Ross Ulbricht Wallet Woes: Accidental Transaction Tanks Pumpfun Coin By $12M

January 30 2025 - 12:39PM

NEWSBTC

Ross Ulbricht, the founder of the notorious Silk Road marketplace,

recently made headlines again—not for his controversial past or his

pardon by former President Donald Trump, but for a staggering $12

million loss incurred while trading a memecoin on the platform

Pump.fun. Ross Ulbricht $12 Million Mistake On January 29,

Ulbricht, or an individual with access to his Solana wallet,

reportedly attempted to manage liquidity for ROSS tokens, a meme

coin created by his supporters to raise funds following his

release. Related Reading: No More Bitcoin Bear Markets Ever?

Fund CIO Explores New Market Reality Ross Ulbricht received 50% of

the total supply of these tokens, which were designed to generate

financial support in the wake of his pardon. Instead of liquidating

his holdings all at once, he sought to add liquidity gradually on

Raydium, a decentralized exchange (DEX) operating on the Solana

blockchain. However, Ulbricht’s attempt to provide liquidity was

marred by a critical error. In setting up the liquidity pool, he

mistakenly utilized a Constant-Product Market Maker (CPMM) model

instead of the more refined Concentrated Liquidity Market Maker

(CLMM) model. The CPMM model, which is the standard for

automated market makers, does not allow liquidity providers to set

specific price ranges for their trades. As a result, Ulbricht’s

tokens became available for trading at an unfavorable price,

leading to immediate and unintended market consequences. ROSS

Tokens Plunge 90% After MEV Exploitation This misconfiguration

attracted the attention of a maximal extractable value (MEV) bot—an

algorithm designed to scan blockchain transactions for profitable

opportunities and execute trades at lightning speed. The bot

seized the moment, purchasing $1.5 million worth of ROSS tokens at

a steep discount, then promptly reselling them at a profit into the

existing liquidity pool. The rapid exploitation of the mispriced

tokens caused a significant price drop, triggering a cascade of

losses. In an effort to rectify the situation, Ross Ulbricht

attempted to fix his liquidity setup but fell into the same trap,

ultimately losing an additional $10.5 million. This brought his

total losses to a staggering $12 million as the MEV bot continued

to exploit the misconfigured liquidity. The fallout from

these transactions resulted in a 90% crash in the token’s price,

eroding a significant portion of its market value. Related Reading:

Solana Restested A Key Level And Now Faces Resistance – Breakout

Next? Despite these setbacks, Ross Ulbricht retains 10% of the ROSS

token supply in another wallet, now correctly configured on

Raydium’s CLMM pools. These remaining holdings are estimated to be

worth around $200,000, a mere fraction of the original investment.

Featured image from DALL-E, chart from TradingView.com

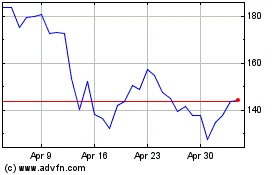

Solana (COIN:SOLUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025