Rio Tinto Sees China Steel Demand Dependent on China Covid Controls -- Commodity Comment

January 16 2023 - 4:43PM

Dow Jones News

Rio Tinto PLC on Tuesday reported higher fourth-quarter

production of most of its commodities, including iron ore and

aluminum. Mined copper output was slightly lower year-on-year, it

said. Here are some remarks from the fourth-quarter operations

report of the world's No. 2 miner by market value.

On Australian iron-ore operations:

"Pilbara operations produced 324.1 million [metric tons] (100%

basis) in 2022, 1% higher than 2021. Shipments were 321.6 million

tons (100% basis), in line with 2021. Performance improvements

continued across the system and we achieved record second-half

performance across the mine and rail system. We expect Gudai-Darri

to reach its nameplate capacity on a sustained basis during

2023."

On iron-ore markets:

"Iron ore Platts CFR prices rebounded 22% in the quarter,

although the average price of $99/ton in the fourth quarter was 4%

lower than the third quarter. Market sentiment strengthened after

Beijing released three stimulus packages in November to stabilize

the real estate market by lifting all previously applied financing

constraints on property developers. Prices trended above $110 at

year-end as China began dismantling its zero-Covid policy and

gradually reopening the economy, while mills also started to

replenish in-plant inventories ahead of the Lunar New Year

holidays. Steel demand recovery hinges on the country's ability to

control the Covid outbreak."

On copper production:

"Mined copper production of 521,000 tons was 6% higher than 2021

due to higher grades at Kennecott and Escondida, partly offset by

lower grades and recoveries at Oyu Tolgoi as a result of planned

mine sequencing. Unplanned maintenance was required at Kennecott in

the fourth quarter of 2022 in our anode furnaces leading to

extended downtime and continued poor anode production, likely to

result in weak cathode production in the first quarter of 2023.

Refined copper production at Kennecott will continue to be

challenged due to the smelter and refinery performance, until we

undertake the largest rebuild in nine years which is planned for

the second quarter of 2023 and is expected to take approximately

three months."

On copper markets:

"The copper LME price rose 10% in the fourth quarter to $3.80 [a

pound], as market sentiment turned more positive on a series of

supply disruptions and low and declining visible stocks, which

remain at historically low levels. Price support came in the form

of Chinese government policy changes such as in the property market

and easing Covid-19 restrictions, together with demand growth in

renewables and EVs, plus the return of the investor net long

position in copper."

On aluminum output:

"Aluminum production of 3.0 million tons was 4% lower than 2021

due to reduced output at our Kitimat smelter in British Columbia,

Canada and Boyne smelter in Queensland, Australia. The rate of pot

restarts at Kitimat picked up in the fourth quarter and Boyne

smelter cell recovery efforts continued. Recovery at both smelters

is progressing with full ramp-up expected to be completed during

the course of 2023. All of our other aluminum smelters continued to

demonstrate stable performance."

On aluminum markets:

"The LME cash aluminum price increased 8% in the quarter,

although the average price of $2,324 in the fourth quarter was 1%

lower than the third quarter. The market was supported by low

reported levels of inventories, and expectations of improving

Chinese demand. In North America, shipments of extrusions and

rolled products softened over the quarter, mainly on weaker

extrusion shipments into the building and construction sector.

Aluminum demand growth from renewables and electric vehicles (EVs)

remains firm. LME stocks are now at their lowest level in 22 years,

and Chinese warehouse stocks are at a six-year low."

On titanium dioxide operations:

"Titanium dioxide slag production of [1.2 million tons] was 18%

higher than 2021, due to community disruptions at Richards Bay

Minerals (RBM) in South Africa in 2021, and continued improved

performance of operations at Rio Tinto Fer et Titane (RTFT),

Canada. Production constraints related to nationwide electrical

power load-shedding at RBM were experienced in the fourth

quarter."

On Canadian iron-ore operations:

"Iron Ore Company of Canada (IOC) production of pellets and

concentrate was 6% higher than 2021. Successful deployment of the

Rio Tinto Safe Production System (SPS) at the concentrator was

completed in the year, with record performance metrics achieved in

the year, including monthly records for concentrate production and

total material moved in the second quarter. Planning for SPS

deployment at the pellet plant commenced in December."

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

January 16, 2023 17:28 ET (22:28 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

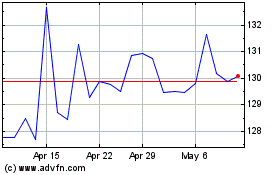

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Jan 2024 to Jan 2025