Bitcoin Price On The Brink: Failure To Hold This Level May Trigger Crash To $74,000

February 04 2025 - 9:15AM

NEWSBTC

Bitcoin (BTC) and other cryptocurrencies are experiencing renewed

selling pressure as escalating trade tensions between the United

States and China lead to fresh tariffs on both sides. The

largest cryptocurrency dropped to as low as $91,000 on Monday,

while major altcoins like Ethereum (ETH) and Solana (SOL) also

faced losses. CME Bitcoin Futures Open Interest Drops 4% The most

recent installment of tariffs comes after the US enacted a 10% tax

on all items from China, leading China to respond with its own

tariffs on certain US imports, such as oil and liquefied natural

gas, starting February 10. In another development, China has

launched an inquiry into Google LLC over supposed antitrust

infringements, intensifying the tension between the two economic

giants. Related Reading: Solana Retraces TRUMP Meme Pump Gains –

But Technicals Suggest A $300 Run This market turbulence has wiped

out the benefits from a short relief rally on Monday, which

occurred after the Trump administration decided to postpone tariffs

on Mexico and Canada for a month. The weekend’s initial declaration

of US tariffs had already triggered a steep drop in cryptocurrency

prices. Investor trust in riskier assets has been notably affected,

as US investors pulled a net $235 million from a set of 12

Bitcoin-centric exchange-traded funds (ETFs) on Monday. Moreover,

open interest in Bitcoin futures contracts on the Chicago

Mercantile Exchange (CME) Group Inc.’s derivatives market decreased

by 4%, reflecting a more cautious attitude among institutional

investors. President Donald Trump, recognized for his pro-crypto

position, has unintentionally brought more uncertainty to digital

asset markets. Although cryptocurrencies experienced a rise

following Trump’s election, the market now faces a difficult

landscape marked by geopolitical strife and regulatory obstacles.

Historical Trends Suggest Potential For Deeper Corrections As of

this writing, Bitcoin was trading at $98,970, about 13% shy of its

all-time high. Meanwhile, US ETFs investing in Ethereum witnessed

record trading volumes on Monday, with significant liquidation of

leveraged positions rattled by ongoing trade uncertainties.

The iShares Ethereum Trust, led by BlackRock, accounted for nearly

half of the $1.5 billion in trading volume among a group of nine

ETFs. ETH plummeted by as much as 27% on Monday, leading to over

$600 million in liquidations within perpetual futures markets,

according to Bloomberg data. Related Reading: TRUMP Coin Tanks

18%—Even Donald Trump Couldn’t Save It Analyzing current price

trends, crypto analyst Ali Martinez identified $92,180 as a

critical support level for Bitcoin, based on MVRV (Market Value to

Realized Value) pricing bands. If this support level fails,

the next target could be $74,400. Despite the recent price

correction, Bitcoin traders are still enjoying a profit margin of

3.36%. Historically, local bottoms have formed when profit

margins drop below -12%, suggesting that Bitcoin could have further

downside potential before reaching a true bottom. Additionally, the

MVRV Momentum indicator has remained in negative territory since

the beginning of the year, signaling ongoing market weakness.

Featured image from DALL-E, chart from TradingView.com

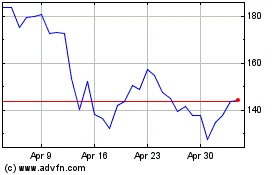

Solana (COIN:SOLUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025