Janus Henderson’s Decarbonisation Panel at COP26 Inspires New Emerging Market Report

November 10 2021 - 5:00AM

Business Wire

Janus Henderson has today announced it will launch a new series

of reports investigating decarbonisation and the part governments,

corporates, capital markets, and asset managers need to play to

facilitate further decarbonisation across the world.

At the World Climate Summit in Glasgow on Monday, Janus

Henderson convened a panel to discuss whether decarbonisation could

be an opportunity for emerging markets, rather than a challenge to

mitigate.

Paul LaCoursiere Global Head of ESG Investments at Janus

Henderson who moderated Monday’s panel said: “Our panel

was the jumping off point. There are success stories like Chile

where markets are already in the midst of their own decarbonisation

journey. Our reports will set out the role that needs to be played

by governments, corporates, capital markets, and asset managers to

facilitate further decarbonisation. The asset management industry

is hungry to play its part in resolving the existential risk of

climate change, but it cannot solve this problem alone. Our new

series of reports will outline the role we all need to play in

helping emerging markets decarbonise.”

For the purposes of the report, emerging markets will be divided

into four regions: Eastern Europe; Africa and the Middle East;

Latin America and Asia. The first of the four regional reports will

be published in the first quarter of 2022.

The panel culminated with some bold conclusions:

Dr Nina Seega, Research Director at the Cambridge Institute

of Sustainable Leadership (CISL): “Financial markets

participants and climate scientists must recognise the gap that

exists between their thinking about the carbon transition. As an

economic community, we tend to think the future will be linear and

will broadly follow the pattern of the past. Climate scientists

think in terms of disruptive transition. While financial analysts

may worry about the effect that the slow but steady carbon

transition will have on the net present value of legacy assets, a

climate scientist would ask: what happens to the value of an asset

under a quick and potentially painful disruptive transition from

climate change? Overall, this was an encouraging COP but now I want

to see more ambitious Nationally Determined Contributions from

governments.”

Mark Cutifani, Chief Executive Officer at Anglo American Plc,

said: “COP26 has firmly shifted the conversation from the

“Why?” to “How?” around decarbonisation. We all understand that we

have a collective role to play in addressing climate change and now

the focus is on how we must work in partnership with multiple

stakeholders – such as governments, regulators, local communities –

to define the actions we need to take. We currently have several

requests from asset owners to help finance our various green

projects and our CFO is looking at these various financing

options.”

Krista Tukiainen, Head of Research at Climate Bonds

Initiative, said: “The fixed income space already has

relatively good definitions and governance mechanisms to ensure

projects can be financed, but market and policy-based mechanisms

can work better in tandem to deliver impact in emerging markets. My

reflection on this COP is that the introduction of a global

baseline taxonomy is perhaps the single most crucial element in

enabling financial institutions to make a tangible impact in

addressing climate change and other sustainability priorities

sooner rather than later. Taxonomies can help identify eligible

projects even at the smallest levels and, if we can harmonise

taxonomies in a scattered marketplace, this will ensure capital

flows where it needs to.”

Francisco López, Chile’s Vice Minister of Energy:

“Chile’s goal of achieving Carbon Neutrality by 2050 is a

challenge, given the need to decouple our economic growth from

energy consumption and reduce our dependence on imported fossil

fuels. 77% of Chile’s Green House Gas emissions are linked to the

energy sector. However, this is the same sector that will help us

tackle climate change and bring both social and economic

opportunities to the country. The energy sector is leading Chile’s

decarbonization plan and commitment to reach carbon neutrality by

2050 through investing in renewable energy, developing a green

hydrogen industry, withdrawing from coal-fired power plants by

2040, replacing fossil fuels with electricity in the transport

sector and aiming to have 100% electric light and medium vehicle

sales by 2035, amongst other things.”

To view the full recording of the panel, please contact Stephen

Sobey, Head of Media Relations.

Notes to editors

Janus Henderson Group (JHG) is a leading global active asset

manager dedicated to helping investors achieve long-term financial

goals through a broad range of investment solutions, including

equities, fixed income, quantitative equities, multi-asset and

alternative asset class strategies.

At 30 September 2021, Janus Henderson had approximately US$419

billion in assets under management, more than 2,000 employees, and

offices in 25 cities worldwide. Headquartered in London, the

company is listed on the New York Stock Exchange (NYSE) and the

Australian Securities Exchange (ASX).

This press release is solely for the use of members of the

media and should not be relied upon by personal investors,

financial advisers or institutional investors. We may record

telephone calls for our mutual protection, to improve customer

service and for regulatory record keeping purposes.

Issued by Janus Henderson Investors. Janus Henderson Investors

is the name under which investment products and services are

provided by Janus Capital International Limited (reg no. 3594615),

Henderson Global Investors Limited (reg. no. 906355), Henderson

Investment Funds Limited (reg. no. 2678531), Henderson Equity

Partners Limited (reg. no.2606646), (each registered in England and

Wales at 201 Bishopsgate, London EC2M 3AE and regulated by the

Financial Conduct Authority) and Henderson Management S.A. (reg no.

B22848 at 2 Rue de Bitbourg, L-1273, Luxembourg and regulated by

the Commission de Surveillance du Secteur Financier). Henderson

Secretarial Services Limited (incorporated and registered in

England and Wales, registered no. 1471624, registered office 201

Bishopsgate, London EC2M 3AE) is the name under which company

secretarial services are provided. All these companies are wholly

owned subsidiaries of Janus Henderson Group plc. (incorporated and

registered in Jersey, registered no. 101484, with registered office

at 13 Castle Street, St Helier, Jersey, JE1 1ES).

[Janus Henderson, Janus, Henderson, Intech, VelocityShares,

Knowledge Shared, Knowledge. Shared and Knowledge Labs] are

trademarks of Janus Henderson Group plc or one of its subsidiaries.

© Janus Henderson Group plc.

D10035

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211110005415/en/

Press Enquiries

Janus Henderson Investors

Stephen Sobey Head of Media Relations T: +44 (0) 2078182523 E:

Stephen.sobey@janushenderson.com

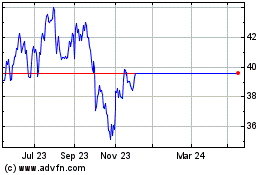

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Janus Henderson (ASX:JHG)

Historical Stock Chart

From Jan 2024 to Jan 2025