Bitcoin Breaks Out: Experts Predict $36,000 Target As Market Outlook Remains Positive

May 05 2023 - 3:30PM

NEWSBTC

Bitcoin (BTC), the world’s largest cryptocurrency, could be set for

a significant price surge in the coming weeks, according to experts

at Matrixport, a leading provider of cryptocurrency financial

services. The company has projected a target of $36,000 for

Bitcoin, based on a technical breakout that signals a strong rally

amidst a positive market outlook fueled by stock buybacks and meme

coins. Related Reading: 4 Reasons To Be Bullish On Bitcoin In

Short-And Mid-Term Bitcoin Set To Soar With Strong Technical

Breakout And Meme Coin Frenzy Matrixport’s analysis shows that

Bitcoin is currently trading within a narrowing triangle formation,

which is about to break to the upside. This could potentially

project a move higher by around 6,100 points, which would bring the

price of Bitcoin to the projected target of $36,000. The positive

market outlook for Bitcoin is driven in part by the popularity of

meme coins, which have seen a surge in interest among retail

investors. Additionally, stock buybacks by major corporations have

provided a boost to the broader market, which has spilled over into

the cryptocurrency space. Furthermore, according to Matrixport,

Bitcoin could see a significant price increase of up to 20% from

current levels. This would set a target of $35,000 to $36,000 for

Bitcoin, driven by a potential breakout in the market. Matrixport’s

analysis shows that a breakout could be imminent for Bitcoin, which

could lead to significant gains for the cryptocurrency.

Additionally, the recent 25 basis point interest rate hike by the

Federal Reserve may be the last for this cycle, potentially setting

up the market for another strong rally. Moreover, Despite a recent

decline in trading volume, Matrixport notes that the path higher

for Bitcoin sees only limited resistance, with transactions on the

network reaching new all-time highs and the number of active

addresses remaining strong. Another interesting trend highlighted

by Matrixport is the increasing popularity of meme coins such as

DinoLFG, Pepe, Wojak, ChadCoin, and IgnoreFud. While these meme

coins may be small, their trading activity is worth noting as it

signals a shift in market sentiment towards a more positive

outlook. BTC’s MVRV Ratio Breaks Key Threshold, Signaling Bull Run

Ahead According to a recent analysis by CryptoQuant’s researcher,

“Onchained”, In January 2023, Bitcoin’s

market-value-to-realized-value (MVRV) ratio broke the 1 level in an

upward direction, indicating a substantial increase in its price

due to significant accumulation in both the spot and derivatives

markets. The MVRV ratio has revealed that the 1.5 level is of

significant importance, serving as a crucial threshold for Bitcoin

to enter its bull run. Currently, Bitcoin’s MVRV has been

fluctuating between 1.55 and 1.45 this month, with large investors

closely monitoring the indicator to capitalize on Bitcoin dips and

accumulate discounted BTC to fill their bags. Furthermore,

According to Onchained’s analysis, the MVRV ratio experiences a

trend change when it breaks its 365-day simple moving average

(365DSMA). If the ratio breaks this moving average in an upward

trend, it signifies the start of a bull market, with the MVRV ratio

changing direction to reach high levels typically between 2 to 3.75

or more. Conversely, if the MVRV ratio breaks the 365DSMA in

a downward trend, it signals the start of a bear market, with the

ratio changing direction to reach low values of 1 or less. These

patterns are visible in the chart. Onchained’s analysis has

revealed that when the MVRV ratio breaks the 1.5 level, the 365DSMA

becomes flattened before changing direction upward. Currently, it

appears that BTC is experiencing this trend, as its MVRV ratio

fluctuates in the range of 1.5 values. If Bitcoin breaks the

$30,000 level, a rapid change in its MVRV ratio is expected, which

is likely to shift to a range of values between 1.8 and 2. Related

Reading: Mystery Wallet Burns 1.69 Billion Shiba Inu, Will It

Result In Price Bump? Featured image from iStock, chart from

TradingView.com

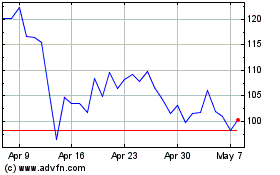

Quant (COIN:QNTUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

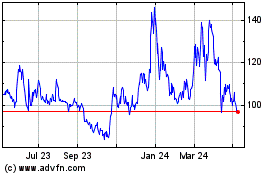

Quant (COIN:QNTUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025