Solana (SOL) Retests Crucial Support Level – Is A 50% Price Drop On The Horizon?

March 13 2025 - 7:30AM

NEWSBTC

Solana (SOL) has seen a nearly 40% retrace over the past month,

losing key support levels since February. As its price retests a

key horizontal level, some analysts warn of a potential 50%

correction to a yearly low. Related Reading: Solana Falls Under

Realized Price: Here’s What Happened Last Time Solana Loses Key

Support Level Solana has been one of the leading cryptocurrencies

of the cycle, fueled by the market’s memecoin frenzy. The altcoin

climbed over 270% in a year to its latest all-time high (ATH) of

$270, registered nearly two months ago. Nonetheless, SOL’s bullish

sentiment has significantly decreased since January, recently

plummeting to its lowest point in over a year. As a result, the

cryptocurrency has dropped over 50% from its January 19 ATH. Solana

lost the key $200-$220 support zone at the start of last month,

with the February market crashes sending SOL to retest its next

crucial levels. After losing the $180 mark two weeks ago, its price

hovered between the $130-$150 range, surging to the $179 mark at

the start of March. This week’s market correction, which saw

Bitcoin (BTC) drop to $76,000 for the first time in four months,

has sent Solana to new monthly lows. On Tuesday, SOL’s price

briefly dropped to $111, a level not seen since the August 2024

market crash, before bouncing back to $125. Amid the ongoing

retest, pseudonym trader Crypto Busy warned that SOL must “hold

this crucial support to maintain a bullish sentiment above $100.”

Crypto analyst Ali Martinez previously noted that the most crucial

zone for Solana appears to be between $110 and $125, as this

horizontal level served as a key support during its 2021 and 2024

rallies. The analyst suggested that “holding above this range could

be key for the next move.” SOL Price Risks Move To $60 Martinez

also pointed out that Solana could be on the verge of a breakdown,

as it has broken below its key level. According to the post, SOL

risks a 50% crash to the $60 mark if it fails to hold the $125

support zone. The analyst highlighted that the cryptocurrency has

been forming a right angle ascending broadening pattern since March

2024, when it first reclaimed the level during this cycle. During

this period, every higher high on Solana’s chart has created a

rising trendline at the top of the pattern, while the $125 support

has held “as a strong horizontal support trendline.” Related

Reading: Ethereum Risks Another 15% Correction After Fall Below

$2,000 – What’s Next For ETH? However, SOL’s break below this

horizontal zone has increased the odds of a 50% price correction to

the Q4 2023 levels. Additionally, Martinez recently warned of a

potential correction based on Solana’s trading pair against

Bitcoin, which started to resemble ETH/BTC’s chart. The analyst

suggested that the SOL/BTC chart was looking like Ethereum’s

trading pair against BTC’s past price action, adding that if it

continued to follow this pattern, the SOL/BTC chart could see a

drop to the 0.0008 region. After the recent price action, the

trading pair hit a 15-month low of 0.0014624 on Tuesday. As of this

writing, Solana trades at $124, a 14% decline in the weekly

timeframe. Featured Image from Unsplash.com, Chart from

TradingView.com

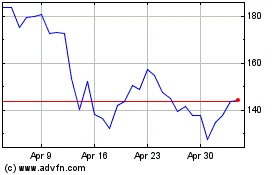

Solana (COIN:SOLUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Solana (COIN:SOLUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025