LG Chem to Take Stake in Piedmont for $75 Million

February 16 2023 - 7:13PM

Dow Jones News

By Kwanwoo Jun

LG Chem Ltd. is buying a 5.7% stake in U.S. mining company

Piedmont Lithium Inc. for $75 million, strengthening its presence

in the North American battery-material supply chain.

The South Korean company said in a regulatory filing early

Friday that it plans to buy about 1.1 million of Piedmont's common

shares on Feb. 23.

Under a separate offtake deal reached by both sides, Piedmont

will supply LG Chem with 200,000 tons of spodumene concentrate, a

high-purity lithium ore, over the next four years.

The agreements illustrate tax credits and other benefits that

the U.S. Inflation Reduction Act grants to battery industries.

Lithium is one of the key materials needed to make batteries.

"We welcome LG Chem as a shareholder in Piedmont and are excited

to partner with them to supply North American lithium that will

meet the requirements of the IRA and support the development of the

U.S. battery supply chain," Piedmont President and CEO Keith

Phillips said in a press release.

"This agreement allows LG Chem to provide differentiated values

to North American customers with products that satisfy IRA

standards by preemptively securing raw materials in the U.S., our

key market," LG Chem Vice Chairman and CEO Shin Hak-cheol said in

the release.

LG Chem plans to build a $3 billion factory in Clarksville,

Tennessee, to supply battery materials for electric vehicles. LG

Chem is the parent company of South Korea-based EV battery maker LG

Energy Solution Ltd.

Write to Kwanwoo Jun at kwanwoo.jun@wsj.com

(END) Dow Jones Newswires

February 16, 2023 19:58 ET (00:58 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

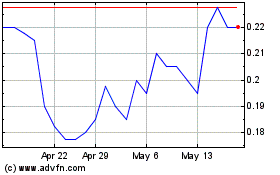

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Piedmont Lithium (ASX:PLL)

Historical Stock Chart

From Jan 2024 to Jan 2025