TIDMTOM

RNS Number : 6175C

TomCo Energy PLC

14 June 2023

14 June 2023

TOMCO ENERGY PLC

("TomCo" or the "Company")

GBP500,000 Equity Fundraise

Cancellation of Convertible Loan Note Facility

TomCo Energy plc (AIM: TOM), the US operating oil development

group focused on using innovative technology to unlock

unconventional hydrocarbon resources, announces that the Company

has raised, in aggregate, gross proceeds of GBP500,000, by way of a

GBP400,000 placing (the "Placing") and a GBP100,000 subscription,

for, in aggregate, 625,000,000 new ordinary shares of no-par value

each in the capital of the Company ("Ordinary Shares") (together,

the "Fundraise Shares") at a price of 0.08 pence per share (the

"Fundraise").

The Fundraise Shares will represent approximately 20.7 per cent.

of the Company's enlarged issued share capital. The Fundraise price

represents a discount of approximately 18.8 per cent. to the

mid-market closing price on AIM of 0.0985 pence per Ordinary Share

on 13 June 2023, being the latest practicable business day prior to

the publication of this announcement.

The Placing was arranged by Novum Securities Limited ("Novum"),

the Company's broker. Accordingly, in connection with the Placing,

the Company has also agreed to issue 30,000,000 'broker' warrants

to Novum, giving them the right to acquire such number of new

ordinary shares at an exercise price of 0.08 pence for a period of

two years from the date of this announcement.

Novum has entered into an agreement with TomCo (the "Placing

Agreement") under which, subject to the conditions set out therein,

Novum has been instructed by TomCo to assume the duties of placing

agent to target subscribers for the Placing shares. The Placing

Agreement includes customary provisions including that the Placing

Agreement can be terminated, inter alia, if (i) there is a breach

of any material warranty, or any of the other obligations on the

Company which is material in the context of the Placing, and (ii)

in the reasonable opinion of Novum there has occurred a material

adverse change in the business of or the financial or trading

position of the Company, or (iii) the name or reputation of Novum

is likely to be prejudiced if it continues to act as placing

agent.

Cancellation of Convertible Loan Note Facility

On 30 March 2023, the Company entered into an unsecured

committed facility for up to GBP1,000,000 via a convertible loan

note instrument and associated subscription and put option

agreement (together, the "Convertible Loan"). As previously

announced, an initial GBP250,000 tranche of the Convertible Loan

was drawn down and GBP225,000 principal amount and associated

accrued interest thereon has already been converted. There remains

GBP25,000 principal amount outstanding under the Convertible Loan,

full details of which were set out in the Company's announcement of

30 March 2023.

The Convertible Loan has now been cancelled with the agreement

of the parties concerned such that no further amounts will be

available to be drawndown by the Company.

Background to the Fundraise

The Fundraise has been undertaken to materially replace the

abovementioned facility and provide additional funds to cover the

Company's anticipated expenditure as it progresses its plans for

Greenfield in relation to the Tar Sands Holdings II LLC ("TSHII")

site located in the Uinta Basin, Utah, United States. As previously

announced, Greenfield owns a 10% Membership Interest in TSHII with

an exclusive option, at its sole discretion, to acquire the

remaining 90% of the Membership Interests for additional cash

consideration of US$17.25 million up to 31 December 2023 (the

"Option"), together with a matching right as detailed in the

Company's announcement of 6 June 2023.

The Company remains in discussions to secure a potential funding

package for Greenfield, that would, inter alia, enable Greenfield

to ultimately exercise the Option and pursue its previously

announced wider development plans. These funding discussions have

taken significantly longer than expected, but the Company remains

in active discussions, as recently outlined in the Company's

announcement of 6 June 2023 to potentially dispose of a majority

stake in Greenfield to a partner(s) in return for, inter alia,

certain upfront cash consideration, a continuing minority equity

participation for TomCo in Greenfield (without the requirement for

further capital contributions from TomCo) and the provision of a

sizeable funding package to Greenfield. The Company remains

optimistic that an appropriate transaction can be successfully

agreed in Q3 2023, but continues to explore alternative funding

routes for Greenfield, including reserves based funding.

However, there can be no certainty that an appropriate funding

proposal for Greenfield will ultimately be successfully concluded

or as to the precise terms or structure of any such funding package

or alternative financing arrangements for Greenfield. Further

announcements will be made in due course as appropriate.

Admission and Total Voting Rights

Application will be made to the London Stock Exchange for the

625,000,000 Fundraise Shares to be admitted to trading on AIM

("Admission"). It is expected that Admission will become effective

and that dealings in the Fundraise Shares on AIM will commence at

8.00 a.m. on or around 28 June 2023.

On Admission, the Company's issued share capital will consist of

3,020,069,217 Ordinary Shares, each with one voting right. There

are no shares held in treasury. Therefore, the Company's total

number of Ordinary Shares and voting rights will be 3,020,069,217

and this figure may be used by shareholders following Admission as

the denominator for the calculations by which they will determine

if they are required to notify their interest in, or a change to

their interest in, the Company under the FCA's Disclosure Guidance

and Transparency Rules.

Enquiries :

TomCo Energy plc

Malcolm Groat (Chairman) / John Potter (CEO) +44 (0)20 3823 3635

Strand Hanson Limited (Nominated Adviser)

James Harris / Matthew Chandler +44 (0)20 7409 3494

Novum Securities Limited (Broker)

Jon Belliss / Colin Rowbury +44 (0)20 7399 9402

IFC Advisory Limited (Financial PR)

Tim Metcalfe / Florence Chandler +44 (0)20 3934 6630

For further information, please visit www.tomcoenergy.com .

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 as it forms part of

United Kingdom domestic law by virtue of the European Union

(Withdrawal) Act 2018, as amended by virtue of the Market Abuse

(Amendment) (EU Exit) Regulations 2019. .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEUOVRROBUNAUR

(END) Dow Jones Newswires

June 14, 2023 02:00 ET (06:00 GMT)

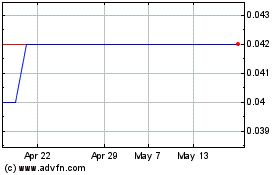

Tomco Energy (AQSE:TOM.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tomco Energy (AQSE:TOM.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025