Rio Tinto on 'Encouraging' 3Q Iron-Ore Performance Trends -- Commodity Comment

October 17 2022 - 6:34PM

Dow Jones News

Rio Tinto PLC on Tuesday downgraded its refined-copper

production guidance for 2022 and said it expects Australian

iron-ore shipments to be at the low end of an earlier forecast

range. Here are some remarks from its third-quarter operational

report.

On its iron-ore shipments:

"We produced 84.3 million [metric tons] in the third quarter, 1%

higher than the corresponding period of 2021, and 7% higher than

the prior quarter with continued commissioning and ramp-up of

Gudai-Darri and Robe Valley. We produced less SP10 this quarter

compared to the prior quarter.

"Third quarter shipments of 82.9 million tons were 1% lower than

the third quarter of 2021, and 4% higher than the prior quarter

despite two unplanned rail outages on the Yandicoogina and

Gudai-Darri lines. The investigation into the Gudai-Darri

derailment is ongoing. There were some encouraging performance

trends in the third quarter in relation to mine material movements,

build-up of run of mine ore stocks and continued ramp up of new

projects."

On the iron-ore market:

"Iron ore Platts CFR prices trended down from $120/dmt [dry ton]

to $96/dmt during the third quarter as the loss of confidence in

China's property market and Covid-related disruptions to

construction activity curtailed China's steel production and

consumption by circa 9% August year to date versus the same period

of 2021. The major iron ore producers shipped the same aggregate

volume during the first three quarters of 2022 as they did over the

same period of 2021. With supply from other producers down 17% year

to date--due to, among other factors, the war in Ukraine and export

taxes in India--total seaborne supply contracted 4.5% during August

year-to-date versus the same period of 2021."

On its aluminum production:

"Aluminum production of 0.8 million tons was 2% lower than the

third quarter of 2021, and 4% higher than the prior quarter as the

Kitimat smelter continues to ramp up and Boyne smelter cell

recovery efforts progress as expected. The Kitimat pot restarts are

progressing but structural issues with the alumina conveyor system

caused disruptions through the quarter slowing the rate of pot

restarts. We continue to focus on full recovery during the course

of 2023."

On the aluminum market:

"The LME aluminium price extended further losses, dropping 20%

over the quarter, averaging $2,354/ton. Additional smelter

curtailments in Europe and China on high power prices and low

hydropower generation, respectively, were insufficient to offset

the weak macro environment. Aluminium demand has deteriorated,

especially in Europe, which placed downward pressure on prices.

Shipments in the U.S. and Canada have been resilient and there are

signs of improvement in demand in China.

On copper production:

"Mined copper production [at Kennecott] was 19% higher than the

third quarter of 2021, and 50% higher than the prior quarter with

significant progress into higher grades following the transition to

the south wall (averaging 0.54% in the first nine months), higher

recoveries and strong mill performance driving higher ore

milled.

"Refined copper production guidance has been reduced to 190,000

to 220,000 tons (previously 230,000 to 290,000 tons), given further

downside risk associated with Kennecott's smelter and refinery

performance, until we undertake the largest rebuild in nine years

which is planned for the second quarter of 2023.

"Mined copper production [at Escondida] was 10% higher than the

third quarter of 2021 mainly due to expected higher concentrator

feed grade and higher recoverable copper in ore stacked for

leaching mainly due to higher material stacked in both oxide and

sulphide leach."

On the copper market:

"The copper LME price dropped 7% over the third quarter to

$3.47/pound. A strong U.S. dollar, tightening monetary policy and

challenging economic outlook weighed on market sentiment.

Nevertheless, prices have been partly supported by supply concerns

and low exchange inventories, which currently remain at multi-year

lows."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 17, 2022 19:19 ET (23:19 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

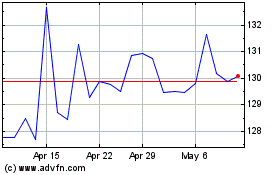

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Jan 2024 to Jan 2025