TIDMVULC

RNS Number : 0183S

Vulcan Industries PLC

06 March 2023

6 March 2023

Vulcan Industries plc

("Vulcan" or the "Company")

Acquisition of Forepower Lincoln (250) Limited and Equity

Issue

Vulcan Industries plc (AQSE: VULC) is pleased to announce that

it has acquired the entire share capital of Forepower Lincoln (250)

Limited ("FPL 250"), a 240-megawatt (MW) Lithium-ion Battery

Storage project.

Acquisition rationale

Following the disposal of its legacy businesses, Vulcan has been

working to extend its portfolio of fabrication activities into the

renewable energy sector. Vulcan has been engaged with the vendor

over the last year to identify and develop a pipeline of Battery

Storage opportunities and this acquisition is the initial project

in this evolution. Further projects are expected to be brought into

the Vulcan Group in due course.

Forepower Lincoln (250)

FPL (250) is a 240MW Lithium-ion Battery Storage project and

holds a grid connection contract (to connect to the National Grid

Infrastructure) and an option to lease a parcel of land for a

minimum of 25 years. It has been identified as a major

infrastructure project which is currently in the pre-planning

stage. The management team of FPL(250) have a track record in

identifying Battery Storage opportunities, obtaining planning,

developing and bringing projects on line.

Vulcan offers the vendor the ability to raise the capital

necessary to develop the FPL (250) project. It is intended to raise

new equity capital initially to fund the working capital

requirements of the enlarged Group; continue the planning process

on the FPL (250) project and to further develop the pipeline of

opportunities.

It is intended to raise new equity capital, initially to fund

the working capital requirements of the enlarged Group; settle

existing liabilities of FPL (250) of GBP250,000; continue the

planning process on the FPL (250) project and to further develop

the pipeline of opportunities.

In the event that the FPL (250) project is sold, the profit on

disposal will be apportioned, with the first GBP1m payable to the

Vendor, the next GBP10m will be retained by the Company and the

remainder to be attributed 75% to the Company and 25% to the

Vendor.

The Company has entered an Introducers' Agreement with the

Seller, whereby Vulcan will be offered rights of first refusal on

all future battery storage projects. A fee of GBP10,000 per MW will

be payable on receipt of planning consent for each project.

Total Consideration

The total consideration payable is GBP2,600,000 to be satisfied

by the issue of 260,000,000 new ordinary shares of GBP0.0004 each

(the "Consideration Shares") at a price of 1p.

Following Admission, the Company's issued share capital will

comprise 870,527,605 ordinary shares of GBP0.0004 each, with each

share carrying the right to one vote.

In total, the Consideration Shares will represent approximately

29.87% of the enlarged share capital of the Company.

Admission

Application has been made for the 260,000,000 Consideration

Shares to be admitted to trading on Aquis Stock Exchange

('Admission'). Admission is expected to occur at 8:00am on or

around 10(th) March 2023.

Total Voting Rights

Following Admission, the Company's issued share capital will

comprise 870,527,605 ordinary shares of GBP0.0004 each, with each

share carrying the right to one vote.

The Company does not hold any ordinary shares in treasury. The

above figure of 870,527,605 may therefore be used by shareholders

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or of a

change to their interest in the Company under the FCA's Disclosure

and Transparency Rules.

Ian Tordoff, Executive Chairman, "We are delighted to be working

with the FPL (250) team to develop initially this exciting project

and subsequently the pipeline of projects that we have identified.

Battery Storage is an important part of the drive for increased

renewable energy in the UK and provides significant opportunities

for growth in future."

For further information, visit: https://vulcanplc.com

The directors of Vulcan accept responsibility for this

announcement.

TR-1: Standard form for notification of major holdings

NOTIFICATION OF MAJOR HOLDINGS (to be sent to the relevant issuer and

to the FCA in Microsoft Word format if possible) (i)

1a. Identity of the issuer or the Vulcan Industries plc

underlying issuer of existing shares

to which voting rights are attached

(ii) :

--------------------------------------------

1b. Please indicate if the issuer is a non-UK issuer (please mark with

an "X" if appropriate)

Non-UK issuer

----

2. Reason for the notification (please mark the appropriate box or boxes

with an "X")

An acquisition or disposal of voting rights X

----

An acquisition or disposal of financial instruments

----

An event changing the breakdown of voting rights

----

Other (please specify) (iii) :

----

3. Details of person subject to the notification obligation (iv)

Name Forepower Lincoln (250) Limited

City and country of registered office East Yorkshire, United Kingdom

(if applicable)

4. Full name of shareholder(s) (if different from 3.) (v)

Name

--------------------------------------------

City and country of registered office

(if applicable)

--------------------------------------------

5. Date on which the threshold was 3 March 2023

crossed or reached (vi) :

--------------------------------------------

6. Date on which issuer notified 3 March 2023

(DD/MM/YYYY):

--------------------------------------------

7. Total positions of person(s) subject to the notification obligation

% of voting % of voting rights Total of both Total number

rights attached through financial in % (8.A + of voting rights

to shares (total instruments 8.B) held in issuer

of 8. A) (total of 8.B (8.A + 8.B)

1 + 8.B 2) (vii)

------------------ --------------------- -------------- --------------------

Resulting situation

on the date

on which threshold

was crossed

or reached 29.87% 0 29.87% 260,000,000

------------------ --------------------- -------------- --------------------

Position of

previous notification

(if

applicable) 0 0 0

------------------ --------------------- -------------- --------------------

8. Notified details of the resulting situation on the date on which the

threshold was crossed or reached (viii)

A: Voting rights attached to shares

Class/type of Number of voting rights % of voting rights

shares (ix)

ISIN code (if possible)

Direct Indirect Direct Indirect

(DTR5.1) (DTR5.2.1) (DTR5.1) (DTR5.2.1)

------------------

ordinary shares

GB00BKMDX634 260,000,000 29.87%

------------------ ------------------ --------------------- ------------

SUBTOTAL 8. A 260,000,000 29.87%

-------------------------------------- -----------------------------------

B 1: Financial Instruments according to DTR5.3.1R (1) (a)

Type of financial Expiration Exercise/ Number of voting % of voting

instrument date (x) Conversion rights that may rights

Period (xi) be acquired if the

instrument is

exercised/converted.

----------- -------------------- -------------------------- ------------

SUBTOTAL 8.

B 1

-------------------- -------------------------- ------------

B 2: Financial Instruments with similar economic effect according to DTR5.3.1R

(1) (b)

Type of financial Expiration Exercise/ Physical Number % of voting

instrument date (x) Conversion or cash of voting rights

Period (xi) Settlement rights

(xii)

------------ --------------- ----------------- ------------

SUBTOTAL

8.B.2

----------------- ------------

9. Information in relation to the person subject to the notification

obligation (please mark the

applicable box with an "X")

Person subject to the notification obligation is not controlled

by any natural person or legal entity and does not control any other

undertaking(s) holding directly or indirectly an interest in the

(underlying) issuer (xiii)

Full chain of controlled undertakings through which the voting rights X

and/or the

financial instruments are effectively held starting with the ultimate

controlling natural person or legal entity (please add additional

rows as necessary) (xiv)

Name (xv) % of voting rights % of voting rights Total of both if

if it equals or through financial it equals or is

is higher than the instruments if it higher than the

notifiable threshold equals or is higher notifiable threshold

than the notifiable

threshold

---------------------- --------------------- ------------------------

Britt Foreman 29.87% 0 29.87%

---------------------- --------------------- ------------------------

10. In case of proxy voting, please identify:

Name of the proxy holder

-----------------------------------------------

The number and % of voting rights

held

-----------------------------------------------

The date until which the voting rights

will be held

-----------------------------------------------

11. Additional information (xvi)

Place of completion East Yorkshire, United Kingdom

Date of completion 3 March 2023

-------------------------------

Contacts

Vulcan Industries plc Via Vox Markets

Ian Tordoff, Chairman

------------------------

First Sentinel Corporate Finance Ltd (AQSE

Corporate Adviser) +44 7876 888 011

------------------------

Brian Stockbridge

------------------------

Jenny Liu

------------------------

Vox Markets (Media and Investor Relations) vulcan@voxmarkets.co.uk

------------------------

Kat Perez +44 7881 622 830

------------------------

Paul Cornelius + 44 7866 384 707

------------------------

About Vulcan

Vulcan seeks to acquire and consolidate traditional but

historically profitable engineering, manufacturing, and industrial

SMEs for value and to enhance this value in part through group

synergies, but primarily by unlocking growth which is not being

achieved as a standalone private company. For more information

visit https://www.voxmarkets.co.uk/listings/PLU/VULC

Forward Looking Statements

This news release may contain "forward-looking" statements and

information relating to the Company. These statements are based on

the beliefs of Company management, as well as assumptions made by

and information currently available to Company management. The

Company does not undertake to update forward--looking statements or

forward--looking information, except as required by law.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Upon the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NEXBBGDXBBGDGXL

(END) Dow Jones Newswires

March 06, 2023 06:13 ET (11:13 GMT)

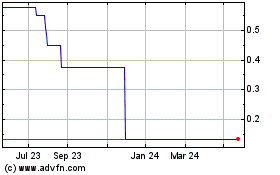

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vulcan Industries (AQSE:VULC)

Historical Stock Chart

From Nov 2023 to Nov 2024