Thwaites (Daniel) Plc Half-year Report

November 03 2021 - 3:15AM

UK Regulatory

TIDMTHW

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2021

CHAIRMAN'S STATEMENT

OVERVIEW

We started the six-month period to 30 September 2021 having been in lockdowns

or periods of significant restrictions to trade for over six months, with most

of our properties closed and the majority of our staff on furlough under the

Job Retention Scheme.

On 12 April 2021 we reopened those properties with outdoor trading space, which

was all of our hotels and about two thirds of the pubs and inns. The remaining

properties reopened on 17 May, with limited capacity due to social distancing

measures, which were removed on 19 July.

Trade has recovered quickly and has surpassed our early expectations, after

months of lockdown our customers were very keen to return to our pubs and

hotels, they were very welcome and we were delighted that they could enjoy our

hospitality once again.

The majority of our staff returned to work during April and May, and they have

had to deal with a number of supply chain issues, staff shortages and

intermittent outbreaks of Covid. I am incredibly proud of the way that our

teams have responded to the challenge of getting going once again and they have

all done an incredible job in helping the business to recover quickly and get

back on track.

RESULTS

Turnover for the half year was £47.8m, which is a 119% increase compared to

turnover last year of £21.8m, which was impacted by three months of lockdown.

Turnover was only 10% down compared to the same period in 2019, which is a good

result considering that trade was restricted during the first three months of

the period.

An operating profit of £9.3m compares to an operating loss of £1.4m last year

and an operating profit of £9.5m in 2019. This has been achieved with the help

of significant support from the UK Government for the hospitality sector in the

form of reduced business rates, business grants, the Job Retention Scheme, and

the reduction in VAT on accommodation, food and soft drinks.

Base rates have remained at their historic low of 0.1% throughout the period.

However, the widely reported price inflation, has resulted in expectations that

the Bank of England will increase interest rates in the near future and this

has had a positive impact on the fair value of our interest rate swaps. This

has resulted in a decrease in the provision of £0.5m at the half year (2020: £

1.8m increase in the provision due to COVID-19 uncertainties), and this

positive movement is shown in our profit and loss account.

Net debt has been an area of special focus and at 30 September 2021 it was £

61.4m (2020: £66.6m); a decrease of £5.2m compared to last year, but more

significantly I am pleased that it represents a decrease of £17.4m during this

half year, reduced from £78.8m at 31 March 2021. At its current level the

business has considerable headroom against its total banking facilities of £90m

as we enter a period of trading uncertainty coming into the winter.

PUBS AND INNS

We started the year with all our tenanted pubs closed, although a number of

pubs offered basic take away services during lockdown. On 12 April, those pubs

with outdoor trading space (about two thirds of the estate) were allowed to

reopen, providing table service only. The creativity of our tenanted pub

operators to maximise the number of customers they could serve by converting

carparks, pavements and spare land into trading space, together with erecting

tents and marquees and other structures to deal with inclement weather was

truly inspiring, demonstrated real community spirit and epitomised why pubs are

at the heart of their communities.

Those pubs that put real and obvious effort into reopening were rewarded with

strong sales as customers were keen to return to their local pubs after months

of lockdown, this coincided with some good spring weather which made for busy

gardens and outside areas.

The remaining pubs opened on 17 May, when indoor trading was permitted, albeit

with social distancing measures in place until 19 July.

Beer volume sales continued to recover through the period, and by September

they were at 97% of 2019 levels. We have seen a shift in consumer behaviour

since reopening, with a move to more premium products as people seek to treat

themselves after the turmoil of the last eighteen months.

Our pub estate benefits from being largely based in community and rural

locations with very little town and city centre presence.

We have continued our regular maintenance spending on our pubs over this

period, but there have been limited capital expenditure projects in order to

minimise the disruption to trading during this period of recovery.

Our Inns are ideally located in rural and honeypot locations which are very

attractive to the domestic leisure market at the moment. They have performed

very strongly since reopening and the increased demand for UK leisure breaks

has led to record levels of room occupancy and average room rates. Sales for

the period were at 98% of 2019 levels, a creditable performance given that

their capacity was severely constrained for seven weeks of the period.

HOTELS & SPAS

The hotels & spas have limited outdoor trading space and in general do not have

passing footfall, so whilst they reopened on 12 April, they did not trade in

any material way until 17 May. Thereafter, leisure sales recovered quickly,

although corporate sales were very slow to pick up as many organisations were

still encouraging their staff to continue working from home.

We saw a slight reduction in demand for leisure breaks as we came into

September, but at the same time we started to see an increase in corporate

activity. On 19 July, the removal of restrictions banning significant group

gatherings saw us host a large number of weddings over the summer, many of

which were re-bookings from weddings that would have taken place if allowed

over the past 18 months.

Sales for the period are at 89% of 2019 levels, although they have been growing

steadily as the year has progressed, by September sales were running 15% ahead

of 2019.

ACQUISITIONS AND DISPOSALS

On 5 October, just after the period end, we were delighted to announce the

acquisition of the Red Lion at Burnsall. This is an iconic coaching inn sitting

alongside the River Wharfe in the Yorkshire Dales. The property has 25 bedrooms

together with five holiday cottages, each with two bedrooms, a large outdoor

area, a busy bar and restaurant and function facilities.

We have also continued to divest of pubs that no longer suit our requirements

and sold eleven properties in the period. We also sold our old Blackburn

brewery site, that we vacated in 2018, during the period. We received total

proceeds from these disposals of £4.5m, making a profit on disposal of £0.3m.

EARNINGS PER SHARE

Earnings per share for the period were 10.7p per share, which compares to loss

per share of 8.2p per share in 2020, due to the period of lockdown and

restrictions last year.

DIVID

The Board does not recommend the payment of an interim dividend (2020: £Nil) as

whilst the business has recovered strongly over the period, the results have

been achieved with financial support from the UK Government. The Board will

continue to review future dividend policy in line with the recovery of the

business and the degree of future uncertainty.

SUMMARY AND OUTLOOK

All credit must be given to our teams across the business for their success in

making the most of the opportunity that has presented itself since re-opening

in the spring. Our decision to reinstate quality cues within our properties at

the earliest opportunity and remove measures that constrain our operational

capacity has been vindicated by strong trading and an excellent set of interim

results.

Our conservative approach and a focus on our balance sheet, in particular in

reducing our level of net debt puts the business in a strong position to face

into a winter with lingering Covid cases and consequently potential government

reactions.

There are many headwinds, largely outside our control, which are creating a

level of uncertainty as we look to the future. The lack of availability of new

team members is disrupting both our ability to fully man our properties as well

as our supply chains. Inflation is rising more quickly than in recent years

with the national minimum wage set to increase by 6.6% next April. Lastly, in

the next six months we will see the withdrawal of government support, which has

been critical in achieving this set of interim results.

The announcement of changes to draught beer duty in the budget are welcome, but

this reduction will be more than offset by inflationary rises elsewhere. As an

industry we have campaigned for a permanent reduction in VAT to 12.5% for pubs

and the hospitality industry as well as root and branch reform of business

rates, both of which would be major investments in the long-term health of our

sector, help it to recover from the past 18 months of closures and provide

confidence and employment, particularly for young people.

The changes that we have made in recent years to orientate the business to

larger scale properties towards the more premium end of the market, means that

we are as well placed as any and better than most to navigate our way through

any difficulties that are thrown at us. I have no doubt that the Company and

our teams will together put the era of Covid behind us and continue to build on

our success.

Richard Bailey

Chairman

3 November 2021

Profit and Loss Account for the six months ended 30 September 2021

Unaudited Unaudited Audited

6 months 6 months 12 months ended

ended ended 31 March

30 September 2021 30 September 2021

GBP'm 2020 GBP'm

GBP'm

Turnover 47.8 21.8 32.2

Operating profit (loss) before property disposals 9.0 (1.4) (9.6)

Property disposals 0.3 - 0.2

______ ______ ______

Operating profit (loss) 9.3 (1.4) (9.4)

Net interest payable (2.0) (2.0) (3.9)

Gain (loss) on interest rate swaps measured at fair

value 0.5 (1.8) 1.6

Finance charge on pension liability (0.3) (0.3) (0.7)

______ ______ ______

Profit (loss) on ordinary activities 7.5 (5.5) (12.4)

before taxation

Taxation (1.2) 0.7 1.9

______ ______ ______

Profit (loss) on ordinary activities after taxation 6.3 (4.8) (10.5)

______ ______ ______

Earnings (loss) per share 10.7 p (8.2) p (17.8) p

Balance Sheet as at 30 September 2021

Unaudited Unaudited Audited

30 September 30 September 31 March

2021 2020 2021

GBP'm GBP'm GBP'm

Fixed assets

Tangible assets 285.2 294.7 291.0

Investments 0.8 0.7 0.6

______ ______ ______

286.0 295.4 291.6

Current assets

Stocks 0.7 0.6 0.5

Trade and other debtors 10.6 11.0 10.4

Cash at bank and in hand 8.1 2.9 0.3

______ ______ ______

19.4 14.5 11.2

Creditors due within one year

Trade and other creditors (17.7) (13.1) (9.8)

Loan capital and bank overdraft (3.5) - (11.6)

______ ______ _____

(21.2) (13.1) (21.4)

Net current (liabilities) assets (1.8) 1.4 (10.2)

______ ______ ______

Total assets less current liabilities 284.2 296.8 281.4

Creditors due after one year

Loan capital (66.0) (69.5) (67.5)

Interest rate swaps (15.9) (22.2) (17.5)

______ ______ ______

(81.9) (91.7) (85.0)

Net assets excluding pension liability 202.3 205.1 196.4

Pension liability (19.5) (32.4) (19.9)

______ ______ ______

Net assets including pension liability 182.8 172.7 176.5

______ ______ ______

Capital and reserves

Called up share capital 14.7 14.7 14.7

Capital redemption reserve 1.1 1.1 1.1

Revaluation reserve 73.6 75.8 74.8

Profit and loss account 93.4 81.1 85.9

______ ______ ______

Equity shareholders' funds 182.8 172.7 176.5

______ ______ ______

NOTES:-

1. Basis of preparation

The interim accounts, which have not been audited, have been prepared on the

basis of the accounting policies set out in the Annual Report and Accounts for

the year ended 31 March 2021.

2. Taxation

The taxation charge is based on the estimated tax rate for the year.

END

(END) Dow Jones Newswires

November 03, 2021 04:15 ET (08:15 GMT)

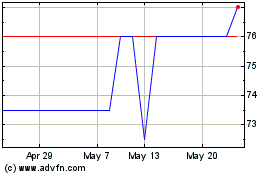

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

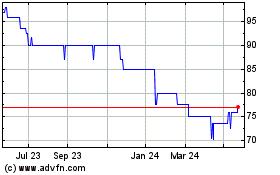

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024