Why Is The Ethereum Price Up 20% Today?

May 21 2024 - 11:00AM

NEWSBTC

The Ethereum price has risen almost 20% in the last 24 hours. This

is a positive development for the second-largest crypto token,

which has been lagging until now. Ethereum’s price surge is

believed to be due to several factors, including the potential

approval of the Spot Ethereum ETFs. SEC Could Soon Approve

Spot Ethereum ETFs Ethereum has risen on the news that the

Securities and Exchange Commission (SEC) could approve the Spot

Ethereum ETF applications. Before now, it was almost certain that

the Commission would deny these applications. However, the SEC is

now open to approving these funds based on Bloomberg analyst Eric

Balchunas’s revelation. Related Reading: Bitcoin Retail

Investors Are Dumping Amid Jump To $67,000, Why This Is Good For

Price Balchunas revealed in an X (formerly Twitter) post that he

and fellow Bloomberg analyst James Seyffart were increasing their

odds of Spot Ethereum ETF approval to 75% (from 25%), having heard

that the SEC could likely approve these funds due to “increasingly

political issue.” Seyffart also confirmed this development, stating

that “things are taking a turn for the better on Spot #ethereum ETF

approvals this week. Upping our odds to 75%.” Seyffart further

noted in a subsequent X post that the 75% approval odds relate to

the 19b-4 filings, with VanEck’s final deadline coming up on May

23. The SEC will still need to approve the S-1 filings before these

funds can launch. S-1 approvals could take up to months, meaning

that it could take a while before these Spot Ethereum ETFs go

live. However, that hasn’t stopped Ethereum whales from

believing, and this group of investors is another reason why ETH’s

price has shot up recently. Data from the market intelligence

platform shows that these whales bought over 110,000 ETH ($341

million) between May 19 and 20. This has turned out to be

profitable since Ethereum’s price had been priced in on the rumors

of a rejection. Time For Ethereum Price And Altcoins To Make

Their Move With the recent development that the SEC will likely

approve the Spot Ethereum ETFs, Ethereum and other altcoins look

primed to make significant moves to the upside. Crypto analyst

Michaël van de Poppe had predicted that the news around the Spot

Ethereum ETFs would trigger a rally for Ethereum and

altcoins. Related Reading: Bitcoin Price Mirrors Historical

Pattern That Led To $1,200 Surge, Will History Repeat Itself? While

explaining why he swapped his Bitcoin holdings for Altcoins, Van de

Poppe suggested that Ethereum (and other altcoins) would likely see

a bullish reversal once the news about a denial of the Spot

Ethereum ETFs was out since the crypto token was already priced

into this news. He added that things could even be better if

the news turns out to be better than people expect, which is

currently the case with the SEC looking increasingly likely to

approve these funds. Meanwhile, crypto analyst Javon Marks

predicted that an Ethereum breakout will kickstart the altcoin

season. That already looks to be the case, seeing how other

altcoins have enjoyed significant price gains in the last 24 hours

thanks to the second largest crypto token by market cap. Featured

image from Dall.E, chart from Tradingview.com

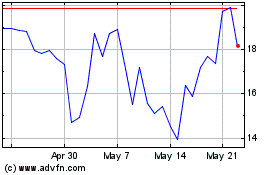

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025