Energy Resources Of Australia Woes Continue, Shares Down 10%

January 27 2011 - 9:32PM

Dow Jones News

Energy Resources of Australia Ltd. (ERA.AU) on Friday forecast

uranium production in 2011 to be similar to the subdued levels it

mined in 2010 as wet weather disrupts its operations and it nears

the bottom of its Ranger pit in Australia's Northern Territory.

Shares in the Rio Tinto Ltd. (RIO.AU) subsidiary plunged 10%

after it also scrapped its final dividend and reported a 2010 net

profit of A$47.0 million, at the bottom end of its recently

delivered guidance of A$45 million-A$55 million.

Lower production due to wet weather and complex geology at the

bottom of the pit, along with lower realized uranium prices and a

strong Australian dollar, contributed to the 83% fall in

profit.

Making matters worse, ERA said that in response to a

higher-than-average wet season to date it will suspend plant

processing operations for 12 weeks.

"As a consequence of the processing suspension, ERA's 2011

production of uranium oxide is expected to be at a similar level to

2010; however, actual production will depend on the actual level of

rainfall for the remainder of the wet season," it said.

Last year, ERA paid a final dividend of 25 cents per share, but

it decided not to pay one for 2010 due to uncertainty surrounding

its first half production.

-By Ross Kelly, Dow Jones Newswires; 61-2-8272-4692;

Ross.Kelly@dowjones.com

Order free Annual Report for Rio Tinto PLC

Visit http://djnweurope.ar.wilink.com/?ticker=GB0007188757 or

call +44 (0)208 391 6028

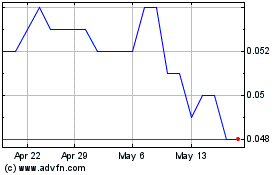

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Energy Resources Of Aust... (ASX:ERA)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Energy Resources Of Australia Limited (Australian Stock Exchange): 0 recent articles

More Energy Resources Of Australia News Articles