Rio Tinto Likes Lithium, But Cautious on Growing via Deals

May 04 2023 - 1:02AM

Dow Jones News

By Rhiannon Hoyle

The chief executive of Rio Tinto, the world's second-biggest

miner by market value, said he is interested in expanding the

company's lithium business, but mindful of paying too much for more

of the battery material used to power electric cars.

"We wouldn't mind having a stronger lithium business," Jakob

Stausholm told reporters after a shareholder meeting in

Australia.

"I think it is very difficult to justify to go in and buy at

these high prices unless you already know you can sell the lithium

at a high price," which is uncertain, he said of the potential for

dealmaking.

Lithium prices surged to record highs last year amid strong

electric-vehicles sales in China, but have pulled lower in recent

months. Mr. Stausholm said the outlook for long-run lithium prices

is unclear.

"I'm not sure the short term is giving you any indications of"

long-term pricing, he said. "What we do know is the world needs to

build a number of lithium mines."

Mr. Stausholm said he remains hopeful of a way forward for Rio

Tinto's Jadar lithium project in Serbia, which ground to a halt

last year when the government there revoked its licenses.

At its Rincon lithium project in Argentina, Rio Tinto is

reviewing a $140 million estimate and schedule to develop a starter

plant because of searing local inflation and rising equipment

costs.

"Of course, I don't like any cost overruns but, on the other

hand, it basically provides invaluable learnings for us before a

project is being recommended for full sanctioning," Mr. Stausholm

said.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

May 04, 2023 01:47 ET (05:47 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

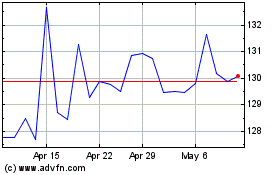

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rio Tinto (ASX:RIO)

Historical Stock Chart

From Dec 2023 to Dec 2024