Wynnstay Properties PLC Acquisition (9501V)

December 07 2023 - 1:00AM

UK Regulatory

TIDMWSP

RNS Number : 9501V

Wynnstay Properties PLC

07 December 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 as it forms part of UK domestic

law by virtue of the European Union (withdrawal) Act 2018. Upon the

publication of this announcement, this information is considered to

be in the public domain.

WYNNSTAY PROPERTIES PLC

("Wynnstay" or the "Company")

Acquisition

7 December 2023

Wynnstay is pleased to announce that it has exchanged contracts

for the acquisition from three members of the Gunne family of Units

1-4, 18a Wildmere Road, Banbury, OX16 3JU ("the Banbury Property")

and Unit 14, The IO Centre, Whittle Way, Stevenage, SG1 2BD ("the

Stevenage Property") for an aggregate cash consideration of

GBP2.525 million (the "Acquisition").

The Banbury Property is freehold and comprises two industrial

buildings, separately let to established national and regional

trade counter businesses, with service yards and an access road.

The total rent passing is GBP103,425 per annum. The net initial

yield is 6.0 per cent., which is anticipated to rise to provide a

reversionary yield of around 7.0 per cent. after a lease renewal or

reletting in 2025 and a rent review in 2026.

The Stevenage Property is held on a 999-year lease at a nominal

rent and comprises a mid-terrace industrial unit. The rent passing

on the single occupational sub-lease to an established national

trade counter business is GBP57,550 per annum. The net initial

yield is 6.0 per cent. which is anticipated to rise to provide a

reversionary yield of 7.2 per cent. after a rent review in

2026.

The total cost of the Acquisition, which includes stamp duty and

other acquisition costs, is anticipated to be slightly less than

GBP2.7 million and is predominantly being funded from Wynnstay's

cash resources, with approximately one-third being funded from

existing borrowing facilities.

The Acquisition in expected to complete at the beginning of

2024.

Commenting on the transaction Chris Betts, Managing Director of

Wynnstay, said:

"The acquisition of these highly accessible and well-let

properties broadens the geographic spread of Wynnstay's portfolio

and enhances our focus on the growth potential of the light

industrial/trade counter warehouse sector."

For further information please contact:

Wynnstay Properties Plc:

Chris Betts, Managing Director

020 7554 8766

W H Ireland (Nominated Adviser and Broker):

Hugh Morgan, Chris Hardie and Sarah Mather

020 7220 1666

LEI number: 2138006MASI24JYW5076

For more information visit: www.wynnstayproperties.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTFBPTMTAMBLJ

(END) Dow Jones Newswires

December 07, 2023 02:00 ET (07:00 GMT)

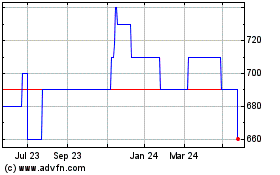

Wynnstay Properties (AQSE:WSP.GB)

Historical Stock Chart

From Jan 2025 to Feb 2025

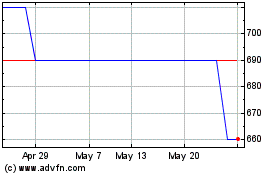

Wynnstay Properties (AQSE:WSP.GB)

Historical Stock Chart

From Feb 2024 to Feb 2025