Intesa Sanpaolo to Pay Shareholders $25 Billion by 2025, Invest in Tech

February 04 2022 - 4:12AM

Dow Jones News

By Cristina Roca

Intesa Sanpaolo SpA is betting that a digital push will help it

reach higher earnings and profitability, and plans to return 22

billion euros ($25.16 billion) to shareholders between 2021 and

2025 as part of its new business plan.

Italy's largest bank by assets said Friday that it expects its

net profit to grow to EUR6.5 billion in 2025. It posted a EUR4.19

billion net profit in 2021.

Intesa will also aim for its return on tangible equity--a key

metric of profitability--to go up to 13.9% in 2025 from 9.1% in

2021.

The bank plans to invest EUR7.1 billion over the next four

years. A large chunk of this will be spent on technology, including

a new digital bank, which Intesa said would make it cheaper to

service retail clients. It will make 4.600 new hires and reskill or

redeploy around 8,000 employees, it said.

Intesa said bolstering its technological capabilities would help

it achieve EUR2 billion in cost savings over 2022-25 and a

cost-to-income ratio of 46.4% in 2025.

Intesa said it will also implement a "massive" derisking by

dumping more non-performing loans over the coming years as it seeks

to eventually become a "zero-NPL" bank.

It plans to drive growth by doubling down on its wealth

management, insurance and advisory proposition, it said.

The bank's capital distribution plan will consist of cash

dividends with a payout ratio of 70%--the same as its current

policy--plus a EUR3.4 billion buyback in 2022, it said.

For 2021, Intesa will pay EUR1.5 billion in dividends, adding to

an interim dividend paid in November.

In the last quarter of 2021, Intesa posted a net profit of

EUR179 million compared with a EUR3.1 billion loss a year earlier,

when it booked large charges related to the acquisition of smaller

peer UBI Banca. Its earnings were also weighed down by a number of

one-off costs relating to deleveraging and a plan to shed 2,000

jobs, UBS analysts noted.

Quarterly operating income fell 1.4% to EUR5.02 billion, driven

by a 5.7% decline in net interest income even as income from fees

improved.

Write to Cristina Roca at cristina.roca@wsj.com

(END) Dow Jones Newswires

February 04, 2022 04:57 ET (09:57 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

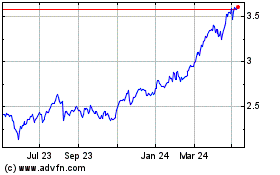

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

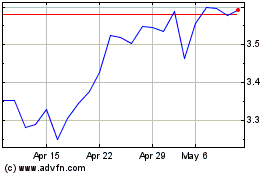

From Feb 2025 to Mar 2025

Intesa Sanpaolo (BIT:ISP)

Historical Stock Chart

From Mar 2024 to Mar 2025