UPDATE: Fortescue Metals Shipments Increase, But Forex Pressures Margins

January 17 2011 - 9:12PM

Dow Jones News

Iron ore shipments by Fortescue Metals Group Ltd. (FMG.AU)

increased by 12.6% on year in the quarter ended Dec. 31 to 10.6

million metric tons, but the stronger Australian dollar kept up the

pressure on the miner's margins despite a 20% rise in its selling

prices.

The world's fourth-largest iron ore miner said its average

selling price was US$150 per dry metric ton, including cost and

freight at end-user ports, compared to US$125/ton in the previous

quarter.

Cash costs rose an identical 20% on the quarter to US$41.50/ton,

Fortescue said in its second-quarter production report.

Chief Financial Officer Stephen Pearce said US$3 of the US$6.67

increase in cash costs was down to the rise in the Australian

dollar, which rose 7.3% against the U.S. dollar from an average

91.5 U.S. cents to 98.8 cents over the quarter.

"The December quarter costs were clearly higher than we would

like and higher than our target levels," he said, although the

increase in prices was offsetting the impact of the rises. In both

quarters, the margin of sales prices above cash costs came to

72%.

Management said rainfall slowed some of the company's

construction activities and caused three iron ore cargoes carrying

a total 500,000 tons of ore to be deferred to the current

quarter.

A tropical cyclone bearing down on Australia's northwest coast

on New Year's Day caused the temporary closure of the Pilbara iron

ore region's two major bulk ports.

However, executive director Russell Scrimshaw said a backdrop of

rising iron ore prices left the company optimistic about its

prospects.

"The market is strong, demand is strong. I'd love to be able to

produce more but we're buoyant about the medium term," he said.

Fortescue expects to mine 40 million tons a year from its

Christmas Creek and Cloudbreak mines and is planning an US$8.4

billion expansion to 155 million tons a year of production in 2014,

which would put it on a par with the current output of Rio Tinto

PLC (RIO) and BHP Billiton Ltd. (BHP), the world's second and

third-biggest iron ore miners behind Brazil's Vale SA (VALE).

Fortescue's own share of ore shipped, excluding third-party

shipments, rose 9.4% on the year to 9.9 million tons, the miner

said, while the overburden removed to access ore bodies increased

50% to 39.5 million tons.

The miner's production was well ahead of the previous year but

slipped back from the record September quarter, when 11.1 million

tons of ore was mined and 10.1 million tons of Fortescue's

production was shipped.

The miner said it had sold a trial shipment to an Australian

steelmaker, understood to be BlueScope Steel Ltd. (BSL.AU) as the

only other steelmaker, OneSteel Ltd. (OST.AU), mines its own iron

ore.

"The initial sale was a trial shipment but we expect we will

have a continuing long-term relationship with that customer," said

Scrimshaw.

Fortescue said cash on hand increased by US$1 billion during the

quarter to US$2.37 billion. Two bond issues over the December

quarter raised US$3.54 billion in capital, although $2.04 billion

of that total was replacing an existing debt facility which was

repaid.

Australia's Bureau of Meteorology is predicting a

heavier-than-usual cyclone season in the Pilbara, with 11 or 12

storms expected before the cyclone season ends in April, of which

only two have formed so far.

Paul Hallam, director of operations, said the company hopes it

has been spared the impact of the weather. "We've got our fingers

crossed," he said. "We have been fortunate in not being impacted by

any major events since we started production."

The company said it wasn't worried by the impact of flooding in

Australia's Queensland state, which has caused disruptions to the

state's exports of hard coking coal that some analysts expect to

double the price of the commodity to US$400/ton or more.

That could have knock-on effects for iron ore demand, as the

tighter margins for steelmakers who use hard coking coal may cause

them to trim production, and thus iron ore purchases.

"We've already scheduled our shipments over the next few months

and the (iron ore) price has continued to adjust (upwards) over the

last few weeks while this bad weather has hit coking coal states,"

said Scrimshaw. "We think our book's pretty well covered."

Management also said they were unconcerned about moves by China

to raise interest rates, as they were only likely to affect

smaller, less profitable steel mills.

"There's probably more than 800 steel mills in China," said

Scrimshaw. "The largest 50 or so are our customers, and yes there

is consolidation going on (but) we're not concerned. We'd love to

have more stock to sell if we could," he said.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

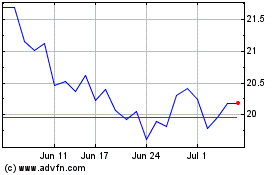

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Dec 2023 to Dec 2024