McEwen Mining Shares Up After Rio Tinto Venture's Investment in Copper Subsidiary

February 27 2023 - 12:07PM

Dow Jones News

By Robb M. Stewart

McEwen Mining Inc.'s shares jumped Monday after a Rio Tinto PLC

venture and existing McEwen Copper Inc. shareholder agreed to

invest a further $30 million in McEwen Copper to value the

subsidiary that is set to be spun off at about $550 million.

In afternoon trading, the shares were 5.9% higher at C$7.87 on

the Toronto Stock Exchange and up 5.6% at $5.77 on the New York

Stock Exchange.

Under the binding agreement between the companies, Nuton will

buy shares in McEwen Copper in a two-part transaction that will

consist of a private placement of 350,000 shares in the copper

subsidiary and a purchase of almost 1.3 million shares owned by

parent McEwen Mining in a secondary sale. When the deal is

completed, Nuton and McEwen Mining are expected to own about 14%

and 52%, respectively, of McEwen Copper.

McEwen Copper expects to see proceeds of about $6.5 million from

the private placement subscription, and McEwen Mining expects to

see proceeds of about $23.5 million from the secondary sale. McEwen

Copper said it plans to use the proceeds to help fund development

of Los Azules, a copper project in San Juan, Argentina in which it

holds 100% interest.

The agreement also offers Nuton an option allowing it to buy a

percentage of the copper products produced at Los Azules equal to

its equity ownership in McEwen Copper.

Also on Monday, McEwen said it closed an investment in Argentina

by Stellantis N.V. that will leave the Chrysler and Fiat parent

company with a stake of about 14% in McEwen copper and the right to

buy a percentage of the copper produced from the Los Azules

project.

Write to Robb M. Stewart at robb.stewart@wsj.com

(END) Dow Jones Newswires

February 27, 2023 12:52 ET (17:52 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

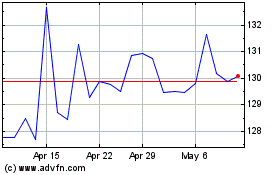

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024