UPDATE: OneSteel Axes Jobs As Steelmaking Unit Posts A$188 Million Loss

August 15 2011 - 11:10PM

Dow Jones News

Australian steelmaker OneSteel Ltd. (OST.AU) will shed 400 jobs

within seven weeks and make further cuts in the long term, the

company said Tuesday, as it struggles with moribund domestic steel

demand and the effects of a high Australian dollar.

OneSteel said net profits in the year ending June 30 fell a

relatively modest 11% to A$230 million. But the core steel

manufacturing segment slipped to a A$188 million operating loss,

from a A$9.7 million profit last year.

The results underscore how a once-in-a-generation boom is

creating tensions within Australia's economy. While mining

companies are generating record profits from high commodity prices

and product sales to emerging economies like China, manufacturers

are facing shrinking margins due to rising costs and currency

swings.

Chief Executive Geoff Plummer said that cuts on the scale of

2009, when the company slashed 1,240 jobs in four months, could be

justified given the performance of the business. OneSteel currently

employs 11,598 people.

"People say, 'You can't keep doing that.' Well, back (in 2009)

we weren't losing money at the rate of A$188 million a year," he

told analysts on a conference call. "We can't cost cut our way to

prosperity but we do have to cost cut to reflect the circumstances

we're in. I'm not going to make public a target, but we're only

part way there."

The cuts would save A$40 million from OneSteel's wage bill and

be focused on the company's manufacturing and Australian

distribution divisions, where sales volumes are still 15%-20% below

their levels on the eve of the 2008 financial crisis.

OneSteel's woes come on the heels of its larger rival BlueScope

Steel Ltd. (BSL.AU), which last week announced a A$900 million

writedown to its business and signaled a possible closure of its

export business and one of its two blast furnaces. OneSteel's

Whyalla blast furnace is the only other such facility in

Australia.

The companies were both spun off from the world's largest miner

BHP Billiton Ltd. (BHP) at the start of the last decade. While

BlueScope's more advanced steel mill caused the company's shares to

outperform in the early part of the decade, OneSteel has since

crept ahead as rising raw materials costs and the strength of the

Australian dollar have hurt its rival.

In contrast to BlueScope, which analysts expect to report a A$1

billion full-year loss later this month, OneSteel has been

relatively insulated owing to its ownership of iron ore mines

producing six million tons of material a year. Operating profits at

OneSteel's iron ore division climbed 57% to A$523.5 million, more

than compensating for the losses from the rest of the business.

On the underlying basis preferred by equity analysts, which

excludes one-off and accounting items, group net profits fell 2.5%

to A$235 million in the 12 months to the end of June, the company

said. This was roughly in line with the average A$236.2 million

forecast by five analysts polled by Dow Jones Newswires.

Analysts have suggested the best outcome for Australia's

beleaguered steelmaking sector could be a combination of

BlueScope's more advanced blast furnaces with OneSteel's access to

cheap raw materials.

Plummer acknowledged that a much stronger Australian dollar

could bring about that outcome, but refused to say where he saw

that level.

"Is there a set of circumstances where it makes sense?

Potentially," he said. "If (the dollar) gets to $1.10, $1.20, or

$1.30 you've clearly got to look at your business in that frame.

But I'm not going to define what's the tipping point."

At 0335 GMT, the Australian dollar was worth $1.05 against the

U.S. dollar.

OneSteel declared an unfranked final dividend of 4 cents,

compared to 6.4 Australian cents expected by the analysts and 6

cents declared at annual results last year.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689; david.fickling@dowjones.com

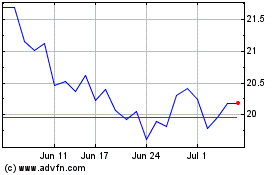

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Bluescope Steel (ASX:BSL)

Historical Stock Chart

From Feb 2024 to Feb 2025