Amcor Limited (ASX: AMC) and Bemis Company, Inc. (NYSE: BMS)

announce another important step toward closing their all-stock

transaction. Unconditional antitrust clearance with no remedial

action has been received from the Brazilian Administrative Council

for Economic Defense (CADE).

The transaction remains subject to regulatory approval in the

United States. The companies are in advanced discussions with US

Department of Justice (DOJ) which includes the potential for

required remedies. Inclusive of remedies required by the European

Commission, collective potential remedies would represent an

immaterial proportion of the total sales for the combined company

and would not impact the USD 180 million of net cost synergies

expected to be delivered by the end of the third year following

completion.

As previously announced, completion of the transaction is

expected on 15th May 2019.

Cautionary Statement Regarding

Forward-Looking Statements

This communication contains certain statements that are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. Amcor Limited

(“Amcor”), its subsidiary Amcor plc

(f/k/a Arctic Jersey Limited) (“New

Amcor”) and Bemis Company, Inc. (“Bemis”) have identified some of these

forward-looking statements with words like “believe,” “may,”

“could,” “would,” “might,” “possible,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook”

or “continue,” the negative of these words, other terms of similar

meaning or the use of future dates. Forward-looking statements in

this communication include, without limitation, statements about

the anticipated benefits of the contemplated transactions,

including future financial and operating results and expected

synergies and cost savings related to the contemplated

transactions, the plans, objectives, expectations and intentions of

Amcor, New Amcor or Bemis and the expected timing of the completion

of the contemplated transactions. Such statements are based on the

current expectations of the management of Amcor or Bemis, as

applicable, are qualified by the inherent risks and uncertainties

surrounding future expectations generally, and actual results could

differ materially from those currently anticipated due to a number

of risks and uncertainties. None of Amcor, New Amcor or Bemis, or

any of their respective directors, executive officers or advisors,

provide any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any

forward-looking statements will actually occur. Risks and

uncertainties that could cause results to differ from expectations

include, but are not limited to: uncertainties as to the timing of

the contemplated transactions; uncertainties as to the approval of

the transactions by Bemis’ and Amcor’s shareholders, as required in

connection with the contemplated transactions; the possibility that

a competing proposal will be made; the possibility that the closing

conditions to the contemplated transactions may not be satisfied or

waived, including that a governmental entity may prohibit, delay or

refuse to grant a necessary approval; the effects of disruption

caused by the announcement of the contemplated transactions or the

performance of the parties’ obligations under the transaction

agreement making it more difficult to maintain relationships with

employees, customers, vendors and other business partners; the risk

that shareholder litigation in connection with the contemplated

transactions may affect the timing or occurrence of the

contemplated transactions or result in significant costs of

defense, indemnification and liability; uncertainties as to the

availability and terms of refinancing for the existing indebtedness

of Amcor or Bemis in connection with the contemplated transactions;

uncertainties as to whether and when New Amcor may be listed in the

US S&P 500 index and the S&P / ASX 200 index; uncertainties

as to whether, when and in what amounts future dividend payments

may be made by Amcor, Bemis or New Amcor; other business effects,

including the effects of industry, economic or political conditions

outside of the control of the parties to the contemplated

transactions; transaction costs; actual or contingent liabilities;

disruptions to the financial or capital markets; other risks and

uncertainties discussed in Amcor’s disclosures to the Australian

Securities Exchange (“ASX”), including

the “2018 Principal Risks” section of Amcor’s Annual Report 2018;

and other risks and uncertainties discussed in Bemis’ filings with

the U.S. Securities and Exchange Commission (the “SEC”), including the “Risk Factors” section of

Bemis’ annual report on Form 10-K for the fiscal year ended

December 31, 2018. You can obtain copies of Amcor’s disclosures to

the ASX for free at ASX’s website (www.asx.com.au). You can obtain

copies of Bemis’ filings with the SEC for free at the SEC’s website

(www.sec.gov). Forward-looking statements included herein are made

only as of the date hereof and none of Amcor, New Amcor or Bemis

undertakes any obligation to update any forward-looking statements,

or any other information in this communication, as a result of new

information, future developments or otherwise, or to correct any

inaccuracies or omissions in them which become apparent, except as

expressly required by law. All forward-looking statements in this

communication are qualified in their entirety by this cautionary

statement.

Legal Disclosures

No Offer or Solicitation

This communication is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law. No offer of

securities will be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Important Information Filed with the SEC and Registered with

ASIC

In connection with the contemplated transactions, New Amcor has

filed a Registration Statement on Form S-4 with the SEC that

includes a joint proxy statement of Bemis and prospectus of New

Amcor. The joint proxy statement/prospectus has been sent or given

to Bemis shareholders and contains important information about the

contemplated transactions. The S-4 has been declared effective by

the SEC. Shareholders are urged to read the joint proxy

statement/prospectus and other relevant documents filed with

the SEC carefully because they contain important information

about Bemis, Amcor, New Amcor, the contemplated transactions and

related matters. Investors and shareholders may obtain free

copies of the joint proxy statement/prospectus and other documents

filed with the SEC by Bemis, Amcor and New Amcor through the SEC’s

website (www.sec.gov).

In connection with the scheme of arrangement, which is part of

the contemplated transaction, Amcor has registered a Scheme Booklet

with ASIC that includes an independent expert’s report and a notice

of scheme meeting. The Scheme Booklet is an important document and

should be read carefully and in its entirety before Amcor

shareholders decide how to vote at the scheme meeting. A copy of

the Scheme Booklet has been sent to Amcor shareholders and will

otherwise be available on the ASX’s website (www.asx.com.au).

Amcor shareholders should carefully read the Scheme Booklet

prepared in relation to the transaction in its entirety before

deciding how to vote on the Scheme of Arrangement that is part of

the transaction. Bemis shareholders should carefully read the joint

proxy statement/prospectus, and any other relevant documents filed

by New Amcor or Bemis before making any voting or investment

decision.

This announcement does not contain all of the information

contained in the Scheme Booklet and S-4. For example section 1.2 of

the Scheme Booklet outlines the disadvantages of the transaction

and section 7 of the Scheme Booklet contains certain risk

considerations relating to the transaction that should also be

considered by Amcor shareholders, and the ‘Risk Factors’ section of

the S-4 outlines the risks relating to the transaction that should

also be considered by Bemis shareholders.

Participants in the Solicitation

Bemis, Amcor, New Amcor and their respective directors and

executive officers may be deemed to be participants in the

solicitation of proxies from Bemis shareholders in connection with

the contemplated transactions. Information about Bemis’ directors

and executive officers is set forth in its annual report on Form

10-K for the fiscal year ended December 31, 2018, including

Amendment No. 1 thereto, which may be obtained for free at the

SEC’s website (www.sec.gov).

Information about Amcor’s directors and executive officers is set

forth in its Annual Report 2018, which may be obtained for free at

ASX’s website (www.asx.com.au). Additional information regarding

the interests of participants in the solicitation of proxies in

connection with the contemplated transactions is included in the

joint proxy statement/prospectus that New Amcor has filed with the

SEC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190410005881/en/

CONTACTS FOR AMCOR:InvestorsTracey WhiteheadHead

of Investor RelationsAmcor Limited+61 3 9226

9028tracey.whitehead@amcor.com

Media – AustraliaJames StrongCitadel-MAGNUS+61 448 881

174jstrong@citadelmagnus.com

Media – EuropeTR ReidHead of Global CommunicationsAmcor

Limited+41 44 316 7674TR.Reid@amcor.com

Media – North AmericaDaniel YungerKekstCNC+1 212 521

4879daniel.yunger@kekstcnc.com

CONTACTS FOR BEMIS:InvestorsErin M.

WintersDirector of Investor RelationsBemis Company Inc.+1 920 527

5288

MediaMatthew Sherman / Sharon SternJoele Frank, Wilkinson

Brimmer Katcher+1 212 355 4449

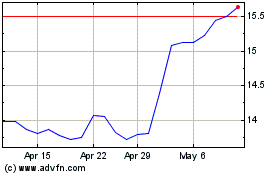

Amcor (ASX:AMC)

Historical Stock Chart

From Nov 2024 to Dec 2024

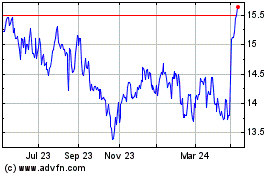

Amcor (ASX:AMC)

Historical Stock Chart

From Dec 2023 to Dec 2024