By William Wilkes

BERLIN -- Rocketing demand and prices for lithium, coupled with

China's stranglehold on supply, are reviving interest in mining

Europe's reserves of the coveted metal some call white

petroleum.

Prices for lithium used in the batteries that power anything

from mobile phones to Teslas more than doubled to $21,000 a ton in

the past two years. Analysts expect the lithium-ion battery market

to surpass $90 billion by 2025 as electric vehicles become

commonplace and growing use of wind and sun power forces utilities

to invest in large electricity storage facilities.

But while European businesses use 25% of the world's lithium, a

group of Chinese companies has secured a potential stranglehold on

the Australian and South American mines that produce almost all the

world's battery-grade metal. That has sent a small group of

pioneers on a race to reopen European mines where the conditions

that gave rise to such lowly metals as tin have left lithium-rich

rocks and hot brines.

The race for European lithium echoes similar efforts in Japan to

track down metals for use in batteries amid concern about China's

hegemony over other minerals used in batteries and electric

vehicles.

For now, the best candidates for lithium are in Germany and the

Czech Republic where companies have successfully mined and produced

battery-grade lithium and hope to sell it to the numerous car

manufacturing plants dotted around central Europe. And in the U.K.,

Portugal and Sweden and Britain's Cornwall region, companies are

drilling bore holes and building 3-D maps of underground lithium

deposits.

One German firm, Deutsche Lithium GmbH, was recently granted a

30-year mining license and has already scooped out 100 tons of

lithium-yielding rock as it fine-tunes its extraction processes.

The company said it could eventually mine 15,000 tons a year.

Meanwhile, Australian mining company European Metals Ltd. has

extracted battery-grade lithium from its mine in the Czech Republic

and is finalizing a $400 million pitch to investors to scale up

production.

Geologists at Cornish Lithium Ltd., a startup scouring for

lithium in the U.K.'s historic tin-mining region of Cornwall, is

using satellite images to search for rock formations and vegetation

patterns typical of lithium-rich grounds -- and even poring over

the yellowing diaries of long-dead tin miners for clues as to where

lithium-rich underground springs may be hidden.

"It's a fascinating moment in the history of mining," said

Richard Shaw, geologist at the British Geological Survey.

Lithium's light weight makes it perfect for use in batteries,

which generate more electricity per unit of weight than any other

conceivable chemistry, according to researchers. Invented by Exxon

in the 1970s and made cheaper and safer since, lithium-ion

batteries are now ubiquitous.

For now, Chinese companies dominate global lithium supply. Last

year, auto maker Great Wall Motor bought a $28 million stake in

Pilbara Mineral, an Australian lithium mine and signed a contract

for a delivery of 150,000 tons of lithium-yielding spodumene from

the company's mine in Western Australia.

China's Ganfeng Lithium holds 20% of an Argentine project.

Chinese firm Tianqi Lithium's has attracted regulator attention in

Chile due to its $4 billion bid to buy a stake in SQM, the world's

second biggest lithium producer. Combined, the companies would

control 70% of the world lithium market.

But with Europe's car makers now set on mass-producing electric

vehicles, the need for the continent to secure its own lithium

reserves is gaining urgency.

"We hope to sell into the upswing in European electric car

manufacturing that'll take place in the mid-2020s," said Keith

Coughlan, director of European Metals Ltd., an Australian-Czech

firm looking for lithium on the Czech side of the border.

Lithium is easy to find. But only the richer seams or brines

will yield enough of the metal to make mining it profitable. If

enough dense deposits can be found, Europe could produce lithium

for around $4,000 per metric ton, according to Martin Bertau,

professor of mining and geology at the University of Freiberg. That

is in line with the cost of Australian production and well below

last year's peak price of $21,000.

Speculators probing the ground on either side of the

German-Czech border think they can profitably produce lithium from

zinnwaldite, a mineral often found encased in granite-like

rocks.

"Using historic mines," said Mr. Coughlan, the Australian

speculator said, "saves a huge amount of time and money compared to

digging a new mine."

Mr. Coughlan said his company would also mine tin at the site,

raising the productivity of the enterprise and offering a hedge if

lithium prices fall.

Gerard Reid, a founding partner at Alexa Capital, a London

corporate-finance firm specializing in energy technology and

infrastructure, said the small outfits now scouring the continent

would struggle to gain critical mass without the help of

deep-pocketed mining giants like Rio Tinto or Glencore.

But Armin Müller, founder of Deutsche Lithium, thinks German

auto makers, late to the electric-car revolution, might want a

local source of lithium if tweaks to Germany's capricious energy

policies mean car makers must account for the carbon footprint of

sourcing raw materials.

Mr. Müller's firm plans to keep the whole battery-grade lithium

production process in Saxony, East Germany, within driving distance

of Volkswagen's sprawling Wolfsburg car plant in the western state

of Lower Saxony.

Deutsche Lithium would mine and crush zinnwaldite in Altenberg

before transporting lithium fragments for chemical purification in

nearby Dresden. The processes would be governed by stringent German

and European laws.

Thomas Kerstin, Altenberg's mayor, said the town was supportive

of reopening the mine shafts closed after German reunification in

the 1990s -- an enticing prospect for the economically struggling

region.

"It feels like the town could get its soul back," Mr. Kerstin

said.

Write to William Wilkes at william.wilkes@wsj.com

(END) Dow Jones Newswires

April 13, 2018 05:44 ET (09:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

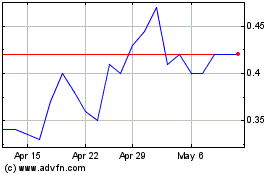

European Metals (ASX:EMH)

Historical Stock Chart

From Feb 2025 to Mar 2025

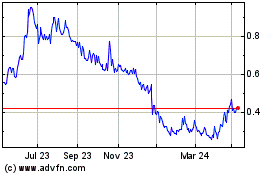

European Metals (ASX:EMH)

Historical Stock Chart

From Mar 2024 to Mar 2025