ERA: Weak Uranium Prices, Weak USD Makes Projects Uneconomic

November 09 2009 - 5:08PM

Dow Jones News

Uranium miner Energy Resources of Australia Ltd. (ERA.AU), a

unit of Rio Tinto Plc (RTP), said Tuesday weak uranium prices as

well as the weak U.S. dollar would render new mining projects

uneconomic in the longer-term.

This would leave the market heavily dependent on expansions in

Kazakstan, in an industry where the global financial crisis was

likely to slow new reactor build in Western countries "but probably

not in China," ERA said in a statement.

In the short-term, spot uranium prices are set to stay volatile

in an uncertain market, where supply disruptions are adding to

jittery prices, ERA said.

The current spot price, which has fallen to around US$50 a pound

from over US$60/lb before the onset of the financial crisis, did

not reflect current long-term fundamentals, ERA said.

Longer-term prices have trended sideways to lower but have held

above US$60/lb.

ERA is the world's fourth largest uranium producer, and operates

two mines in Australia's Northern Territory.

-By Elisabeth Behrmann, Dow Jones Newswires;

61-2-8272-4689 elisabeth.behrmann@dowjones.com

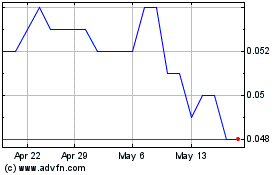

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jun 2024 to Jul 2024

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jul 2023 to Jul 2024