Australia Stocks Edge Slightly Higher; AGL Energy Stands Out

September 28 2016 - 2:12AM

Dow Jones News

By Robb M. Stewart

MELBOURNE--Australia's equities market managed only a slight

gain Wednesday as sharply weaker energy stocks following a drop in

oil prices offset gains by utilities and a modest recovery by most

of the big banks.

After an initial push higher, the market settled into a narrow

range for most of the session before finishing up 6.5 points, or

0.1%, at 5412.4. So far this week, the index is down 0.4% after

Tuesday's drop and a flat session Monday.

The utilities sector jumped 2.2%, led higher by AGL Energy Ltd.

after it announced plans to buy back 5% of its own shares and lift

the payout ratio for its dividend. The basket of energy stocks

dropped 1.2%, after an overnight slide in crude prices amid growing

investor skepticism that the Organization of the Petroleum

Exporting Countries will move closer to an agreement to limit

production. Shares in AGL jumped 5.8%.

Woodside Petroleum Ltd. lost 0.7%, Santos Ltd. sank 3.1% and

Origin Energy Ltd. dropped 3.7%.

After declining Tuesday, Australia & New Zealand Banking

Group Ltd. added 0.7%, Commonwealth Bank of Australia advanced 0.3%

and National Australia Bank Ltd. edged up 0.1%. Still, Westpac

Banking Corp. shed 0.1%.

Among the miners, BHP Billiton Ltd. fell 0.5%, South32 Ltd. was

0.4% lower and gold producer Newcrest Mining Ltd. was 2.7%

weaker.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

September 28, 2016 02:57 ET (06:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

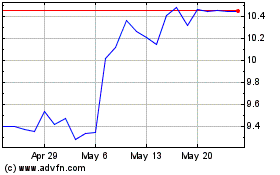

AGL Energy (ASX:AGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

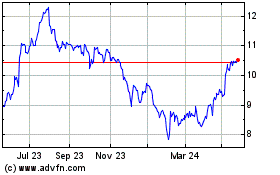

AGL Energy (ASX:AGL)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about AGL Energy Limited (Australian Stock Exchange): 0 recent articles

More Agl Energy Fpo News Articles