TIDMZAM

RNS Number : 4621E

Zambeef Products PLC

30 June 2023

Zambeef Products plc

("Zambeef" or the "Group")

Interim results for the half-year ended 31 March 2023

Zambeef (AIM: ZAM), the fully integrated cold chain foods and

retail business with operations in Zambia, Nigeria and Ghana, today

announces its results for the half-year ended 31 March 2023.

Financial Highlights

Figures in 000's 2023 2022 % 2023 2022 %

ZMW ZMW USD USD

------------ ------------ ---------- ----------

Revenue 2,784,261 2,568,680 8.4% 158,738 148,136 7.2%

Change in fair value

of biological assets 484,630 381,567 27.0% 27,630 22,005 25.6%

Cost of sales (2,394,019) (2,096,854) 14.2% (136,489) (120,926) 12.9%

Gross profit 874,872 853,393 2.5% 49,879 49,215 1.4%

Administrative expenses (658,098) (597,097) 10.2% (37,519) (34,435) 9.0%

Distribution Expenses (68,801) (29,850) 130.5% (3,923) (1,721) 128.0%

Net impairment losses

on financial assets (449) - 100% (26) - 100%

Other (expenses)/income (47,950) 3,961 -1310.6% (2,734) 228 -1299%

Operating profit 99,574 230,407 -56.8% 5,677 13,287 -57.8%

Share of loss equity

accounted investment (1,415) (1,287) 10% (81) (74) 9.5%

Finance income - 113 -100% - 7 -100%

Finance costs (54,087) (58,413) -7.2% (3,084) (3,369) -8.5%

Profit before taxation 44,072 170,820 -74.2% 2,512 9,851 -74.5%

Taxation charge (14,405) (33,587) -57.1% (821) (1,937) -57.6%

Group income for

the year from continuing

operations 29,667 137,233 -78.4% 1,691 7,914 -78.6%

(Loss)/ Profit from

asset held for sale (10,654) 10,330 -203.1% (607) 596 -201.9%

Group income for

the period 19,013 147,563 -87.1% 1,084 8,510 -87.3%

EBITDA 229,377 310,422 -26.1% 13,078 17,902 -26.9%

Gross Profit Margin 31.4% 33.2% 31.4% 33.2%

EBITDA Margin 8.2% 12.1% 6.2% 12.1%

Debt/Equity (Gearing) 35.4% 14.9% 39.0% 14.9%

Debt-To-EBITDA 5.7 1.9 196.5% 6.9 1.8 153.6%

------------ ------------ --------- ---------- ---------- --------

PERFORMANCE OVERVIEW

The half-year period ended 31 March 2023 was characterised by a

difficult trading environment due to constricted consumer spending

amidst a tight monetary policy. This was further exacerbated by a

rise in the cost of key inputs and commodities which the Company's

operations rely upon. Compared to prior year comparative period,

the cost of maize purchased increased by ZMW80 million (USD 4.6

million), the cost of soya by ZMW25 million (USD1.4 million) and

the Company saw a sharp increase in agriculture inputs, by

approximately ZMW67 million (USD3.8 million). Key to note among the

various price increases was also the volatility in the price of

diesel, which in comparison to the previous period went up by ZMW

20 million (USD1.1 million). Invariably, these increased factors

impacted our cost of sales and these unanticipated increases could

not be fully passed on to the consumer and was contained by the

business.

The local currency experienced a steady depreciation against the

US Dollar with a sharp depreciation in March 2023 which resulted in

exchange losses of ZMW58 million (USD3.3 million). The key drivers

for the depreciation were the increased demand for the USD,

uncertainty over the debt restructuring and a sustained rise in

global interest rates affecting participation of offshore investors

in local bond auctions. The ZMW/USD exchange rate opened at K15.75

and ended at K21.31 (35% increase).

Despite the challenges highlighted, the Group posted volume

growth in most of its divisions as the momentum of the second half

of 2022 continued into the current period, aided by a meticulous

price moderation approach. The gross profit margin for the period

under review was 31.4%, a decrease of 1.8 percentage points from

prior year. The decline in gross margin despite a 9.2% growth in

revenue highlighted the impact of the escalation in our input costs

with cost of sales increasing by 39.1%.

The outbreak of Contagious bovine pleuropneumonia (CBPP) disease

towards the end of the last financial year continued to impact the

performance of our beef division in the current period.

The accelerated slaughter of cattle resulted in the depletion of

our cattle herd in the feedlot and, therefore, impacted supply at a

time when the Group aimed to build up cattle stock.

The Group generated revenue of ZMW 2.78 billion (USD 158.7

million) and achieved a gross profit of ZMW 874 million (USD 49.9

million) representing an increase of 8.4% and an increase of 2.4%

on the prior year comparative period in kwacha terms, and an

increase of 7.2% and decrease of 1.3% in US dollar terms,

respectively.

The Group delivered a half year operating profit of ZMW 99.6

million (USD 5.7 million), representing a decline of 56.8% in

kwacha terms (57.3% in US dollar terms), compared to ZMW

230.4million (USD 13.3 million) in the prior year comparative

period. Performance against prior year was impacted by

exceptionally higher price of soya beans and wheat in the prior

year from which the Cropping division benefited.

Finance costs reduced by 7.4% despite an elevated net debt

position owing to a reduction in exposure to foreign denominated

debt. The actions previously taken by the Group allowed for

reduction of currency risk.

The US$100 million expansion programme which commenced last year

is in progress with most of these projects expected to be concluded

in the coming financial year. This has resulted in an increase in

the Net debt to ZMW 1.4 billion (USD 67.4 million) at 31 March 2023

from ZMW 818 million ($45.3 million) at 31 March 2022. Of this

capex funding increase was ZMW 566 million (USD 32.2 million)

whilst working capital funding increase of ZMW 8.8 million (USD 0.5

million) primarily due to increased input costs.

Management continued optimising top line growth through revenue

management while the continued cost control measures positioned the

Group on the path to actualise its short to medium-term

strategy.

Commenting on these results, Chairman Mr. Michael Mundashi

said:

" The Group's performance demonstrates our ability to remain

resilient in the evolving market and illustrates the strengths of

our vertically integrated business model which is key to creating

long-term shareholder value.

The Board is committed to unlocking the value of its shares and

is actively engaging the Company's shareholder British

International Investments Plc, on the preference shares it

holds.

We remain excited as Zambeef remains well positioned to

capitalise on the opportunities ahead with the progress made in the

expansion of our cropping operation and investment in production

facilities."

Copies of Accounts the Interim Report for the half-year ended 31

March 2023 will shortly today be available on the Group's

website.

For further information, please visit www.zambeefplc.com

or contact:

Zambeef Products plc Tel: +260 (0) 211

369003

Faith Mukutu, Chief Executive Officer

M'boo Mumba, Chief Financial Officer

FinnCap Ltd (Nominated Adviser and Broker Tel: +44 (0) 20 7220

) 0500

Ed Frisby/Abigail Kelly (Corporate Finance)

Tim Redfern/Barney Hayward (ECM)

Autus Securities Limited Tel: +260 (0) 761 002 002

Mataka Nkhoma

About Zambeef Products PLC

Zambeef Products plc is the largest integrated cold chain food

products and agribusiness company in Zambia and one of the largest

in the region, involved in the primary production, processing,

distribution and retailing of beef, chicken, pork, milk, dairy

products, fish, flour and stockfeed, throughout Zambia and the

surrounding region, as well as Nigeria and Ghana.

It has 236 retail outlets throughout Zambia and West Africa.

The Company is one of the largest suppliers of beef in Zambia.

Five beef abattoirs and three feedlots are located throughout

Zambia, with a capacity to slaughter 230,000 cattle a year. It is

also one of the largest chicken producers in Zambia, with a

capacity of 8.8m broilers and 22.4 million-day-old chicks a year.

It is one of the largest piggeries, pig abattoirs and pork

processing plants in Zambia, with a capacity to slaughter 75,000

pigs a year, while its dairy has a capacity of 120,000 litres per

day.

The Group is also one of the largest cereal row cropping

operations in Zambia, with approximately 7,263 hectares of row

crops under irrigation, which are planted twice a year, and a

further 7,830 hectares of rainfed/dry-land crops available for

planting each year.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGZVRLDGFZM

(END) Dow Jones Newswires

June 30, 2023 02:00 ET (06:00 GMT)

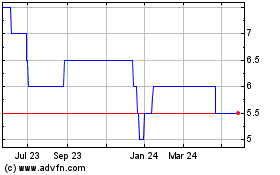

Zambeef Products (AQSE:ZAM.GB)

Historical Stock Chart

From Nov 2024 to Dec 2024

Zambeef Products (AQSE:ZAM.GB)

Historical Stock Chart

From Dec 2023 to Dec 2024