Eni Strikes Saipem Deals, Selling Shares and Recovering Debt -- Update

October 28 2015 - 9:36AM

Dow Jones News

By Liam Moloney and Eric Sylvers

Eni SpA said Wednesday it will sell a stake in its oil-services

subsidiary Saipem SpA in a deal that it expects to bring in EUR5.4

billion ($5.9 billion) after the unit repays debt.

The Italian oil company will sell a 12.5% stake in Saipem to

Fondo Strategico Italiano, an Italian state-run investment fund,

for as much as EUR487 million, with the final price of the share

sale to be determined later. Saipem will also repay Eni EUR6.1

billion in debt.

Eni has earmarked the proceeds for investment in its own

exploration activities.

As part of the agreements, Eni plans to take up its share of a

EUR3.5 billion capital increase at Saipem. The capital boost is

scheduled to be completed in the first quarter of next year.

The move falls under Eni Chief Executive Claudio Descalzi's plan

to recoup debt held by Saipem while sharpening the company's focus

on oil and gas exploration. Like those of other large oil

companies, Eni's results have been battered by the plunge in oil

prices since the middle of last year.

In April, Standard & Poor's cut its long- and short-term

credit rating on Eni, and at the start of this month it lowered its

outlook on the company to negative.

The money Eni raises by selling the stake in Saipem and

recouping the debt will be used to develop the company's oil and

gas reserves, Mr. Descalzi said.

Eni has outperformed most of its rivals in recent years in

finding new resources, including the discovery in August of a

massive natural gas field off the coast of Egypt, where several

competitors had given up looking.

"Ultimately this deal enables Eni to focus on upstream

[exploration and production activities]," wrote Bernstein in a note

to clients, adding that it provides for "one of the strongest

balance sheets in the industry."

Eni, which is 30%-owned by the Italian government, said the deal

will reduce its net debt by about EUR5.1 billion. At the end of

June, its net debt stood at EUR16.5 billion. On Thursday, Eni will

release its third-quarter results.

Saipem is trying to shore up its finances through the stock

sale, as oil-services companies have also been hit hard by the fall

in oil prices as oil and gas producers have slashed capital

spending and rushed to cut costs.

The company, which in July said it would lay off almost a fifth

of its workforce in the next two years, has lowered its profit

forecasts at least three times since 2013 and Tuesday reiterated a

forecast that it will lose EUR800 million this year.

"Today's announcement marks a turning point for Saipem: We have

a new shareholder structure, a strengthened balance sheet [and] a

new strategic plan" Saipem CEO Stefano Cao said. Mr. Cao is

Saipem's third CEO in three years.

Saipem will refinance EUR3.2 billion of debt, said the

Milan-based company. Up to now, Eni has funded Saipem's debt.

The deal will reduce Eni's stake in Sapiem to about 30.5%.

In early-afternoon trading in Milan, Saipem's shares were up

7.3%, while Eni's were 0.5% higher.

Write to Liam Moloney at liam.moloney@wsj.com and Eric Sylvers

at eric.sylvers@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 28, 2015 10:21 ET (14:21 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

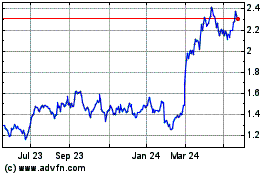

Saipem (BIT:SPM)

Historical Stock Chart

From Oct 2024 to Nov 2024

Saipem (BIT:SPM)

Historical Stock Chart

From Nov 2023 to Nov 2024