Janus Henderson Group plc (NYSE/ASX: JHG) today announced the

launch of five actively managed sustainable exchange-traded funds

(ETFs) for investors in the U.S.

Janus Henderson’s Sustainable ETF Solutions include three equity

and two fixed income ETFs, including:

- U.S. Sustainable Equity ETF (SSPX),

- International Sustainable Equity ETF (SXUS),

- Net Zero Transition Resources ETF (JZRO),

- Sustainable Corporate Bond ETF (SCRD), and

- Sustainable & Impact Core Bond ETF (JIB).

Actively managed by four established teams across three

continents, the new ETFs draw on the firm’s 30-year heritage of

sustainable investing and commitment to providing differentiated

ETF solutions. This launch is a part of Janus Henderson’s

significant efforts over the last two years to more centrally

engage in a wide range of environmental, social and governance

(ESG) related efforts within the firm’s investment teams and

client-facing professionals, as well as from a corporate

perspective, and to grow its offering of actively managed ETFs.

The Portfolio Managers for the funds include Hamish

Chamberlayne, CFA; Aaron Scully, CFA; Daniel Sullivan; Darko

Kuzmanovic; Tal Lomnitzer, CFA; Tim Gerrard; Michael Keough; Brad

Smith; Greg Wilensky, CFA; and Nick Childs, CFA.

“The launch of this comprehensive suite of sustainable ETFs is

designed to showcase Janus Henderson’s intention to help investors

embrace sustainability in an authentic way, without sacrificing a

commitment to robust investment results. These ETFs also represent

the intersection of two very significant growth opportunities for

Janus Henderson, our ETF franchise, and the surge in client demand

for robust ESG solutions,” said Nick Cherney, Head of Exchange

Traded Products of Janus Henderson.

Investors are increasingly considering how their route to

achieving financial goals impacts the world around them. Janus

Henderson’s Sustainable ETF Solutions seek to deliver strong,

risk-adjusted returns by identifying companies supportive of

positive ESG change.

“To us, sustainability is a logical and critical component of a

robust investment process. And it is our belief that addressing

complex and nuanced factors such as climate change and social

issues in a meaningful way requires an active and engaged

investment approach. It is through detailed analysis and regular

interaction with companies that we believe true progress and sound

investment decisions can be made,” said Paul LaCoursiere, Global

Head of ESG Investments.

Janus Henderson’s pioneering Global Sustainable Equities

franchise has an extensive track record in sustainable investing

with its first product launch in 1991, and the firm was a founding

signatory of the UN Principles for Responsible Investment in 2006.

With this launch, the firm is building on that commitment by

expanding a global ESG framework, which supports the investment

teams behind these ETFs.

Notes to editors

About Janus Henderson

Janus Henderson Group (JHG) is a leading global active asset

manager dedicated to helping investors achieve long-term financial

goals through a broad range of investment solutions, including

equities, fixed income, quantitative equities, multi-asset and

alternative asset class strategies.

At 30 June 2021, Janus Henderson had approximately US$428

billion in assets under management, more than 2,000 employees, and

offices in 25 cities worldwide. Headquartered in London, the

company is listed on the New York Stock Exchange (NYSE) and the

Australian Securities Exchange (ASX).

Investing involves risk, including the possible loss of

principal and fluctuation of value. Past performance is no

guarantee of future results. There is no assurance the stated

objective(s) will be met.

Please consider the charges, risks, expenses and investment

objectives carefully before investing. For a prospectus or, if

available, a summary prospectus containing this and other

information, please call Janus Henderson at 800.668.0434 or

download the file from janushenderson.com/info. Read it carefully

before you invest or send money.

Equity and fixed income securities are subject to various

risks including, but not limited to, market risk, credit risk and

interest rate risk.

Foreign securities are subject to additional risks including

currency fluctuations, political and economic uncertainty,

increased volatility, lower liquidity and differing financial and

information reporting standards, all of which are magnified in

emerging markets.

Securitized products, such as mortgage- and asset-backed

securities, are more sensitive to interest rate changes, have

extension and prepayment risk, and are subject to more credit,

valuation and liquidity risk than other fixed-income

securities.

Natural resources industries can be significantly affected by

changes in natural resource supply and demand, energy and commodity

prices, political and economic developments, environmental

incidents, energy conservation and exploration projects.

Environmental, Social and Governance (ESG) or sustainable

investing considers factors beyond traditional financial analysis.

This may limit available investments and cause performance and

exposures to differ from, and potentially be more concentrated in

certain areas than, the broader market.

Actively managed portfolios may fail to produce the intended

results. No investment strategy can ensure a profit or eliminate

the risk of loss.

Not all products or services are available in all

jurisdictions.

Janus Capital Management LLC is the investment adviser and ALPS

Distributors, Inc. is the distributor. ALPS is not affiliated with

Janus Henderson or any of its subsidiaries.

Janus Henderson is a trademark of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210909005174/en/

Media: Sarah Johnson, +1 720-364-0708

sarah.johnson@janushenderson.com Investor Relations: Jim Kurtz,

303-336-4529 jim.kurtz@janushenderson.com

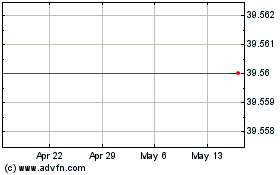

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Jan 2025 to Feb 2025

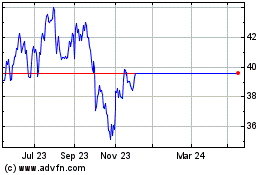

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Feb 2024 to Feb 2025