Sei Foundation Unveils ‘Parallelized’ EVM In v2 Upgrade, Driving 11% Spike In SEI’s Price

May 20 2024 - 9:30PM

NEWSBTC

To increase the capabilities of its Layer 1 (L1) blockchain, the

Sei Foundation has announced a governance proposal to upgrade Sei

to Version 2. This proposed upgrade will reportedly introduce a

“high-performance, parallelized” Ethereum Virtual Machine (EVM) to

improve the network’s overall functionality. Sei Rolls Out

Multi-Phase V2 Upgrade According to the announcement, the Sei V2

launch will be rolled out in three phases to minimize risk, set

user expectations, and optimize network performance. “By rolling

out Sei v2 in measured steps, Sei Contributors can ensure a stable

and scalable network for everyone,” the foundation stated. Related

Reading: Crypto Analyst Sounds Warning Alarm For Potential 50-60%

Crash In Chainlink Price, Here’s Why The first phase will focus on

validating software upgrades and transitioning the existing Sei

Pacific-1 mainnet to the new “v2” iteration. This will pave the way

for deploying EVM-based contracts and infrastructure integrations

on the Sei network. The announcement cautioned that “not everything

will be functional at the start of this period. “For example,

bridges will need time to deploy to Mainnet before the community

can use them.” However, the foundation promised to provide an

official announcement once the v2 network is deemed stable and

critical infrastructure, such as RPCs, bridges, indexers, and

multi-sigs, is ready for use. If the governance proposal is

accepted, the Sei mainnet upgrade to Version 2 is scheduled for

Monday, May 27th. Interestingly, the announcement of the Sei V2

upgrade has already sparked a surge in the blockchain’s native

token, SEI, which has emerged as one of the biggest gainers in the

market over the past 24 hours, with a price increase of 11%. All

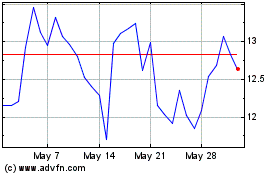

Eyes On All-Time High On Mainnet Upgrade Prospects The SEI token is

trading at $0.5830, surpassing its previous resistance level of

$0.560. This breakthrough aims to consolidate the token’s price

above this mark, a key level for the token’s prospects of testing

higher resistance walls and potentially reaching its all-time high

(ATH) of $1.14, set on March 16. Furthermore, the token has

recorded a trading volume of $95 million since the announcement,

resulting in a substantial 150% increase compared to the figures

recorded during the previous weekend, according to CoinGecko data.

Despite these positive developments, it remains to be seen whether

the governance proposal to upgrade the Sei blockchain to Version 2

will be approved. Related Reading: Dogwifhat (WIF) Surges

10.4% Amid Whale Frenzy, New ATH Coming Soon? In the event of a

bullish outcome and the successful implementation of the V2

upgrade, the key resistance levels to watch on the upside are

$0.592, $0.613, and $0.637. These levels could be potential targets

for the token’s continued bullish momentum. Conversely, should the

token experience a price correction, the $0.544 and $0.527 zones

would be the levels to monitor for potential support and

stabilization of the SEI price in the coming days. Featured image

from Shutterstock, chart from TradingView.com

Dexe (COIN:DEXEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Dexe (COIN:DEXEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024