KAVA Token Ignores Market Downtrends With Over 10% Daily Gains

March 09 2023 - 1:00PM

NEWSBTC

Amid the bearish crypto market, the KAVA token emerged as the top

daily gainer with a 10.29% over the past 24 hours. The crypto

market is currently dancing to tunes played by the bears as

depressing sentiments push coin prices toward bottoms. But the

bearish season is also a time for cryptocurrencies to prove

resilience, probably by finding other support systems to help them

defeat market pressure. In Kava’s case, the newly launched

validator incentives are responsible for its recent price actions.

These ecosystem funds have successfully pushed the token price as

more validators run their node on the Kava blockchain. This is

evident in the coin’s recent price surge and rises in trading

volume amid the market downtrend. Factors Influencing Token’s Price

Today The token recently incentivized its validators to migrate

their cloud infra from AWS and Google Cloud to Akash. Akash also

pledged $1 million in AKT (Akash Network’s native token) to Kava

Strategic Vault to advance decentralized infra on Kava. This

incentive must have motivated users on Kava while increasing the

network activity. The reward which Kava gives its contributors is

another factor that could be fuelling its price rally. Related

Reading: Bitcoin Dealt Another Round Of Blows, Is The Bear Market

Back? According to a March 8 tweet, the token has recorded a 135.2%

bullish sentiment among the Kava community. Social activities on

the Kava network have increased, with the number of social

contributors and social dominance climbing to 89.8% and 125.8%,

respectively. Kava is a decentralized blockchain that combines the

speed and interoperability of Cosmos with Ethereum’s developer

power. The Ethereum co-chain supports EVM Smart Contracts, while

the Cosmos co-chain enables a lightning-fast Tendermint consensus

engine. Integrating the two most-used blockchain development

environments makes Kava highly scalable and supports seamless

interoperability. This feature could be one of the factors

sustaining Kava’s price since its launch. Price Outlook Of

Kava Token And Other Cryptocurrencies Of Ecosystem The token is

trading at $0.8653, with a 194.44% increase from its all-time low

of $0.3 recorded on March 13, 2020. However, it is still over 90%

down from its September 2021 all-time high. Despite the token’s

connection to Ethereum and Cosmos, its price rally did not rub off

on Ether and Cosmos’ ATOM. Ether is currently down by 1.5%, while

Cosmos (ATOM) is down by 7% over the past 24 hours. Meanwhile, the

Kava ecosystem houses three kinds of tokens, Kava token, USDX

stablecoins, and HARD token. USDX has recorded a 0.29% price gain

over the past 24 hours, with a 0.12% rise in trading volume. USDX

is the stablecoin issued by the Kava blockchain. The stablecoin is

trading at $0.840534, with a more than 84% increase from its May

2022 all-time low. Related Reading: Lido (LDO) Plummets Over 20% In

Past Week, Here’s Why On the other hand, the HARD token is the

governance token of Kava Lend, a decentralized money market built

on its blockchain. The HARD token is trading at $0.1805, 1.47% down

over the past 24 hours. It has lost all past-price gains while

succumbing to the bearish pressure on the market. At press time,

HARD has observed a 13.5% decline in a week. Featured image from

Pixabay and chart from TradingView.com

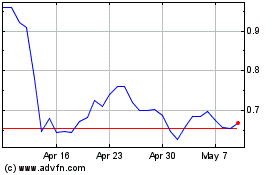

Kava BEP2 Token (COIN:KAVAUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

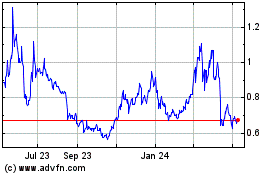

Kava BEP2 Token (COIN:KAVAUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Kava BEP2 Token (Cryptocurrency): 0 recent articles

More Kava BEP2 Token News Articles