MATIC In Consolidation: Key Price Levels To Watch After A Breakout

May 30 2024 - 6:30AM

NEWSBTC

For a while now, the price of MATIC has been in a consolidation

zone, moving between $0.7730 and $0.6233, forming a bearing

triangle flag in the process. This is a result of the drop from its

high of $0.9288 that happened days ago which led to MATIC dropping

by over 25%. Although the price of MATIC is still

consolidating, it is building up momentum for a potential breakout.

So taking a trade at this point is not advisable until a breakout

occurs which can be either above the consolidation zone or below

it. In this article, we will dive into the possible price actions

when a potential breakout from the consolidation occurs. Lately,

MATIC’s price and market cap have dropped, suggesting that the

bulls may be waiting out this spike. As of the time of writing,

MATIC’s price was down by 2.97%, trading around $0,6926 below the

100-day Simple Moving Average (SMA) in the last 24 hours. Its

market capitalization has decreased by over 5% in the past day to

$6.91 billion. Meanwhile, its trading volume has risen to $374

million, indicating a more than 1% increase in the past day. MATIC

On The 4-hour Chart Looking at the 4-hour timeframe chart, MATIC is

attempting to break below the 100-day moving average, suggesting

that prices might break below the consolidation zone and move

bearishly. Also, using the Relative Strength Index (RSI) to analyze

the price action in the 4-hour timeframe, we can see that the RSI

line has crossed below the 50% level, heading toward the oversold

zone, suggesting that the price might break below the consolidation

zone. Meanwhile, in the daily time frame, it can also be

observed that the price attempts to break below the bearish

triangle out of the consolidation zone below the 100-day simple

moving average. The 1-day RSI also suggests that the price of MATIC

might break below the consolidation as the RSI signal line has

broken below the 50% level and is heading toward the oversold zone.

Specifically, this indicates that sellers weaken buyers in the

market. With this strength of the sellers in the market, MATIC will

continue to move downward when there is a break out below the

consolidation zone. Potential Price Actions In The Event Of A

Breakout Conclusively, if there is a break out above the

consolidation zone, MATIC will continue to move upward toward the

$0.9488 resistance level. If the price breaks this resistance

level, it could rise even higher to test the resistance level of

$1.0968. On the contrary, should MATIC’s price break below the

consolidation zone, in continuation of its downtrend the price

might begin to move toward the $0.5030 support level. It might

continue to move downward toward the 0.3132 support level if the

price breaks below this level. Featured image from Adobe Stock,

chart from Tradingview.com

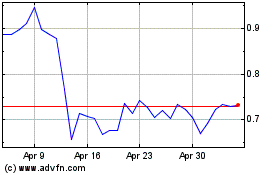

Polygon (COIN:MATICUSD)

Historical Stock Chart

From May 2024 to Jun 2024

Polygon (COIN:MATICUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024