Analyst Exposes Ethereum Ascending Support At $2,400 – Best Chance To Accumulate ETH?

November 01 2024 - 10:30AM

NEWSBTC

Ethereum is trading at $2,500, following a 9% pullback from recent

highs after it failed to establish a higher high above $2,820. This

retrace has sparked renewed interest among investors, with top

analyst and investor Carl Runefelt sharing a technical analysis

that points to a promising setup for accumulation. Runefelt

highlights a bullish pattern emerging in ETH’s price action,

indicating that this retracement could be a prime opportunity for

long-term holders to accumulate more Ethereum before a potential

rally. Related Reading: Bitcoin Consolidates Near ATH – Volume

Suggests A Big Move Ahead The coming days will be pivotal for

Ethereum as the crypto market closely watches Bitcoin’s attempt to

break its all-time highs. Should BTC achieve this feat, it would

confirm a new bull run, likely bringing Ethereum. The crypto

community is eagerly waiting to see if Ethereum can hold its ground

above $2,400 and eventually surpass resistance at $2,820,

potentially setting the stage for higher gains. Ethereum’s current

levels and consolidation phase suggest a decisive move could unfold

soon, making it a crucial time for ETH’s trajectory in the broader

market cycle. Ethereum Sideways Consolidation Ethereum has

been lagging behind Bitcoin and several other altcoins like Solana,

which have recently seen more robust price action. This

underperformance has drawn attention from analysts and investors

alike, including top analyst Carl Runefelt, who recently shared an

in-depth technical analysis on X. Runefelt highlights

Ethereum’s current formation around an ascending support level,

suggesting that ETH’s current price could present one of the best

accumulation opportunities before a potential rally. Runefelt’s

analysis points to a crucial ascending support level of around

$2,450, which has held steady despite Ethereum’s pullbacks,

maintaining a bullish structure. He emphasizes that if Ethereum

continues to trend down, this support could be an attractive entry

point for long-term investors looking to accumulate ETH while it’s

relatively undervalued. The chart formation suggests a

possible price floor, which, if buyers intervene, could catalyze a

move toward higher levels. Related Reading: Dogwifhat (WIF)

Prepares For A Bullish Breakout – Analyst Sets $3 Target On the

upside, Ethereum faces a key resistance at $2,800. Runefelt notes

that breaking this resistance could trigger a significant upward

move, potentially aligning ETH with broader market trends if BTC

breaks into new all-time highs. If Ethereum successfully

clears the $2,800 level, it would confirm the bullish pattern and

likely fuel a surge in price action. This breakout could signal

that Ethereum is ready to catch up to Bitcoin and outperform

altcoins, creating a more favorable outlook for ETH in the broader

market landscape. The next few days will be crucial for Ethereum’s

trajectory as it continues to hold above the ascending support

level. Traders and investors are watching closely to see if ETH can

break out of its recent underperformance and reclaim its position

as an altcoin leader. ETH Technical Details Ethereum is

trading at $2,505 after a failed attempt to hold above the 4-hour

200 moving average (MA) at $2,530. This slip below the 200 MA has

put ETH in a precarious position as it seeks new demand levels to

stabilize the recent retrace. The price is nearing a crucial

support level, and breaking below this area could trigger a

significant correction, adding considerable downside risk to

Ethereum’s current price action. For Ethereum to avoid a deeper

drop, finding support around the $2,450 mark is essential. If

buyers step in and manage to keep ETH above this level, it would

signal a positive shift in momentum. An even stronger bullish

indicator would be if ETH rebounds and pushes above the $2,550

level, which would help restore confidence in the asset and signal

a potential recovery phase. Related Reading: Dogecoin Metrics

Reveal Increasing Network Activity – Is DOGE Ready To Break Yearly

Highs? Such a move could mark the end of the retrace and position

ETH for further upside in the coming sessions. However, until the

price finds solid footing, ETH remains vulnerable to further

declines, making this a pivotal moment for the asset’s short-term

outlook. Featured image from Dall-E, chart from TradingView

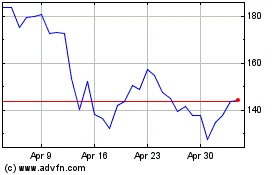

Solana (COIN:SOLUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024