Jacobs Sells Resources Arm to WorleyParsons in $3.3 Billion Deal -- Update

October 21 2018 - 8:51PM

Dow Jones News

By Rhiannon Hoyle

SYDNEY--Jacobs Engineering Group Inc. (JEC) will sell its

energy, chemicals and resources business to WorleyParsons Ltd.

(WOR.AU) via a US$3.3 billion deal that will enable Jacobs to focus

on more-profitable divisions while also handing it a chunk of the

Australian engineering company.

Jacobs has been narrowing its focus on lucrative infrastructure

and government-services and the deal to offload its resources

division--for US$2.6 billion in cash and US$700 million in

WorleyParsons shares--will help it better invest in those

higher-growth, higher-margin businesses, it said.

"This transaction marks an inflection point in our portfolio

transformation focused on more consistent, higher-margin growth,"

said Jacobs Chairman and CEO Steve Demetriou.

Under the deal, which is expected to close in the first half of

2019, Jacobs will also take a roughly 11% stake in WorleyParsons.

That means the Dallas-based company should continue to benefit from

a nascent oil-and-gas market recovery, it said.

Resources and energy companies have been gradually spending more

on drilling to firm up their production pipeline after several

years of lackluster investment. "This is reflected in the recent

level of contract awards and our growing backlog," said

WorleyParsons.

WorleyParsons in August recorded an 86% rise in fiscal-year

profit and forecast improved earnings in the current year,

underpinned by rising spending by resources customers. It said the

purchase of Jacob's resources arm will give it greater exposure to

"more-stable" revenues from commodity producers and help it further

reduce costs.

"The transaction will bring complementary capabilities in key

business lines" and give WorleyParsons "greater earnings

diversification and resilience," said Andrew Wood, Chief Executive

of the Sydney-based company.

Jacobs plans to initially use cash from the sale to pay down

debt, but said it will give the company more flexibility to review

new opportunities including acquisitions.

"Our strong financial flexibility and free cash flow will

support incremental profitable growth investments and capital

returns to shareholders," said Chief Financial Officer Kevin

Berryman.

Write to Rhiannon Hoyle at rhiannon.hoyle@wsj.com

(END) Dow Jones Newswires

October 21, 2018 21:36 ET (01:36 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

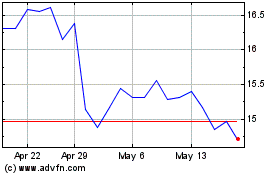

Worley (ASX:WOR)

Historical Stock Chart

From Jan 2025 to Feb 2025

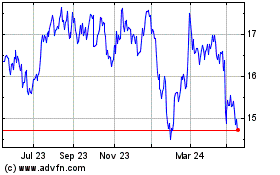

Worley (ASX:WOR)

Historical Stock Chart

From Feb 2024 to Feb 2025