illimity Approves Its 2021-25 Strategic Plan

June 22 2021 - 3:23AM

illimity Approves Its 2021-25 Strategic Plan

via InvestorWire –

SIGNIFICANT AND SUSTAINABLE PROFITABILITY

|

|

2021E |

2023E |

2025E |

|

ROE1 |

10% |

15% |

20% |

|

NET PROFIT |

€60-70MLN |

€140MLN |

>€240MLN |

ROBUST CAPITAL BASE INCLUDING DIVIDEND FLOW

- Shareholders’

equity 1 billion euro in 2023, 1.4 billion in 2025

- CET1 RATIO

constantly above 15%

- cumulated DIVIDENDS

of ca. 180 million euro over the Plan horizon2

STRATEGIC ALLIANCE WITH THE ION GROUP

License agreement signed for illimity’s IT

platform which will generate revenue of 90 million euro by 2025

Wide-ranging collaboration agreement also

including an overall investment of up to 9.99% in illimity’s share

capital to be achieved through a capital increase reserved to the

ION group for 5.75 million ordinary shares and warrants for a

further 2.4 million shares

Resolved to convene the Extraordinary

Shareholders’ meeting on 29 July 2021 to adopt resolutions on

capital increases

B-ILTY is born, the first direct bank at the

service of small corporates: launch by the fourth quarter of

2021

NEW HYPE: launch by the third quarter of

2021

____________________

1 Ratio between net profit for the year and

average net equity. Annualised. Rounded figures.

2 On the assumption that the ECB’s current

restrictions on dividend payments for the period through 30

September 2021 are not confirmed.

Chaired by Rosalba Casiraghi, the Board of

Directors of illimity Bank S.p.A. (“illimity” or

the “Bank”) yesterday approved the illimity

Group’s 2021-25 Strategic Plan (the “Plan”).

The Plan is based on the solid results

accomplished, first and foremost the already achieved return on

equity (ROE3) of around 8% for the first quarter of 2021 and

expected at 10% for the year 2021 as a whole, with a forecast net

profit of between 60 and 70 million euro while maintaining a low

risk profile and a robust capital base

The results achieved are based on a series of

strategic decisions that have proved to be

correct:

- illimity has

focussed on loans to SMEs and specifically

in three segments of significant interest:

-

performing loans to corporates: a market

worth 700 billion euro4 where in two years of activity,

illimity has succeeded in becoming a reference player, disbursing

corporate loans of around 1 billion euro and gaining a key position

also in the Acquisition Finance sector;

- unlikely

to pay (“UTP”) corporate loans: a rapidly

growing market where transactions of over 35 billion

euro5 are expected to take place

between 2021 and 2025 and where illimity is already

positioned as one of the leading operators;

-

corporate NPLs: a market where

transactions of over 140 billion

euro6 are forecast to take place

between 2021 and 2025 and where illimity has already

succeeded in becoming one of the largest private investors over the

past two years.

- illimity has

built up a team of over 650 professionals with

significant expertise that is not always available in the banking

sector. In fact, the illimiters come from over 200 different

organisations. With 70% of illimiters coming from non-banking

entities, particular importance has been given to experience in the

various business sectors, with Tutors – experts in industries and

districts – playing a central role in the SME investment and

lending process;

- illimity has

placed considerable focus on technology in all its

sectors of activity, and among other things has developed

proprietary software architecture with features unique of its kind:

fully digital, modular, in cloud and therefore highly flexible and

totally scalable, capable of continually integrating innovations

and new fintech;

- illimity

has built ESG principles into its various

activities from the very beginning and has already

achieved important goals with a strong commitment to going beyond,

also by including qualitative and quantitative objectives in

management’s medium-long term incentive scheme:

- on

Environmental matters: in 2020 illimity achieved

carbon neutrality at a Group level, uses electricity produced 100%

from renewable sources, and is committed to extending the adoption

of ESG metrics when assessing all its lending positions over the

duration of the Plan;

- on

Social matters: illimity makes people its strength

and this is reflected in a system of corporate welfare and training

that is one of the best in Italy, in enhancing the values of

Diversity & Inclusion at all levels of the organisation. Thanks

to this approach, the Bank has obtained Great Place to Work®

certification for two consecutive years. With the creation of

Fondazione illimity, the Bank has gone beyond the

boundaries of its organisation, fostering an ecosystem of

partnerships which, starting from the regeneration of real estate

assets, will give rise to projects with a social impact;

- on

Governance matters: right from the start,

membership of the Board of Directors has been fairly balanced and

illimity has already consolidated important processes by setting up

a Sustainability Committee and publishing a Voluntary Non-Financial

Statement for 2020 as well as the illimity way

policy. illimity’s commitment on this front is to enhance

the value of and improve its direct and indirect ESG profile in all

its areas of activity.

___________________________

3 Ratio between net profit for the year and

average net equity, annualised.

4 Bank of Italy figures – “Banks and financial

institutions: loans and funding by sector and local area” –

December 2020.

5 6 Source: Estimates based on various market

sources (including, inter alia, the Bank of Italy and PwC).

Estimates relate to the entire market of transactions in

non-performing loans, as accurate projections for the SME segment

alone are not available.

For more details view the entire announcement:

https://assets.ctfassets.net/0ei02du1nnrl/5axfHp04Yvtgl91sMwCDcp/008507c4c77036fc29c98e2aedf30087/illimity_Strategic_Plan_2021-25.pdf

For further information:

Investor Relations Silvia Benzi:

+39.349.7846537 - +44.7741.464948 - silvia.benzi@illimity.com

Press & Communication illimity

Isabella Falautano, Francesca D’Amico +39.340.1989762

press@illimity.com

Sara Balzarotti, Ad Hoc Communication Advisors

+39.335.1415584 sara.balzarotti@ahca.it

Wire Service Contact:InvestorWire

(IW)Los Angeles, Californiawww.InvestorWire.com212.418.1217

OfficeEditor@InvestorWire.com

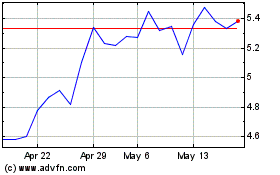

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Dec 2024 to Jan 2025

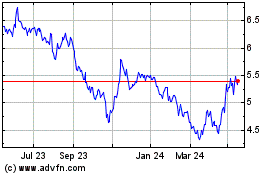

Illimity Bank (BIT:ILTY)

Historical Stock Chart

From Jan 2024 to Jan 2025