Societe Generale signs two exclusive agreements to sell its private banking’s subsidiaries in the United Kingdom and Switzerland

August 05 2024 - 12:00AM

UK Regulatory

Societe Generale signs two exclusive agreements to sell its private

banking’s subsidiaries in the United Kingdom and Switzerland

SOCIETE GENERALE SIGNS TWO EXCLUSIVE

AGREEMENTS TO SELL ITS PRIVATE BANKING’S SUBSIDIARIES IN

THE

UNITED KINGDOM AND SWITZERLAND

Press release

Paris, 05 August 2024 at 7:00 am

Societe Generale has signed agreements

with Union Bancaire Privée, UBP SA (UBP), a Swiss bank specialised

in wealth and asset management, for the sale of

SG Kleinwort Hambros and

Societe Generale Private Banking

Suisse operating respectively in the United

Kingdom and Switzerland.

These sales are part of the execution of Societe

Generale's strategic roadmap targeting a streamlined, more

synergetic and efficient business model, while strengthening the

Group’s capital base. Societe Generale intends to pursue the

development strategy of its private bank by relying on its leading

positions in France and abroad, in Luxembourg and Monaco, to

support its high-net-worth clients thanks to its expertise and

recognised services.

The assets under management of the businesses

covered by these agreements amount to almost €25 billion at the end

of December 2023. These transactions would be structured as sales

of relevant legal entities. They would be implemented at a total

price of around EUR 900 million including equity with a

positive impact of around 10 basis points on the Group's CET1

ratio, on the expected completion dates which could take place by

the end of the first quarter of 2025.

(1)

According to the commitments made in these

agreements, UBP would take over all activities operated by SG

Kleinwort Hambros and Societe Generale Private Banking

Suisse, as well as all client portfolios and employees within

these entities.

These two divestment projects are subject to the

applicable social procedures, the usual conditions precedent and to

approval by the relevant financial and regulatory authorities.

(1)

Unaudited figures

Press contacts:

Jean-Baptiste Froville_+33 1 58 98 68 00 _

jean-baptiste.froville@socgen.com

Amandine Grison_+33 1 41 45 92 40_

amandine.grison@socgen.com

Societe Generale

Societe Generale is a top tier European Bank

with more than 126,000 employees serving about 25 million clients

in 65 countries across the world. We have been supporting the

development of our economies for 160 years, providing our

corporate, institutional, and individual clients with a wide array

of value-added advisory and financial solutions. Our long-lasting

and trusted relationships with the clients, our cutting-edge

expertise, our unique innovation, our ESG capabilities and leading

franchises are part of our DNA and serve our most essential

objective - to deliver sustainable value creation for all our

stakeholders.

The Group runs three complementary sets of businesses, embedding

ESG offerings for all its clients:

- French

Retail, Private Banking and Insurance, with leading retail

bank SG and insurance franchise, premium private banking services,

and the leading digital bank BoursoBank.

- Global

Banking and Investor Solutions, a top tier wholesale bank

offering tailored-made solutions with distinctive global leadership

in equity derivatives, structured finance and ESG.

- Mobility,

International Retail Banking and Financial

Services, comprising well-established universal banks

(in Czech Republic, Romania and several African countries), Ayvens

(the new ALD I LeasePlan brand), a global player in sustainable

mobility, as well as specialized financing activities.

Committed to building together with its clients

a better and sustainable future, Societe Generale aims to be a

leading partner in the environmental transition and sustainability

overall. The Group is included in the principal socially

responsible investment indices: DJSI (Europe), FTSE4Good (Global

and Europe), Bloomberg Gender-Equality Index, Refinitiv Diversity

and Inclusion Index, Euronext Vigeo (Europe and Eurozone), STOXX

Global ESG Leaders indexes, and the MSCI Low Carbon Leaders Index

(World and Europe).

For more information, you can follow us on

Twitter/X @societegenerale or visit our website

societegenerale.com.

- Societe

Generale-signs-two-exclusive-agreements-to-sell-its-private-banking-s-subsidiaries-United-Kingdom-Switzerland

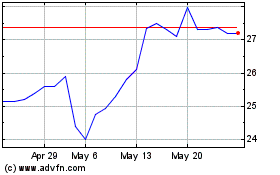

Societe Generale (BIT:1GLE)

Historical Stock Chart

From Oct 2024 to Nov 2024

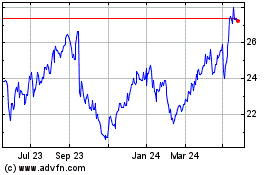

Societe Generale (BIT:1GLE)

Historical Stock Chart

From Nov 2023 to Nov 2024