ING provides update on 2020 Annual General Meeting

April 10 2020 - 1:45PM

ING provides update on 2020 Annual General Meeting

ING provides update on 2020 Annual General

Meeting

In the context of the coronavirus pandemic, ING today provides

an update on the 2020 Annual General Meeting. ING confirms that it

will hold the 2020 AGM on 28 April 2020. In order to mitigate

health risks for all participants and to comply with Dutch

government directives, a number of aspects of the meeting will be

changed from what was earlier indicated.

In light of current government guidance, the location of the AGM

will be changed to ING’s corporate office Cedar, Bijlmerdreef 106

in Amsterdam, the Netherlands. On behalf of ING only a limited

number of Executive Board and Supervisory Board members will attend

the meeting in person; other members will follow or, to the extent

needed, participate in the meeting remotely. ING will also forego

the tradition of offering food and drinks before and after the

meeting in an informal setting.

Given government instructions and restrictions, a limited number

of places for shareholders’ in person participation will be

available at the AGM venue. In these extraordinary circumstances,

to limit health risks for all parties involved, we urge

shareholders not to attend the AGM in person. Shareholders that

nevertheless wish to attend the meeting in person, are requested to

follow the usual instructions as available on www.ing.com/agm. If

the number of shareholders wishing to attend in person exceeds the

capacity, ING will make a fair selection via a blind draw by the

civil law notary and will inform shareholders who have applied.

Shareholders who do attend the meeting in person will do so at

their own health risk and are responsible for maintaining the

mandatory social distance at all times.

In light of the above we encourage shareholders to cast their

votes online prior to the meeting, following the usual instructions

on www.ing.com/agm. The 2020 AGM will be webcast live via

www.ing.com so that all shareholders will be able to follow the

meeting. In addition, shareholders who have registered at the

registration date will be able to submit questions on the AGM

agenda items in writing, in advance of the meeting via the link at

www.ing.com/agm until 17:30 pm CET on 21 April 2020. ING intends to

answer these questions during the meeting.

The full details of all AGM proposals are included in the proxy

materials for ING’s 2020 AGM, which are available at

www.ing.com/agm. As announced on 30 March 2020, ING will follow the

recommendations made by the European Central Bank to European banks

on 27 March 2020 regarding dividend distributions. ING is well

capitalised, above regulatory requirements, but in line with the

ECB’s recommendations, it will suspend any payment of dividends on

its ordinary shares until at least 1 October 2020. Accordingly, at

the AGM the proposal to pay a final 2019 dividend (agenda item 3B)

will not be put to a vote and has been removed from the agenda. ING

will review any further dividend announcements after 1 October

2020. The proposed dividend distribution as reflected in the ING

Group 2019 Annual Report is amended by the new information included

in the press release of 30 March 2020.

ING will continue to closely monitor developments and might

further change aspects of the AGM based on relevant circumstances.

Updates and further details on the AGM will be shared at

www.ing.com/agm when appropriate. Information for holders of

American depositary shares is available at www.ing.com/ads.

Shareholders are advised to check the information regularly.

Note for editors

For further information on ING, please visit www.ing.com.

Frequent news updates can be found in the Newsroom or via the

@ING_news Twitter feed. Photos of ING operations, buildings and its

executives are available for download at Flickr. ING presentations

are available at SlideShare.

| Press enquiries |

|

Investor enquiries |

| Raymond Vermeulen |

|

ING Group Investor Relations |

| +31 20 576 6369 |

|

+31 20 576 6396 |

| Raymond.Vermeulen@ing.com |

|

Investor.Relations@ing.com |

| |

|

|

|

ING PROFILEING is a global financial institution

with a strong European base, offering banking services through its

operating company ING Bank. The purpose of ING Bank is empowering

people to stay a step ahead in life and in business. ING Bank’s

more than 53,000 employees offer retail and wholesale banking

services to customers in over 40 countries. ING Group shares are

listed on the exchanges of Amsterdam (INGA AS, INGA.AS), Brussels

and on the New York Stock Exchange (ADRs: ING US, ING.N).

Sustainability forms an integral part of ING’s strategy, evidenced

by ING’s ranking as Leader in the banks industry group by

Sustainalytics and ‘A’ rating in MSCI’s ratings universe. ING Group

shares are included in major sustainability and Environmental,

Social and governance (ESG) index products of leading providers

STOXX, Morningstar and FTSE Russell.IMPORTANT LEGAL

INFORMATIONElements of this press release contain or may

contain information about ING Groep N.V. and/ or ING Bank N.V.

within the meaning of Article 7(1) to (4) of EU Regulation No 596/

2014.Certain of the statements contained herein are not historical

facts, including, without limitation, certain statements made of

future expectations and other forward-looking statements that are

based on management’s current views and assumptions and involve

known and unknown risks and uncertainties that could cause actual

results, performance or events to differ materially from those

expressed or implied in such statements. Actual results,

performance or events may differ materially from those in such

statements due to a number of factors, including, without

limitation: (1) changes in general economic conditions, in

particular economic conditions in ING’s core markets, (2) changes

in performance of financial markets, including developing markets,

(3) potential consequences of the United Kingdom leaving the

European Union or a break-up of the euro, (4) changes in the fiscal

position and the future economic performance of the US including

potential consequences of a European sovereign debt crisis (5)

potential consequences of a European sovereign debt crisis (6)

changes in the availability of, and costs associated with, sources

of liquidity such as interbank funding, (7) changes in the

conditions in the credit and capital markets generally, including

changes in borrower and counterparty creditworthiness, (8) changes

affecting interest rate levels, (9) inflation and deflation in our

principal markets, (10) changes affecting currency exchange rates,

(11) changes in investor and customer behaviour, (12) changes in

general competitive factors, (13) changes in or discontinuation of

‘benchmark’ indices, (14) changes in laws and regulations and the

interpretation and application thereof, (15) changes in compliance

obligations including, but not limited to, those posed by the

implementation of DAC6, (16) geopolitical risks, political

instability and policies and actions of governmental and regulatory

authorities, (17) changes in standards and interpretations under

International Financial Reporting Standards (IFRS) and the

application thereof, (18) conclusions with regard to purchase

accounting assumptions and methodologies, and other changes in

accounting assumptions and methodologies including changes in

valuation of issued securities and credit market exposure, (19)

changes in ownership that could affect the future availability to

us of net operating loss, net capital and built-in loss carry

forwards, (20) changes in credit ratings, (21) the outcome of

current and future legal and regulatory proceedings, (22)

operational risks, such as system disruptions or failures, breaches

of security, cyber-attacks, human error, changes in operational

practices or inadequate controls including in respect of third

parties with which we do business, (23) risks and changes related

to cybercrime including the effects of cyber-attacks and changes in

legislation and regulations related to cybersecurity and data

privacy, (24) the inability to protect our intellectual property

and infringement claims by third parties, (25) the inability to

retain key personnel, (26) business, operational, regulatory,

reputation and other risks in connection with climate change, (27)

ING’s ability to achieve its strategy, including projected

operational synergies and cost-saving programmes and (28) the other

risks and uncertainties detailed in the most recent annual report

of ING Groep N.V. (including the Risk Factors contained therein)

and ING’s more recent disclosures, including press releases, which

are available on www.ING.com, (29) this document may contain

inactive textual addresses to internet websites operated by us and

third parties. Reference to such websites is made for information

purposes only, and information found at such websites is not

incorporated by reference into this document. ING does not make any

representation or warranty with respect to the accuracy or

completeness of, or take any responsibility for, any information

found at any websites operated by third parties. ING specifically

disclaims any liability with respect to any information found at

websites operated by third parties. ING cannot guarantee that

websites operated by third parties remain available following the

publication of this document, or that any information found at such

websites will not change following the filing of this document.

Many of those factors are beyond ING’s control. Any forward looking

statements made by or on behalf of ING speak only as of the date

they are made, and ING assumes no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information or for any other reason. This document does not

constitute an offer to sell, or a solicitation of an offer to

purchase, any securities in the United States or any other

jurisdiction. |

- PDF version of press release

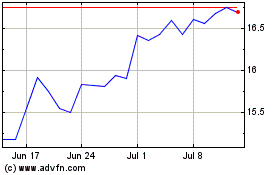

ING Groep NV (BIT:1INGA)

Historical Stock Chart

From Oct 2024 to Nov 2024

ING Groep NV (BIT:1INGA)

Historical Stock Chart

From Nov 2023 to Nov 2024