TIDMTHW

DANIEL THWAITES PLC

RESULTS FOR YEARED 31 MARCH 2022

CHAIRMAN'S STATEMENT

After another challenging year Daniel Thwaites has emerged from the COVID-19

pandemic in a strong financial position. Our priority for the past two years

has been to take decisive action to control our cost base and debt levels to

protect the business for a time when we could put restrictions and a loss of

liberty behind us.

The Company and our teams have risen to this task in the most impressive

fashion and I am immensely proud of the way in which they have responded.

Our decision to reinstate quality cues within our properties at the earliest

opportunity after government restrictions were removed has been vindicated by

strong trading, profitability being restored and the business generating

significant cashflows. This has allowed us to initiate investments for the

future, start to make acquisitions and confidently set ourselves back on a path

for growth which the pandemic temporarily disrupted.

Once more our family values, and the strong culture within the business has

helped us to come through all that has been thrown at us. Well publicised

issues with recruitment coupled with natural attrition to our teams from

repeated lockdowns and closure has meant that for much of the year we have had

significant numbers of vacancies across all of the business. This has been

extremely testing for our teams and the way that they have responded by going

the extra mile, being inventive and resourceful is humbling.

Different parts of the business have pulled at different speeds throughout the

year, with outdoor areas playing a hugely important role for our pubs, despite

there being no prolonged period of sunny weather last summer. Likewise, the

leisure facilities in our hotels and spas and the honeypot locations of our

inns have been very helpful in a strong staycation market. As a result, despite

long periods of disruption the business has traded well and has been able to

capitalise on its premium levels of service and positioning, which in turn has

produced a strong set of results.

Results

For the second year running the business was not able to trade without some

form of government restrictions for 23 weeks. We started the year with the

business shut, opening with outdoor trading space only on 12 April, which

accounted for about half of our pubs and all of our inns and hotels.

The remaining properties opened on 17 May, with limited capacity due to social

distancing measures, which were removed on 19 July. Trading throughout the key

summer period was very encouraging and in the first half of the year the pubs

and the inns traded strongly, particularly those with good outside areas, which

benefited from investments made in anticipation of people wanting to get out

and about but nervous of indoor areas.

The leisure market for our hotels was also strong and we were able to achieve

strong growth in room rates in both the hotels and inns as a result of the

strong summer staycation market. The corporate hotel market began to pick up

once the summer leisure business tailed off in September, and this built

steadily over the following month.

On 10 December we embarked upon Plan B measures in the face of trying to

pre-empt the unknown Omicron variant. These measures mandated and advised the

use of face masks in most public settings as well as COVID passes and guidance

to work from home. Although hospitality settings were excluded for customers

who were seated the measures destroyed confidence and the all-important

Christmas season was largely lost.

Plan B measures were ended on 27 January, with the business starting to rebuild

itself once more between 27 January and its year end on 31 March.

Despite these material levels of disruption, the financial performance has been

resilient given the circumstances, with turnover increasing to £96.0m (2021: £

32.2m; 2020: £98.1m) and an operating profit of £12.3m (2021: £(9.6)m; 2020: £

12.6m). The earnings per share was 20.6p (2021: (17.8)p; 2020: 5.6p).

Net Debt at 31 March 2022 was £61.6m (2021: £78.8m; 2020: £65.4m), broadly

similar to that at the interim results at 30 September 2021 despite the

disruption to the winter season.

The Bank of England has now started to respond to higher inflation arising from

the unprecedented amounts of monetary and fiscal stimulus funded through

central government debt in response to the pandemic, and subsequently the

actions of Russia in Eastern Europe.

Interest rates have now risen from their all-time low of 0.1% to 1% with market

speculation that they will rise further. Increases in interest rates and the

discount rate used to value the Company's pension scheme and swap liabilities

have a positive impact on their mark to market valuations. As a result, we have

seen a gain of £3.8m on our swap liabilities and a decrease in our pension

liabilities of £30.0m, such that the pension scheme is now showing a surplus of

£10.1m for the first time in many years.

The profits retained for the year together with these mark to market gains

provided a net asset value per share at the year-end of £3.62 (2021: £3.00;

2020: £3.02).

Acquisitions, Developments and Disposals

During the year we acquired The Red Lion at Burnsall to join our Inns. This is

an iconic coaching inn, sitting alongside the River Wharfe in the Yorkshire

Dales, and we have exciting plans to develop its 25 bedrooms and 5 holiday

cottages in the coming year.

In addition, we have acquired a number of staff houses to assist us in

recruiting team members in some of our more rural locations and we believe that

this gives us an advantage in these local markets, particularly in Cumbria and

the Yorkshire Dales.

The Company has sold 15 bottom end pubs and our old brewery site in Blackburn,

with total proceeds of £7.5m.

Dividend

The Board understands that the dividend plays an important role for

shareholders and that one has not been paid whilst the Company was making

losses and sought to protect its financial health for the future. Now that the

Company is making profits once more the Board recommends reinstating a final

dividend. There is still much uncertainty about the pace and strength of any

recovery, as well as an increasingly challenging domestic economic picture. The

Board is mindful of maintaining a dividend distribution that is prudent and

sustainable, with a view to increasing it as conditions permit, as a result the

Board recommends a final dividend of 2.2 pence per share.

People

I have written above of the way that our teams have pulled us through the last

two years, and we would not be in the strong position that we are without them.

I was delighted that we recently held our Pride of Thwaites Awards, which

celebrates and recognises the outstanding contribution that they make. Whilst I

am immensely grateful to all of our team members, I would like to highlight the

role that the area business managers of our tenanted pubs have played over the

past two years. It has been far from easy and we have asked much of them,

however they are justly our winners of our Team of the Year Award.

I would also like to thank our shareholders, who have supported the business so

strongly over the past two years. I am pleased that we have been able to

restart paying them a dividend and hopeful that we are embarking on a path of

dividend growth.

Outlook

It is possible that the interruption of COVID may have been contained within

the past two sets of financial results, certainly we all hope that is the case.

From 1 April 2022 government financial support was largely withdrawn and the

business is now trading with a new set of challenges.

Our new headwinds are of a different nature, largely outside our control, which

we are working our way through. Staffing our properties, particularly our

kitchens, continues to be a major issue and everywhere you turn inflation of

our everyday goods is rampant, a dynamic that has not been present for many

years.

Supply chain issues are continuing to cause major problems with on-going

out-of-stock products and shortages. Investment schemes are experiencing long

lead times and cost increases, both of underlying goods and from the exchange

rate impact of a weak pound. Together these are threatening to undermine the

feasibility of some projects that for the time being are expensive to deliver

and so hamper our ability to invest.

As we grapple with these issues the country now, more than ever, needs its

businesses to be trading freely and investing to help to pay off our national

debt. The government is in a position to help businesses firstly by seeing

through its promised reform of business rates and secondly by opening up the

labour market by relaxing measures to allow some foreign workers to come into

the country in a controlled manner through short term employment licenses. We

continue to lobby the government strongly in both areas as well as other tax

reforms to lessen the burden on pubs.

None of these issues are ours alone, we are only able to manage our own destiny

and are confident in our ability to do so. To that end we continue to improve

the quality of our estate and our offering and our recent trading over Easter

has been promising. Our properties are well invested and attractive, ready to

make the most of the coming summer season. Our customers are becoming more

adventurous and people's new socialising habits are becoming clearer.

Like us, our customers are ready to put the pandemic behind them, meet their

friends and family and rediscover that time spent with others, and the

enjoyment of our pubs, inns and hotels makes life a little brighter.

R A J Bailey

Chairman

14 June 2022

OPERATING REVIEW

Overview

The biggest challenge in the year was not the managing of COVID and opening and

closing, which we learnt to do last year, but the staffing of the teams in our

pubs, inns, hotels, and spas. For much of the year we had vacancies across many

of the departments, particularly in our kitchens, housekeeping teams and front

of house.

It is not completely clear why the UK, like much of the world is facing a

shortage of employable labour, it is also not possible to separate the effects

of Brexit, which was now nearly six years ago, from the pandemic. However,

reports of around 1.5 million people leaving employment through either going

back overseas, leaving the hospitality industry or choosing to retire early

probably cover most of this shortfall, none of it helpful.

It is very frustrating when the customer demand is there not to be able to make

the most of it and we have worked hard to make sure that we are better

positioned for this coming summer, that said the business turned in a strong

performance for the year given the disruption that it faced.

We have developed our order and pay capabilities further which has the benefit

of reducing the intensity of front line order taking and allows the team to

focus on delivering food and drink. We have obtained a sponsorship license to

bring skilled labour in from abroad, which has had some impact in helping to

bolster our kitchens and senior front of house teams. We are having to be much

more flexible in our rotas, as people generally seem to want to work fewer

hours, and we have recruited a number of older people returning to the

workforce in retirement, as well increasingly some of those who have left the

industry but miss the human contact.

We have boosted our employee benefits, as well as moving to a higher than

minimum wage for younger team members. We have had some success with our URefer

scheme, which rewards team members for helping us to find new people and we

have strengthened our induction and training process, together with developing

our ELMA happiness and performance reviews. There is no silver bullet, but many

threads create the tapestry of our teams and we continue to think of new ways

to attract and retain the best talent.

Increasing costs are also a major challenge and we have been forced to increase

our prices in response, continuing to monitor the pricing of our competition to

make sure that we stay within the cohort but at a level that reflects the

quality of our properties. We raised our prices in December, tweaked again in

April and are likely to have to increase again later this year. Utility prices

are also a major concern and whilst we have had the benefit of some forward

contracts these will expire towards the latter part of this year, at which

point we will be exposed to market increases. We will protect our position as

far as possible, however some real pain will be felt, which will put our

profits under pressure.

Our supply chain has been fragile and in response to this we have reformulated

menus to take advantage of what is available. This has meant slimming the menus

down and relying more on specials, which helps us to create more interesting

and seasonal alternatives. We have also had interruptions to our drinks

supplies, which have been difficult to manage, particularly in our tenanted

pubs, where the temptation is to go elsewhere.

The steps that we continue to take to premiumise our offer across all of our

properties have been helpful as we are riding a strong consumer trend. The

investments in our properties over the last few years puts us in a position to

make the most of that trend. Premiumisation extends not only to the drinks

ranges in our pubs, where premium world lagers, cocktails and gin amongst other

things have been very popular, but also in our restaurants where people have

been treating themselves when out and we have had significant interest in

lobsters, Exmoor caviar, fillet steaks and large premium sharing platters, all

of which present good margin opportunities.

Financial Results

Turnover for the year was £96.0m (2021: £32.2m), the business was shut for 3%

of the year and traded under restrictions for a further 40% of the time. When

trading under Plan B and the associated government messaging our customers lost

confidence and people socialised less in December to protect Christmas and to

shield the vulnerable from infection at this time. The operating profit for the

year was £12.3m (2021: operating loss £9.6m). Net debt decreased to £61.6m

(2021: £78.8m) a decrease of £17.2m. At the year end the company had banking

facilities of £83m.

The results in the year benefited from government support in the form of

business rate concessions, lower rates of VAT and grants. This support was

withdrawn from 1 April 2022 with the exception of the 2022/23 Retail,

Hospitality and Leisure Business Rates Relief (RHL) scheme which provides

eligible, occupied, retail, hospitality, and leisure properties with a 50%

relief, up to a cash cap limit of £110,000 per business from 1 April 2022 to 31

March 2023. This is of benefit to our tenanted pubs but our managed properties

do not qualify.

Pubs and Inns

Understanding our Pubs

Our freehold estate of tenanted pubs numbers approximately 215 properties. We

continue to recycle capital into new, more attractive tenanted and managed pub

opportunities, where there is the potential to invest and add value and so we

continue to dispose of pubs that we do not believe have a long-term future with

us.

Our pub estate encompasses community locals to destination food led pubs in

both rural and town centre locations, ranging geographically from Cumbria to

the Midlands, and from North Wales to Yorkshire. In the trading environment

during the pandemic the geographic diversity of the pub estate and the lack of

exposure to major city centres has provided some resilience.

We have been operating tenanted pubs for a long time, and we have a strong

reputation for our well-established approach. We strongly value our reputation

as a partner of choice, acting with integrity, and focusing on investing

alongside proven operators to expand and improve the premises with a focus on

establishing good quality food offerings. Where the property has the scope, and

we believe the demand exists, we support the development of letting bedrooms.

We have an estate of high quality, sustainable businesses with multiple income

streams that have the ability to generate attractive cashflows.

Our tenanted pubs are a mature business and we aim to deliver returns at least

in line with inflation. They tend to be heavily influenced by weather and so

are subject to the vagaries of the British summer.

Pubs performance

The tenanted pubs re-opened their outdoor areas with table service only after

lockdown from 12 April and about two-thirds of them were able to do so. The

creativity that our tenanted operators showed to maximise the number of

customers that they could serve by converting carparks, pavements and spare

land into trading space, together with erecting tents, marquees and other

structures to deal with the inclement weather was truly inspiring and

epitomised why pubs are at the heart of their communities. The steps that the

government has since taken to extend pavement licenses permanently will be

helpful.

It was the case that the more real and obvious the effort put in to re-opening

these pubs was directly correlated to their success and with a patch of good

spring weather, customers were quick to flock back to their local and support

it after winter months of lockdown and confinement.

The remaining pubs opened on 17 May, when indoor trading was permitted, albeit

with social distancing measures in place until 19 July. There was no further

sustained period of good weather throughout the summer but beer sales grew

steadily, such that by the autumn they had regained their 2019 volume levels,

before another period of disruption in the winter, after which they started to

rebuild their trade once again.

There were no acquisitions of tenanted pubs in the year and very little has

come to the market which would suit us. We disposed of 15 pubs to which we

could no longer add any future value.

During the year we completed four development projects at a cost of £0.7m. The

largest of which was The Foundry in Blackburn, with schemes also completed at

the Fox & Hounds, Ewood, the Eagle & Child, Ramsbottom and The Clockface,

Prescot.

The financial support provided to the tenanted pubs from government grants and

business rate support has given a period of protection ahead of the spring and

a plethora of cost increases. This will not fully mitigate the pressure that is

coming to bear from price rises, particularly from utilities which are creating

immense pressure on pub profitability.

Partly as a result of this and partly as a result of people reassessing their

life options, we have seen an increase in the number of pubs where our tenanted

partner has decided to move on. We monitor this statistic closely as it is a

lead indicator of the financial health of our tenanted pubs, it has hovered at

about 20 pubs all year (9% of the estate), compared with about half this number

two years ago. We are continuing to receive high numbers of enquiries for new

customers and are taking care to make sure that we match candidates to pubs

that we believe will be successful for both parties.

Brewery

Our craft brewery has gone from strength to strength. It has won awards for the

quality of its ales and the customer feedback on the beers has been very

positive, although the cask market has been challenged by changing habits. We

were delighted to be recognised by CAMRA for our contribution to the beer

market over the past 50 Years and to celebrate their same anniversary, as well

as receiving design awards for our beer range.

We have started to reintroduce our popular range of guest ales, but cask ales

have suffered significant declines over the past two years whilst people have

been drinking packaged beers at home. Whilst we are proud of the beers that we

produce we are investigating broadening our range into some new craft keg

products. This will require a low level of investment in the brewery in the

coming year.

Understanding our Inns

We own and manage a growing portfolio of inns and we will continue to look to

expand this segment of our business in the future through the acquisition of

high quality properties in outstanding locations.

Our Inns are positioned at the premium end of the market, they have a busy bar

at their core, a home cooked food offering and high quality, comfortable

accommodation - they focus on providing outstanding hospitality and offer an

attractive and more personal alternative to the mid-market hotel chains.

This segment of the market has performed strongly over the past few years and

is positioned for continued growth as customers look for something special that

is authentic and honest, delivered by operators who can provide a quality

experience consistently.

Inns performance

Almost all of the Inns have large outside trading areas and so they were able

to open from 12 April and very quickly started to trade strongly. Over the

summer period we were seeing weeks where the trading performance was up by 20%

per week, but this benefited from VAT support from the government, on a like

for like performance this was more like 12%. The Inns even showed single digit

growth against the Eat Out to Help Out Scheme in the previous year.

In parts the Inns performance was held back by not being able to recruit

sufficient team members, where in order to protect the offering and quality of

the service we restricted trade. This was most acute in the National Parks,

which are presently devoid of any foreign workers, a resource that they have

relied upon in the past.

When all was said and done, the Inns had an outstanding year, with some star

performances, particularly at The Royal Oak, Keswick, The Lister Arms, Malham,

The Beverley Arms and the Bulls Head, Earlswood.

The Pendle Inn, Barley joined the Inns for its first full year of trading and

we have plans to develop this in the coming year, Barley is a beautiful

location at the foot of Pendle Hill and walkers flock to it throughout the

year. In October we purchased the Red Lion, Burnsall; another honeypot rural

location, and after some teething problems in assembling a new team, this

property is now performing strongly and will be a high performer for the

future.

The opportunity arose in the autumn to acquire Lendal House, a beautiful listed

building adjacent to the Judge's Lodgings, York and this will be developed to

provide an additional ten bedrooms, which will complement the 21 bedrooms that

we have already.

We have also acquired additional staff houses to strengthen our ability to

recruit team members in Keswick, Penrith and Beverley. This has been a

necessary reaction to the problems of recruitment but should give us an

advantage in each of those markets.

Understanding our Hotels & Spas

We own and operate ten hotels which are spread across England. Our hotels are

positioned towards the premium end of the market and most have leisure and spa

facilities. In recent years we have invested in them to amplify the individual

character of each hotel in its local area, supported by a great food and drink

offering with local nuances. Our vision, similar to our inns, is to create a

collection of interesting, characterful contemporary hotels, that are the best

in their local area.

Hotels & Spas performance

The hotels were slower to build sales after re-opening as for the second year

running they were not allowed to open properly until late July. Once they did

open, they traded well and were well positioned to take advantage of the

staycation market. We worked hard to add to their offer to maximise spend per

head and cash margin. This included upgrading supplements to room packages,

expanding the range of treatments in our spa treatment rooms, which were very

busy, upscaling our restaurant specials and serving thousands of cocktails.

The corporate bedroom and conference business overall was weak throughout the

year but gaining momentum by the autumn. This was put into sharp reverse by the

work from home order in December and January which was a major setback and at

the time impacted the all-important Christmas party season - which was a

write-off. Weddings had a busy season in the summer and autumn as people took

the opportunity to catch up on those lost the previous year. This seems to be

a trend that looks like it will continue into the coming year as we have strong

forward bookings. The leisure business has been strong all year and reflects a

changing mix in the sales for the hotels, we will aim to hold onto this

business and use the corporate business to backfill our occupancy, typically at

marginally lower rates.

Hotel profitability returned to a level equivalent to 2019/20, which was a very

satisfactory result given the level of disruption.

Summary and future developments

Our strategy last year was to maintain the quality of our offering in all

areas, push service levels higher than our competition and trade the business

for cash, to protect the strength of our balance sheet and the financial health

of the business coming out of the pandemic. The business has re-established its

profitability, albeit with some government support and saving a disaster, it

really does feel like we have been able to move on from the past two years of

closure and disruption.

The issues now facing the business are different but no less immediate.

Managing high levels of inflation requires us to be nimble in our offering,

whilst not diluting it and be agile in responding to price rises, passing them

on wherever possible without overly subduing demand.

Our approach in the coming year will therefore not be radically different, the

major change being that now we have more confidence about our ability to trade

uninterrupted by government intervention, which means that we can position

ourselves to start to reinvest in the properties and the business, to regain

our growth and momentum for next year and beyond.

We are therefore in the advanced stages of developing a number of investment

schemes that will help to grow our profits, and these will be started once we

have a few months clear trading under our belts.

The cost of living squeeze has been much discussed in the press and will no

doubt have an impact on the business. At this stage it is difficult to assess

exactly how detrimental it will be, nor whether the UK economy will contract

and so we should be cautious, having been careful to put the business in a

position of financial strength.

We will consider acquisitions on a case by case basis, but our focus for the

moment must be on the core business and sticking to the knitting. We are

likely to have a challenging year or two that will need all of our attention.

Where outstanding opportunities do arise, we will work hard to convert them and

add them to our portfolio as we have the resources to do so.

The early part of the year has seen encouraging trading, but our continuing

recovery has been disjointed and halting, with a series of strong weeks then

seeing inexplicable lapses. The overall trend is however positive and we are

forecasting to grow our sales year on year, despite the loss of government

support.

The hospitality industry is likely to face some challenging months ahead,

particularly next winter if the cost of utilities does not subside. However,

our businesses have been positioned to appeal to the mid-market and above,

where there is more disposable income and affordability. In the medium to

longer term people still want to socialise, treat themselves to a trip away or

a meal out with their family and friends, so whilst we may see some short term

challenges the business is invested in long term sustainable markets. The pub

will continue to play its critical role - it is the social glue that holds

communities together and helps people to fend off loneliness and it is

difficult to see that changing in the coming years.

We are a strong business that has endured one of the most testing of times. The

philosophy of freehold ownership of our assets is of huge benefit and the steps

we have taken over the past year means that we do not have a legacy of debts

and unpaid bills to deal with.

Real focus on our purpose, values and culture; maintaining the quality of our

approach; being creative and single minded in facing the inflationary threat;

and confidence in the strength of offering will mean that we will continue to

strive to be the best we can be and will grow the business for the future.

Financial Review

Results

Turnover for the year ended 31 March 2022 increased by 198% to £96.0m (2021: £

32.2m). An operating profit of £13.3m was made compared to an operating loss of

£9.4m in the prior year.

The measurement of the interest rate swaps at fair value resulted in a credit

to the profit and loss account of £3.8m (2021: £1.6m).

Profit before taxation for the year was £12.7m (2021: loss of £12.4m).

Business Review

The key issues facing the Group are covered in the Chairman's Statement and

Strategic Report. The KPIs used by the Group to monitor its overall financial

position can be summarised as follows:

2022 2021

Group £m £m

Turnover 96.0 32.2

EBITDA 20.1 (2.2)

Depreciation 6.8 7.2

Operating profit (loss) 13.3 (9.4)

Profit (loss) before tax 12.7 (12.4)

Net debt 61.6 78.8

Earnings (loss) per share (pence) 20.6 (17.8)

Pubs and Inns

£m £m

Turnover 52.1 19.0

EBITDA 18.8 5.4

Depreciation 3.2 3.5

Operating profit (before Group central charges) 15.6 1.9

Average number

Tenanted 219 226

Managed 14 12

Hotels & Spas

£m £m

Turnover 43.9 13.2

EBITDA 10.1 (1.0)

Depreciation 3.1 3.3

Operating (loss) profit (before Group central charges) 7.0 (4.3)

Average number 10 10

The principal non-financial indicators monitored by management are:

Pubs and Inns

Utility consumption, health and safety incidents, beer volumes, customer

ratings and tenant recruitment.

Hotels

Room occupancy rates, customer ratings, health and safety incidents, spa

memberships and wedding and event numbers.

Interest rate swaps measured at fair value

The Group has interest rate swaps for £55m which are recognised as a financial

liability. The recent increases in interest rates and expectations of further

increases led to a reduction in the fair value of the interest rate swaps,

which resulted in a credit to the profit and loss account for the year ended 31

March 2022 of £3.8m (2021: £1.6m).

Interest payable

Whilst loan capital has reduced from £78.5m at the start of the year to £67.0m

at the year end, increasing interest rates resulted in net interest payable

increasing slightly to £4.0m (2021: £3.9m).

Taxation

There is a tax charge of £0.6m on the profit for the year, an effective rate of

4.7% due to a credit to deferred tax in respect of the pension schemes.

Earnings per share

Earnings per share of 20.6p (2021: loss per share 17.8p).

Dividend

The last dividend paid by the Company was in January 2020, prior to the start

of the pandemic. As the performance of the business has recovered strongly over

the past year, the Board recommends a final dividend in respect of the year

ended 31 March 2022 of 2.2p per share.

Cash ?ow and ?nancing

The Group's net borrowing decreased by £17.2m, from £78.8m at 31 March 2021 to

£61.6m at 31 March 2022 due to the recovery of the business.

The Group has £45m of long-term debt, £22m of bank loans and cash balances of £

5.4m at 31 March 2022. The Group has three-year revolving credit bank

facilities which are due to be renewed in the first quarter of 2023, which is

less than 12 months from the date of the balance sheet. Consequently, bank

loans are shown within current liabilities at 31 March 2022.

Pensions

The Group made contributions to the defined benefit pension schemes of £1.2m

(2021: £0.4m). Whilst these schemes were closed in August 2009, the Group is

committed to the long-term funding of the schemes. At 31 March 2022 the schemes

had a combined surplus, before tax, of £10.1m which was a movement of £30.0m

from a deficit of £19.9m, before tax, at 31 March 2021.

The movement from deficit to surplus was due to an increase in the value of

scheme assets and a significant fall in liabilities due to increases in bond

yields.

Property

During the year we sold 15 pubs and our old brewery site for a total of £7.5m

generating a profit against book value, after disposal costs, of £1.0m.

In line with our accounting policy, 20% of our properties were subject to a

formal revaluation, and additionally an impairment review was carried out on

the rest of our property estate. This resulted in an increase in the total

value of our property portfolio of £1.9m, of which £2.2m was added to the

revaluation reserve and £0.3m deducted from cost and charged to the profit and

loss account.

Treasury policy and ?nancial risk management

Treasury policies are subject to Board approval. All borrowings are in sterling

and comprise a mixture of fixed interest loans and facilities carrying SONIA

related floating rates. The Group has interest rate swaps for £55m where it is

committed to pay the difference between SONIA and fixed interest rates. At 31

March 2022 a financial liability of £11.4m has been recognised in respect of

these interest rate swap contracts.

Going Concern

At 31 March 2022 the Company had total borrowing facilities of £83m, which were

made up of the long-term loan of £45m, revolving credit facilities of £35m, and

overdraft facilities of £3m. When compared to net debt of £61.6m at 31 March

2022, this gave headroom of £21.4m.

The Company has generated positive cashflows over the period, such that it has

reduced its net debt by £17.2m during the year and has comfortably met all of

its banking covenants. Its financial modelling shows that it is expected to be

cash generative and meet its banking covenants for at least the next twelve

months.

The revolving credit facilities are due to be renewed in the first quarter of

2023 and the Directors believe that this process will have a satisfactory

outcome.

The Directors therefore believe that the Company has the cash flows and

facilities to meet its needs for the foreseeable future.

Kevin Wood

Finance Director

14 June 2022

EXTRACT FROM AUDITED FULL FINANCIAL STATEMENTS FOR THE YEARED

31 MARCH 2022

GROUP PROFIT AND LOSS ACCOUNT

2022 2021

£'m £'m

Turnover 96.0 32.2

Cost of sales (72.7) (42.8)

Gross profit (loss) (10.6)

23.3

Distribution costs (3.3) (2.5)

Administrative expenses (9.4) (7.8)

Other operating income 1.7 11.3

Operating profit (loss) before 12.3 (9.6)

property disposals

Property disposals 1.0 0.2

Operating profit (loss) 13.3 (9.4)

Net interest payable (4.0) (3.9)

Gain on interest rate swaps

measured at fair value 3.8 1.6

Finance charge on pension (0.4) (0.7)

liability

Profit (loss) on ordinary (12.4)

activities before taxation 12.7

Taxation on profit (loss) for (0.6)

the year 1.9

Profit (loss) on ordinary (10.5)

activities after taxation 12.1

Earnings (loss) per

share

20.6p (17.8)p

DANIEL THWAITES PLC

GROUP BALANCE SHEET

At 31 March 2022 2022 2021

£'m £'m

___________________________________________________________________________ _______ _______

Fixed Assets

Tangible assets 292.9 291.0

Investments 0.6 0.6

___________________________________________________________________________ _______ _______

293.5 291.6

Current assets

Stocks 0.7 0.5

Trade and other debtors 5.5 10.4

Cash at bank and in hand 5.4 0.3

___________________________________________________________________________ _______ _______

Creditors due within one year 11.6 11.2

Trade and other creditors (20.6) (9.8)

Loan capital and bank overdraft

___________________________________________________________________________ (22.0) (11.6)

_______

_______

(21.4)

(42.6)

Net current liabilities (31.0) (10.2)

___________________________________________________________________________ _______ _______

Total assets less current liabilities 262.5 281.4

Creditors due after one year (60.0) (85.0)

___________________________________________________________________________ ______ _______

Net assets excluding pension asset (liability) 202.5 196.4

___________________________________________________________________________ _______ _______

Pension asset (liability) 10.1 (19.9)

___________________________________________________________________________ _______ _______

Net assets including pension asset (liability) 212.6 176.5

___________________________________________________________________________ _______ _______

Capital and reserves

Called up share capital 14.7 14.7

Capital redemption reserve 1.1 1.1

Revaluation reserve 75.1 74.8

Profit and loss account 121.7 85.9

___________________________________________________________________________ _______ ________

Equity shareholders' funds 212.6 176.5

___________________________________________________________________________ ________ ________

DANIEL THWAITES PLC

GROUP CASH FLOW STATEMENT

For the year ended 31 March 2022

2022 2021

£'m £'m

__________________________________________________________________________ _______ _______

Cash flow from operating activities 28.2 (5.4)

Tax received (paid) 1.4 (0.2)

Cash flow from financing activities (17.9) 6.9

Cash flow from investing activities (6.0) (1.7)

Equity dividends paid -

__________________________________________________________________________ _______ -

_______

Increase (decrease) in cash and cash equivalents 5.7 (0.4)

Cash and cash equivalents at beginning of year (0.3) 0.1

__________________________________________________________________________ _______ _______

Cash and cash equivalents at end of year 5.4 (0.3)

Loan capital (67.0) (78.5)

__________________________________________________________________________ _______ _______

Net debt (61.6) (78.8)

Reconciliation of net cash flow to movement in net debt

Increase (decrease) in cash (0.4)

5.7

Cash flow from decrease (increase) in debt (13.0)

___________________________________________________________________________ 11.5 _______

_______

(13.4)

17.2

Net debt at beginning of year (78.8) (65.4)

___________________________________________________________________________ _______ _______

Net debt at end of year (61.6) (78.8)

___________________________________________________________________________ ________ ________

END

(END) Dow Jones Newswires

June 14, 2022 10:36 ET (14:36 GMT)

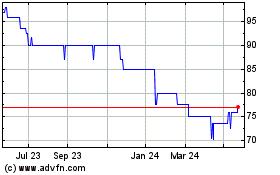

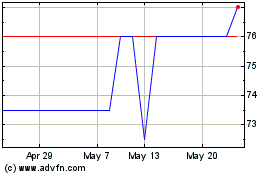

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From May 2024 to Jun 2024

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jun 2023 to Jun 2024