Solana Slips To $209: Rising Bearish Pressure Threatens Key Support

December 17 2024 - 10:30AM

NEWSBTC

Solana is navigating a critical juncture as its price edges toward

the $209 mark under increasing bearish pressure. Recent market

dynamics have tilted in favor of the bears, challenging SOL’s

previous upward momentum. The $209 level now emerges as a crucial

line of defense, with the bulls required to act swiftly to prevent

deeper losses and regain control of the market narrative. This

heightened selling pressure highlights growing uncertainty, making

the stakes even higher for both sides of the market. If the bulls

manage to hold the line, it may signal strength and set the stage

for a potential rebound. However, failure to defend this level

could pave the way for further downside, reinforcing the bearish

outlook. Solana Nears The Critical $209 Support Level Recent price

movements indicate that Solana is under significant downside

pressure as it approaches the crucial $209 support level. This

decline comes despite the cryptocurrency remaining above the

100-day Simple Moving Average (SMA), a key indicator often

associated with broader bullish trends. The negative sentiment has

overshadowed the SMA’s support, signaling possible vulnerability in

SOL’s price structure. Related Reading: Solana To New ATH Before

Christmas – Analyst Expects $300 Soon While the 100-day SMA

typically acts as a safety net for upward momentum, the increased

selling pressure suggests that bears are testing the strength of

this support. If Solana fails to hold above the $209 mark, it might

invalidate the SMA’s bullish influence, paving the way for deeper

losses. However, a rebound at this level could reaffirm the SMA’s

role in sustaining the positive outlook, setting the stage for

potential recovery. Furthermore, the 1-day Relative Strength Index

(RSI) is trending below the critical 50% threshold, signaling a

shift in market sentiment toward bearish dominance. The RSI, a

widely used momentum indicator, measures the speed and magnitude of

price movements. When it dips below 50%, it typically indicates

weakening buying pressure. This downward trend in the RSI reflects

the increased bearish influence on Solana’s price, aligning with

its recent decline toward the $209 support level. Sustaining its

position below 50% suggests that bulls may be losing their grip,

making it imperative for them to regain control soon to prevent

further losses. Should the RSI continue to decline, it could

reinforce the negative outlook, potentially leading to a deeper

price correction. Potential Scenarios: Rebound Or Further Decline?

Solana’s price, currently hovering near the $209 support level,

sets up two potential scenarios: a bullish rebound or an extended

decline. If the price successfully rebounds from this level, it may

indicate strength and resilience, possibly pushing Solana toward

higher resistance levels, such as $240 and $260, while reigniting

its uptrend. Related Reading: Solana Price On The Rise: Key

Resistance At $235 Could Spark Major Breakout However, failing to

hold above $209 could intensify selling pressure, potentially

driving the price lower toward $194 as bearish dominance takes

hold. A break below this level would heighten the risk of more

drops, with Solana testing the 100-day SMA as the next key support.

Featured image from iStock, chart from Tradingview.com

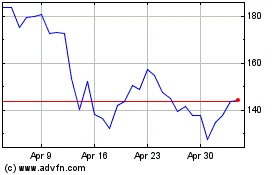

Solana (COIN:SOLUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024