate costs in the business, as well as

accessing grants for both ourselves and our pub tenants. All of our suppliers

were paid to terms and whilst for a period we suspended contributions to our

pension scheme recovery plan, those payments have now been brought up to date.

We took advantage of HMRC VAT deferral schemes, deferring £1m of VAT until

2021. We reviewed all non-essential spend, cancelling or suspending contracts

wherever possible and we implemented pay cuts for the Board and Executive team

of up to 30%.

Preservation of cash has been imperative throughout the past year, and we have

suspended new capital investment, although we know that we will suffer on

reopening if the quality of our properties is not up to scratch, so we dealt

with maintenance as normal. There have been some outstanding examples of teams

using their time in property during closure to do jobs that have been low on

the to-do list, but have had immense impact. Floors have been stripped and

polished, bedrooms, cellars and public areas have been painted and almost

everything that could be jetwashed has been!

There have been some very successful examples of takeaway across all areas and

in one notable case a tenanted pub has created a takeaway business that is

larger than the core pub trade pre-COVID-19.

Planning for re-opening

An immense amount of time and thought has been put into how we reopened last

July and on subsequent occasions. It is difficult to convey in words the energy

that was deployed in the unchartered waters that we navigated, all the time

trying to second guess the government, who were themselves learning and

creating a response to the crisis. Once again the safety of our staff and

customers has been at the forefront of our thinking; from table placement and

distancing, to signage, hand sanitisers and all of the other measures that we

have now become familiar with. We created our "Stay Safe" system - by and large

we have pitched these measures at the right level and the response from our

teams and customers has been overwhelmingly positive.

Across the estate we have invested in our outside areas, which will stand us in

good stead as we go into the coming year. In our tenanted pubs there have been

some ingenious and creative solutions which we will learn from and use to make

further investments as we move forward. We have developed our approach to

outside bars and these in particular have flourished when we have been open.

Pubs and Inns

Understanding our Pubs

Our freehold estate of tenanted pubs numbers approximately 225 properties. We

continue to recycle capital into new, more attractive tenanted and managed pub

opportunities, where there is the potential to invest and add value and so we

continue to dispose of pubs that we do not believe have a long-term future with

us.

Our pub estate encompasses community locals to destination food led pubs in

both rural and town centre locations, ranging geographically from Cumbria to

the Midlands, and from North Wales to Yorkshire. In the current environment

the geographic diversity of the pub estate and the lack of exposure to major

city centres should provide some resilience.

We have been operating tenanted pubs for a long time, and we have a strong

reputation for our well-established approach, as a partner of choice, acting

with integrity, and focusing on investing alongside proven operators to expand

and improve the premises with a focus on establishing good quality food

offerings. Where the property has the scope, and we believe the demand exists,

we support the development of letting bedrooms. We have an estate of high

quality, sustainable businesses with multiple income streams that have the

ability to generate attractive cashflows.

Pubs performance

The tenanted pubs re-opened after the first lockdown on 4 July 2020 and got off

to a strong start, over the summer period they built their sales as customers

returned, at peak achieving like for like beer volumes of 94% of the previous

year, despite capacity constraints as a result of social distancing. The estate

benefits from having a community bias, with not many city centre properties,

this proved to be a positive as people continued to work from home.

However, increasing restrictions from the end of September, the tier system and

further lockdowns meant very little trade thereafter.

In 2020 we acquired three new tenanted pubs, investment planned for these pubs

was postponed in 2021 and will be picked up once our debt position improves.

There were no acquisitions in the year, but we disposed of three pubs.

During the year we completed one development project at a cost of £0.4m at The

Clockface, Prescot. This work was under way when we entered lockdown and the

project was completed during the period.

The financial support provided to the tenanted pubs has given a period of

protection ahead of reopening. At the year-end we had six pubs (3% of the

estate) which were looking for new tenants compared to ten pubs last year.

Brewery

Our craft brewery has gone from strength to strength. It has won awards for the

quality of its ales and when they have been available the customer feedback on

the beers has been very positive.

This coming year we will build on this success by re-introducing our popular

range of guest ales, which was not possible whilst we were shut.

Understanding our Inns

We own and manage a growing portfolio of inns and we will continue to look to

expand this segment of our business in the future through the acquisition of

high quality properties in outstanding locations.

Our inns are positioned at the premium end of the market, they have a busy bar

at their core, a home cooked food offering and high quality, comfortable

accommodation - they focus on providing outstanding hospitality and offer an

attractive and more personal alternative to the mid-market hotel chains.

This segment of the market has performed strongly over the past few years and

is positioned for continued growth as customers look for something special that

is authentic and honest, delivered by operators who can provide a quality

experience consistently.

Inns performance

Once they could re-open after the first lockdown the inns recovered strongly

and by August, when the Eat Out to Help Out scheme was introduced, we were

seeing year on year sales growth of 14%. As new restrictions were introduced

over the Autumn the performance of the inns tailed off, however they continued

to show growth until the tier system was introduced in October. The strong

performance when we were open was reflected across all of the properties.

Understanding our Hotels & Spas

We own and operate ten hotels which are spread across England. Our hotels are

positioned towards the premium end of the market and most have leisure and spa

facilities. In recent years we have invested in them to amplify the individual

character of each hotel in its local area, supported by a great food and drink

offering with local nuances. Our vision, similar to our inns, is to create a

collection of interesting, characterful contemporary hotels, that are the best

in their local area.

Hotels & Spas performance

The hotels were slower to build sales after re-opening as their leisure

facilities were not allowed to open until 25 July 2020. Once they did open,

they traded well given the severe capacity constraints that were imposed on

them, not least in their swimming pools and treatment rooms. The corporate

bedroom and conference business has been severely disrupted for all of the year

as people have worked from home and there have been virtually no weddings,

conferences or events. Throughout the summer the hotels traded at approximately

80% of the previous year, however as new restrictions came into force like

other parts of the business the sales reduced rapidly.

Summary and future developments

Once the economy fully re-opens and people are free to have unrestricted access

to our properties then the prospects for the business are good.

We have a recovery plan which we are implementing, it is not complicated; take

the learnings from the last year and adopt helpful technology such as our

online order and pay system; reinstate the full quality of our offering and do

not be tempted to dumb it down; be careful with our capital expenditure and

allow the strength of the balance sheet to recover as the business naturally

generates cash.

The are other changes that have been forced upon us which we embed as they have

enhanced the customer experience. Examples of these would be a la carte

breakfasts, cooked to order, meet and greet stations, booking times for

residents in our restaurants and leisure facilities, and expanded and enhanced

outside areas. These improvements will enrich the overall enjoyment of visits

to our properties and are positive improvements.

Since the year end we have disposed of some non-core properties which have been

helpful in lowering our debt levels and we also have several properties under

offer. When our resources allow for it we will start to consider new

acquisitions and we believe that some interesting opportunities might arise

over the next few years.

Re-opening the business on 12 April 2021 in our outside spaces and from 17 May

2021 inside with social distancing measures has been insightful and

encouraging. Against our expectations of a year ago, a lack of candidates for

new roles in the recruitment market is acute. Foreign workers who have returned

home as a result of the dual effect of Brexit and COVID-19 and also the

furlough scheme are now having an adverse effect.

We have vacancies but believe that the situation will ease as the summer

progresses. We have worked hard on our employee proposition over lockdown,

bringing additional structure and clarity to our existing employees and for

those looking to join us. In addition we have looked at how we can add

additional value to the employment package that we offer. It is early days but

the measures that we have taken should yield rewards.

We are positioned in attractive segments of the market and our properties are

well positioned to take advantage of the staycation market. Disposable income

has grown in lockdown and people are looking forward to returning to the pub.

Forward bookings for the summer are shaping up positively and we have seen

increases in both rate and occupancy which should mean that our bedrooms will

have a strong summer leisure trade. Likewise there is pent up demand in the

wedding sector and when larger weddings can be held again we are likely to see

a spate of celebrations.

Looking to the autumn uncertainty remains as to when offices and business

travel will pick up again. However there seems to be a growing feeling within

the business community that online meetings are no match for real physical

contact when developing culture, collaborating and innovating. This gives us

hope that our hotels, which play to this area, will also start to recover as we

enter the second half of the year.

In summary, we are ready to move forward when allowed, and for the business to

make the most of its considerable breadth of offer. When the time comes we will

make the most of every opportunity that presents itself.

Financial Review

Results

Turnover for the year ended 31 March 2021 decreased by 67% to £32.2m (2020: £

98.1m). An operating loss of £9.4m was made compared to an operating profit of

£12.6m in the prior year.

The measurement of the interest rate swaps at fair value resulted in a credit

to the profit and loss account of £1.6m (2020: charge £4.5m).

Loss before taxation for the year was £12.4m (2020: profit £3.6m).

Business Review

The key issues facing the Group are covered in the Chairman's Statement and

Strategic Report. The KPIs used by the Group to monitor its overall financial

position can be summarised as follows:

2021 2020

Group £m £m

Turnover 32.2 98.1

EBITDA (2.2) 19.5

Depreciation 7.2 7.7

Operating (loss) profit (9.4) 12.6

(Loss) profit before tax (12.4) 3.6

Net debt 78.8 65.4

(Loss) earnings per share (pence) (17.8) 5.6

Pubs and Inns

£m £m

Turnover 19.0 52.8

EBITDA 5.4 18.1

Depreciation 3.5 3.6

Operating profit (before Group central charges) 1.9 14.5

Average number

Tenanted 226 225

Managed 12 13

Hotels & Spas

£m £m

Turnover 13.2 45.3

EBITDA (1.0) 10.0

Depreciation 3.3 3.5

Operating (loss) profit (before Group central charges) (4.3) 6.5

Average number 10 10

The principal non-financial indicators monitored by management are:

Pubs and Inns

Utility consumption, health and safety incidents, beer volumes, customer

ratings and tenant recruitment.

Hotels

Room occupancy rates, customer ratings, health and safety incidents, spa

memberships and wedding and event numbers.

Interest rate swaps measured at fair value

The Group has interest rate swaps for £55m which are recognised as a financial

liability. The economic uncertainty created by the start of the COVID-19

pandemic led to a significant reduction in interest rates in March 2020, as a

result the movement in the fair value of the interest rate swaps was a charge

to the profit and loss account of £4.5m for the year ended 31 March 2020. As

the economic outlook improved in March 2021 with the government's roadmap for

re-opening the economy, expectations of increases in future interest rates led

to a reduction in the fair value of the interest rate swaps, which resulted in

a credit to the profit and loss account for the year ended 31 March 2021 of £

1.6m.

Interest payable

Whilst loan capital has increased from £65.5m at the start of the year to £

78.5m at the end of the year, interest rates were reduced from March 2020, such

that net interest payable was flat year on year at £3.9m.

Taxation

There is a tax credit of £1.9m on the loss for the year, an effective rate of

15.3% due to the restriction on interest deductions.

Earnings per share

There was a loss per share of 17.8p (2020: earnings per share 5.6p).

Dividends

No dividends were paid during the year due to the need to preserve cash due to

the closure of the business in response to the COVID-19 pandemic. Future

dividend policy will be reviewed in line with the recovery of the business.

Cash ?ow and ?nancing

The Group's net borrowing increased by £13.4m, from £65.4m at 31 March 2020 to

£78.8m at 31 March 2021 due to the closure of the business.

The Group made deficit contributions to the defined benefit pension schemes of

£0.4m (2020: £0.8m). Whilst these schemes were closed in August 2009, the Group

is committed to funding the deficit on the schemes which was £19.9m, before

tax, at 31 March 2021, a decrease of £12.4m from £32.3m at 31 March 2020.

The Group increased its revolving credit facilities by £8m to £43m in December

2020, of which £33.5m was drawn down at 31 March 2021. The Group also has £45m

of long-term debt, overdrafts of £0.6m and cash balances of £0.3m at 31 March

2021.

Pensions

The combined deficits of the defined benefit pension schemes decreased, net of

deferred tax, by £10.1m from £26.2m at 31 March 2020 to £16.1m at 31 March

2021.

The main reason for the reduction in the deficit is due to a significant

increase in the value of scheme assets at 31 March 2021 after a significant

fall in equity values in March 2020 at the start of the COVID-19 pandemic.

Property

During the year we sold three pubs and two ancillary properties for a total of

£0.8m generating a profit against book value, after disposal costs, of £0.2m.

In line with our accounting policy, 20% of our properties were subject to a

formal revaluation, and additionally an impairment review was carried out on

the rest of our property estate. This resulted in a reduction in the total

value of our property portfolio of £1.4m, of which £0.8m was deducted from the

revaluation reserve and £0.6m deducted from cost and charged to the profit and

loss account.

Treasury policy and ?nancial risk management

Treasury policies are subject to Board approval. All borrowings are in sterling

and comprise a mixture of fixed interest loans and facilities carrying LIBOR

related floating rates. The Group has interest rate swaps for £55m where it is

committed to pay the difference between LIBOR and fixed interest rates. At 31

March 2021 a financial liability of £17.5m has been recognised in respect of

these interest rate swap contracts.

Going Concern

At 31 March 2021 the Company had total borrowing facilities of £90m, which were

made up of the long-term loan of £45m, revolving credit facilities of £43m,

which were increased from £35m in December 2020, and overdraft facilities of £

2m. When compared to net debt of £78.8m at 31 March 2021, this gave headroom of

£11.2m.

The Company renegotiated its banking covenants during the year and has put in

place a revised set of covenants in line with the expected recovery of the

business following reopening.

The Directors believe that the Company has the cash flows and facilities to

meet its needs for the foreseeable future.

Kevin Wood

Finance Director

30 June 2021

EXTRACT FROM AUDITED FULL FINANCIAL STATEMENTS FOR THE YEAR ENDED

31 MARCH 2021

GROUP PROFIT AND LOSS ACCOUNT

2021 2020

GBP'm GBP'm

Turnover 32.2 98.1

Cost of sales (42.8) (74.1)

Gross (loss) profit (10.6) 24.0

Distribution costs (2.5) (3.8)

Administrative expenses (7.8) (8.4)

Other operating income 11.3 -

Operating (loss) profit before (9.6) 11.8

property disposals

Property disposals 0.2 0.8

Operating (loss) profit (9.4) 12.6

Net interest payable (3.9) (3.9)

Gain (loss) on interest rate 1.6 (4.5)

swaps measured at fair value

Finance charge on pension (0.7) (0.6)

liability

(Loss) profit on ordinary (12.4) 3.6

activities before taxation

Taxation on (loss) profit for 1.9 (0.3)

the year

(Loss) profit on ordinary (10.5) 3.3

activities after taxation

(Loss) earnings per share (17.8)p 5.6p

DANIEL THWAITES PLC

GROUP BALANCE SHEET

At 31 March 2021 2021 2020

GBP'm GBP'm

___________________________________________________________________________ _______ _______

Fixed Assets

Tangible assets 291.0 297.5

Investments 0.6 0.8

___________________________________________________________________________ _______ _______

291.6 298.3

Current assets

Stocks 0.5 0.5

Trade and other debtors 10.4 11.1

Cash at bank and in hand 0.3 0.5

___________________________________________________________________________ _______ _______

Creditors due within one year 11.2 12.1

Trade and other creditors (9.8) (13.3)

Loan capital and bank overdraft (11.6) (0.4)

___________________________________________________________________________ _______ _______

(21.4)

(13.7)

Net current liabilities (10.2) (1.6)

___________________________________________________________________________ _______ _______

Total assets less current liabilities 281.4 296.7

Creditors due after one year (85.0) (86.9)

___________________________________________________________________________ ______ _______

Net assets excluding pension liability 196.4 209.8

___________________________________________________________________________ _______ _______

Pension liability (19.9) (32.3)

___________________________________________________________________________ _______ _______

Net assets 176.5 177.5

___________________________________________________________________________ _______ _______

Capital and reserves

Called up share capital 14.7 14.7

Capital redemption reserve 1.1 1.1

Revaluation reserve 74.8 75.8

Profit and loss account 85.9 85.9

___________________________________________________________________________ _______ ________

Equity shareholders' funds 176.5 177.5

___________________________________________________________________________ ________ ________

DANIEL THWAITES PLC

GROUP CASH FLOW STATEMENT

For the year ended 31 March 2021

2021 2020

GBP'm GBP'm

__________________________________________________________________________ _______ _______

Cash flow from operating activities (5.4) 18.7

Tax paid (0.2) (1.5)

Cash flow from financing activities 6.9 (13.9)

Cash flow from investing activities (1.7) (4.4)

Equity dividends paid - (2.6)

__________________________________________________________________________ _______ _______

Decrease in cash and cash equivalents (0.4) (3.7)

Cash and cash equivalents at beginning of year 0.1 3.8

__________________________________________________________________________ _______ _______

Cash and cash equivalents at end of year (0.3) 0.1

Loan capital (78.5) (65.5)

__________________________________________________________________________ _______ _______

Net debt (78.8) (65.4)

Reconciliation of net cash flow to movement in net debt

Decrease in cash (0.4) (3.7)

Cash flow from (increase) decrease in debt (13.0) 8.0

___________________________________________________________________________ _______ _______

(13.4) 4.3

Net debt at beginning of year (65.4) (69.7)

___________________________________________________________________________ _______ _______

Net debt at end of year (78.8) (65.4)

___________________________________________________________________________ ________ ________

END

(END) Dow Jones Newswires

June 30, 2021 07:08 ET (11:08 GMT)

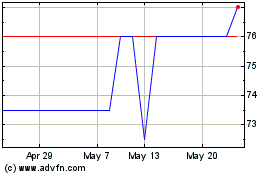

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

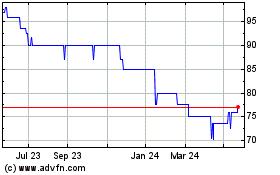

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024