Bitcoin Hashrate Nears Record Levels Amidst Price Decline – Details

August 03 2024 - 7:30AM

NEWSBTC

According to data from CoinMarketCap, the price of Bitcoin

(BTC) has taken a nosedive this week falling by 9.03% to trade

below the $62,000 price mark. This negative price action brings the

asset’s net gain over the last month to a mere 0.20%, indicating a

period equally influenced by both buyers and sellers. As Bitcoin

now attempts to find a support level, blockchain analytics platform

CryptoQuant has revealed certain elating developments in the token

mining space. Related Reading: Bitcoin Miner Capitulation Comes To

An End – Time To Buy BTC? Bitcoin Miners Hashrate 2% Away From

Network ATH On Friday, CryptoQuant shared on X that the Bitcoin

miner hashrate has been on the rise this last week, reaching as

high as 604 exhashes/second (EH/S). According to the analytics

team, this value represents a 6% gain from the lows on July 9 but

remains 2% off the network’s current all-time high hashrate

value. Cryptoquant report states that Bitcoin miners are

currently enjoying a better pay condition compared to April as

daily mining revenues have grown by over 50% since early July, thus

reducing the need to offload their assets. This is proven evidently

as daily Bitcoin miner outflows stayed between approximately 5000 –

10,000 BTC in July, showing a notable decrease from the range of

10,000 – 20,000 BTC seen in early March when Bitcoin reached the

$70,000 price mark. Generally, the Bitcoin hashrate measures the

total computational power used to mine and process transactions on

the Bitcoin network. It is a crucial indicator of miners’

confidence in BTC, with an increase signaling belief in mining the

token due to profitability from current or future prices.

However, the ability of Bitcoin miners to sustain their recent

performances despite the token’s recent dip could prove pivotal in

initiating a market price rebound, especially as a sell-off by

these miners could further drive down the token’s price.

Nevertheless, a future decline in hashrate is a more likely

scenario as miners’ profitability is largely depends on Bitcoin’s

price in addition to network fees. Related Reading: Bitcoin Miners

Slow Down Selling In July, What This Could Mean For Price BTC Price

Overview At the time of writing, Bitcoin trades at $61,387

with a loss of 5.05% in the last 24 hours. Meanwhile, the asset’s

daily trading volume is barely up by 5.35% and is valued at $42.9

billion. Historical price data indicates BTC may currently be in

the support zone, however, any further decline past this level

could result in prices as low as $55,000 as seen in early July.

Alternatively, if the crypto market eventually finds some stability

in this zone, a return to the $70,000 price zone is on the cards.

Featured image from Reuters, chart from Tradingview

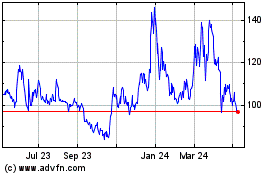

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

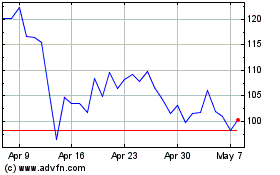

Quant (COIN:QNTUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025