S&P/ASX 200 Hits 5-Week Low in Broad Declines

October 08 2013 - 7:56PM

Dow Jones News

0026 GMT [Dow Jones] Australia's S&P/ASX 200 is down 0.3% at

5135.4 after hitting a five-week low of 5118.9 in broad-based

declines after sharp falls on Wall Street as the U.S. budget and

debt ceiling impasse continues. BHP (BHP.AU), Westpac (WBC.AU),

Telstra (TLS.AU), Woodside (WPL.AU) and Fortescue (FMG.AU) are

holding ground but ANZ (ANZ.AU), NAB (NAB.AU), CSL (CSL.AU), Rio

Tinto (RIO.AU) and QBE (QBE.AU) are down 0.3%-1.5%. "It's really

turning off investors at the moment," Anson Rosewall, BBY's U.S.

based director of Australian research sales said of the U.S. debt

crisis. "The most concerning thing is that one-month U.S. Treasury

bill yields have hit their highest level since 2008." But Mr.

Rosewall says Australian shares could benefit from the change of

government last month. Despite a reduction in Westpac's consumer

sentiment index this month consumer and business confidence remain

relatively high. "The picture has changed now that we have a

pro-business and pro-economy government in power," Mr. Rosewall

says. He also points to signs of private-equity interest in the

resources sector as positive for Australian shares.

(david.rogers1@wsj.com)

Contact us in Singapore. 65 64154 140; MarketTalk@dowjones.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

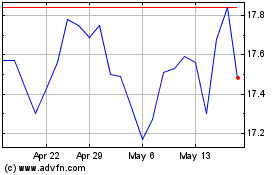

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Nov 2024 to Dec 2024

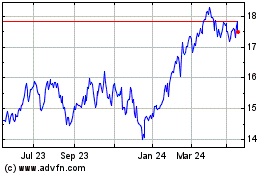

QBE Insurance (ASX:QBE)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about QBE Insurance Group Limited (Australian Stock Exchange): 0 recent articles

More QBE Insurance News Articles