Thwaites (Daniel) Plc Half-year Report

November 02 2022 - 4:00AM

UK Regulatory

TIDMTHW

INTERIM RESULTS FOR THE SIX MONTHSED 30 SEPTEMBER 2022

CHAIRMAN'S STATEMENT

OVERVIEW

The Company has turned in a respectable performance over the last six months, a

period in which we have operated under the shadow of war in Europe and have

also looked to stabilise the business as support from the pandemic has been

withdrawn.

RESULTS

Turnover for the half year was £57.9m, which is a 21% increase compared to

turnover last year of £47.8m, which had disruption from closure and a benefit

from government support on VAT and Business Rates. Our turnover is 8% ahead of

the same period in 2019, the last clean set of trading results.

An operating profit of £9.9m for the half year compares to £9.3m last year and

£9.5m in 2019. The business has emerged successfully from a couple of difficult

years and whilst there are some very significant challenges ahead it is

financially stable.

Interest rates have started to rise, and rates in the UK gilt market have seen

an even more rapid adjustment higher, such that they are now materially higher

than the Bank Rate. Inflation has not proven to be as transitory as the Bank of

England had forecast and it seems that we may be entering a new period where

interest rates will be higher than we have experienced during the past decade

of cheap money, perhaps reverting to the historic norm of a 3-6% rate band.

This has had a positive impact on the mark to market fair value of our interest

rate swaps, resulting in a decrease in the provision of £7.6m at the half year

(2021: £0.5m), and this positive movement is shown in our profit and loss

account.

Net debt at 30 September 2022 was £61.1m (2021: £61.4m); a decrease of £0.3m

compared to last year, and down from £61.6m at 31 March 2022. The business has

considerable headroom against its total banking facilities of £83m.

PUBS AND INNS

Customers have been keen to get back into their local pubs, but the trading

picture is extremely mixed with a polarisation in performance. Some pubs are

trading very well, others are not and it is difficult to discern a pattern. The

summer was not as busy this year as last year, which benefitted from a

staycation boom that has not repeated to the same extent this year, although

hot weather in August was helpful.

Beer volumes have not recovered to pre-pandemic levels and there seems to have

been a structural volume decline of around 12%, which may yet recover. This is

due to several factors, but the main ones appear to be reduced opening hours

from staff shortages and a change in customer habits, either going out less or

going home earlier. There is also work to be done to encourage some of the

older customers to rediscover the pub and wean themselves off cheap supermarket

offers.

At the same time pubs face a broad front of increasing costs, particularly from

energy and whilst the government's intervention over the winter is extremely

helpful, it is not in itself a solution to longer term structural taxation

issues. Pubs are critical community assets and are overtaxed; the government's

review of business rates, due in the spring, must give them further relief and

other ways must be found through duty or VAT to provide them a sustainable

platform.

Our inns have performed very strongly over the past few years, but they are

facing a challenging market and whilst they traded up year on year their costs

have risen dramatically, particularly for food, meaning that margins are being

squeezed. In addition, the staycation market was much weaker this summer as

many people opted for overseas holidays.

HOTELS & SPAS

The hotels & spas have delivered a robust performance in sales, which are up by

27% year on year, however due to all of the factors already mentioned relating

to increases in their cost base and the withdrawal of government support,

profitability dropped by 4%. Sales are up approximately 13% on 2019, with

profits broadly flat in comparison, a statistic that paints the picture for the

rest of the market at the moment.

It has been encouraging to see demand from corporate customers recover, which

forms an important part of the hotel sales mix, and spa and treatment sales

have been another highlight as customers continue to treat themselves when they

visit us. Weddings have also performed well, as people have started to catch up

on celebrations that were postponed during the pandemic.

ACQUISITIONS, DEVELOPMENTS AND DISPOSALS

We have made no acquisitions during the period although we continue to look at

opportunities for high quality properties.

We have closed Langdale Chase and embarked upon the development and

repositioning of this hotel, which we acquired in 2017 and is situated on the

banks of Lake Windermere. This is a major undertaking and a significant

investment, due to reopen in November 2023, and we are very excited about its

prospects.

We have also continued to divest of pubs that no longer suit our requirements

and sold four properties in the period. We received total proceeds from these

disposals of £2.7m, making a profit on disposal of £1.3m.

EARNINGS PER SHARE

Earnings per share for the period is 22.6p per share, which compares to 10.7p

per share in 2021. The earnings per share has benefitted in each year from mark

to market gains on our interest rate swaps, these are unlikely to continue at

the same rate in the future.

DIVID

The Board is pleased to reinstate of an interim dividend at a rate of 0.75p per

share to be paid on 10 January 2023 to shareholders on the register on 9

December 2022. The Board will continue to review future dividend policy against

the significant economic headwinds that the business continues to face.

BOARD CHANGES

As previously announced, in line with the Yerburgh Family's Constitution, Oscar

Yerburgh passed on, by rotation, the role of family non-executive director to

his sister Rosy McKinley on 1 November 2022. I know that Oscar will continue to

take an active interest in the business, and is hugely supportive of, and

engaged in, its future development. I would like to thank him for his valuable

perspective and contribution to our board discussions over the past six years.

SUMMARY AND OUTLOOK

The Company has been sailing into strong headwinds in the first six months of

the year that are only strengthening. Despite that, our teams have continued to

deliver superb hospitality and service.

We have held the line in our relentless focus on quality, on which we will not

compromise. This has undoubtably cost us in the short term, in a market where

input costs are increasing, our margins are being eroded and our challenges

have been compounded by shortages of labour, which the government has done

nothing to address or alleviate. We have transitioned to a new world in which

we no longer rely on financial support from the government, and in doing so we

have absorbed cost increases, passed them on where we can and have held our

profits, which is a satisfactory performance.

The recent performance of the government has left people completely lost, and

between government turmoil and the relentless negativity of the media, customer

confidence is being rapidly eroded.

The cost of living is increasing, but people are beginning to adapt to

increasing costs, particularly on food, energy and mortgage rates. Although

this is likely to continue to present challenges, when people are in the mood

to go out and treat themselves, it seems that on average they are prepared to

spend a little bit more, a little bit less often.

The Company has fixed its own utility costs until March next year and is

watching the differential between spot energy prices and forward rates closely.

The fixed term loan with the Prudential offers us some protection against

rising interest rates, and they in turn alleviate pressure from both our

interest rate swaps and our legacy defined benefit pension schemes.

Despite the challenges that face us, we will find a way through the uncertain

and volatile world in which we find ourselves and whilst this winter is likely

to be extremely tough, we are investing for the future and are in a strong

financial position.

Richard Bailey

Chairman

2 November 2022

Profit and Loss Account for the six months ended 30 September 2022

Unaudited Unaudited Audited

6 months 6 months 12 months

ended ended ended

30 September 2022 30 September 31 March

£'m 2021 2022

£'m £'m

Turnover 57.9 47.8 96.0

Operating profit before property disposals 8.6 9.0 12.3

Property disposals 1.3 0.3 1.0

______ ______ ______

Operating profit 9.9 9.3 13.3

Net interest payable (2.0) (2.0) (4.0)

Gain on interest rate swaps measured at fair 7.6 0.5 3.8

value

Finance income (charge) on pension asset (liability) 0.2 (0.3) (0.4)

______ ______ ______

Profit on ordinary activities before taxation 15.7 7.5 12.7

Taxation (2.4) (1.2) (0.6)

______ ______ ______

Profit on ordinary activities after taxation 13.3 6.3 12.1

______ ______ ______

Earnings per share 22.6 p 10.7 p 20.6 p

Balance Sheet as at 30 September 2022

Unaudited Unaudited Audited

30 September 30 September 31 March

2022 2021 2022

£'m £'m £'m

Fixed assets

Tangible assets 293.9 285.2 292.9

Investments 0.6 0.8 0.6

______ ______ ______

294.5 286.0 293.5

Current assets

Stocks 0.8 0.7 0.7

Trade and other debtors 8.0 10.6 5.5

Cash at bank and in hand 2.9 8.1 5.4

______ ______ ______

11.7 19.4 11.6

Creditors due within one year

Trade and other creditors (21.9) (17.7) (20.6)

Loan capital and bank overdraft (19.0) (3.5) (22.0)

______ ______ _____

(40.9) (21.2) (42.6)

Net current liabilities (29.2) (1.8) (31.0)

______ ______ ______

Total assets less current liabilities 265.3 284.2 262.5

Creditors due after one year

Loan capital (45.0) (66.0) (45.0)

Deferred tax (3.7) - (3.6)

Interest rate swaps (2.8) (15.9) (11.4)

______ ______ ______

(51.5) (81.9) (60.0)

Net assets excluding pension asset (liability) 213.8 202.3 202.5

Pension asset (liability) 10.8 (19.5) 10.1

______ ______ ______

Net assets including pension asset (liability) 224.6 182.8 212.6

______ ______ ______

Capital and reserves

Called up share capital 14.7 14.7 14.7

Capital redemption reserve 1.1 1.1 1.1

Revaluation reserve 74.8 73.6 75.1

Profit and loss account 134.0 93.4 121.7

______ ______ ______

Equity shareholders' funds 224.6 182.8 212.6

______ ______ ______

NOTES:-

1. Basis of preparation

The interim accounts, which have not been audited, have been prepared on the

basis of the accounting policies set out in the Annual Report and Accounts for

the year ended 31 March 2022.

2. Taxation

The taxation charge is based on the estimated tax rate for the year.

END

(END) Dow Jones Newswires

November 02, 2022 05:00 ET (09:00 GMT)

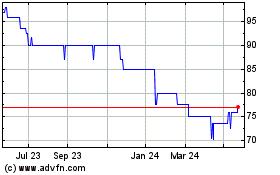

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Jan 2025 to Feb 2025

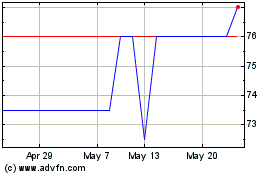

Daniel Thwaites (AQSE:THW)

Historical Stock Chart

From Feb 2024 to Feb 2025